Best CD rates | Certificate of Deposit rates

Certificates of deposit (often simply called CDs), by definition are time deposits. You give your money to the bank and then promise not to touch it for a specific length of time. In general, the longer you agree to let the bank keep your money via a CD investment, the higher the interest rate you will receive.

If certificates of deposit offer higher returns than a savings account, then why doesn’t everybody use them? The primary reason is that a CD investment is less liquid than a savings account in that you can’t just move money in and out without penalty as you can in a savings account. You can take your money out of a CD before it “matures,” but you are docked interest when you do. In fact, it is typical for a bank to penalize the interest amount even if it hasn’t been earned (meaning you could lose part of your principal if you close your CD early).

Anatomy of a CD

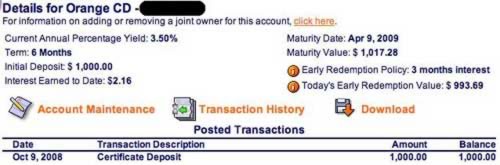

I was fortunate to win a $1,000 6-month certificate of deposit from ING Direct recently. (I never win anything!) Looking at it might be instructive:

Reviewing this screenshot, you can see that a certificate of deposit has an initial value (in this case, $1,000), an interest rate (3.50%), and a term (6 months). In other words, this is very much like a loan that I am making to the bank.

You can also see that the bank has an “Early Redemption Policy” that states that I would sacrifice three months’ interest if I chose to redeem this CD early, whether the interest has been earned or not. Because I have held the CD less than a month, I would actually sacrifice part of my principal if I were to close the account now.

When this CD investment matures on April 9th, I will have $1,017.28. Obviously $17.28 isn’t a huge return, but it’s important to remember that interest rates are low right now. (Also consider that if my $10,000 emergency fund were all in CDs, I would earn $172.80 in six months.)

Another important difference to be aware of is that, unlike a savings account, a certificate of deposit ends after a set amount of time. What happens at the end of the term depends on the arrangements you have (or have not) made with your bank. (I explain this further below.)

CD Tips and Tricks

A certificate of deposit is a great way to put your savings on steroids, so to speak, but there are ways to make them even better. Here are a few tips and tricks that can help you get the most out of your investment.

Use CDs to beat falling interest rates. When the Federal Reserve cuts short-term interest rates, you feel the pinch in your savings account. Certificates of deposit are a great way to buy yourself “protection.”

When you see a rate drop coming, open another CD. For example, the Federal Reserve just cut short-term rates another 0.50 percent last week. I would be shocked if banks didn’t follow suit, lowering the interest on their savings accounts. ING Direct could go as low as 2.25 percent.

When you see an interest drop coming, take some money from your savings account and throw it into a 6- or 12-month certificate of deposit, locking in the higher rate. (My web research hasn’t revealed what causes CD rates to move, but they do not move in lockstep with savings accounts.)

Climb the CD investment ladder. Just as you might use dollar-cost averaging to profit from fluctuations in the stock market, you can use a “CD ladder” to profit from fluctuations in interest rates.

Say you have $5,000 to invest. To build a CD ladder, you would invest the money in CDs with staggered maturation dates:

- $1,000 in a one-year CD

- $1,000 in a two-year CD

- $1,000 in a three-year CD

- $1,000 in a four-year CD

- $1,000 in a five-year CD

As each CD matures, you immediately invest your money in a new five-year CD, effectively maintaining the one-year stagger, or ladder. You won’t earn the best possible rate of return, but you will earn a good one, and your income will be relatively constant. The CD ladder is also a form of diversification: you’re not betting all your money on one interest rate.

Protect yourself with parallel CDs. One of the biggest risks to your investment in a certificate of deposit is the need for early withdrawal. What if something happens and you need to pull the money out? As we’ve seen, this can be expensive. Nickel at Five Cent Nickel suggests mitigating your risk with parallel certificates of deposit.

Again, assume have $5,000 that you’d like to put into CDs. Instead of opening a single certificate of deposit for the full amount, consider opening multiple CDs. You might open three CDs at once, for example: two $1,000 CDs and one $3,000 CD.

This gives you a buffer in case you need to get at the money early. If you find you need $500, you can break a single $1,000 CD and the rest of your money is safe from penalty.

Related >> Beginners’ Guide to Investing

Beware of auto-renewals. Nicole wrote last week because she was surprised to find that her certificate of deposit at Countrywide had automatically renewed at the maturation date. Many (most?) banks will do this unless you instruct them not to.

If you know you’re ready to pull your money out of a certificate of deposit, be sure to contact your bank to find out the proper procedure for doing so. Nicole found herself locked into another twelve month CD when she needed the money now. If she broke the contract, she would be forced to sacrifice 180 days interest, whether earned or not.

(Note that Nicole’s story had a semi-happy resolution. She knows to speak up when something seems wrong. Countrywide wouldn’t let her out of the CD investment entirely, but “I was able to negotiate a compromise to transfer the money to a 3-month CD, rather than the 12 month CD. Although the interest rate is lower, I will be out in 3 months, which isn’t too bad.”)

Shop around. As with any financial decision, it pays to shop around for CD rates. You may find that your local bank actually offers a better deal on certificates of deposit than the online banks.

For example, my local credit union only offers 0.35% on its regular savings account, but its CD rates are competitive with (and sometimes higher than) ING Direct. Since I keep my checking account at the credit union, it might make sense for me to hold my CDs there. (In this case, however, they’re not high enough to make me switch; I’d rather track everything in one place at ING.)

Here’s my list of current CD rates from online banks.

CDs in Practice

I’m new to the certificate of deposit, but I can already see some uses for it. My $10,000 emergency fund, for example, is currently earning 2.75%. I may instead create a series of parallel CDs, as described above.

Also, I’m saving for my Mini Cooper. That money is also earning 2.75%. I’m nowhere close to buying the car, though, so I might as well put it into a certificate of deposit, too.

Though certificates of deposit are new to me, I’m sure that most of you have been using them for years. What tips and tricks can you offer? Do you have favorite sources for CD investments? How do you decide which money to keep there and which to keep in a savings account?

Identifying the Best CD Rates

It is important to think through how best to use a certificate of deposit in your overall financial plan, but it starts with understanding your goals and how a CD can help you reach them. Interest rates change constantly, so having up-to-date rate information is critical to identifying the best CD rates and terms to make the most of your investment. We have made the whole process easier in a convenient page that is updated weekly with the most current interest rates.

Different strategies can help you capitalize on fluctuating interest rates too.

A CD ladder can help you maintain a relatively constant income no matter how current CD rates change. A parallel CD strategy can help you maintain some accessibility to your funds during the term. Richard Barrington’s post can help you understand how to find the right CD but do shop for the highest CD rates and terms regularly to maximize your return. Bookmark this page as well so you can easily come back to our table to check rates and terms as often as you want.

Current Certificate of Deposit Rates

An online account is arguably one of the most convenient ways to manage CDs and, generally speaking, online banks offer higher rates than traditional brick-and-mortar institutions. The following listings of online banks are updated weekly too, and a little more information about each bank is given next to each listing as well. Credit unions and savings associations are also sources of CDs and other deposit accounts.

CD Basics

A certificate of deposit, or CD, is a deposit account that is generally considered a very low-risk investment. You might also hear it described as a time deposit because it is not a liquid asset that can be accessed on demand. Instead, the amounts deposited into a CD are expected to remain untouched for a specific period of time, which is the term of the CD. In exchange, the bank will pay you a fixed rate of interest.

Example investment: You put $10,000 in a 5-year certificate of deposit at an interest rate of 1.75%. At the end of five years, with interest compounded daily, you would have $10,914.

Early withdrawal penalty – The full value of the CD (your principal plus the interest earned) is accessible when the term has been reached; however, there is usually a penalty if you withdraw your funds before the end of the term. This means that the bank will keep a portion of the interest earned, which could also cut into the original principal balance if the CD has not accrued enough interest to satisfy the entire penalty yet.

For example, if a depositor wishes to close a one-year CD account after two months but the bank’s policy states that an early withdrawal penalty equal to three months’ interest would be due in that event, then the bank will dip into the depositor’s principal balance to make up for the shortfall between the interest earned and the penalty. Early withdrawal penalties vary from bank to bank, and this is another important item to consider as you shop for the best CD rates and open your new account.

Fixed interest rates – Even though interest rates change regularly, banks usually offer a fixed interest rate that doesn’t fluctuate, allowing you to lock in that particular rate for the entire term of your CD. Banks are willing to fix the interest rate, which is generally higher for certificates of deposit than for most savings accounts, because the funds remain on deposit with the bank untouched for that specific period of time. (In general, the longer the term, the higher the interest rate for a CD.)

FDIC insurance – The Federal Deposit Insurance Corporation insures most certificates of deposit so that the balance of your CD will be paid to you even if the banking institution becomes insolvent for some reason. The standard deposit insurance coverage limit is $250,000 per depositor, but it is important to verify the amount of FDIC insurance that applies to the particular CD accounts you open.

High Interest CDs that Can Double Your Interest Income

According to the FDIC, five-year CD rates (certificates of deposit or CDs) are currently averaging just 0.75 percent nationally. Fortunately though, not all CDs are created equally. Here are 10 CDs that offer at least double the interest income that today’s average account provides:

- iGOBanking. Forget the awkward name and focus on the rate: Annual percentage yield (APY) is 0.35 percent on a five-year CD. iGOBanking is the online division of Flushing Bank. Though Flushing Bank is quite small, with deposits of less than $600 million according to FDIC data. The minimum deposit is just $1,000, so the iGOBanking CD is readily accessible. The penalty for early withdrawal is 12 months now. (Rate as of July 5, 2016.)

- EverBank. EverBank has made a commitment to offering high interest rates by pledging to keep its CD rates in the top 5 percent of comparable products. With a 1.76 percent APY on its 5-year CD, it seems to be living up to that pledge. (Rate as of July 5, 2016.) EverBank’s 17 branches are all in Florida, but its products are available to a national audience online, and with more than $10 billion in deposits, they have built up a fairly substantial customer base. The minimum to open is a reasonable $1,500, but the only catch is a hefty penalty for early withdrawal — equal to 900 days of interest on its five-year CD.

- Nationwide Bank. This online banking affiliate of the insurance giant offers a five-year CD with a 1.95 percent APY for balances between $0 and $9,999.99 and a minimum of $500 to open. That APY bumps up to 2.00 percent for deposits of $100,000 or more. These strong rates do require a long-term commitment, since the early withdrawal penalty is 360 days of interest. (Rates as of July 5, 2016.)

- Barclays Bank. Barclays is an international banking powerhouse, and it offers a very competitive five-year CD with a 2.65 percent APY. This rate applies to its online CD, which has the added advantages of having no minimum balance requirement and the penalty for early withdrawals is 180 days. (Rate as of 05 March 2018.)

- GS Bank. GS Bank’s five-year CD has a 2.00 percent APY and a user-friendly $500 minimum deposit to open. There is a 270-day early withdrawal penalty, so make sure you are committed for at least a couple years if you choose this product. (Rate as of July 5, 2016.)

- BBVA Compass. Though most of these highest-yielding CDs are found at online banks, BBVA Compass also offers a traditional, branch-based alternative with 716 locations. The account minimum is just $500, and the rates may reach as high as 2.00 percent APY for a four-year term, depending on which branch location you visit. Rate collected within: Birmingham, AL: 0.50%(Rate as of July 5, 2016.)

- Ally Bank. One of the leaders in online banking, Ally has built itself up to more than $40 billion in deposits. The 1.65 percent APY on its five-year CD is well over twice the national average, but there is a 150-day early-withdrawal penalty. Still this CD is an excellent choice even if you think that rates might rise within the next five years. (Rate as of July 5, 2016.)

- Sallie Mae. Sallie Mae is probably better known for student loans, but it also offers online deposit products, including a five-year CD with a 1.80 percent APY and a $2,500 minimum deposit. The early withdrawal penalty is equal to 180 days of interest. (Rate as of July 5, 2016.)

- Discover Bank. Though the Discover name is more commonly linked to credit cards, Discover Bank also has more than $40 billion in deposits. Its five-year CD rate offers an APY of 1.85 percent with a $2,500 minimum deposit to open and an early withdrawal penalty equal to what can be up to 18 months of interest. (Rate as of July 5, 2016.)

The above are not necessarily the 10 highest-yielding five-year CDs in the country. They were chosen because their rates are at least twice the national average, they are available in multiple states and they have relatively user-friendly websites. You may find additional options in your area, but the points discussed above can still provide you with some framework for what criteria to consider — including rates, minimums and penalties — when choosing a CD.

Have you been able to find CD rates that rival these? If so, please add a comment below. Don’t forget to include the details: name of the bank, state, rate, when you opened the account with this rate, and whether you can open the account online or must appear in person.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)