Should you consider ETFs for your portfolio?

Exchange-traded funds (commonly known as ETFs) are a relative newcomer to the American investment scene, having been approved to be publicly traded by the New York Stock Exchange just over 20 years ago. However, in that time, they have managed to capture about $1.7 trillion in investor money. Why are they so popular, and should you consider investing in them?

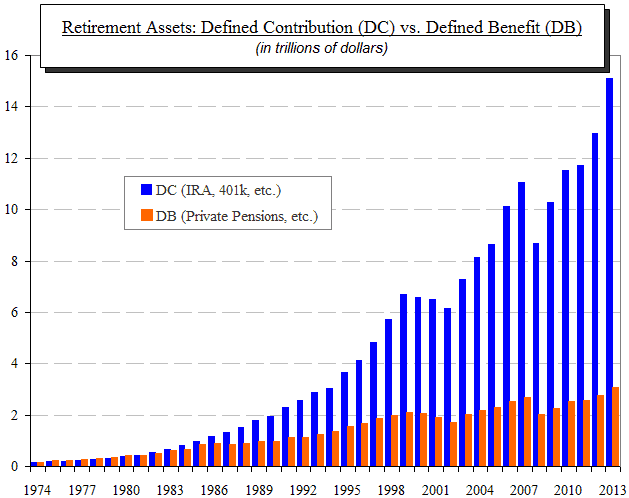

Over the past 40 years we have witnessed a major shift in how America funds retirement. The chart below shows how private employer pensions and other defined benefit plans have been displaced by defined contribution plans (things like IRAs, 401(k) plans and others):

(source: Investment Company Institute)

The most popular categories of retirement plans are those provided primarily by employers, like 401(k), 403(b) and similar retirement funds. By law, those funds are allowed to invest only in mutual funds, and that has led to the burgeoning of an enormous market for mutual funds.

However, retirement plan participants are not the only people who invest in mutual funds. Millions have bought mutual funds outside of retirement plans because of the benefits they provide:

- Diversification: The best way to reduce risk in any type of investment is to diversify. With mutual funds, every $100 you contribute from your paycheck can be invested into a portfolio of several hundred investments (stocks, bonds or both).

- Liquidity: You have a guaranteed buyer when you want to sell, and it takes but a day to get your money from a sale.

- Expertise: Professionals, who know the investment market, take care of your money.

Traditionally, the biggest downside to mutual funds, however, has been the costs associated with each fund because, let's face it, those professionals who manage the fund charge a lot for their expertise.

Index funds

Mutual funds typically fall into one of two groups: managed funds and index funds.

The theory behind managed funds is they have experts who know better than anyone else how to invest smartly and make more money so that, even after their fees are deducted, their mutual fund holders still earn a superior return.

Index funds have much lower fees because they are run by computers using formulas, which cost less than high-profile fund managers.

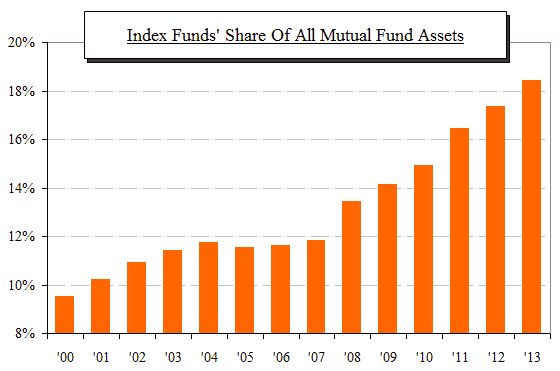

What's interesting is that, over time, index funds have outperformed managed funds. As a result, they have become more popular, as this chart shows:

(source: Investment Company Institute)

This chart may look impressive; but, if you consider it carefully, you realize that index funds still account for less than 20 percent of all mutual fund assets. That means more than 80 percent of mutual fund investors invest in managed mutual funds. It's been known for a while that the managed mutual fund business is shrinking, not growing. If index funds still have such a small share, where are the managed mutual fund investors going?

Exchange-traded funds

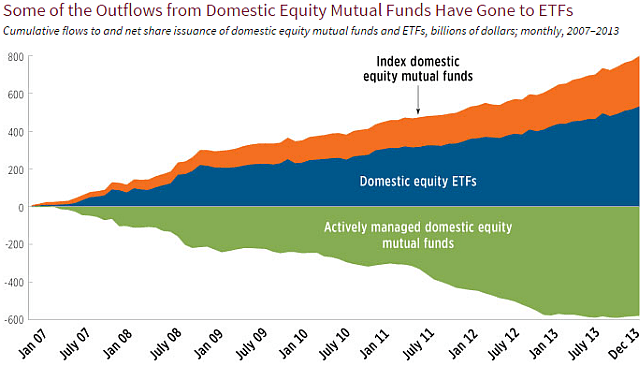

For every dollar index funds has siphoned off of managed mutual funds, ETFs have siphoned two. Ninety nine percent of all ETFs are index investments — just like an index fund, in other words. It would appear that when people make a change out of managed mutual funds, twice as many go to ETFs as go to index funds. Here's a chart prepared by the fund management industry's association, the Investment Company Institute:

(source: Investment Company Institute)

To be sure, the total amount invested in ETFs is still small potatoes, compared to mutual funds, but it's one of the fastest growing types of investments.

Why? And is there anything you might be missing out on?

What are ETFs?

In a nutshell, an ETF is an index fund you can trade like a stock. (Less than 1 percent of all ETF assets are actively managed.)

Around 80 percent of all ETFs are issued and controlled by the “big three” investment houses: BlackRock Inc., State Street Global Advisors and Vanguard, Inc. An ETF invests in hundreds of stocks (or bonds, or whatever) and, in large measure, has the same benefits as a mutual fund.

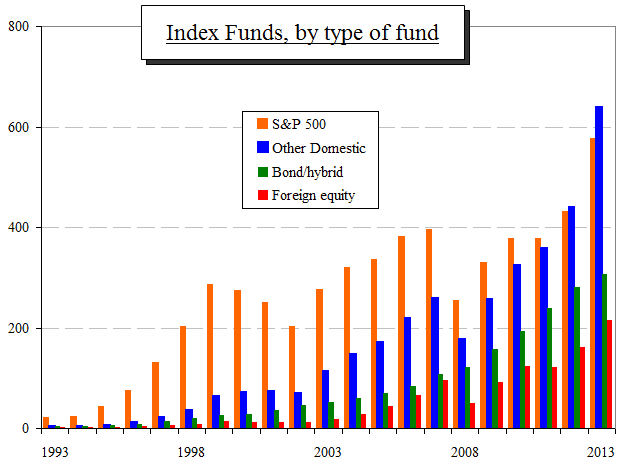

Index fund investing started with a single fund, indexing the S&P 500 stock market index. Over time, many index funds have been added, each tracking a different index. In fact, the S&P index fund is no longer even the largest category of index fund, as the following ICI chart shows:

(source: Investment Company Institute)

Today, you have ETFs which mirror those index funds, plus a whole array of others.

Benefits of ETFs

If you can buy an index fund and an ETF, which both invest in the same index, why would someone buy an ETF? For individual investors, the short answer is: no reason at all. You can invest in most indexes with an index fund or with an ETF — but there are a few subtle differences.

Asset class opportunities. With an ETF, you can invest in some types of assets other than securities. One of the biggest is gold. Some mutual funds claim to be a way to invest in gold, but they usually invest in gold company stocks, and none of those are index funds. Unlike futures and other vehicles investing in gold stocks, bonds, derivatives or futures, the GLD ETF actually buys and stores gold. In fact, it owns more physical gold than all but three national governments. The physical bars are stored in a specified location in London, are listed by number daily on its website, and are audited twice a year. Therefore, GLD is probably one of the most secure and efficient ways to own gold, should you believe the world is going to that place in a hand basket.

Stop-loss protection. If you're a passive investor and don't pay a lot of attention to the stock market, you have two strategies to deal with big, sudden losses (the kind which happen once every seven to 10 years):

- You can ride out the storm, because chances are your investment will more than recover its losses in the uptick which usually follows the drop, or

- You can cut your losses by selling when the drop hits a certain point (say, 10 or 15 percent) and wait till the storm has passed.

If your choice is the latter, an ETF offers you the option to put a stop-loss order in place, just like any other stock, and it will be sold automatically.

Taxation could be slightly more advantageous to ETF owners compared to an identical index mutual fund. When you buy any investment for your IRA, 401(k) or other tax-shielded retirement fund, there are no tax implications until you withdraw, at which time there is no difference between index fund or ETF withdrawals. However, if you are investing taxed funds in a “normal,” i.e., taxed, investment fund, income tax matters. Both index funds and ETFs pay dividends, which are taxable; but there is no intrinsic difference in how dividends from the two vehicles would be taxed. ETFs can be slightly more advantageous for capital gains purposes because index funds might be required to capture gains (for instance, in a sell-off, when they are forced to sell) and those are passed through to you, the holder. Taxation, though, is very situational, so it is best to get a professional opinion to see if this generality will apply to you.

If the difference between index funds and ETFs is so marginal, and there is such a variety of index funds to be had, why are ETFs twice as popular in terms of attracting new investment? The answer is professional investors. ETFs offer the pros several advantages which don't matter so much to individuals. The first one is greater liquidity. An ETF buy or sell is executed within seconds, at low cost, while mutual fund transactions typically take an entire day to complete. It is easier to do day trading in ETFs than in mutual funds, index or managed, and they can be bought on margin and sold short.

Then there are ETFs which allow you to invest in the inverse of an underlying investment. Say you think the S&P is overvalued and is going to go down but you don't want to go to the bother of shorting the index. You can get ETFs which allow you to buy the “short” as a normal stock. Should the market tank, that ETF will go up and you can make money. There are also leveraged ETFs which allow you to magnify the movement, up or down, of an index. Typically, those benefits don't hold much appeal to conservative individual investors, but their availability is part of what is driving the popularity of ETFs.

In other words, the greater popularity of ETFs is not because of some terrific benefit over index funds which you have been missing out on.

Disadvantages of ETFs

Several ETFs trade for free; but for individuals making monthly contributions to their retirement plan, brokerage commissions could end up costing more when buying ETFs. The smaller the contribution, the higher the (typically fixed) commission is as a percentage of the purchase. However, if you are going to make a single lump-sum contribution, such as an inheritance you receive, the transaction cost of an ETF might well be lower than for an index fund.

ETFs which are less popular can have low liquidity and the spread between the bid and ask price can be high. Those two issues can dramatically reduce the profitability of an investment. However, the ETFs which have low liquidity tend to be the more exotic type, the type conservative individual investors tend to avoid. The clue to use is the average daily volume (ADV). An ETF with a higher ADV will generally be more liquid and have a narrower bid-ask spread.

The bottom line

Most of the growth in ETFs seems to come from professional investors who value their combination of diversity and liquidity.

For individuals making regular monthly investment contributions, a traditional index fund might still be the best option.

For individuals planning to invest a lump sum in a taxed account, an ETF may offer a cost effective investment alternative to an index mutual fund containing the same pool of securities. Also, if you are contemplating an investment in a physical commodity like gold, an ETF may offer you a low-cost and secure investment alternative.

What do you think of ETFs? Given the advantages and disadvantages of ETFs, would you consider them for your portfolio?

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)