How to Make Separate Finances Work: An Interview with J.D. and Kris

Every couple has its own way of managing money. Some folks share their finances completely. Some — like my wife and me — keep their finances completely separate. Most couples fall somewhere between these two extremes.

Every couple has its own way of managing money. Some folks share their finances completely. Some — like my wife and me — keep their finances completely separate. Most couples fall somewhere between these two extremes.

Writing for the June issue of Redbook magazine, Virginia Sole-Smith highlighted what she calls the new money rules for couples. Experts don't agree on how couples should manage their money, Sole-Smith says. That's because there's no “one size fits all” solution. What's most important is to find a system that works for you and your circumstances:

Clearly, the real experts are you and your partner, and it's critical to find an arrangement that suits your exact situation, as pairs who bicker over bills once a week or more are 30 percent more likely to get divorced than those who squabble about it less, according to research from Utah State University.

Her article profiles four couples who have developed unique systems for managing their personal finances — including the laundry agreement Kris and I use.

Due to the nature of the article, Sole-Smith couldn't possibly include all the info we provided when she interviewed us by e-mail. She had two paragraphs to explain our system, but we wrote over 2000 words. Rather than let all that info go to waste, though, I thought it'd be fun to share the entire interview here at Get Rich Slowly. This may answer some of the questions we often get from new readers.

Redbook

How old are you? What are your occupations? How long have you been married? Do you have any kids?

Us

J.D. is 42 and a writer. Kris, who will turn 41 in late June, is a scientist. We've been married since August 1993. We have three cats but no children.

Redbook

Can you give a ballpark figure for your household income and, if relevant, who contributes the bigger portion?

Us

Kris makes about $60,000 per year. J.D.'s income is too varied to give a meaningful answer. Sometimes it's less than that, but some years it's much more.

Redbook

I've seen on the blog that you keep finances separate. What was the inspiration for this decision?

J.D.

I'm not sure it was an actual decision at first. We dated — and then lived together — for several years before getting married. We both contributed equally to household expenses, but from our individual accounts. When something was out of whack — say, I wanted to eat out more often than Kris — then one of us would pick up the slack based on who was causing the increased expense.

When we got married, our system worked fine, so neither of us felt any pressure to merge finances. Plus, Kris didn't like how I spent my money. She didn't want my foolish expenses draining the money she'd worked hard to save.

Kris

I knew from the start that J.D. and I had different money skills and financial habits. Since we didn't plan to make one spouse financially dependent on the other, it made sense to us that we were each in charge of our own salaries. Of course, major purchases were shared, but I could follow my “saver-tendencies” to prepare for a rainy day even during the years that J.D. was living paycheck-to-paycheck.

If I had felt that he was spending “my” money as well as “his” money, it would have been incredibly stressful for me. Now that he's reformed his spending habits, there's less of a reason to keep things separate, so the lines have blurred a bit.

Redbook

How does that work in practice? How do you decide who pays what bills? How many bank accounts do you have? Basically, what are all the nitty-gritty details of the day-to-day money management stuff?

Us

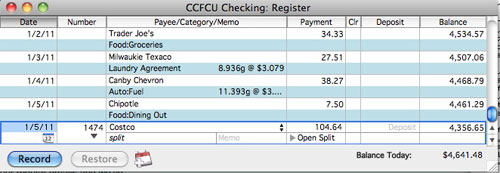

We each have our own checking accounts and savings accounts. We each pay some of the utility bills (we divided them up so they are roughly equivalent on an annual basis) from our own separate accounts, but when we were doing lots of remodeling on the house we had a joint account to pay the contractors. Kris buys most of the groceries while J.D. usually pays when we eat out. J.D.'s income is larger now, so he tends to offer to pick up the tab for more of the “splurges”. For day-to-day stuff, J.D. keeps a spreadsheet to show various expenditures and once in a while one of us will write out a check to the other one to even it out.

Redbook

How often do you talk about money and how much do you know about your spouse's financial situation at any given time? For example, even though everything is separate, do you keep each other in the loop about the state of various credit card bills or payments sent? Or are things so separate that you don't even know what the other person makes?

J.D.

I have a general idea of what Kris makes and a general idea of what she spends, but I don't know the specifics. I have no idea what her monthly salary is — just her annual income. (And yes, I can divide by twelve to get a rough guess.) I've never looked at her credit card bill, and I've never checked to see how much she's spending on anything. I trust her. I don't need to check up on her. As long as she's contributing her share of the household expenses, she can do whatever she wants with her money!

Kris

Pretty separate in terms of the day-to-day bills and expenditures but we have an overall picture of the other's financial state. My mind is much more at ease than when he was struggling with debt. I feel free to mention it if it looks to me like J.D. is making too many impulse purchases, but he has become much more self-aware about his spending habits and triggers and monitors himself.

Redbook

Of course, we want to talk about the laundry agreement. J.D., I already have your take on this from the blog post (unless there's anything you want to add!) but Kris, it would be great if you could weigh in on how this works from your perspective.

Kris

I love it. I got to trade a task that I don't mind at all (laundry) for a chore I hate (gassing up the car). Now if I could only get him to put his socks in the laundry hamper!

Seriously, I think all successful relationships have cooperation like this to some degree — ours is just more overt than some. In some families, one person does the earning while another runs the household. In others, one partner pays the bills while the other fixes the car. Why not make the most of the individual strengths to make life run more smoothly?

Redbook

Anything else super quirky or unusual about how you manage money besides the laundry deal?

Kris

To us, none of this seems quirky or unusual! I can't imagine being in a relationship where one partner or spouse controls all the finances. We know couples where one spouse gives the other an allowance. That works for them. Our way works for us. Some people (commenters on the blog) seem to think that separate finances means that we aren't fully invested in our marriage, but that simply isn't true.

J.D.

Here's another one related to the fact that I'm a slob: We have a housekeeper that comes in every two weeks. I pay for two-thirds of that cost, Kris pays for one-third. I think she'd actually like me to pay 100%.

Also, we used to be very anal-retentive about splitting grocery receipts. We shopped together, and after every trip one of us would sit down and itemize the expenses. What did I buy? What did Kris buy? Which were joint expenses? Whoever paid would then be re-imbursed by the other person.

We did this sort of thing with a lot of expenses, actually. But after we moved to a new house in 2004, things gradually changed. We didn't merge finances, but we stopped being so detailed about balancing them. Instead, we sort of developed “bailiwicks”. That is, Kris started paying for most of the groceries, but I paid for eating out. Kris bought a lot of the household necessities, but I was in charge of entertainment. And the vacations we've been taking are funded by the money that I make during the good years.

Redbook

How do you think your financial arrangements impact your marriage? I think I saw something on the blog about how this ensures that you fight much less about money — how and why?

J.D.

Oh, I think this absolutely prevents fighting about money. I used to say that we've never fought about money — not once. But we had a fight a couple years ago about how much to spend on remodeling, I think. Still, the principle holds. Because we trust each other, and because we both uphold our end of the marriage, we don't fight about finances. Now, this may just be because of who we are, but I think the separate accounts has a lot to do with it.

Kris

I'm the lucky one because over the years, J.D.'s money habits have grown to be closer to my own natural tendencies. He's had to do the hard part of changing. J.D. and I each value our marriage, and each other, but we also value our own individuality and what makes us different people. We don't have to overlap completely to love each other deeply. Our independence to make our own decisions (and mistakes) about our finances is mirrored in the independence we try to give one another in other areas as well.

Redbook

Can you imagine any scenario where you would want to handle money differently or merge finances to a greater degree?

J.D.

Good question. If it ain't broke, why fix it? Maybe if there were some Big Life Event. If we were to move to another country — which we've talked about — maybe then we'd merge finances. Or maybe if one of us became gravely ill. Or if we planned to have children. (I've talked with folks who kept separate finances, but abandoned that once kids came on the scene.)

Kris

If we had children, we would have had to re-assess this method of money management. But I think I would have still wanted to have separate accounts, and also joint accounts for specific purposes.

Also, since J.D.'s salary has climbed much faster than mine has, if we want to take a major trip together, we'll come to an agreement about what proportion each of us will pay. If I had to pay my entire share of 50%, we wouldn't get to travel as much as we both would like. This is something that we've just started over the last year, and it still requires some mental adjustment on my part. In return, I try to help J.D. with his blog when I can.

We have separate retirement investments, and it will be interesting to see how that works out when we get to the age where we start drawing from them. At this point, we're both where we want to be in our retirement savings.

J.D.

I agree that retirement is a big question. I suspect that we'll need to pool our resources more when we're finished working.

Redbook

J.D., since you write about finance and hear from readers on this all the time, do you think the way married couples are managing their finances has changed in the past five years or so? And if so, what are you seeing, and what are the factors at play (recession, more women working, etc)?

J.D.

I don't think anything radical has changed in the past five years, but I think things have changed radically in the past twenty or thirty years. Yes, more women are working. There are more stay-at-home dads. Couples are seeing that sometimes traditional methods aren't necessary for the modern world.

Tradition is fine if you value it and it's useful; but it doesn't make sense to cling to old habits just because “that's the way they're done”. I think many people in their twenties and thirties (and even their forties) recognize this, and they're willing to try new things to see if they work. That's a good thing.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)