A simple budget planner (free budget template)

J.D. doesn't talk a lot about budgeting at Get Rich Slowly — he uses a spending plan — but I want to share a personal budget planner I've created that has helped me immensely. I'm not historically a budget person myself, but I've been using this for a while and it seems to be working quite well. I hope that some of you find it useful, too.

This budget planning spreadsheet is available in the following formats:

- Microsoft Excel (70kb) — right-click and choose “Save as…” to download. This file should also work with Open Office.

- Google Docs — select “USE TEMPLATE” to save to your account.

Please note: This spreadsheet is designed solely to keep you on a budget you've already set, not to help you create a budget. Budgets vary from person-to-person. Create one that works for you, and use this planner to track your progress. (If you need help developing a budget, try this budget estimator from GRS reader Justin M.)

Budget Planner Overview

While my spreadsheet may seem complex at first, it's actually very simple. It's also much more customizable than any software program I've ever used. I've tried both Quicken and Microsoft Money, and but they just had too much going on. They were confusing. My spreadsheet holds a budget for an entire year, yet works on a month-to-month and day-by-day basis. It has a very simple structure:

- The first column contains labels for the various lines in the budget planner.

- The second column lists budgeted amounts for each item. Once you set up your budget, you should only have to change these numbers if your situation changes (you get a raise or a bill increases).

- There are subsequent columns for each month of the year. As you earn and spend money, note it on the appropriate line.

This budget planning worksheet is divided into four sections.

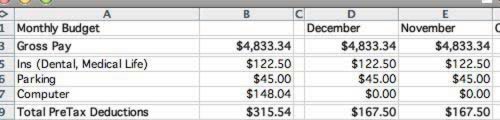

Pre-Tax Deductions

Section one contains all of your pre-tax deductions. This includes insurance and other company benefits. My company takes parking directly from my paycheck before taxes and offers a computer purchase plan that removes money from my paycheck as well. Your budget might include a line for retirement accounts.

The first section contains pre-tax deductions.

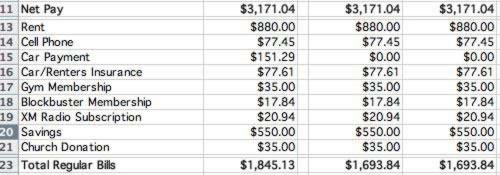

Regular Bills

Section two is headed with your Net Monthly Pay (for me, that's two semi-monthly payments). It then lists all regular bills, including Needs and Wants. For budgeting purposes, I don't differentiate between the two — if you pay for it monthly, it goes here. For me, this includes my Rent, but also things like my XM Radio and Gym Membership. I also put my Savings amount here. By treating my Savings deposit like a bill, it comes out before I spend any other money. I pay myself first.

The second section is for regular bills.

Irregular Expenses

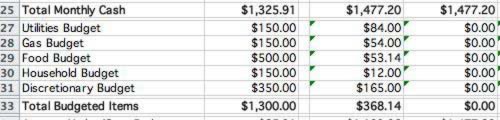

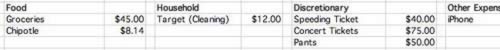

Section three tracks your Monthly Cash, which is your Net Pay minus your Regular Bills. This is how much money you have available each month after your fixed expenses. I've budgeted for five categories, but you can easily add or remove them as you wish. I'm considering dividing Food into Groceries and Dining Out myself.

I've also included a Discretionary Budget which includes all manner of items, from Christmas Gifts to Movie Tickets to Alcohol to Speeding Tickets to Books and other entertainment for myself.

Budget Summary

After the Budgeted Items section, there's a line to show how well you've stuck to your budget.[J.D.'s note: This is the concept of “cash flow” I mentioned recently. Jeff has a high positive cash flow!] This total is cumulative across all categories. If you go $50 over on utilities but cut back on food to compensate, that's fine. Your budget will zero out.

Related >> The Power of Positive Cash Flow

This line measures budget performance.

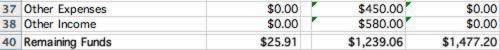

Non-Budgeted Expenses

The final section contains a simple Other Category. I don't like to have special expenses and income show up in my regular budgeted goals. If I get a bonus from work, I don't want it to look like I made my budget when I didn't. Likewise, if I put $900 into car repair but otherwise stayed perfectly within my regular budget, I don't want to look like I missed horribly.

For example, this month I received a $580 bonus from work but bought a $450 iPhone. I put both of those purchases in Other. My remaining funds for the month show how everything really worked out, but those nonstandard items haven't wreaked havoc with my budgeting process.

The final section is for non-budgeted items.

Day-to-Day Use

The trick to staying with your budget is to track your purchases.This budget planner includes a worksheet for each month. Simply navigate to the sheet for the current month and put in a quick description of each purchase, and the amount.

Track your daily expenses on the monthly pages.

Personally, I do this via receipts. Everything I buy gets a receipt and I keep track of it. If I give $20 to a friend, I just write it on the back of a receipt I already have. I keep all of my receipts in my back left pocket, and each night (or every few nights), I put them all on the sheet. It takes all of five minutes to put in several days worth of purchases.

I've put some example numbers in for the December spreadsheet so you can see how it works.

Conclusion

You can keep the budget planner tidy by “hiding” columns and sheets for the coming months in Excel. (Under the “Format” menu, select “Column -> Hide” or “Sheet -> Hide”.) If you do this, the first column after the original budget numbers (and first sheet after Total Budget) will always be for the current month. When the next month comes, simply Unhide that month, and away you go. This keeps the current month close but past months available for reference. (I'm not sure Google Docs can do this.)

I hope you find this budget planner helpful. It took me several hours to get set up, but now tracking my budget only takes 5-10 minutes of work every few days. It's so much easier to track my money this way than importing and analyzing a bunch of data from my bank and tracking my free credit report has made it all the more easier to understand the past errors and plan or correct my expenses wisely. I've been using this budget planner for six months, and I'm loving how much less money I waste.

Related >> How to Get a Free Credit Report Online

If you've ever wondered “Where does all my money go?” this budget planner can help!. Several years ago I got a $10,000 raise but succumbed to lifestyle inflation. This year I got a similar raise and was determined to see most of it go to savings. And it has, thanks in part to this spreadsheet!

Download: Budget Planner (70kb Excel file)

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)