The flywheel of wealth (and the importance of patience)

His name is Dave. A retired Naval officer, he’s written two novels and about to publish his third. His books (thrillers in the style of Dan Brown and John Grisham) have been well received and even won awards, yet he’s still a relative unknown in the competitive world of fiction.

Her name is Michal. She’s a residential and commercial painting contractor in central Ohio. She’s a natural artist, a trait she inherited from her father and passed on to her daughter. She’s truly gifted, yet has struggled to grow her young business.

His name is Rob. He wants to achieve financial freedom at a young age. Yet, fresh out of college, he has mountains of debt. He makes a good salary, but most of it goes to paying school loans and everyday expenses. He manages to save and invest $100 a month, but feels like he’s making little progress.

These are all true stories.

- Dave is Dave Grogan, a friend of mine. You can find his books here.

- Michal is Michal Cheney, my sister. She owns and operates No Drip Painting, a company that has enjoyed tremendous growth, but only after years of hard work that seemed to go nowhere.

- Rob is, as you might have guessed, me — 25 years ago. What started as $100 a month turned into early retirement at the age of 49.

What do these stories have in common? The Flywheel.

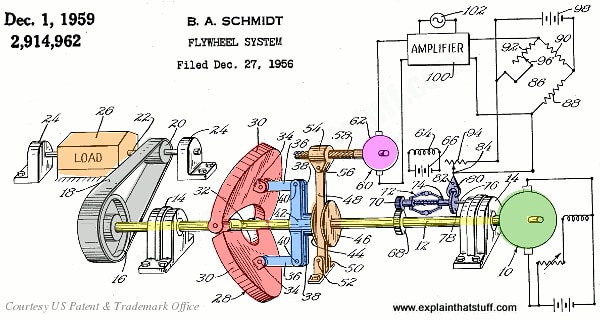

A flywheel is a mechanical device designed to efficiently store rotational energy. Well, that’s how an engineer would describe a flywheel. I majored in English. To me, a flywheel is a wheel that’s really hard to get started. Once it gets going, however, it’s really hard to stop.

Anybody who has taken a spin class and tried to stop the pedals with their feet has learned firsthand just how much a moving flywheel wants to keep moving!

Today, I want to tell you about the flywheel of wealth. Like any flywheel, it can be slow to get started. But once it’s moving, it’s almost unstoppable.

The Flywheel and Business

Most young entrepreneurs experience the flywheel. The new realtor struggles to get her first sale. The second sale is just as hard. So is the tenth. As she struggles, she watches long-time realtors get new clients with ease.

An online entrepreneur struggles to get visitors to his new website. He publishes great content, yet watches as long-established websites, even those with lesser quality content, get gobs of visitors.

I can remember publishing my first article on my personal finance site, The Dough Roller. I was terrified. I knew that as soon as I clicked publish, the entire world could see my ideas, my thoughts, my opinions. How would they react? With adrenalin aplenty, I clicked publish and sat back and waited, and waited, and waited. Nothing happened.

In hindsight, my fear was comical. Why? Absolutely nobody, and I mean nobody, read that first article published on 27 May 2007. I was pushing against a flywheel that was at a dead stop. It didn’t budge.

Up at 5:30 am seven days a week to work on my blog, I kept pushing against that flywheel. On the subway going to work I pushed some more. I pushed against the flywheel at lunch. I pushed against the flywheel at night after the family went to bed. It didn’t move.

Then the inner voice we all have spoke up. “Keep pushing if you want, buy you’ll never get this flywheel to move. You don’t have what it takes. Just give up. Life will be easier and you won’t embarrass yourself.”

I kept pushing.

It took six months following this schedule before the flywheel begrudgingly moved ever so slightly. I kept pushing. And pushing. And pushing.

Fast-forward eleven years and what started out as a blog with one post nobody read had become a multi-million dollar business. The flywheel was humming along so fast I couldn’t stop it if I wanted to.

What accounts for the success? I didn’t quit. I kept pushing and, importantly, learning how to push against the flywheel. In my case, it was learning the art and science of online publishing.

Note: I sold the blog in 2018, but continue to record the Dough Roller Money Podcast. Here’s my interview with J.D. about how to manage your money as the CFO of your own life.

The Flywheel and Financial Freedom

All of this brings me to the flywheel of wealth. I’m on a mission to motivate young people to save and invest. It’s not easy.

Many people in their twenties see saving money as:

- A huge sacrifice,

- Having no short-term benefit, and

- A long-term benefit they may never get to enjoy.

I challenge these beliefs in my new book, Retire Before Mom and Dad, which was published last week. [J.D.’s note: I read Rob’s book a few weeks ago. It’s fantastic!]

Here’s the thing. Most young people can’t see past the seemingly immovable flywheel of investing.

Let’s imagine you read my book and I’ve convinced you to start saving and investing today. Excellent! So you give up cable TV to save more money. You take the $100 monthly cable fee and invest it in a low-cost index mutual fund. You feel good about your decision, although you miss some of the shows you use to watch on TV.

Now let’s fast forward one month. You’ve suffered through withdrawals from the lack of cable. You’ve yelled at your kids a bit more than usual. Surly would best describe your “I gave up cable to invest” mood.

To ease your pain, you decide to check your investments. You log into your account, and if we assume the month was an average month for the stock and bond market, you earned about one-twelfth of 8% — or .67%. (Over the long term, the U.S. stock market returns about 8% per year.)

Your $100 investment has turned into the princely sum of $100.67. The flywheel didn’t turn much!

At this point several things happen.

- First you curse me and the day you bought my stupid book or read this article.

- Second, you kick yourself for giving up a month of Property Brothers for a lousy 67 cents.

- And you’re at a loss on how to respond to your significant other who went through his own cable TV withdraws and wants to know how the investment is performing.

Welcome to the world of investing. Yeah, it starts really, really slow. (Maybe that’s why J.D. named this site Get Rich Slowly?)

Greasing the Flywheel

And that brings me to what I call the “Nine Year Rule of Compounding Magic”. Here it is:

It takes about nine years of investing the same amount each month for the monthly returns to equal the amount you’ve been investing.

Let’s use our example of investing $100 a month. If we again assume an 8% return, after nine years we’ll have $15,742.96. If on an average month we earn about 0.67% (which is 8% divided by twelve), our $15,742.96 will be generating an average monthly return of $105.48.

Magic!

Now our investments are generating more than our monthly contributions. And if we continue to invest our $100 a month plus the income generated by our investments, our wealth continues to compound . The flywheel picks up speed.

Now let’s take it to the next level.

It took about nine years at an 8% return for our wealth to generate monthly income of about $100. How long will it take to increase this income to $200 a month? If you’ve been following along, you know it will be fewer than nine years given the magic of compounding.

Let’s do the math. Using an Excel spreadsheet, we can quickly calculate that after another five years, our balance rises to $30,802.26. That amount of wealth will generate about $200 a month in income at an 8% return ($205.35 to be exact).

Magic again!

It took us nine years saving $100 a month to have enough to generate another $100 in monthly income. But it took us just five years to double the monthly income to $200.

We can keep going:

- 9 years: $100 a month

- 5 more years: $200 a month

- 3.5 more years: $300 a month

- 2.7 more years: $400 a month

- 2.3 more years: $500 a month

- 1.9 more years: $600 a month

- 1.7 more years: $700 a month (26.1 years total)

Here’s the key point. The first $100 of income is the hardest. It took us nine years.

As the power of compounding grows, it gets easier and easier. In our example above, we jumped from $600 of monthly income to $700 in just 18 months. And in case you were wondering, our $100 monthly investment grew to $105,195.67 after 26.1 years.

Why is this important? It’s important because we need to set realistic expectations. M. Scott Peck in his bestseller, The Road Less Traveled, makes this point in a different context. He says that life is tough. And as soon as we realize that life is tough, life gets a little easier.

Building wealth is slow at first. It can even be discouraging at times. But once we realize this, once we set realistic expectations, it gets a little easier.

Keep pushing on that flywheel!

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)