How to check your Social Security benefits online

Last week, I drove out to the box factory to see my brother Jeff and my cousin Nick. Ostensibly, I made the trip to check up on Mom's financial situation. Really, though, it was an excuse to spend three hours chatting about nothing and everything all at once.

As I was looking through Mom's Social Security info, I decided to check my own account online.

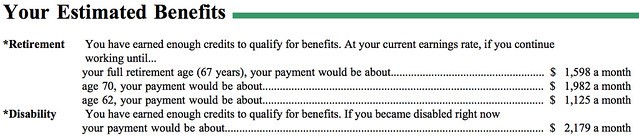

“Look,” I said. “I'll get $1125 per month if I start Social Security in thirteen years. If I wait eighteen years, I'll get $1598 per month. That's as if I had another half-million dollars saved for retirement.” [I based this very rough estimate on the math for the four-percent rule.]

“Wait,” Nick said. “You can check your Social Security benefits online?” He was less interested in my hypothetical half-million dollars in added wealth than he was in looking at his Social Security account.

“Yes,” I said. “Of course. Generally speaking, the U.S. government websites are awesome.” It's true. They are. Our government may get a lot of crap for the things it does wrong, but government websites are universally useful and informative.

“But is that safe?” Nick asked.

“Yes, it's safe,” I said. “It's the official Social Security site with official Social Security information. The government isn't trying to scam you.”

“I didn't know you could do this either,” Jeff said.

“Huh,” I said. “Maybe I should share this at Get Rich Slowly. If you guys don't know about this, there are probably tons of other people who haven't heard about it.”

How to Check Your Social Security Statement Online

It's easy to check your Social Security statement online. Everything works exactly as you'd expect and the website security is tight. Here's how.

- Head to the official Social Security website. (Make sure you're at ssa.gov and that the start of the URL includes “https” indicating that it's a secure connection.)

- Create an account. Follow the instructions carefully. When you receive your activation code, return to the Social Security website to complete the process.

- After you've created your account, log in. Even here, you'll encounter an additional security measure. After you submit your password, the website will email you a one-time security code. After you enter that, you'll be able to access your information. (You'll get a new security code each time you access the account.)

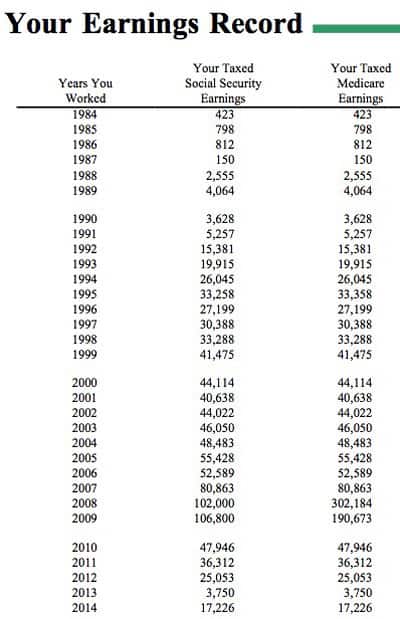

From the main page of your account, you have access to all of your basic Social Security info, such as your earning record:

And your estimated benefits:

You can also download your most recent Social Security statement and/or order a replacement card. (True story: My Social Security card was stolen from the glovebox of my Datsun 310 GX in 1988, when I was a sophomore in college. I've never replaced it.)

There's not a lot to see in your Social Security account, but that's fine. Sometimes you simply need to check your estimated benefits or your lifetime earnings. The Social Security website makes that easy and efficient to do.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)

There are 6 comments to "How to check your Social Security benefits online".

How do I get into my account? Should

I cancel the account my wife set in 2021 and start a new account?

I have not been receiving SSA benefits for the last two months, maybe more, I was in the throws of moving from Ohio to Tennessee.

I have lost a 1099-r and need a replacement to file my taxes

i hear we are getting extra money starting in january. my husband and i have not receive our. we both have direct deposit to our bank. i check with them today and there is no extra money added to our account for Jan. or Feb.

I attempted to sign up so I could check on my social security, couldn’t get through with making a password that I could remember!

How can I find out what is going on with my benefits!

According to my bank, my next deposit is going to be $392.50 less than what my deposits have been.

Why?? What’s going ??

I have lost a 1099-r and need a replacement to file my taxes