Does the world of personal finance need more politics?

Note: I've added a short addendum to this piece in an attempt to clarify some things. This may or may not have helped.

Earlier this week at The Washington Post, Helaine Olen wrote that the world of personal finance needs more politics.

Olen specifically calls out FinCon, the financial media conference I attended last week. I love FinCon. She doesn't. She's disappointed that so many members of our community emphasize personal action and responsibility instead of directing our efforts toward changing the systemic and societal issues that make it difficult for some people to succeed.

She writes:

Spending a few days at FinCon 2019 shows the limits of the nonpolitical approach to improving your financial life…Over and over again, the systemic problems facing Americans are simply accepted as a given and unfixable, and tossed back onto the individual for him or her to solve.

Rarely mentioned are the political system’s many contributions to common economic troubles.

Olen is concerned that there are larger societal and systemic issues that hold some people back and prevent them from achieving financial success. I agree.

I disagree, however, that FinCon is the place to address these issues. And I disagree that we, the financial media, should turn our attention from the personal to the political.

Personal finance is personal. It's right there on the label.

Politics at FinCon

I don't know how many times Olen has attended FinCon. I've attended every year so far (and have already registered for next year's tenth installment). From my experience, she's wrong that attendees accept systemic problems as “given and unfixable”. We don't.

This year, I had a memorable conversation about privilege with Julien from rich & REGULAR. I spoke with several people in the FIRE community about how we can make the principles of financial independence more accessible to everyone, especially those with lower incomes. (We talk about this all of the time. So much, in fact, that I'm tired of the topic.) In past years, I've had extensive conversations about the challenges women face in mastering their money.

Here's another example: In 2015, the Debt Free Guys attended their first FinCon. Kim and I (and several others) enjoyed hanging out with John and David at the hotel bar. They confided that they were afraid about coming out to their readers. “Do it,” our small group told them. They did. Four years later, they're killing it, and LGBT financial blogs now have a powerful impact.

Financial bloggers talk about systemic and societal issues often. But we talk about these things amongst ourselves, one on one or in small groups, not in hundred-person breakout sessions or, worse, as a 2500-person body in the Hilton grand ballroom.

Why not? Because these conversations are nuanced. They're sensitive. Nobody agrees on any of this stuff. Even two people who have very similar political viewpoints will disagree on solutions. (Case in point: The current Democratic debates.) Imagine what it'd be like trying to do this with hundreds of people from across the political spectrum. Tackling subjects like the “student loan crisis” is best done in small groups, not as a FinCon collective.

FinCon founder Philip Taylor says that past sessions at the event have explored Universal Basic Income, women and money, minorities and money, and more.

This year, there were sixteen attendee-organized sessions with political themes, including an “equity and justice” meetup. Plus, the National Endowment for Financial Education sponsored a community service project.

FinCon in not a political event and never has been. Too, nothing about personal finance is inherently political. Sure, some folks put a political spin on the material they present, but that's an individual choice. And the political spin Dave Ramsey employs is different than, say, the spin Helaine Olen would use.

That's the biggest reason I'm glad FinCon doesn't include politically-charged topics in its official schedule: We are a diverse group with diverse beliefs. Olen writes as if there are universally agreed-upon solutions to the systemic and societal barriers confronting Americans. There aren't.

It's this lack of agreement that causes so much friction in our current national discourse. What does she think would be accomplished by holding these sorts of political discussions at FinCon?

The Political and the Personal

In Olen's article about FinCon, she argues that personal finance has failed. She believes the solution is to move from the personal to the political:

We are facing staggering levels of income and wealth inequality, while facing staggering costs for housing, health care, education and so on. If better personal finance could fix this one by one for more than 300 million Americans, we would know by now.

Here's the thing, though. We do know by now that better personal finance can and does fix things one by one for Americans. I'm not sure why Olen believes that it can't.

I've been writing about money for more than thirteen years now, and I've had hundreds (thousands?) of readers contact me to tell me how they've turned their lives around after deciding to take charge of their finances.

- Government doesn't help GRS readers get out of debt.

- Government doesn't help GRS readers negotiate pay raises.

- Government doesn't help GRS readers increase their saving rate.

No, GRS readers do these things themselves.

Each year, I meet one-on-one with dozens of folks from the GRS community. Without fail, these people are taking action to master their money — and their lives. They're not waiting for somebody else to solve their problems. They're seeking solutions themselves. And while not every reader finds success, most do.

I believe strongly that the focus of my work is (and should remain) personal, not political. I don't believe turning my attention to systemic and societal problems would solve anything for anyone. But by helping individual readers find ways to improve their lives, I can help many people.

If I were to write an article bemoaning the state of student loan debt in the United States, it wouldn't solve anything. I'd just be adding to the noise. If we at FinCon were to hold a panel discussion on student loan debt, we wouldn't solve anything. We'd just be adding to the noise. Frankly, it worries me that Olen believes we should be adding to the noise instead of offering readers tools and solutions that they can apply to their individual circumstances.

It's not my job to change the system. It's my job to give readers the tools they need to thrive within the world we've created. If Olen wants to fight the system instead of teaching readers to better their lives, that's fine. She can do that. I genuinely wish her well. But I'm not sure why she thinks it's necessary for everyone else to have the same goals that she does.

Here's the thing, though. As the 1960s feminist movement made clear, the personal is political. That is, how we live our lives should be consistent with our political (and spiritual) beliefs. Even though I don't discuss politics overtly here at Get Rich Slowly, I hope that my choices and actions for the site subtly reflect what I believe, in a way that leads by example rather than shouts from the rooftops. I hope that I'm “walking the walk”, not just “talking the talk”. That's my goal, anyhow.

Here's an analogy borrowed from my buddy Jim Wang of Wallet Hacks.

A doctor's job is to maintain (and restore) the health of her patients. It is not a doctor's job to battle insurance companies or the pharmaceutical industry. She may have concerns about these aspects of the medical-industrial complex, and she may have a deep desire to see things change, but changing the system isn't why she spent 15+ years in higher education. She did that so she can improve the lives of individual patients.

Likewise, my job is to improve the financial lives of individual readers. It is not my job to solve the student loan crisis, to fight high taxes, or to rail against our modern corpocracy. I may occasionally bitch and moan about how shitty our healthcare system is, and I may secretly wish our corporcracy would die a fiery death, but I generally try to steer clear of politics because my job is to help you build wealth. Period. The end.

Whose Side Are You On?

Another problem that Olen doesn't mention is that there's no unanimous agreement over how to address the problems with our socioeconomic system. There's not even agreement that the things she views as problems are problems. (Conversely, I'm sure other folks would consider some things pressing issues that she'd dismiss as unimportant.)

Olen complains, for instance, that Americans face “staggering” costs for housing, health care, and education. But she doesn't acknowledge that there's no consensus on how to address these problems.

My conservative readers would suggest one possible course of action. My liberal readers would argue in favor of another. People like me who are generally centrist would prefer a third alternative. Which way is right? How can we possibly know? How would arguing about this at Get Rich Slowly (or any other money blog) possibly improve society?

It wouldn't and it won't.

But Get Rich Slowly can make the world a better place by showing people how to pay off debt, start saving, and achieve financial freedom despite the societal and systemic structures that surround us. I can make things better by helping people become more resourceful, helping them develop the skills they need to build wealth. And then these people can teach others.

Over the years, I've received many messages from readers thanking me for keeping politics off this site. While I'm a human being and have my own opinions and beliefs, I do my best to keep the blog itself as neutral as possible. All readers are welcome: gay, straight, black, white, religious, atheist, libertarian, socialist, whatever. I don't care.

This seems like a good time for a Taylor Swift GIF to express my stance:

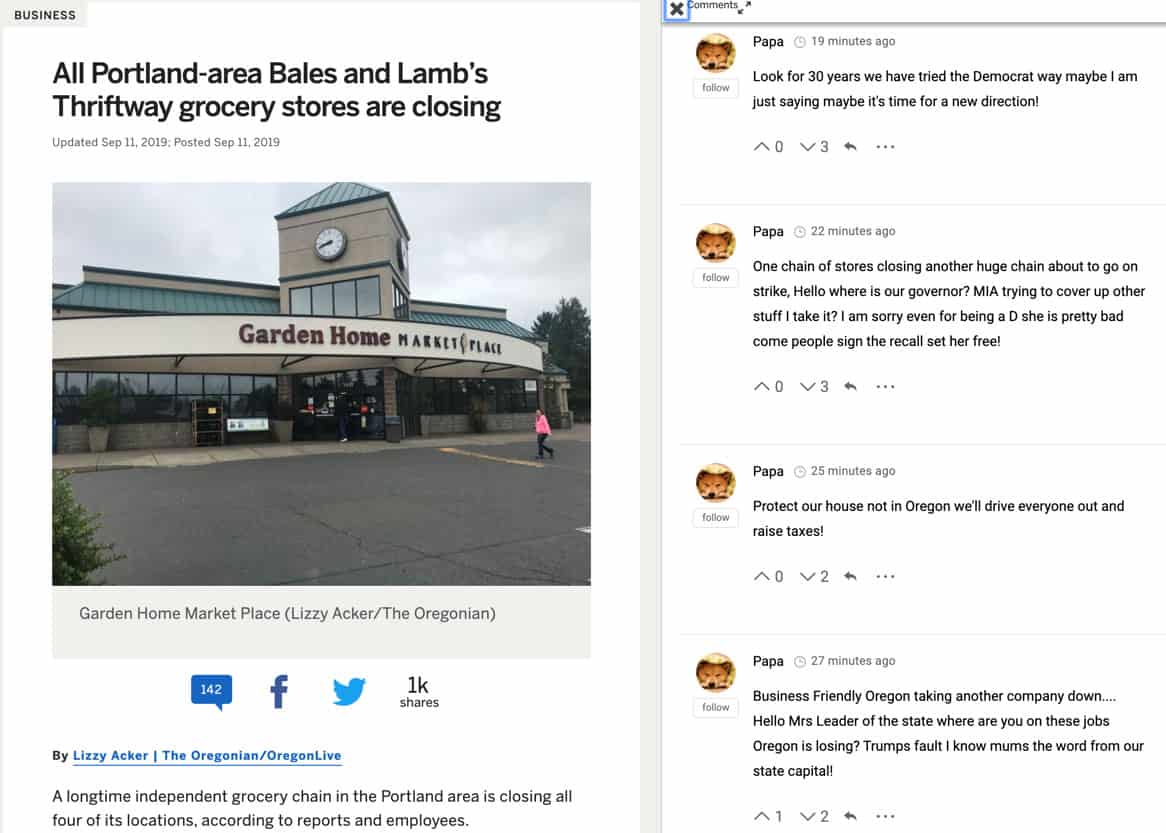

Because GRS is a safe space, we're able to have civil conversations about topics — taxes, divorce, Taylor Swift — that would provoke heated nonsensical debate on other sites. Earlier today, I was reading an article about taxes from my local city's newspaper. The comments were ridiculous. Like five-year-olds with larger vocabularies and less civility.

Here's an actual example of what happens when an innocuous story — “local grocery store chain is closing” — is hijacked by political discussion. It's ludicrous.

Besides, the GRS readership isn't exclusively USian. We have many Canadian readers among us. (And my business partner is Canadian.) Lots of people in the U.K. read this site. I've had beer with readers in Turkey, Hungary, Ecuador, Germany, Switzerland, and France. (Well, in France we drank wine and in Switzerland we drank whisky. You get the idea.) If I were to shift my focus to politics, what good would that be for these folks?

About three years ago, Brad Barrett and Jonathan Mendonsa launched the Choose FI podcast. These two men have polar opposite political perspectives. But because they keep the politics out of their show and out of their friendship, they've achieved huge success. They're focused on helping people, not on changing the system.

Breaking Bread

On the final morning of FinCon this year, I met Joshua Sheats for breakfast. Sheats is the whipsmart host of the Radical Personal Finance podcast. His mind works at a million miles per minute, and our conversations always make me think. Whenever we meet, I take notes. Even at breakfast.

Joshua and I share drastically different political and religious views. Yet every year at FinCon, we break bread together. We engage in a deep, respectful discussion about the world we live in. It's one of my favorite parts of the conference.

We're only able to do this, though, because we're meeting each other as two individuals. While we disagree on certain fundamental issues, we share a passion for helping others get better with money, and we both believe strongly that ultimately it's up to each individual to improve her own life.

“Are you and Kim married now?” Joshua asked this year, pointing to the ring on my finger.

“No,” I said. “But we're committed to each other.”

“How does that work from a practical financial perspective?” he asked. “My world view is based on the Bible. I understand how Biblical marriage works. I don't understand how a secular partnership like yours would work.” I explained how we manage our shared lives.

Joshua wasn't challenging me. I didn't feel threatened. We weren't shouting at each other. We hold radically different viewpoints, but were able to engage in a civil discussion because we entered the conversation as two individuals with mutual respect.

In Olen's world — in a world where FinCon and money blogs focus more on political issues — this kind of thing would be less likely to occur. Instead of engaging as complex indviduals, attendees would engage as adherents of one or another political movement. When this happens, people stop thinking of others as real human beings. We end up with the sort of political discourse that is already destroying our society. It's as if Olen wants Finconners to give up their mutual admiration and respect in order to become a mirror of existing American culture. That seems insane to me.

We at FinCon come from myriad different backgrounds. The conference is racially diverse. It seems fairly gender balanced. (I don't have precise stats.) There's a large contingent of Christian bloggers. There are many atheists. There are Republicans. There are Democrats. In a way, it's almost as if the conference itself is a microcosm of American society…but without the bickering. It's wonderful.

I don't think FinCon could be this tiny five-day utopia if politics were a prominent part of the discussion. If politics were a central focus, we'd risk shattering this fragile, precious thing, this sublime soup of mutual love and respect.

“I'm taking my son to the Museum of the Bible this morning,” Joshua said as we finished our breakfast on Sunday. “Do you want to join us?”

“I can't,” I said. “I have another meeting.”

But I was deeply grateful that Joshua would ask me to accompany him, especially since he knows my political and religious beliefs. He wasn't trying to proselytize. He was simply trying to engage and share. I'm honored he would want me to be with him.

These sorts of interactions are only possible, though, because FinCon doesn't do politics. The moment that politics become a primary focus, I believe much of the FinCon magic will disappear.

Final Thoughts

Ultimately, what bugs me most about Olen's argument is this: By trying to convince readers that societal and systemic issues are too large and too powerful, she strips individuals of agency. She denies them the ability and power to change their own lives. She encourages a passive, reactive mindset instead of an active, proactive point of view.

This seems like a miserable worldview. It robs people of dignity and hope. It's a tacit argument that “you can't control your life; your life is controlled by larger forces”. I don't believe that. I don't want others to believe that.

The fundamental premise of this site is: Regardless the hand you've been dealt, it's up to you to take action to improve your life. You can't wait for somebody else to make things better for you.

At the same time, I agree with Olen. There are problems with our current socio-economic system. And while we may not agree how to remedy these problems, talking about them is important.

But I don't think FinCon is an appropriate venue. Nor is Get Rich Slowly.

I love the idea of a new event dedicated to this discussion, a conference where financial journalists discuss systemic issues and politics and how they relate to personal finance. If this were deliberately inclusive, intentionally designed to include all points of view and to foster respectful discussion, I think it could be awesome. I'd attend.

But it seems misguided to come to an existing event that works, one that's valuable precisely because people can escape politics for a few days, and then complain that it ought to be more political.

Why politicize the non-political?

Whoa! While researching for this article, I found a short 2006 piece I published about the politics of personal finance. In it, I wrote: “Personal finance is non-political. It helps everyone when another person avoids debt, learns to save, and becomes financially independent.” I'm pleased to see my position has remained consistent all of these years!

Addendum

In the 24 hours since I published this piece, I've had some great conversations about the subject via email, on Facebook, on Twitter, by text, and here in the comments section at Get Rich Slowly. Many folks agree with me. Some don't. That's awesome!

My concern is that a few don't understand my overall point, which makes me feel like I did a poor job of explaining myself — probably because I took 3000 words to do it. Let me try a shorter version.

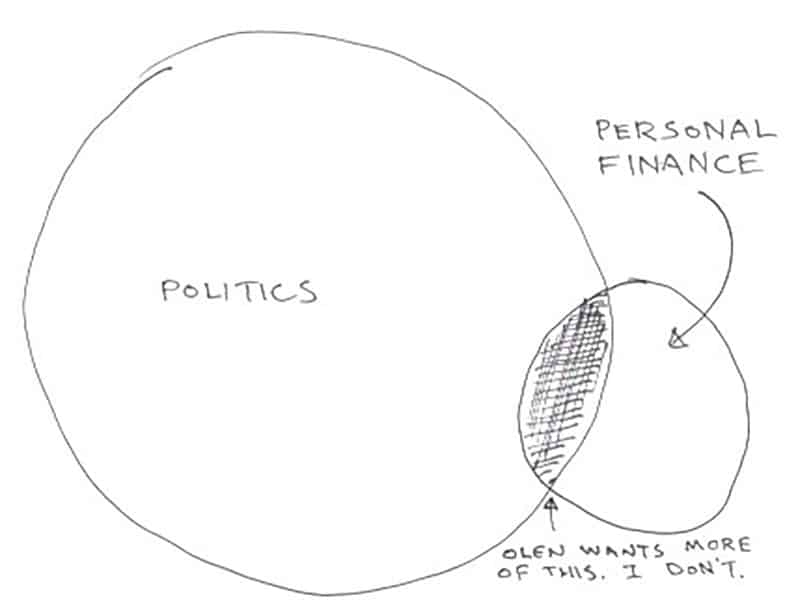

Personal finance is personal. Yes, I agree that the personal is often political, but I don't think it always is. And when there's overlap between politics and money, I believe the two can (and often should) be addressed separately. To me, it's like the following Venn diagram, which I have lovingly crafted for you:

If you want to write about the intersection of politics and personal finance, do it. If you want to have a conference about the intersection of politics and personal finance, do it. But don't be cranky if and when others don't.

What I object to is the idea that personal finance needs more politics (in general), and that FinCon needs more politics (specifically). I believe there's already plenty of politics in personal finance.

Some of my favorite money blogs tackle both politics and personal finance at the same time. (Bitches Get Riches is a great example.) And there are already alternatives to FinCon for folks who want political discussion at the same time. (The amazing Stefanie O'Connell and Emma Pattee, for instance, put on the Statement Event every year.)

My mission is to help individuals get better with money regardless their political or religious affiliations. Others, including Helaine Olen, have a broader vision. They want to change our society and are less concerned with the success of discrete people.

There's nothing wrong with either aim. There's room for both sorts of crusaders in the world. But I feel it's wrong to complain that somebody else — or some other conference — doesn't share your aim or objectives, that they ought do to things the way you would do them.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)

![This graphic by James Clear shows the Mr. Money Mustache version of Stephen Covey's circles. Confused? I don't blame you! [Circle of Concern vs. Circle of Control]](https://www.getrichslowly.org/wp-content/uploads/23783342876_61fe34d89c.jpg)