How to prevent identity theft (and: What to do if you’re the victim of identity theft)

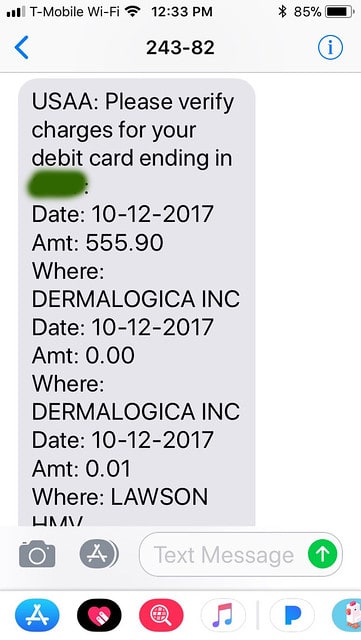

The thief first tried a couple of test transactions for amounts of $0.01 and $0.00. (How is a $0.00 transaction even possible? I have no idea.) When those worked, she went all-in. She charged $555.90 to the account.

Fortunately, Kim has an excellent bank. USAA both phoned and texted to let her know something seemed suspicious. Then, over the next week, they worked with her to keep disruptions as minimal as possible.

In the end, nobody knows exactly what happened. How did the ID thief get Kim’s debit card info? How were they able to buy $555.90 in cosmetics? What’s to prevent this from happening again? All that’s certain is that Kim lost a great deal of time (but no money) handling this hassle.

Credit Where It’s Due

Since the incident, I’ve been coaching Kim on what she can do to protect herself. We’re not taking a comprehensive approach (as suggested in this very thorough identity theft resource at the Personal Finance subreddit). I don’t feel like this event warrants more than increased vigilance. To that end, we’re taking three specific steps.