Fixed expenses and flexible expenses: How to budget for both

Having flexible spending can help reduce your stress because you never know when you're going to get hit by flexible expenses.

A few months ago, my local bank and I had a falling out and my husband and I were suddenly very motivated to switch banks. We'd narrowed it down to two choices:

- Citizens Bank, which has a local branch where I can deposit the cash and many small checks I receive in the course of running my business, or

- ING Direct, where we already had a high-interest savings account.

Related >> Which Online High-Yield Savings Account & Money Market Account is Best?

Then I had a crazy idea. An idea so crazy it just might work. And it has — beautifully — for the past three months. Why not use both?

We could use one account for our day-to-day flexible expenses like grocery shopping, and another to pay our fixed bills, like the mortgage and utilities.

We went ahead and set up a new checking account at the local branch of Citizens Bank, but we also opened our ING checking account. Then we did something we really should have done years ago.

Fixed and Flexible Expenses

We sat down one night with all our financial records for the past year and worked out what our fixed expenses are: our mortgage, our utility bills, our debt payments. For the first time, we went past the monthly stuff and tallied in the quarterly and annual fixed expenses; those budget-busting surprises that are actually regularly scheduled expenses, like annual insurance premiums and the excise tax for our car.

My husband plugged all these numbers into a huge spreadsheet that eventually spit out a number: the number of dollars we needed to budget every week to pay our fixed expenses and meet our savings goals.

Happily, that number was smaller than the number of dollars we earn each week. What remains, whether we like it our not, is our flexible expense budget: the money we use to pay for everything that isn't committed to a regularly scheduled bill.

That includes groceries and gas, not just fun stuff like birthday gifts and dinners out. Yes, we need that stuff, but it's not money that has to be spent in a specific place, on a specific day. That makes it a flexible expense.

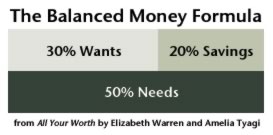

I've struggled with budgeting for years. I love the balanced money formula, but when I apply it to my own life, I get stuck on figuring out what's a need versus a want.

Related >>The Balanced Money Formula: Should you let it get out of balance?

With a fixed vs. flexible split in my expenses, it doesn't matter. I may need groceries and merely want auto insurance, but that car insurance bill is due on the 15th regardless of my priorities. If I don't have enough money to cover my flexible needs, I need to cut back on my fixed expenses somewhere.

Once we had those numbers, we set up our finances between the two checking accounts like this:

- My husband's direct deposit goes into our local bank account, where I deposit all my little checks and cash payments as they come in.

- Once a week, the amount of our fixed expense budget is transferred from our local checking account to our ING account.

- All of our recurring, fixed expenses are automated to pay out of that account.

- All of our flexible spending for things like groceries and entertainment comes out of the local account.

Splitting our finances up according to what's a fixed expense and what's a flexible one made about 90% of my day-to-day money stress simply evaporate. It was like hiring a personal assistant to keep track of all the details for me. Except that it was free, and actually saved me money in bank fees and late charges.

Yet Another Money Hack

At heart, this is just a money hack. I have about the same amount of money I had three months ago — I'm just looking at it differently. I'm using this hack to play to my strengths in managing my finances.

I'm terrible at keeping track of due dates for bills, at keeping my checking register accurate to the penny and at knowing exactly how much of the cash I have on hand I can safely spend.

Now that I have my fixed expenses being handled by my shiny new automated personal assistant, there's a lot less detail to keep track of. I don't need to remember, while grocery shopping, that my car insurance is due in three days. The money to pay the insurance bill is cooling its heels in an interest-bearing account my debit card can't touch, while I'm shopping.

There's also less money to play with. I can't cheat my budget by using money that should be earmarked for the cat's annual vet visit next month to pay for new jeans this month. The money in the spending account is all okay to spend, but it's a small number of dollars. This makes it pretty easy to see how careful I need to be, and to silence the naughty voices in my head that suggest I can somehow afford a little splurge.

Overall, this approach has saved me money. Making mistakes about due dates and bank balances can get expensive fast. But more important than the money is the time and energy it's freed up. I have hours every week that I used to spend carefully managing our cash flow and accounting for incoming bills. Now I use those hours to write, and to play with my family.

One Quick Caveat

A word of warning about this money hack. It's a great way to relieve day-to-day stress if keeping track of dates and dollars is not your forte;. It is not an excuse to set your finances on autopilot and walk away.

I do keep track of our finances every week. I check to make sure the bills have paid out correctly, I look for ways to save on those fixed expenses as well as the flexible ones.

Once a month, my husband and I sit down and go over every single category in the budget together, check our actual spending against our goals, and look for ways to save.

Having the bills automatically pay out of a separate account from our flexible spending makes it easier for me to not screw up. It's like having a safety net. But I still have to do the work of walking the tightrope.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)