Starting to save for retirement at 40

There's something about reaching the big 4-0 that often causes you to re-evaluate your direction in life. And when you do, it's hard to escape the fact that your day of retirement is indeed approaching faster than you ever thought possible.

If you're one of those who eliminated debt and made investing for retirement a habit since your 20s, there's very little to do other than enjoy your 40th birthday and continue on with what you're doing. But if you're heading into your 40s having done nothing to prepare for retirement, the prospects can be downright scary.

Related >> Maneuver Toward Retirement: What to do in Your 30s

Where Should You be?

If you missed the opportunity to let time perform its compounding magic on your investments, you face a problem of simple math: The compounding approach won't work for you if you get started this late.

Related >> The Extraordinary Power of Compound Interest

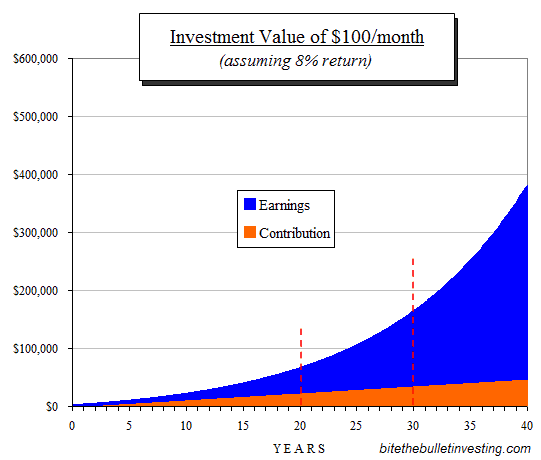

This chart shows the gravity of the situation:

The two red, dotted lines represent the eventual value of a $100-per-month investment after 20 and 30 years — i.e., if you wanted to retire at age 65 and started at ages 45 and 35, respectively, investing in index funds with an average return of 8 percent per year, the $100 a month would yield you:

- approximately $65,000 after 20 years, as opposed to

- approximately $162,000 after 30 years.

Now What?

You missed the luxury train to retirement. It's not pleasant to hear, but it's true. Although it's not the end of the world, your situation is, shall we say, “imperfect,” and you will need to find a way to compensate for that imperfection.

Invest three times more than someone who started 10 years earlier. The good news is there are ways to get on track. The bad news is that none of them are ideal or even easy. You, therefore, have to decide which one (or more) of the following impositions of imperfection you will pursue for your best shot at recovery:

- Accept a higher level of risk

- Get more involved in your investing activities

1. Investing More

The math may be brutal, but it is simple. Let's say you want to have your investments provide you with $50,000 a year (to pick a random, round number). Nobody knows what prevailing interest rates will be 20 or 30 years from now. (Thirty years ago we were lucky to get a mortgage under 12 percent per year.) Relatively safe S&P 500 index funds yield 2 percent in cash dividends these days. On safe Apple or Microsoft bonds, you can earn something similar.

If those numbers stay unchanged, you would need $50,000 ÷ 2% = $2,500,000 to provide your $50,000 in relative safety. In order to arrive at that $2,500,000 number in your 20-year time horizon, you would have to invest more per month — something more on the order of say $3,850. Like I said, brutal, but simple.

Related >> How to Invest $1,000, $10,000, or $100,000

2. Accepting More Risk

Risk is a topic laden with emotions and even lots of opinions. But we seem to forget that risk is all around us: We take a risk driving along a highway, believing a simple painted line will keep an oncoming truck from wiping us out. The question is not risk or no risk, it is how much risk.

If you don't have $3,850 a month to invest in safe index funds, you will have no choice but to assume some risk somewhere along the line to compensate. Not pleasant; but again, the only way around the brutal math.

Alternative Investment Example

One avenue of higher risk might be to rely on a higher return on your investments once you retire (than the 2 percent we assumed above). The City of Detroit, for instance, recently issued a new round of bonds for its Fire Department. These bonds yield 4.75 percent, more than double the rate we assumed earlier. When people hear “Detroit,” they cringe and run for the hills. However, those bonds are probably very safe because they will stand before all existing bonds (and it has never happened that a big city paid zero on their bonds). Perfect? Of course not. But something to consider? Absolutely — especially when you know you have no chance of getting more than $2 million in 20 years.

If you assume that similar deals will continue to become available (a fairly safe assumption), that affects the nest egg you need dramatically: Instead of needing to invest $3,850 a month, $1,900 a month might work if you're ready to assume the added risk.

A Little Caveat About Being in this Situation

Before the quick/lazy readers get on their soap boxes and yell at the top of their lungs that risk is bad, please note: We are not advocating assuming a higher risk to get rich quick. As the saying goes, “Desperate times call for desperate measures.” There are all sorts of reasons someone could find themselves in a desperate situation with their retirement investments. (More on this below, but they don't all have to do with being lazy or cavalier about retirement.)

Still, it's important to note that risk is not a black-and-white affair, a choice between complete safety and total ruin. Rather, risk comes in shades of gray. Thousands of people navigate those shades quite successfully. It is not a slam dunk, however. Navigating risk successfully depends on …

3. Working Harder

There are investments out there which are less passive than, say, index funds but which, if you learn to do them well, may be more profitable. Probably the most visible example is rental property. Few investments have proven themselves over so much time and in so many countries as the classic home next door which you rent out.

As anyone who has ever taken this route will attest, this is not a passive investment by any stretch of the imagination. A friend of mine who succeeded at this very well called it a second job on steroids. To enhance your success, you will have to do renovations and repairs yourself, and you will have to deal with finding tenants and dealing with the inevitable problems they bring. But, in 20 years, you can turn this investment into a self-perpetuating income stream with a built-in hedge against inflation.

That is only one example; there are many. I alluded to the Detroit bond issue above. If you are willing to spend time to research a specific investment like bonds, you will in time be able to discern opportunities that others who rely on simplistic formulas pass over. The key, once again, is exploring options and setting aside the time it will take to get beyond passive investing.

Pulling It Together

Unless you are a mega-earner, there is no painless way to recover the ground you lost. Chances are you will end up employing some combination of the strategies outlined above.

Tighten Your Belt

In order pull it off, the first thing you will need to do is some serious belt-tightening. In your 40s, you will be close to your maximum earning potential. If you are not investing for retirement now, simple math says you are probably spending it all. The same math says that, in order to invest, you will have to cut back that spending. If you plan to invest a lot, you will need to cut back a lot. There really is no getting around that.

- A budget is your first essential step. Slaughtering sacred cows will be next. Club memberships, eating out, travel, shopping, even your nice home, every one of those things near and dear to your heart will have to go on the chopping block. Things will only get worse if you don't.

- The second step is getting rid of any consumer debt. When my wife and I arrived at this point, the view we took was that if we needed to eat bread and water, we'll do it. Fortunately, it never quite came to that, but you get the point: To succeed, you need a mindset of no entitlements and a microscope for all expenses.

- You might even have to take a second job. That will help boost your income to get the money for that “catch-up” investment.

There is Hope

In summary, getting started with retirement planning in your 40s will not be easy, and that's putting it mildly. Almost everyone has some slack they can cut out in order to free up money to invest. Everyone has a few hours every day to invest in a second income and/or learning more about a particular kind of investing to get beyond what passive investments can generate.

That's the bad news. The good news is that it is not impossible; there is hope. A commenter or two on previous posts have noted that such a heavy emphasis on getting money for a nest egg may be overkill — money isn't everything. That is true. But money is the emphasis on this blog. And the only time to address the problem of taking care of yourself when Social Security is not enough is now. As I said earlier, although it gets more painful the later you start, it is never too late.

Related >> Best CD Rates | Certificate of Deposit Rates

Addendum: Life Isn't Always Kind

There are a few readers who, like me, blasted through the black-themed birthday party with nothing in place for those final years; others encountered situations that set them back to zero. Some of those predicaments might have been of their own making, perhaps poor choices; but they could just as easily be due to events being sprung on them through no fault of their own.

Lenny, a friend of ours, lost her job last week when the newspaper company she worked at for almost 20 years decided to shut down her division and eliminate all those jobs. They gave her a terrific recommendation, but recommendations don't pay the groceries when you are 75. Another friend buried his wife of a few decades this month, claimed by cancer. It's not hard to imagine that illness and care wreaked havoc on their finances.

Life isn't always kind — nor is it predictable — but this post is for those who, for one reason or another, are not on track to retire but realize it's time to get busy and do something about it. Life isn't always kind, but we don't have to make it harder for someone else. Please be kind to your fellow readers as you comment.

Are you older and starting to save for retirement? What options are you pursuing to deal with a shortened horizon? What would help you overcome the challenges?

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)