Life expectancy: The most important variable in retirement planning

When I write about retirement and retirement planning, I frequently mention that I aim for my savings and investments to last another thirty years. So, for instance, when I use retirement calculators to determine how long my nest egg will last, I use 78 as my projected age of death. Several readers have written to ask how I arrived at this number.

For example, Richard wrote:

I’m wondering why you’re only projecting out 30 years. You’re only 48. I’m 54 (and retired) and, in my projections and calculations, I go out 40 years. I probably don’t need to plan out that far, but you never know. My last surviving grandparent died just a couple years ago at age 99.

This is a great question. In fact, I believe life expectancy is the most critical factor in determining how much money you need to save — and how much you can spend. Unfortunately, it's also the variable that's most difficult to calculate with any kind of precision.

Why is Life Expectancy so Important?

When the mainstream media publishes an article about early retirement, the comments are filled with folks who say things like, “These people are cheap. I could never live like that. Besides, what if they drop dead tomorrow? Then what good is all of that money? YOLO!”

On the other hand, early retirement forums are filled with people who go to the opposite extreme. “OMG! I can't believe you're only expecting to live until age 90. What about modern medicine? What about gene therapy? What if you live to 108? Boy, then you're going to be sorry you didn't save more!”

Both sides make valid points.

- If your assumptions about life expectancy are too optimistic, you risk not making the most of the money you've saved. If you budget as though you were going to live to 95 but end up dead by 65, you'll have a lot of money that essentially goes to waste — money you might have used to do the things you'd always dreamed of doing.

- If your assumptions about life expectancy are too pessimistic, you risk running out of money. If you make choices based on the idea that you'll die at age 65, for example, but live until 95, you'll end up broke. You'll spend decades eating beans and rice.

Here's the bottom line: If you knew when you were going to die, you could calculate how much money you'd need to get from now to then.

Pretend that next week Elon Musk announced he'd developed the Methuselah, a machine that can tell users the precise date and time of their death. It's 100% accurate and somehow can even account for accidental death. When the Methuselah comes on the market, you try it just for kicks. It tells you that you'll die on 06 November 2034. You have about seventeen years left to live.

Based on that information, you'd be able to calculate with great precision how much money you'd need in order to make it to your date of death. You'd know whether you need to continue working or could call it quits right now. You'd know whether you had enough saved to travel the world in luxury or if you needed to live a more meager existence.

Unfortunately — or fortunately, depending on your point of view — there isn't a way to tell with any precision how much longer you have to live. Elon Musk hasn't developed the Methuselah machine. (Yet.) All you can do is make an educated guess.

How to Determine Life Expectancy

One basic way to estimate your time remaining is to consult an actuarial life table. The U.S. Social Security Administration, for instance, has a basic period life table that shows how much time the average person has left to live based on their current age. A 48-year-old man like me can expect to live another 31.32 years — until I'm 79.

My cohorts and I each have a 0.4167% chance of dying this year. Of 100,000 of us born in 1969, 93,759 are still alive.

But actuarial tables apply to entire populations. They don't take into account our individual habits and genetic predispositions. For a more customized guess at your date of death, you can consult one of the many online life expectancy calculators. To one degree or another, these tools take into account variables like diet, exercise, and family history.

Here are three online life expectancy calculators that I've tried and liked:

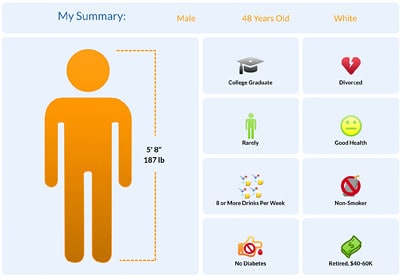

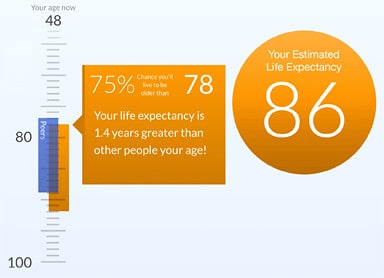

- The Blueprint Income How Long Will I Live? calculator uses data from the AARP and the National Institute of Health. It asks some basic questions about your health habits to generate a personal profile and estimated life expectancy. According to this tool, I can expect to live until 86.

- I'm a long-time fan of the Living to 100 life expectancy calculator. This tool is cool because it takes into account a wide range of factors, then provides specific recommendations for how you can increase your expected lifespan. The downside? To get the most from this calculator, you have to register for an account. Living to 100 says that I will probably live until age 82. (Unsurprisingly, I can add tons more time to my life expectancy by improving my diet and fitness — and reducing my alcohol intake.)

- The John Hancock life expectancy calculator is short and to the point. Plus, it makes adjustments in real time so that you can see how different factors influence the projections. I could boost my own life expectancy by seven years if I were to drink less beer and wine. This tool shows I should live until age 81.

Based on these life expectancy calculators, I can expect to live until my early eighties. If I lost a little weight, ate more vegetables, and reduced my alcohol intake, my life expectancy would jump by almost a decade! Hmmm….

I'm sure there are other good life expectancy calculators out there. If you know of one, please share it in the comments.

My Own Life

If the life expectancy calculators show me living until 81 or 82 or 86, then why do I use 78 as my projected age of death?

The truth is I'm more pessimistic than that. The truth is that when I give presentations, I often use a date much nearer on the horizon: 04 July 2019. That's right: There's a part of me that thinks I'll be dead in about a year. I'm not joking.

I don't mean to be morbid, but I can't help it. You see, the men in my father's family tend to be short-lived. My dad died of cancer ten days before his fiftieth birthday. His brother died of cancer at age 52. My cousin died of cancer at age 46. My grandmother died of cancer in her early seventies. I have another cousin — one of my best friends, actually — who turns 54 today. He too is fighting cancer. (Thankfully, he seems to be winning the fight.)

With a health history like this, I get nervous. I plan for the worst.

That's one of the reasons I've been so eager to travel while I'm still relatively young. I'm afraid that if I don't visit Europe, if I don't take an RV trip across the U.S., if I don't spend time in South America, then I won't ever get the chance.

Still, I recognize that my situation is different than that of my family members who fell to cancer. For one, I'm healthier. I eat better and exercise more. (That's not to say that I couldn't do more. I absolutely could.) Plus, I have better access to health care. Maybe most important of all, I'm aware and vigilant of potential problems. (I get a colonoscopy every five years, for example.)

I also recognize that my mother's family has completely different longevity stats than my father's family. People on my mother's side live a long time.

Based on all of this, I hold two separate, contradictory ideas in my head when I make projections about my future. On the one hand, I always ask myself what my best option would be if I knew I were going to die in a couple of years. On the other hand, I also explore options based what might happen if I were to reach my projected life expectancy of 78. (I never project beyond that, though.)

What about you? When you plan for the future, how do you decide how long you'll live? How does that affect your decisions? Are you worried about saving so much that you're unable to enjoy today? Are you worried about spending so much that you won't have enough set aside when you're older? How do you account for life expectancy in retirement planning?

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)