Money moves for graduates: How to set up a budget

If you are a recent graduate, congratulations and best wishes for your success!

Whether you were lucky enough to have a job lined up right after completing your degree or not, whether you graduated without student loan debt or your new balance rivals the national average of $30,000, you still need to get your financial life in place. So now that the celebrating is behind you, it’s time to get to work. What are your next steps?

Here’s a primer to get you started.

Start With a Simple Budget

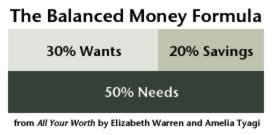

A budget is a money plan. It’s the most important thing you can do with your money. There are a lot of different budgeting methods; but at Get Rich Slowly, we find that it’s often easiest to think in broad strokes at first and then work your way down to the specifics, especially if you’re a budgeting newbie. We’re pretty fond of the Balanced Money Formula (BMF) for this reason, because it’s really easy. Here’s the basic idea:

Simple, right?

But what if you don’t have a job yet? How can you plan a budget if you don’t even know how much income you will have coming in? And suppose you’re fortunate enough that your parents are letting you crash with them while you get on your feet? How should you be allocating your funds in the meantime?

Good questions! Let’s break it down a bit, shall we?

How Much Money Will You Really Make?

Hopefully you graduated with some clarity about the type of job you wanted — and even more, hopefully your major and other scholastic activities, like internships, actually prepared you for that career path. The Bureau of Labor Statistics Occupational Employment Statistics is a great source for figuring out what industry your degree prepared you for, what the entry-level jobs are in that industry, and how much those jobs pay.

Here’s some sticker shock for you, though. That BLS figure doesn’t accommodate for things like health insurance, social security taxes, federal or state taxes. Here’s how to figure out what you’re really likely to bring home:

How to Determine Your Proposed Monthly Income

- Take the average entry-level annual salary in your proposed field.

- Divide by 26, which assumes you get a paycheck every two weeks.

- Now take two-thirds of that amount. (That’s a ballpark estimate of what your take-home pay could be after all deductions.)

- Multiply that by two. (Yes, you’ll have some three-paycheck months; but generally speaking, there will be two).

That’s it, folks — a fairly reasonable guess at what you can expect to be living off of each month even if you don’t have an actual job yet.

An Example of Income

Now that we have a basic idea of what you’ll have to work with, let’s take another gander at the Balanced Money Formula. This might be easier to visualize with some hard numbers, so let’s assume that Graduate Bob is making the average salary for an individual with a bachelor’s degree.

According to the National Center for Education Statistics, “In 2013, median earnings for young adults with a bachelor’s degree were $48,500.” So using the formula above:

Sample Income Calculation

- Average entry-level salary = $48,500 per year

- $48,500 / 26 = $1,865.38

- $1,865.38 x 0.67 = $1,249.81

- $1,249.81 x 2 = $2,499.61

Let’s call it $2,500 for easy math. That’s what Graduate Bob has to spend on wants, needs, and savings each month.

Extrapolate Amounts for Other Categories and Establish Goals

Armed with an estimate of monthly income, you can then extrapolate amounts for each of the other aspects of the Balanced Money Formula budget. Let’s look at how that works.

What Are Needs?

The Balanced Money Formula identified that needs are things you must pay no matter what:

List of Needs

- Housing

- Food

- Utilities

- Transportation costs

- Insurance

- Legal obligations (minimum debt payments — such as a car payment or your minimum student loan payment — are legal obligations)

According to the BMF, 50 percent of monthly net earnings should go toward needs. Under our scenario, that leaves Graduate Bob $1,250 to spend on everything in the needs list above.

Let’s assume Graduate Bob spends the high end of one-third of his after-tax income on housing ($825 per month) and owes $30,000 in student loans at a 6.8 percent interest rate.

Under the standard (10-year) repayment plan, his student loan payment will be $345 per month. So his rent and student loan payments come to $1,170.

Ruh-roh.

That leaves Bob with $80 per month to spend on everything else listed above. That sounds … how to put this nicely … ambitious? unlikely?

However, knowing this, Bob has some options.

Let’s say that he gets some roommates and reads the student loans best practices guide, eventually determining that PAYE is right for him. He reduces these expenses to $500 for rent and $257 for student loans, or $757 total, leaving $493 for all his other needs. That’s better, but I sure hope his car is paid off and his car insurance is reasonable. I’m not seeing a lot of wiggle room there.

What Is Savings?

This category is a little more intuitive than needs, but still there are different forms of savings:

Types of Savings

- Emergency fund

- Retirement savings

- Debt payments (beyond the minimum legal obligations)

- Short-term savings goals

Graduate Bob has $500 per month to allocate toward savings. Saving for six months’ worth of needs would mean Bob should shoot for an emergency fund of $7,500. If he wants to save that amount in a year, he needs to save $625 per month, which is likely out of reach for Bob. A more modest three-month emergency fund of $3,750 is attainable in a year if he saves $312.50 a month in a high-yield savings account.

He should also start saving for retirement, considering that funds contributed in one’s 20s have the greatest impact due to the extraordinary power of compound interest. If he’s got a job that offers retirement matching, he should contribute up to the match. If not, maxing out a Roth IRA means setting aside $450 per month or so.

Knocking out those student loans is not only a good use of savings, but also paying off that debt will free up a huge portion of spending in his needs category. And of course, if Bob has credit card debt, he needs to pay that off too.

Fortunately, getting paid every two weeks means there will be two months during the year when Bob will get three paychecks (an extra $5,000 during the year). If he isn’t running a deficit during his normal, two-paycheck months, he can throw that amount toward savings and make some big progress. How would you prioritize?

What Are Wants?

Anything that isn’t a need or savings is a want. This includes things like:

List of Wants

- Entertainment (cable, movies, concerts)

- Food beyond the basics (think dining out, organic foods)

- Hobbies

Sometimes, the balanced money formula can get out of balance. However, by allocating needs and wants first, you can ensure you’re not spending too much on wants. Graduate Bob has $750 per month to allocate toward wants if he can manage to keep his needs within 50 percent of his budget. If his needs exceed that, the excess should be paid for out of his wants category — he shouldn’t sacrifice savings if at all possible.

Tailor Your Strategy to Your Circumstances

Of course, everyone’s exact situation will vary. Some people live with their parents and can save more or pay down debt faster. Others won’t be able to find full-time employment in their field right away and will have less income. The area of the country in which you live has a huge impact on the availability of jobs, wages, and cost of living too. And of course you should consider more than salary when evaluating a job offer.

However, doing some basic research in advance will help you create a spending plan that’s aligned with what you are actually likely to earn. Then you can make adjustments as needed.

What money moves would you recommend for new graduates? Share in the comments below!

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)