Your lifetime wealth ratio (and how to calculate it)

While browsing money blogs yesterday, I came upon an old article from my pal Joe at Retire by 40. The post is from 2015, but it contains a cool concept that I think might be useful for readers of Get Rich Slowly.

Joe — who was inspired in turn by J. Money at Budgets Are Sexy — asks, “What's your lifestime wealth ratio?” According to Joe and J. Money, your lifetime wealth ratio is result of a simple equation:

Lifetime Wealth Ratio = Your Net Worth / Your Lifetime Income

In pain English, your lifetime wealth ratio (or LWR) compares how much you have today with how much you've earned during your time in the workforce. It's a way to look at the wealth you've created and gauge how well you've done at keeping that wealth.

Let's take a closer look at the lifetime wealth ratio and how it's calculated.

For this article, I'm going to be using my own numbers from 2014. Why 2014? Because that's the most recent year for which I (and the government) have info on my lifetime earnings.

Your Net Worth

Your net worth is easy to compute. Many money geeks have it handy in a spreadsheet or their favorite personal finance software. Your net worth is simply the total of everything you own (your assets) minus the total of everything you owe (your liabilities).

According to my records in Quicken, my net worth at the end of 2014 was $1,658,333.58 — roughly the same as it is today. (While today's number is accurate because I'm actively using Quicken once again, the number from the end of 2014 is more of an estimate. I wasn't really tracking my money at that time.)

If you've never calculated your net worth, take a look at this free net worth calculator I created for Money Boss a couple of years. It's a Google spreadsheet. Simply click “USE TEMPLATE” to copy it to your own Google Drive, and you can use it to determine your personal net worth.

Your Lifetime Earnings

Finding your lifetime earnings might seem more complicated — but it doesn't have to be. (At least not if you live in the United States.) You see, the U.S. government tracks this information for you.

If you head to the Social Security Administration website, you can login to (or create) your my Social Security account to view your current statement. That statement includes a summary of all the money you've earned in your life. (Well, all the money you've earned that's subject to Social Security withholding. For most folks, these are the exact same thing.)

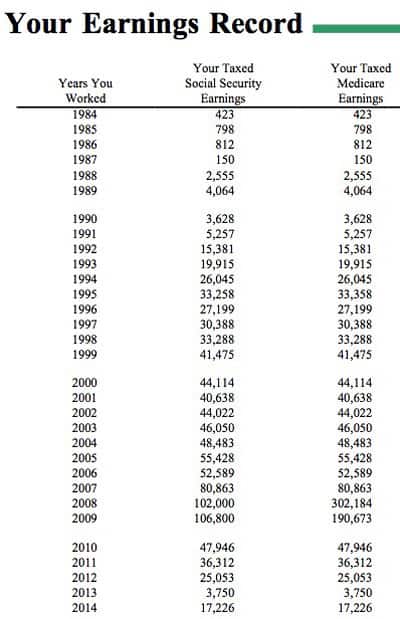

Here, for example, is my complete record of earnings through 2014 (the last year for which the SSA has updated my records):

I made a quick spreadsheet containing these numbers so that I could see how my total lifetime income increased from year to year. (I used “your taxed Medicare earnings” instead of “your taxed Social Security earnings” because the former has no limit and provides a more accurate overview.) By the end of 2014, I had earned a total of $1,279,797.

Your Lifetime Wealth Ratio

Putting these two numbers together, we can calculate that my lifetime wealth ratio is 1.30. My net worth at the end of 2014 was 130% of the total money I'd earned up until that point.

In his original article at Budgets Are Sexy, J. Money proposed the following scale for ranking your lifetime wealth ratio:

- 0%-10% – Meh

- 10%-25% – Now we’re cooking!

- 25-50% – You’re on fire, baby! Give me your number!

- 50-100% – Marry me.

- 100%-1,000% – How do I get into your will?

Based on this, my 130% lifetime wealth ratio isn't too bad.

I haven't always been in this position. Out of curiosity, I calculated numbers for the end of 2005. At this point, I had begun my quest to get out of debt, but I hadn't yet founded Get Rich Slowly.

On 31 December 2005, my net worth was $113,355.75 — nearly all of which was home equity. I had lifetime earnings of $523,201. That means my lifetime wealth ratio in 2005 was only 0.22. My net worth at the end of 2005 was comparable to only 22% of the money I'd earned in my lifetime. Yikes!

No wonder I felt crushed. By 2005, at the age of 36, I had earned half a million dollars, yet I had little show for it. I was still deep in consumer debt, and my net worth was barely over $100,000.

The Bottom Line

Clearly, the lifetime wealth ratio isn't perfect. Like any such number, it's meant as an estimating tool, a way to measure your progress. But it doesn't take into account certain financial events — both good and bad — that might not show up in your earnings history.

In my case, I experienced a windfall when I sold Get Rich Slowly back in 2009. That sale wasn't ordinary income, and it doesn't show up in my Social Security statement, so it's not part of the lifetime wealth equation. If we were to measure how much money I've actually accumulated over the course of my life, my LWR would be much lower than 130%.

Like many such numbers, the lifetime wealth ratio isn't really meaningful for young folks just starting out in life. When you're young, your income is low and your expenses are high. It often takes a few years for the balance to shift in your favor. (All the same, you should do what you can to achieve a positive cash flow immediately, to grow your net worth, if possible.)

What about you? What's your lifetime wealth ratio? How do you feel about this number? Is it an accurate reflection of your current financial position — and how you got there? Is there a different number you prefer for measuring your financial progress?

Here's another similar exercise from the classic money manual, The Millionaire Next Door. The authors suggest that most people can use a simple formula to see how they're doing financially. Here's how it works.

Multiply your annual gross (pre-tax) income by your age. Divide by ten. Your net worth — less any inheritances or windfalls — should be equal to this number. So, if you're forty years old and earning $50,000 per year, your expected net worth would be $200,000.

If your net worth is close to the expected number, the authors consider you an “average accumulator of wealth”. If your net worth is less than half that expected number, you are an “under accumulator of wealth”. If you have twice the expected amount, however, you are a “prodigious accumulator of wealth“.

It's important to note that this formula doesn't work well for younger folks, and the authors know it. It's mean to be a gauge for people getting closer to retirement.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)