How to invest in index funds

This is the third installment of a three-part series examining index funds. In Part I, we looked at the managed mutual fund market. In Part II, we looked at how an index is calculated and what an index fund is. In this installment, we'll consider how to evaluate index funds and where to buy them.

Despite the fact managed mutual funds still dominate the mutual fund landscape, there has been a steady migration of assets from managed funds to index funds and ETFs (most of which are indexed). In fact, there are more than 350 index funds from which to choose, so when you start to look into investing your money in an index fund, you'll need to understand these two things:

- What kinds of index funds are available

- Where do you get them

Types of Index Funds

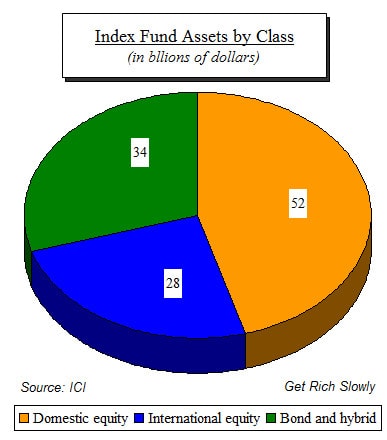

Some people classify money market funds as index funds because they're passively managed, but money market funds are not based on an index. Instead, three broad categories describe how index funds are generally broken down, as shown in this pie chart from ICI data:

What is an index fund exactly?

[This is the second installment in a series examining index funds. In Part I, we looked at the managed mutual fund market. In this installment, we will look at how an index is calculated and what an index fund is. In Part III, we'll consider how to evaluate index funds and where to buy them.]

In the first part of this series, we saw that mutual funds are the dominant investment vehicle for individuals because they reduce risk through diversification on a scale that individuals cannot achieve on their own. And we mentioned that index funds typically have larger returns and lower fees than managed funds but that investors are largely unaware of their existence.

But why do we have index funds, and what are they?

What are mutual funds and how do they work?

[This is the first installment in a series examining index funds. We'll discuss the managed mutual fund market first to form a basis of comparison with index funds. In Part II, we will look at how an index is calculated and what an index fund is. In Part III, we'll consider how to evaluate index funds and where to buy them.]

We can't predict the future — so when it comes to investing, minimizing risk is the name of the game. One highly effective strategy to help limit investment risk is through diversification, and most of us achieve it by investing in mutual funds.

Mutual funds, and their close cousins, Exchange Traded Funds (ETFs), achieve diversification by buying a wide variety of different bonds, stocks, or whatever investments they focus on. You and I typically don't have enough money to achieve that kind of diversification on our own, but we can get it on our limited budget by investing in a mutual fund. Continue reading...

Personal finance and the long game

When you think about it, personal finance is about playing the long game. Sure, it's about other things as well. It's about paying off debt. It's about spending less than you earn. But when you think about it overall, it's about making choices that are harder in the short term for the good of the long term. Here's what I mean….

Saving for retirement

Saving for retirement, for example, means having less money to spend today. Having less to spend today can help avoid lifestyle inflation, which is generally regarded as a good thing.

However, there are plenty of responsible things that could be done in the short term with that money. For example, you could pay off debt or give to a charitable cause that is meaningful to you. You could stash that cash in an emergency fund or eat organic foods and hire a personal trainer. Continue reading...

The rise of alternative investments

Back during the dotcom collapse of 2000, I was losing money in the stock market like a champ. I was a second-year financial analyst who had a serious case of confusing brains with a bull market. When I turned to my VP and told him I was still bullish about the stock market, he almost slapped me upside the head. "We're in a bear market, son. Get used to it and stop dreaming!"

After losing about 30 percent in my after-tax portfolio, my dreams of stock market riches finally faded. I cried "uncle" and moved my money into more conservative investments. The funny part was that my 401k was actually up in 2000 and in 2001 because I had allocated 50 percent of my assets into a hedge fund called Andor Capital Management that went short the market.

Normally, only accredited investors -- those who earn $200,000 a year or more or who have a net worth of over $1 million or more (excluding their primary residence) -- can invest in hedge funds. But my firm had a partnership with Andor that gave us peons access to invest as well.

How to ladder CDs

How to build a CD ladder? It's a great question -- unless you have no idea what a CD "ladder" even is. Let's start at the beginning. A CD ladder is a method of staggering the maturity dates of certificates of deposits so you can invest your money safely and still keep some of it easily available for emergencies.

The Federal Deposit Insurance Corporation (FDIC) insures certificates of deposit (or time deposits) just like they insure savings accounts -- so they are just as safe.

Retirement travel and frugal living

Retirement travel is in. Out is the era of spending unending retirement days on a golf course in plaid pants and interminable games of bridge with the blue-rinse set.

The new generation of retirees is looking for more adventure, with more activity … and lower costs. Few strategies deliver like the recreational vehicle (RV) retirement lifestyle. Continue reading...

How to evaluate mutual funds to boost your returns

I'm a bit of a nut about Christmas; I even have a daughter named Noelle. So this time of year can be a bit of downer for me. The tree gets disassembled, the Bing Crosby CDs get packed away, and the holiday cards stop coming. Regarding that last one, however, the void in my mailbox will soon be filled by a different type of tiding -- in the form of annual statements from my investment accounts.

OK, so they're not as jolly as cards with pictures of friends and relatives. But using your year-end statements to give your portfolio a thorough checkup can pay off, especially if you discover ways to increase your chances at higher returns. To see the potential benefit, check out this table, which shows how much $10,000 could amount to, given different rates of return and time periods. As you can see, earning another two percentage points a year can add thousands of dollars to your net worth.

| Annual Return | 5 years | 10 years | 15 years | 20 years |

| 6% | $13,382 | $17,908 | $23,966 | $32,071 |

| 8% | $14,693 | $21,589 | $31,722 | $46,696 |

| 10% | $16,105 | $25,937 | $41,772 | $67,275 |

Alas, you can't just snap your fingers and pump up your returns. Most investments involve taking on risk, which many people think of as volatility -- the ups and downs you'll experience -- but I prefer to think of it as uncertainty, as in you generally don't know exactly how an investment will perform, which can make things like retirement planning a bit of a challenge.

How to Save for a House

How to save for a house? It's a common question among newly married couples, but this was not our first marriage milestone. My wife and I didn't wait too long after our wedding to create a family.

We were parents one week before our first anniversary. Our apartment was too small for a third human, so we endeavored to buy a house. Unfortunately, we didn't have a lot of cash on hand since we moved from Florida to Virginia six weeks before we got married, and we footed most of the bill for the wedding.

However, we were still able to buy a house, though barely in time for the birth, but amassing a down payment relatively quickly. If you're also scrounging for a down payment, here are some ways you can save and reach that goal faster.<

Average 401(k) balance by age

Saving for retirement isn't easy, but 401(k)accounts are a universally popular way to save thanks to hands-off investing features and contributions drawn directly from your paycheck.

But how do you know if you've saved enough? How is your retirement savings plan shaping up against people your same age?

Here's the Data:

Average 401(k)balance up to age 25: $4,048 Median: $1,385