How to manage your personal finances like a business

Lots of people find dealing with personal finances to be a tough task. For some, money wasn’t a topic of family discussions growing up. There was no place in the curriculum for it at any level of schooling. So, how then, if people aren’t exposed to it in their youth, will they be prepared to deal with it as adults?

You can read Dummies Books. You can read magazines like Money and Kiplinger. You can pay for courses from financial “gurus”. You can read blogs like Money Boss. But maybe the best way to master your money is to start treating your personal finances like a business.

This idea might seem strange at first, but it makes a lot of sense if you think about it. Businesses require structure. Building a business takes planning. It requires patience. The people who run successful businesses have to be accountable to shareholders, partners and investors. And sometimes they have to call on outsiders to help them with specific problems.

Is any of that really much different than managing your own finances?

Here are five business practices you can use to reach your own specific personal financial goals.

Have a Plan

All businesses start with a plan. They’re not always hyper-detailed — some plans start on a napkin! — but all businesses begin with some sort of roadmap.

These plans cover, in one form or another:

- What products/services the business will provide.

- How much to charge.

- Who the target market will be.

- How much money will be needed to cover start-up costs.

- What needs to be done to reach the launch point.

You can use the same idea in your own life. Here at Money Boss, J.D. teaches that you should start by creating a personal mission statement. As an accountant, I think a key part of a personal plan is building a budget.

I know, I know. Lots of people hate budgets. Some folks are afraid of them. Others don’t understand them. But budgets don’t have to be awful.

Quite frankly, I believe a budget is a business plan for how you will run your household. It allows you to see what’s coming in and where you’re spending it. You can see how close you are to your financial goals. (Or how you’re coming up short.) Actively budgeting keeps you accountable. It forces you to be completely transparent and brutally honest with yourself. But building a reliable budget takes time and patience.

J.D.’s note: As I mentioned in last week’s article about The Money Boss Budget, I’m a fan of broad budget frameworks. They give you all the benefits of budgeting without the drawbacks that come from being overly detailed. If you like tracking lots of categories, do so. But at a bare minimum, be aware of how much you’re spending on Needs, Wants, and Saving.

Sadly, many people fail at budgeting. Trust me, I’ve been there.

In my youth, I lived paycheck to paycheck. I had no discipline. I had no financial goals. I was happy to live each day having fun and throwing money around like I was a trust-fund kid (which couldn’t have been further from the truth!).

The funny thing is, my parents had taught me the value of money. But I lost my way for a few years. Eventually, I wised up. I swallowed my pride and asked for help. I moved back in with my parents until I could straighten out my money issues.

I purchased Microsoft Money and started inputting the past few months of my frivolous lifestyle. The results were eye opening! I saw just how much money I was throwing away on partying irresponsibly, on treating my friends, on buying things that I didn’t use or need simply because they were “cool”.

I think that’s what really scares people about budgeting: It reveals the ugly truth about how they use their money.

Believe me when I say that my truth was very ugly. But you know what? When I put a new budget in place, it helped me change my ways. I was able to see my money problems and make changes. My sensible side got rebooted and I was able to align my spending with my goals.

I tracked everything I earned and spent. I actively managed the spending categories I had previously allowed to get out of hand. I cut out expenses that weren’t necessary for reaching my newly-set goal of moving out of my parents’ house. The nonsense spending was eliminated and my money now went to paying down my debts.

It didn’t stop there…

When the debt was gone, I kept the same spending restrictions as before. Now instead of eliminating debt, I was paying into my new Down Payment Fund. In two years, I was back on the path my parents had shown me in the first place.

Did it suck? Yes! Was it hard? Double yes!! Would I have been able to set myself straight on my own just by winging it? Not a chance.

Learning how to budget, and using the budget to keep myself accountable for both my failure and my success, was the biggest factor in me turning my financial life around.

Train and Educate

How do businesses ensure that they have the best people working for and running them? Education and training. The best ones look for well-educated and highly-trained employees. They value “teachability”, the willingness to learn and grow professionally. They encourage employees to continue their education and training. From education-assistance programs to ongoing training, successful businesses push employees at all levels to improve themselves.

You can do the same exact thing with your personal finances.

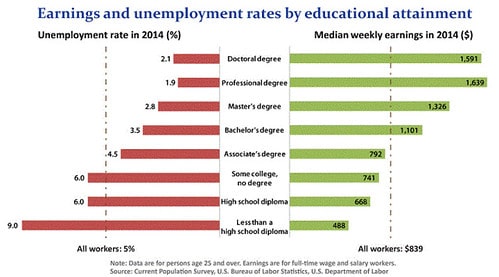

On the one hand, you use education to increase your value to a current employer, therefore (hopefully) leading to an increase in pay. On the other hand, you can learn new skills in order to move on to a better-paying line of work, or even to start your own business.

Another way to go is to learn all you can about topics such as credit (to ensure you use it properly) or investing (to minimize fees and expenses, or to maximize your returns). That way you not only have a better understanding of your finances, you can also act as your own oversight committee if you pay others for their financial expertise.

In fact, a friend of mine just did this. She had a pretty bad past with credit, both due to her own lack of knowledge and getting screwed over by someone else. A few years ago, a credit repair company recommended that she file for bankruptcy. Her credit score was in the low 500s. That’s pretty awful.

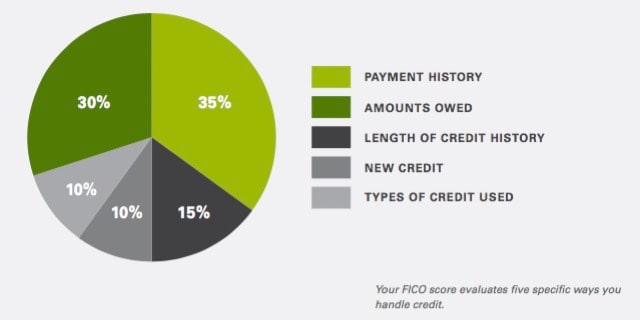

My friend felt sick over it but didn’t know what to do or where to start to fix it. I asked if she knew how credit scores were compiled. She only knew that it had to do with being on time with your payments. We had a brief lesson about a few key points.

She was overwhelmed for sure. I told her that didn’t have to be the case. She could teach herself everything she needed to know. She could learn all about FICO scores. I told her to go to the credit bureau websites and read their sections of Frequently Asked Questions. Her response? She texted me the “Home Alone” emoji!

It was a lot of info to take in, and I knew it, but I told her it was important. I assured her that all of the research and learning would prove beneficial at some point in the future. Turns out I was right. A few months ago we had dinner and she said she now understands the workings of credit and credit scores. In fact, her score has jumped to the low 700s. She was able to get a car loan without needing a co-signer and at the lowest rates.

Education comes in all forms, not just schooling. All it takes is a desire to improve yourself and your situation. That’s what being a money boss is all about, right?

Know When to Give Up Control

Smart business people surround themselves with people who are experts in areas they themselves aren’t.

The owner of an NFL team has a scouting director, VP of player personnel, and a huge coaching staff — “football people” who know more about putting a team together. Business owners have outside (and sometimes in-house) legal counsel, accountants, PR firms — all experts on specific individual areas of business.

Why do they do this? Simple.

Smart business owners concentrate on their own areas of expertise, doing what brings in the money. They recognize where their strengths lie and pay others to handle what they don’t know as well.

You can apply this concept to your personal finances:

- Have an accountant who advises you on tax issues.

- Hire an insurance agent who deals with your home, car, health, long-term care insurances.

- Get an investment advisor to watch over your portfolio and worry about what the markets are doing.

Why spend the money when you can eventually figure it all out yourself? While you should do as much as you can yourself, it takes time to acquire knowledge. Plus, it’s impossible to become an “expert” in all areas of your finances.

Plus sometimes it makes sense to be just like the smart business owner: Spend your time earning the money doing what you are already an expert at and leave the rest to people who are experts in their respective fields.

One of the places I definitely follow my own advice is insurance.

I’m sure you’ve seen all of the same commercials I have about how this company will save you $X and the next company will also save you $Y. To me, it’s absolutely ridiculous that each and every company claims to save you over the others. What makes it even more annoying is that whenever I test it out, I never get quoted a lower rate than any of my existing policies carry.

So, I don’t bother with it.

I have an insurance agent who handles all of that for me, so I don’t have to waste my time. It frees me up to do the things I enjoy in life as well as the things that earn me money to pay for my insurances.

Because I’m a fan of transparency, I’ll admit that I don’t outsource my investing. There are a lot of people who simply don’t trust the financial services industry. (J.D., for instance, is very vocal that he believes most of the investment industry is there to milk money from average people like you and me.)

For me, it goes deeper. You see, I like simplicity. As an accountant, I’ve prepared thousands of tax returns. From what I’ve seen, when people use investment professionals, there’s not much simplicity. That bothers me.

In time, I may turn my portfolio management over to someone who has the time and resources to manage it. For now, I’ll hold onto it myself.

Communicate

Public companies hold quarterly earnings announcements where they discuss company performance and future expectations. Many privately run businesses also hold regular meetings to go over performance and direction. You should follow suit in your own household. Have household money meeting where you review and analyze everyone’s spending. (Granted, if you live by yourself, the meeting may be a bit awkward!)

While older generations found it taboo to discuss money openly, especially with children, it’s important for everyone to be involved with the family finances. Help your kids develop a strong money-conscious attitude. (And learn it yourself along the way, if you have to.) Be open about money. Get everyone involved with being certain your household spending is aligned with your family’s goals.

Let me tell you about the most annoying client I ever had. He called me every single day for one reason or another. He was always playing the victim — nothing was ever his fault — and he felt like everyone was trying to prevent his business from succeeding. He complained about everything under the sun. And he communicated all of this to me.

He also communicated how his wife spent on the debit card without checking the account first, about how they were struggling to pay the tuition for their two kids’ private school, about all of the other problems with their marriage and money.

Want to know the strange thing? He never talked to her about any of that stuff! He only complained to me. When I’d ask how she reacted when he talked to her about money, the answer was always the same: “She never listens to anything so I don’t bother”. And that’s the issue in a nutshell…no constructive communication.

If you don’t talk about what’s going on, how can you expect anyone else to know? People aren’t mind readers. The lines of communication need to be fully open, both ways — especially in households where one person handles all of the finances.

Granted, open communication won’t solve all money problems, but it can certainly alleviate some of the financial pressures.

In the case of my annoying client, we brought the couple into the office and had a closed-door meeting for two hours. We put everything out on the table (literally, as we showed them profit and loss statements from their business, plus tax returns showing negative trends).

Did it help? Yes, in the short-term. My client’s complaining calls decreased significantly. But for any long-term benefit to be achieved, they need to keep the lines of communication open.

Be Patient

Business success doesn’t happen overnight. No one can realistically expect that the day after launching a business they’ll be inundated with people throwing money at them.

Even in the world of tech start-ups, the hottest companies generally lose money for several years before they start generating a regular profit. It’s important to keep everything in perspective. The same holds true for your personal finances.

Building your wealth snowball can be a long and arduous process. Getting out of debt, saving for a down payment on a home, and funding retirement take persistence and dedication.

In the beginning, your excitement will fuel your drive as you get immediate results. But as time passes, the milestones will be fewer and farther between. It will seem like progress has slowed (or halted) and you might lose some of that enthusiasm. But just like the business owner who guts out the lean beginning years, you’ll benefit greatly by staying the course and being patient.

Me? I’m not the most patient person in the world. When I want something I want in yesterday. When I went through my own financial recovery, I was impatient. I hated seeing how slowly my debt whittled down. In my mind, I thought I’d never get debt-free. I even considered giving up on the idea!

But there was something that wouldn’t let me quit. I kept hearing a voice in the back of my mind. It was my father’s voice. He kept saying that I’m responsible for my own actions and that nothing worth achieving is going to come easy. (Of course, I wasn’t actually hearing voices…I was just recalling lessons he instilled in me from my youth.)

I had to make a decision.

Did I want to be a failure? Or did I want to be an adult and face my responsibilities, fix the problems I caused in the first place, and reach the goal I had set for myself?

I rededicated myself to my objectives. Time didn’t pass any quicker and my balances didn’t decline any faster, but changing my attitude helped me to persevere. I saw my goal through to completion.

Final Thoughts

Managing your money like you’re managing a business isn’t a cure-all for your financial troubles. Neither J.D. nor I will ever over-simplify the challenges you face. Meeting your goals takes hard work and dedication.

This idea, though — that you should be a money boss — is a terrific starting point. It’s a great frame of mind to help guide you on your journey toward debt freedom, business ownership, or whatever else you have in mind.

Here’s one last very important point: Nothing will ever change unless you take action. Whether you decide to manage your household budget as if you were running a business or come up with some other plan, remember this: The most important thing you can do is just take action.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)