Which matters more for building wealth: Your saving rate or your investment returns?

My name is Zach, and I write at Four Pillar Freedom, where I tend to tackle financial topics through data visualization. While J.D. is on vacation, I offered to explore one of his favorite topics: the effects of saving rate versus investment returns.

Albert Einstein supposedly once said that compound interest is the eighth wonder of the world.But does data actually support this claim?

In this post, I explore the nature of compound interest, how long it takes to become an important factor in wealth accumulation, and whether or not it actually matters much for people who hope to achieve financial independence in a relatively short time.

What matters more: your saving rate or your investment returns?

Accumulating Wealth in the Early Years

Suppose your goal is to achieve a net worth of $1 million. If you invest $10,000 every year and earn a 7% annual return on your investments — which is a reasonable assumption for long-term stock market returns — you'll accumulate $1 million in about 30.7 years.

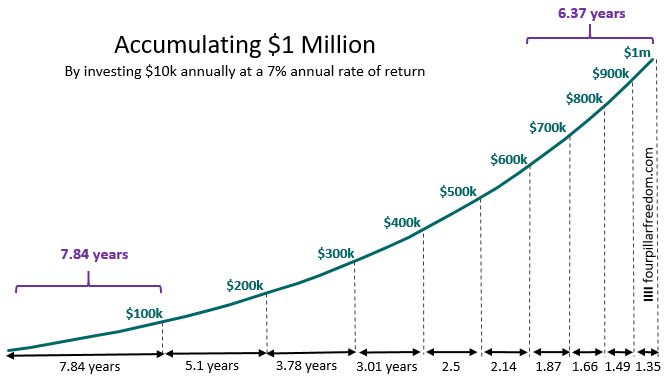

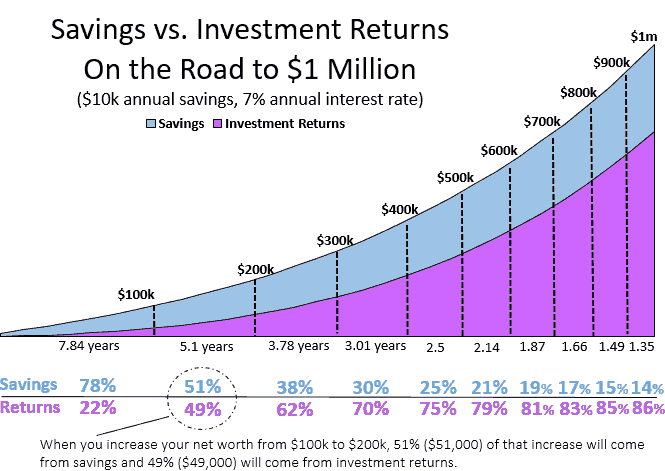

The chart below shows exactly how long it would take to reach every $100,000 net worth milestone, using the assumptions of a $10,000 annual investment earning a 7% annual return:

Notice how each $100,000 net worth milestone takes less time to reach than the last. In fact, it's mind-boggling to see that it will take youlongerto go from $0 to $100,000 than it will to go from $600,000 to $1 million:

The first $100,000 takes the longest to save because you don't receive much help from investment returns early on. The time it takes you to go from $0 to $100,000 is mostly dependent on the gap between your income and your spending.

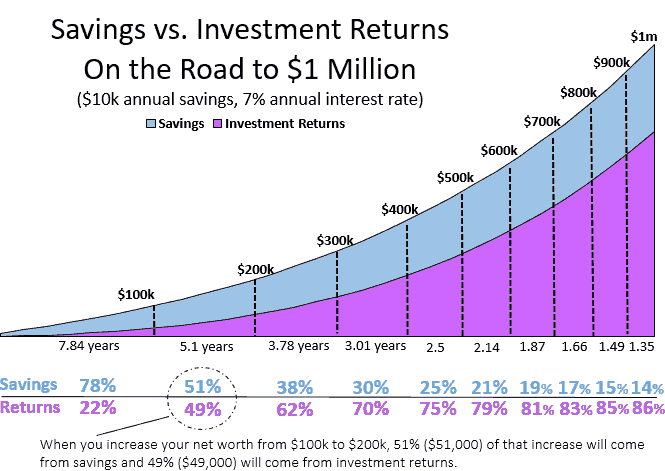

The following chart shows just how much savings contribute to net worth growth compared to investment returns:

If you invest $10,000 each year at a 7% annual rate of return, you'll go from $0 to $100,000 in 7.84 years and a whopping 78% of that $100,000 will come purely from savings.

Important note: For the sake of simplicity, we're assuming a steady 7% annual return in these examples. It makes things easier. But please remember that in real life, returns are almost never average. Some years, the stock market drops 10%. Other years, it gains 20%. Over the long term, however, the average real returns are close to 7%. So, we're keeping things clearer by using that number.

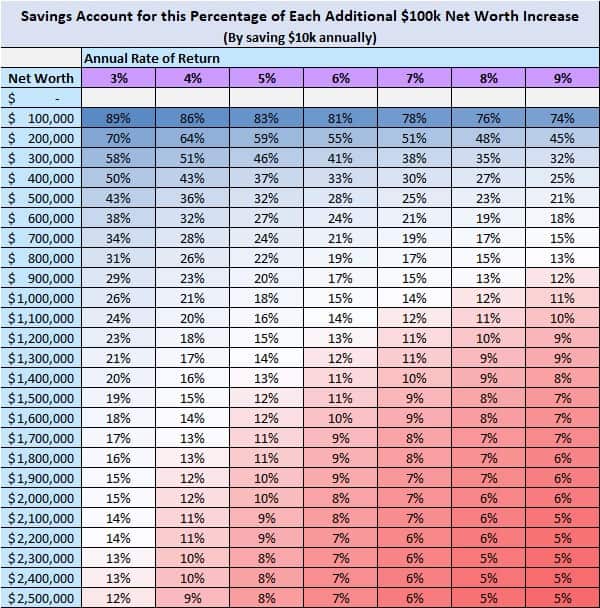

Even if you earn higher annual investment returns, the majority of your first $100,000 will still come from savings. The table below shows how much savings account for each $100,000 net worth milestone based on different annual rates of return:

On the low end, if you only earn 3% annual returns, then savings will account for 89% of your total net worth growth from $0 to $100,000. On the high end, if you earn 9% annual returns, then savings will still only account for 74% of total net worth growth.

Note: This is why Get Rich Slowly has written many times before that the number-one factor in determining how much you'll have in retirement is the amount you save.

The good news is that once you cross the $100,000 net worth milestone, investment returns begin to help you. For example, if you keep investing $10,000 each year at a 7% annual rate of return, then 49% of your net worth growth from $100,000 to $200,000 will come from investment returns:

So, even though you're saving and investing the same amount each year ($10,000), it will only take you 5.1 years to go from $100,000 to $200,000 since investment returns add to your net worth. Notice how it takes less and less time to accumulate each $100,000 because investment returns begin to account for more growth as time goes on.

Why Your First $100,000 is Such a Big Deal

You might find these charts discouraging if you're someone who has yet to save their first $100,000. After all, the numbers don't lie: The first $100,000 takes the longest to accumulate. Warren Buffett's longtime business partner Charlie Munger even once said, “The first $100,000 is a bitch!”

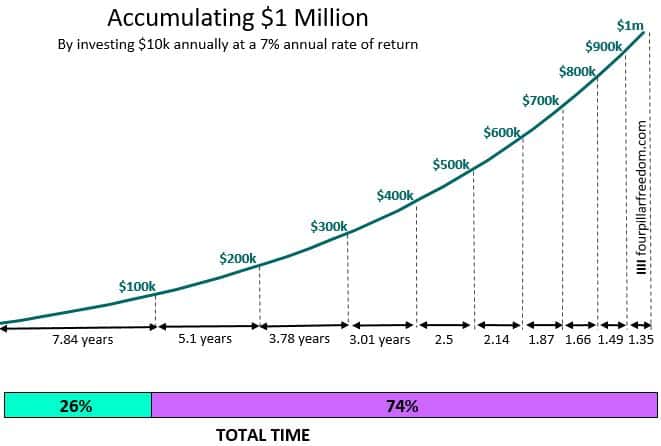

The good news, though, is that accumulating your first $100,000 represents a huge milestone. If your goal is to save $1 million, then $100,000 only represents 10% of your total goal. But let’s instead view wealth accumulation from a time perspective: It takes 7.84 years to get your hands on that first $100,000 and a total of 30.7 years to go from $0 to $1 million.

This means accumulating the first $100,000 takes up a whopping 26% (7.84 years / 30.7 years) of the total time it takes to accumulate $1 million:

Although it may not feel like a huge milestone in terms of dollars, accumulating your first $100,000is a huge milestone in terms of time.

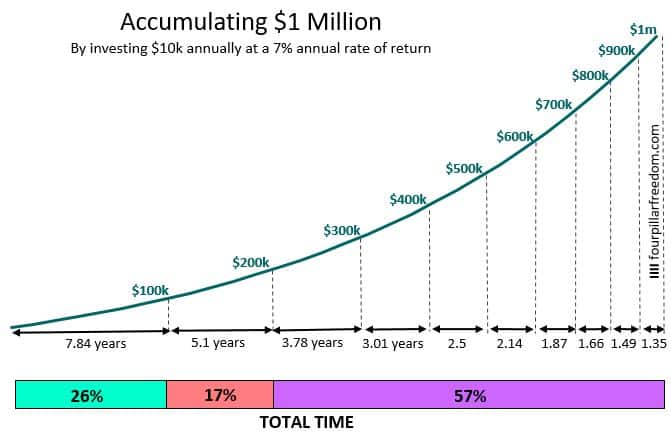

It's fascinating to see how much time each $100,000 milestone actually accounts for on the road to $1 million. For example, going from $100,000 to $200,000 represents 17% of the total journey in terms of years:

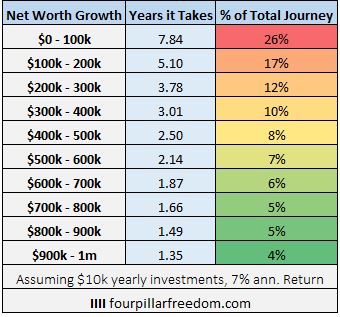

This means that accumulating your first $200,000 represents 43% of the journey to $1 million in terms of years. The table below showshow much time each $100,000 takes up on the journey to $1 million (again, assuming consistently investing $10,000 annually at a 7% rate of return):

As your net worth marches higher, each subsequent $100,000 takes less time to reach than the last.

When Do Investment Returns Matter More Than Savings?

We've seen that net worth growth can be slow in the early stages simply because you don't have enough money invested for investment returns to make much of a difference. As time goes on, though, investment returns begin to account for more and more net worth growth. You might be wondering:When do investment returns matter more than savings?

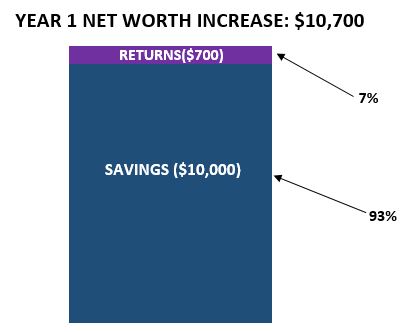

To answer this, let's consider the case from earlier where you invest $10,000 and earn a 7% annual return.At the end of year one, you have your initial $10,000 plus $700 in investment returns for a total of $10,700. This means 93%($10,000 / $10,700)of your net worth growth came from savings and only 7%($700 / $10,700)came from investment returns.

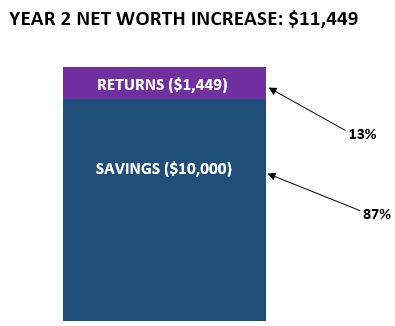

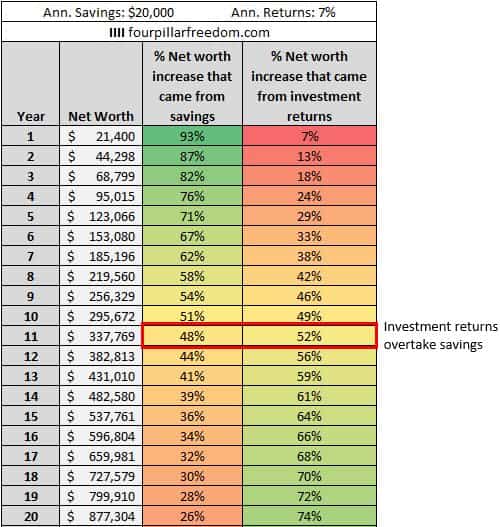

In year two, you invest another $10,000 and again earn a 7% return. This year you would earn $1,449(($10,700 + $10,000) * 7%)from investment returns. This means 87%($10,000 / $11,449)of your net worth growth came from savings and 13%($1,449 / $11,449)came from investment returns:

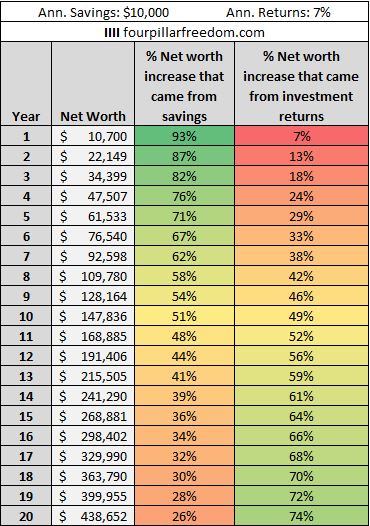

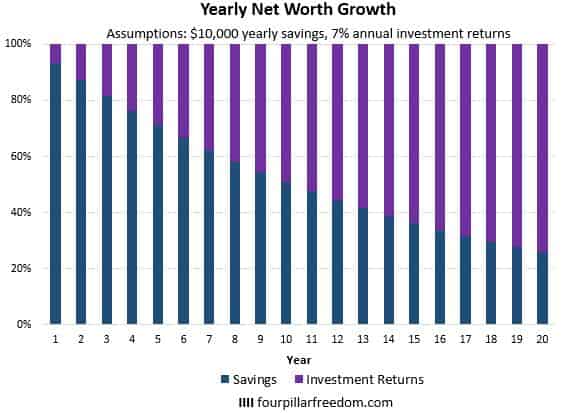

If we keep doing these calculations each year, we’ll find that investment returns account for more and more of yearly net worth increases as time goes on:

Notice how it takes about 11 years for investment returns to account for more yearly net worth growth than savings:

After year 11, investment returns become the main force that pull your net worth higher.

Here’s another way to view these numbers:

It turns out that no matter how much you save each year, these numbers hold true. For example, suppose you saved $20,000 consistently each year instead of $10,000:

Only the net worth numbers change. The percentages stay the same. Investment returns overtake savings again in year 11.

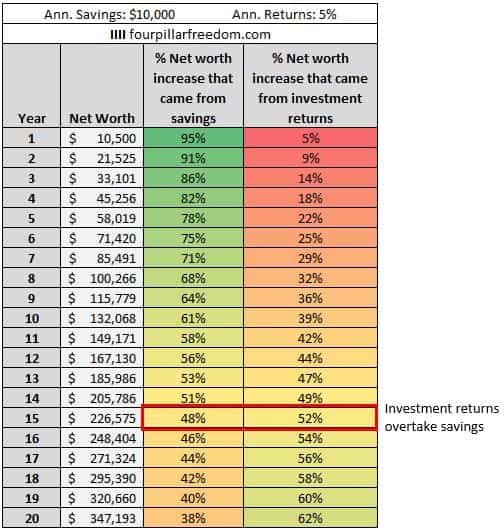

But what if you earn less than 7% annual returns on your investments? For example, suppose you save $10,000 each year again but instead earn 5% annual returns:

We see a similar pattern: Investment returns slowly begin to account for more net worth growth over time, but in this scenario it takes about 15 years for returns to become more important than savings.

This brings up an interesting question:How long does it take for investment returns to overtake savings for different annual return amounts?

This table reveals the answer:

The lower your annual investment returns, the longer it takes for investment returns to become more important to net worth growth than savings.

J.D.'s note: This last table is important, even though it might not seem so on first glance.

Right now, the FIRE movement is hot, right? Everybody's talking about early retirement. A lot of young folks are able to quit their jobs because their investments have done so well. How well?

My calculations show that as of today (28 Nov 2018), the stock market has returned an average of 15.06% annually since its bottom on 06 Mar 2009. This is an insanely high rate of return for an insanely long period of time, and it's allowed patient investors to rack up big returns quickly.

Many folks aged 30 to 35 have only known this environment where investment returns are so strong that they soon matter more than the amount you save. This is not normal!

When things do normalize, I believe it'll cool some of the heat the FIRE movement has been building.

How Much Do Investment Returns Matter for Early Retirees?

We've seen that the amount you save usually matters more than the investment returns you earn in the early years of a net worth journey. This brings up an interesting question: how much do investment returns matter for people who hope to achieve financial independence in a time span of only 10 to 20 years?

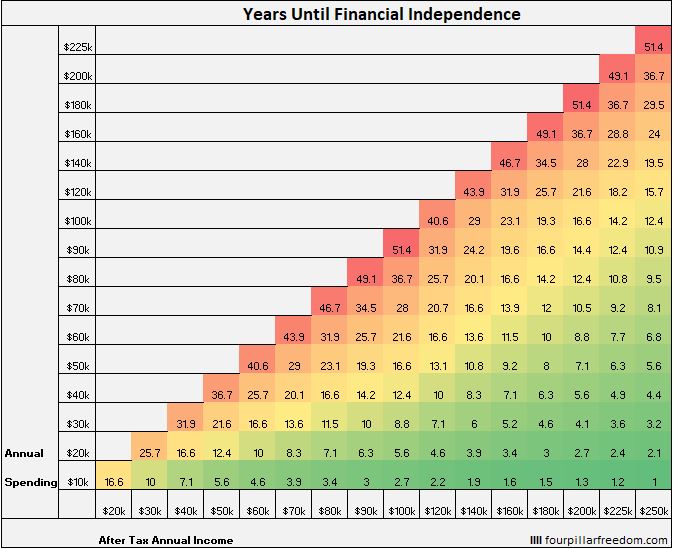

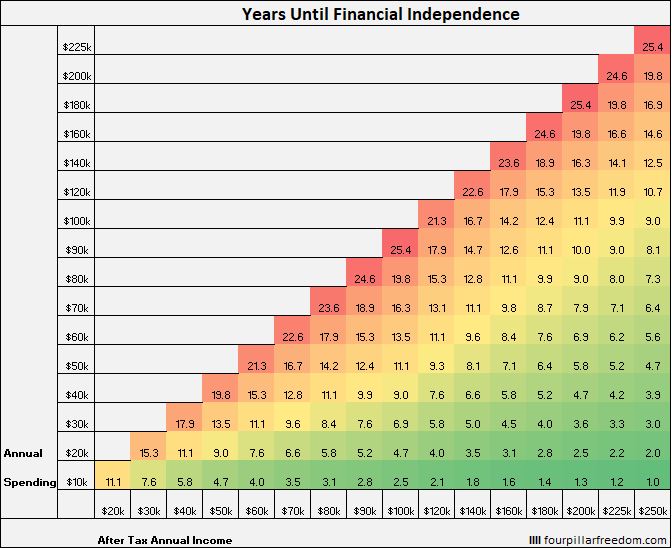

According to the Financial Independence Grid, a household that is able to save 50% of their post-tax annual income each year will be able to achieve financial independence (25 times their annual expenses) in just 16.6 years, assuming they start with $0 and earn 5% investment returns each year:

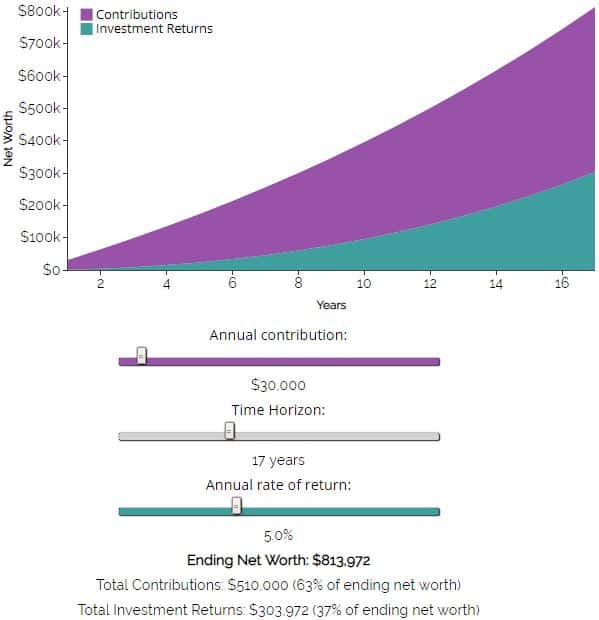

Let's round this number up to 17 years and find out just how important investment returns vs. savings are on the road to financial independence. Using my Contributions vs. Returns Calculator, we can find out just how much investment returns matter. (Note: I'm using the term “contributions” and “savings” interchangeably here.)

Consider a household that is able to invest $30,000 per year at a 5% annual rate of return for 17 years. At the end of these 17 years, they'll have $813,972, 63% of which will have come purely from savings. Only 37% of this total ending amount will have come from investment returns.

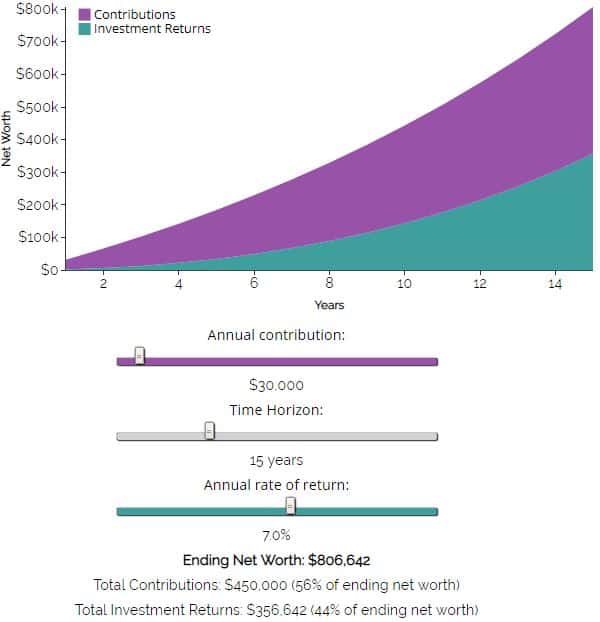

Consider instead if this household is able to earn 7% annual returns while still saving half of their income. It turns out that they would be able to achieve F.I. in just 15 years. In this case, investment returns would account for 44% of their total net worth after 15 years:

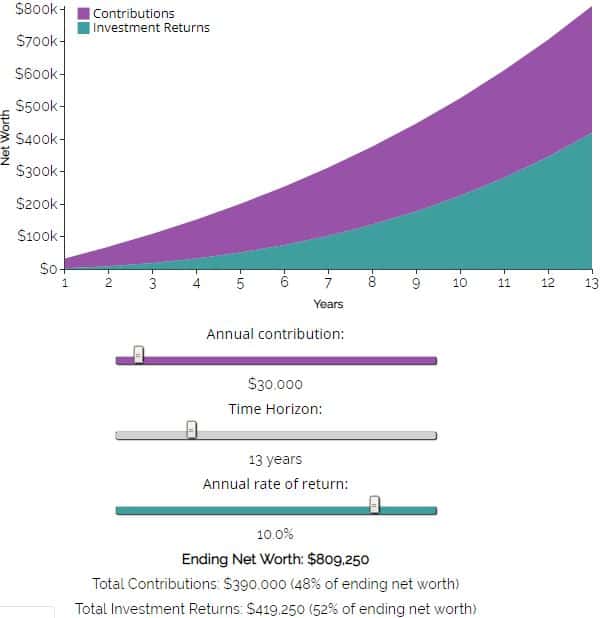

And if this same household instead earned stellar 10% annual returns, they would be able to achieve F.I. in just 13 years. In this case, investment returns would account for 52% of their total net worth after 13 years:

So, for people who are able to achieve F.I. in 13 to 17 years, investment returns account for anywhere from one-third to one-half of total net worth growth.

But suppose this same couple experiences incredible 15% annual returns like we've seen since since the stock market bottom of March 2009, as J.D. previously mentioned. Here's the same financial independence grid from earlier, except with the assumptions of 15% annual investment returns instead of 5%:

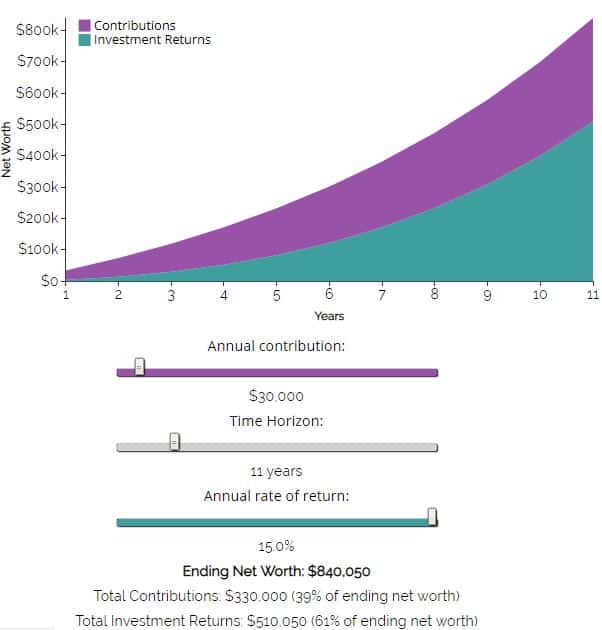

If this same couple was able to save and invest half of their income each year at a 15% annual return, they would be able to achieve financial independence in just 11.1 years.

For simplicity, let's round to 11 years and plug in the same numbers as we did earlier into theContributions vs. Returns Calculator:

It turns out that 61% of this couple's net worth after 11 years would be composed of investment returns. Recall that this same couple who earned 5% annual returns on their way to F.I. only had 37% of their final net worth composed of investment returns. That's a massive difference!

As J.D. pointed out, these incredible returns since 2009 have given investors a huge boost over the past decade, but these type of returns are not typical. The stock market typically delivers around 7% annual returns, which is why I used that number consistently throughout this post.

Conclusion

We saw a few interesting things in this post:

- On a net worth journey, the first $100,000 often takes the longest to accumulate. Each subsequent $100,000 takes less and less time to accumulate, though.

- The amount you save matters more than your investment returns in the early years.

- For people who are able to achieve F.I. in 13 to 17 years, investment returns account for anywhere from one-third to one-half of total net worth growth.

Your job as an individual is to focus on what you can control. This means focusing on increasing your income, keeping your spending in check, minimizing investment fees, and maintaining an asset allocation that aligns with your financial goals.

If you hope to achieve financial independence in a relatively short period of time, you'll likely be better off focusing on these variables you can control rather than fretting over investment returns, which are largely out of your control — and not likely to ever be as good as they have been over the past decade.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)