Best budgeting apps of 2023

YNAB: You Need a Budget Review

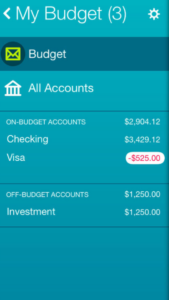

If you're ready to account for where every cent of your money goes, You Need a Budget could work for you. The app is based on the premise of "giving every dollar a job," meaning you budget for every expense -- fixed, discretionary or otherwise. Want to buy a new purse or pair of shoes? If your monthly clothing budget is $100, then you may not be able to afford it this month. Friends want to double date at that trendy new Italian restaurant? It may not be in your $200 dining out budget.

![]()

The app makes budgeting straightforward, allowing you to see how much over or under you are for a particular line item. But it's best for people who want to get serious about how much they actual spend and where they may need to make sacrifices to achieve a larger goal.

What I Liked

Zero-based budgeting is tough, but I can see its value. You have to account for every dollar coming in, either using it to cover monthly household expenses, pay off debt, for dining out and for what YNAB calls "quality of life" expenses like vacation. During this process, I realized that I'm not as good a budgeter as I thought. I do a good job of tracking our spending after the fact, but I could improve when it comes to setting aside money for specific purposes -- basically being more financially proactive. For example, before using this app, I had no idea how much my husband and I spent each month dining out and we never really set aside a specific amount for this purpose. It was more like "we'll eat out no more than two times a week." I also had no gauge of my own discretionary spending, since this money comes out of my personal account. Using the tool allowed me to see that we spend less than $200 a month eating out, but that I need to keep a better eye on my discretionary spending for things like beauty and hair products and anything from Amazon.com (Amazon Prime admittedly has turned me into a shopping junkie). We plan to buy a house within a few years, so YNAB allowed me to see that these are two areas where we (or I) could curb spending and put that additional money toward a down payment. Actually seeing the budget also showed me that we could be saving more. We have more cushion than we need in our account for household expenses, so it might be better to put more of that money toward retirement or paying down my student loans.

Hmmm, Not So Much

The set-up process. Before you set up the mobile app, you had to set everything up on desktop. This took me several days because I had difficulty importing information from my bank account.

After some back and forth with YNAB's customer service, we figured out that the issue was the security settings on my Bank of America account. I had it set up to enter a passcode for every login. I had to remove this security feature to import my transactions into the YNAB app. However, even after it was set up, my transactions weren't regularly imported. While I troubleshooted this, I had to manually add each of my transactions. I re-authenticated my bank account for a second time, but even after this it didn't work. I wish this process was a lot less cumbersome. In spite of this hassle, YNAB's customer service was awesome. Every time I had a question or technical difficulty I received a response the same day or within 24 hours. Once I got in and started using the app, it was pretty user-friendly. YNAB also has plenty of helpful videos and user guides on its site, plus you can attend a free webinar. These self-service options cover most of what you need to navigate the tool or tackle certain issues.

Book review: You Need a Budget

In a nutshell: By diligently applying four simple rules, you can move from being at the mercy of money to being a master of money.

The Mechams felt flat broke.

Visualize your budget flows with a Sankey diagram

There's a new fad in the financial independence subreddit, one that might be fun for Get Rich Slowly readers to play around with. People have discovered Sankey diagrams, a type of chart that makes it easy to visualize data flows. That sounds sort of geeky, I know, so it's probably best to show an example. Or four.

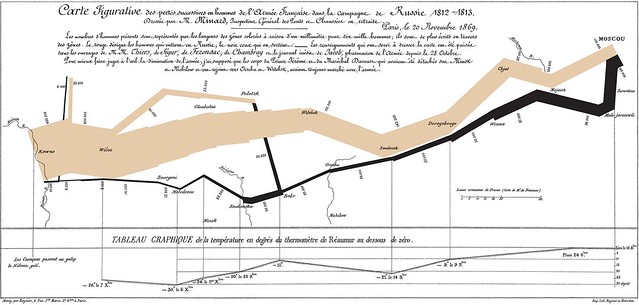

Perhaps the most famous example of a Sankey diagram (certainly the example I've seen most often) is Charles Minard's map of Napoleon's disastrous invasion of Russia:

Seven money strategies to master this year

It's that time of year again. After several weeks of over-indulgence, people are coming to their senses and realizing it's time to make changes for the better. Some -- like me -- have decided to improve their relationships with food and exercise. They've resolved to eat well, drink less, and move more. Others have decided that 2017 is the year they'll take charge of their finances.

If you are one of those determined to make this the year you become the boss of your own life (or if you've been on that path for a while and simply need a shot in the arm), here's an overview of seven smart strategies to improve your financial position.

These aren't just arbitrary suggestions. I've been reading and writing about money for more than a decade now. Based on my experience -- and based on thousands of conversations with other people -- these are seven specific strategies that work.

Household Budgets for Beginners: Simple Tips for Success

We all know we should make and stick to a household budget if we want to be able to sock away savings each month—and end up financially comfortable. But building a household budget as a beginner can be daunting.

Only one in three Americans takes the time to create a monthly budget, a recent Gallup poll showed. (I don't need to tell you the rest of us are spending an inordinate amount of time looking at cat memes instead…)

How to manage your personal finances like a business

Lots of people find dealing with personal finances to be a tough task. For some, money wasn't a topic of family discussions growing up. There was no place in the curriculum for it at any level of schooling. So, how then, if people aren't exposed to it in their youth, will they be prepared to deal with it as adults?

You can read Dummies Books. You can read magazines like Money and Kiplinger. You can pay for courses from financial "gurus". You can read blogs like Money Boss. But maybe the best way to master your money is to start treating your personal finances like a business.

This idea might seem strange at first, but it makes a lot of sense if you think about it. Businesses require structure. Building a business takes planning. It requires patience. The people who run successful businesses have to be accountable to shareholders, partners and investors. And sometimes they have to call on outsiders to help them with specific problems.

The money boss budget

I'm not a fan of budgets. Even before I became a money writer, I found budgets onerous. Their prescriptions sometimes seemed arbitrary -- why this much for groceries and that much for entertainment? -- and they didn't do a good job of taking into account personal differences.

During a decade of writing about money, I've come to like budgets even less. They lead people to the mistaken belief that there's only one right way to handle money, a concept I hate.

That said, there are certain budgets that I do like.

How to save money each month

Is this the year to focus on saving more? If you've been disappointed when you've checked out your savings account balance, let's change that this year by figuring out how to save money each month.

How Much Should I be Saving?

Actually, advice on the topic of how much you should be saving differs based on who's giving the advice. At a minimum, most people recommend saving 10 percent of your income. Dave Ramsey recommends saving 15 percent of your income as a good goal. Still others recommend 20 percent. However, no one will complain if you save as much as you possibly can.

7 surprising results when you pay your kids for chores

One of our parenting goals is to rear frugal kids. Take care of their stuff. Spend wisely. Save for a rainy day.

Making the goal is easy, but implementing the goal? Definitely harder.

How Our (Current) Allowance System Works

Over the last couple of years, we've been experimenting with the best ways to teach our kids to manage money. What I've learned is that it's best to keep our system flexible as the kids mature and develop more skills. So we decided that our system will probably always be subject to change so we can accommodate their growth, but here's how our family's allowance system currently works:

How do you decide what to spend on a computer?

Decide to buy a computer these days and immediately you're confronted with a complex decision process wherein you pit features against price. The choice is intensely personal and a total reflection of your tastes, priorities, and pocketbook. I know how I've gone about it in the past, but I was curious to see how other people approach the problem.

It wasn't hard to get people to talk. (People are passionate about their computers!) But as they did, I identified three basic methods to decide on price:

- The features route

- The cheap route

- The set-price route

Now that I think about it, this may be true for a lot of purchases!