How to cancel COBRA insurance

In a recent article, I described what COBRA insurance is and my experiences obtaining it. One of the biggest complaints I had about COBRA was the sign-up process. Signing up for COBRA insurance had to be initiated by my employer, and it was a paper process to boot. This meant there was a lag between when I signed up and when I received proof of insurance.

Unfortunately, after wading through the sign-up process, the rest of my experience with COBRA didn't get any easier. A paper bill was mailed to me each month and I was supposed to send in my check. I couldn't find cancellation instructions anywhere on the documentation I received, and it wasn't possible to initiate the cancellation process online either.

Billing Mismatch was Just the Beginning

As I stated in my previous article, I needed COBRA only for the period between April 15 and May 1, when my insurance at my new employer was set to kick in.

What is COBRA insurance? (and other frequently asked questions)

Next week marks my two-month anniversary at my new job. Huzzah! In addition to celebrating my new, higher salary, I am also feeling simultaneously challenged and less stressed.

I feel challenged because my new job is in an entirely different industry than my former position. But I'm definitely less stressed because the performance expectations are reasonable and my colleagues are fun and friendly. I may even be celebrating a new coworker soon, since the friend who got me into SEO in the first place (and who was also one of my professional references for my current position) has applied for a job in my department.

Saving can Make a Job Transition Easier

While all of these are good things, one aspect of my job transition that was less than festive was the Consolidated Omnibus Budget Reconciliation Act (COBRA) insurance process. Since one of the features of an improved economy is an increased willingness to switch jobs -- or even to leave a current job without having another lined up -- I thought I would share my experience with COBRA.

When to use intermittent FMLA

Disclosure: I am not an attorney or HR specialist. This is just my experience with, and understanding of, FMLA.

According to the United States Department of Labor (DOL) website, "The Family and Medical Leave Act ("FMLA") provides certain employees with up to 12 workweeks of unpaid, job-protected leave a year, and requires group health benefits to be maintained during the leave as if employees continued to work instead of taking leave." The whole point of FMLA is to promote work-life balance by taking a reasonable amount of leave to deal with personal or family issues.

Because many situations requiring use of FMLA are health-related, the law also requires that your health insurance be maintained as if you continued to work. The Consolidated Omnibus Budget Reconciliation Act (COBRA) allows employees to stay on a former employer's health plan for a limited time after job separation, provided they pay the full premium (employer share and employee share). Unlike COBRA, if you are on FMLA, then your employer still pays their share of the premium for your health plan, even if you are not being paid a salary during your leave.

Job search tips that work

You may have noticed that, since last September, many of my posts here at Get Rich Slowly have focused on the job search. Some of you may have wondered why I would write about such a topic at all, since my job tenure was over seven years.

Well, it's because I have been job-hunting. And I succeeded! As I write this, I just wrapped up my first week at a new job.

So I thought it would be helpful to revisit some of the posts I wrote during that time to see what job search tips actually worked for me as I went through the process. Here's an overview of how I approached my job search and what made it successful.

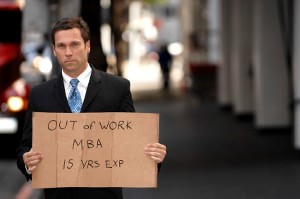

What to do when you can’t find a job?

For the last few months, I've been talking about various aspects of job-hunting. But what do you do if you can't find a job? OK, you can start with cutting your budget to the bone and applying for public assistance programs if you are eligible. But what next? Well, as with many things, the short answer is: It depends. On what, you may ask? Here's what I came up with:

- Are you currently unemployed, underemployed, or employed and just looking for a better opportunity?

- Do you have any debt? How much? What kind (a mortgage, consumer debt, student loans)?

- How big is your emergency fund? Do you have any other liquid reserves?

- Do you have a significant other or other loved ones (including parents or adult children) who are currently earning and/or with whom you can share expenses?

To pick randomly from the list above, an unemployed person with no debt and a beefy online savings account who is married to a high-earner living in Small Town, USA may actually be in a better situation than someone with a full-time job, lots of debt, and no emergency fund who is single and stuck in a lease on a one-bedroom apartment in Manhattan.

Everyone's situation is different, so take my suggestions on what to do if you can't find a job with a grain of salt (and a side of no judgment). That said, here are some strategies for those who are wondering if the recession is over, where are the jobs?

How to interview a prospective employer

Speaking about building wealth, J.D. Roth felt that he could never make this point emphatically enough: "Frugality is important, but if you want to make real progress, increase your income." It's in this context that being able to ace an interview becomes a very important skill. And certainly part of the interview process should include your asking questions of a prospective employer to make sure that the job and the company are right for you.

If you are early in your career, though, it is natural to approach a job interview as if it's a test that you might or might not pass. But this perspective could lead to some undesirable results:

- Firstly (and ironically), it may prevent you from highlighting your strengths.

- Secondly, it may keep you from finding out the things that you need to know in order to properly consider a job offer if they do want to hire you.

Here are three more ways having a test mentality can affect how you conduct your interview and some strategies for how to avoid potential missteps.

How to achieve long-term financial goals

In my last post, I talked about how personal finance is about playing the long game and "making choices that are harder in the short term for the good of the long term." But when the payoff is so many years down the road, it can be difficult to stay on track. In order to actually reach long-term goals, you have to keep making the right choices day after day. How easy is it to fall off the wagon a week or two after you start a new diet, for instance? You need a game plan for the short term that supports your long game too.

Establish Priorities

Especially when you are young, there are just so many goals to strive for simultaneously. For example, Jake and I currently have the following goals:

-

House projects. We replaced our HVAC and decided solar panels aren't for us right now, but we still need to demolish a corroded metal shed and resurface our back deck.

Personal finance and the long game

When you think about it, personal finance is about playing the long game. Sure, it's about other things as well. It's about paying off debt. It's about spending less than you earn. But when you think about it overall, it's about making choices that are harder in the short term for the good of the long term. Here's what I mean….

Saving for retirement

Saving for retirement, for example, means having less money to spend today. Having less to spend today can help avoid lifestyle inflation, which is generally regarded as a good thing.

However, there are plenty of responsible things that could be done in the short term with that money. For example, you could pay off debt or give to a charitable cause that is meaningful to you. You could stash that cash in an emergency fund or eat organic foods and hire a personal trainer. Continue reading...

How to turn down a job offer (or resign) gracefully

So, you've done it. You've considered all the costs of a new job, networked your heart out, and considered all aspects of your job offer. Now you are facing one of two outcomes:

-

Pull the trigger! Take the new job.

-

Not good enough! For whatever reason, you've decided to decline the offer.

Preparing financially for a job search

Looking for a new job is a multi-faceted process. I've discussed many aspects of career-building that apply even if you are just trying to keep a job you already have. But laying the groundwork for a successful job search is about more than just your reputation. A job search can take months -- in some cases, up to a year or more -- so it is very important to be prepared financially before you start to look.

How to prepare financially for a job search

1: Beef up your emergency savings

To cover the gap between your last paycheck at your old job and your first paycheck at your new job, it is a good idea to beef up your savings. There are many reasons this could be the case: You may need to relocate for your new job, you may find it difficult to time your start and end dates, or you may be laid off or terminated before you can line something else up. These challenges can have a ripple effect on your finances.

For example, if your new job will require that you relocate, your significant other may also need to leave their current job. If you are the primary breadwinner in your family (or you are single) then having a gap in your income can have a major impact on your life. This is especially the case if you are living paycheck to paycheck.<