Guarding Against the Invasion of Stuff

Since August, I've been on a quest to reduce the clutter in my life. Back when I was a spendthrift, I bought a lot of Stuff. Stuff comforted me. When I was buying things (even on credit), I felt wealthy.

Stuff doesn't make me feel wealthy anymore — it makes me feel cramped. With time, Stuff simply becomes clutter. Slowly but surely, I'm banishing excess belongings from my household. I still sometimes buy more than I ought, but mostly I've been guarding the borders of my life against the invasion of Stuff. Here are some of the defenses I've been employing:

- I ignore the proverbial Joneses. One of the most dangerous paths to clutter (and to overspending) is the urge to own the same things your friends do. Peer pressure can be powerful. I've come to realize that lifestyles are not a competition. What does it matter what others buy? I'm content with what I have — more Stuff is not going to make me more happy.

- If I don't need it, I don't buy it. As I've purged my Stuff over the past year, I've been shocked by how many things I bought but never used. I would see something in a store — a voice recorder, for example — and convince myself that I needed it. Or I would tell myself, "I might as well buy a jig saw — we'll need one in the new house." But I used the jig saw only once in four years (on the day we moved in). I never used the voice recorder at all! These items are clutter, and were a waste of money. I've learned not to buy something unless I know I'll use it.

- I try to value experiences instead of things. Make no mistake — experiences still cost money. But a trip to England or the entrance fee to a marathon or a nice dinner with friends all share a common characteristic: they don't take up space in my home. I get value for my money, and there's no residual Stuff.

- I'm trying to practice the one-in, one-out rule. I'll admit up front that I'm not good at this, but Kris is trying to teach me. I'm attempting to keep a steady state of Stuff. If I have, for example, twelve pairs of socks, and then buy another, I must get rid of one pair. Practicing this rule prevents a build-up of Stuff.

- I focus on quality. It's been difficult for me to realize that sometimes it makes sense to pay more for the things I buy. My instinct is to buy whatever's cheapest. (And sometimes that is the best choice.) But I'm learning to base my purchase decisions on the value an item will give me. Often it makes more sense to have one excellent expensive item than to have several lousy cheap ones. The lousy items just become clutter.

- I borrow and lend. Shakespeare might have advised against it, but I've found that by borrowing and lending things among friends, there's less we each need to own. I've loaned out a drill, a rototiller, some golf clubs. I've borrowed books, a video camera, a lamp. By sharing these items, we're each able to have less Stuff in our lives.

- I've reduced my exposure to advertising. Since I stopped watching television a few years ago, I buy much less Stuff. But it's not just television. I used to enjoy reading the ads in magazines. Now I try to ignore them. The less I pay attention to advertising, the less I buy.

I don't want to pretend like I have Stuff licked. I don't. I'm still especially susceptible to free and cheap things. In the past year, for example, I've dragged home:

- Energy Star qualified products — "Products in more than 50 categories are eligible for the Energy Star. They use less energy, save money, and help protect the environment."

- Home improvement — There's a wide range of resources here for homeowners. There's a list of common home problems and solutions. If you have your last year's worth of energy bills, the home energy yardstick can compare your home to others across the country and give recommendations for improvements. There's also information about home energy audits.

- Energy Star qualified new homes — "An Energy Star qualified new home performs better for the homeowner and the environment thanks to a variety of energy-efficient features."

- The cost of seeds and fertilizer.

- Our approximate water usage.

- The time we spend planting, weeding, and harvesting.

- The amount of food we harvest.

- The cost-equivalent from the local grocery store.

How to stop junk mail in its tracks

This article is part of Financial Literacy Month.

Most Americans receive a daily flood of junk mail. Some savvy citizens take a stand against the torrent. My friend Pam gets great delight from calling the sender of every catalog she receives in order to be removed from their mailing lists. This works well, but there are easier ways to deal with the problem. Here's a list of four tools you can use to keep the marketers at bay.

OptOutPrescreen.com

OptOutPrescreen.com looks like it might be a phishing site at first. It's not. It's an official site established by the Consumer Credit Reporting Industry to allow consumers to opt-in or opt-out of credit offers. I did this the last time I posted about the service, and haven't received a credit card offer in over a year!

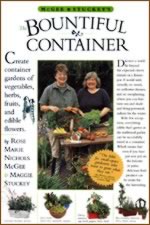

The Bountiful Container: Gardening in small spaces

I've been gardening for almost fifteen years. I started with flowers, added herbs and vegetables, then a few fruits, then a lot more. I've gardened in plots and pots and raised beds. I've drooled over bedding plants, spent too much on whatever was my obsession-of-the-moment (bulbs! daylilies! gooseberries! ornamental grasses!), and have certainly read my fair share of plant books and magazines.

I've been gardening for almost fifteen years. I started with flowers, added herbs and vegetables, then a few fruits, then a lot more. I've gardened in plots and pots and raised beds. I've drooled over bedding plants, spent too much on whatever was my obsession-of-the-moment (bulbs! daylilies! gooseberries! ornamental grasses!), and have certainly read my fair share of plant books and magazines.

By this time, I'm somewhat jaded about most gardening educational materials — I find they are often at one extreme or another: either an all-around reference that is about as exciting to read as The Merck Index, or beautiful but vapid plant-porn packed with color photos of planting schemes and "outdoor rooms" that can only be reproduced in Southern California!

However, I give a rave review — and two green thumbs up — to a recent find on container gardening: The Bountiful Container by Rose Marie Nichols McGee and Maggie Stuckey (2002). This book was suggested last spring by a reader named Beth in J.D.'s overview of square-foot gardening. It will find a permanent place on my gardening reference shelf, despite the fact that I don't plan to grow anything new in a container in the foreseeable future. (Although this book just may have changed my mind.)

<How to get rid of ants (Without calling an exterminator)

I Hate Ants.

Eventually, it got so bad that we had to bring in an exterminator. It seemed crazy to hire an exterminator to deal with little sugar ants, but nothing else we tried would work. So we plopped down $100 every three months to keep the ants under control. (It may not have been $100 for each visit — Kris thinks it could have been $300.) It didn't really help. After the exterminator visited, the ant problem would subside for a couple weeks, but then we'd be right back at war with them again.

Sad but true: the ants were one of the reasons I wanted to move out of that house. Continue reading...

Suze Orman’s ultimate protection portfolio (and a do-it-yourself alternative)

For the past few months, I've been pursuing a paperless personal finance system. I've scheduled electronic transactions with my bank, and I scan important documents when I receive them. My method is still very much in "beta", but I hope to write about it later this year.

My sister-in-law, Tiffany, isn't a computer geek, but she's been trying to get her financial documents organized, too. So when she saw an advertisement for Suze Orman's Ultimate Protection Portfolio, she figured it was worth $66.24 to make her life a little easier. She ordered the kit, and has spent the past week putting it to use. When I dropped by her house today, she showed me the system.

My sister-in-law, Tiffany, isn't a computer geek, but she's been trying to get her financial documents organized, too. So when she saw an advertisement for Suze Orman's Ultimate Protection Portfolio, she figured it was worth $66.24 to make her life a little easier. She ordered the kit, and has spent the past week putting it to use. When I dropped by her house today, she showed me the system.

The Ultimate Protection Portfolio

The Suze Orman Ultimate Protection Portfolio comes in a big blue plastic case, which is ostensibly water-resistant. (I didn't actually put this to the test.) Inside the case are:

Energy Star: Saving Money Through Energy Efficiency

If you've bought a major appliance in the U.S. during the past decade, you've probably noticed the government-issued Energy Star certification. Energy Star is a joint program of the U.S. Environmental Protection Agency and the Department of Energy. Their goal is to "help us all save money and protect the environment through energy efficient products and practices."

If you've bought a major appliance in the U.S. during the past decade, you've probably noticed the government-issued Energy Star certification. Energy Star is a joint program of the U.S. Environmental Protection Agency and the Department of Energy. Their goal is to "help us all save money and protect the environment through energy efficient products and practices."

But Energy Star goes beyond simply recommending energy-efficient washers and dryers. The website offers a number of useful resources. Main sections include:

With tax season in full-swing, it's probably worthwhile to check the list of Federal tax credits for energy efficiency. Most of these expired at the end of 2007, but were valid for all of last year. Other resources include the news room, which contains information about the program, and — believe it or not — the Energy Star podcast.

Mortgage prepayment made easy: Own your home in half the time

Because I recently eliminated all of my non-mortgage debt, I have a significant positive cash flow. The $1,000 per month I was putting toward debt can now be used for investing. I'm making maximum contributions to my Roth IRA, of course, but that still leaves several hundred dollars each month available for other purposes. This has forced me to evaluate my financial goals.

Mortgage Prepayment Options

For the past year, Kris and I have discussed making accelerated payments on our mortgage. I've written about this choice several times at Get Rich Slowly, and it seems clear that mathematically it makes more sense to invest the money. However, it's also clear that eliminating a mortgage offers a tremendous psychological boost. I've never heard anyone say they regret owning their home outright.

I've researched a variety of mortgage acceleration schemes:

The GRS garden project: How much does a garden really save?

Kris and I are huge fans of gardening. We grow our own flowers, herbs, fruit, berries, and vegetables. We're not able to supply all of our needs, but we do what we can. For the past two years, I've argued that this is an excellent way to save money if you have the time and the space. But is it really?

An actual weekend harvest from August 2006.

During the next year, Kris and I plan to track all of our work and expenses in the yard. I'm not going to tabulate how long it takes to trim the laurel or the boxwood, but I will track the following:

For example, when Kris places her seed order in the next week or two, I'll note how much she spends for a packet of tomato seeds. I'll keep track of how much she uses her grow lights (using my handy Kill-a-Watt electricity usage monitor), how much water and fertilizer we consume, how many tomatoes we harvest, and how much that would have cost us at the store.

Using a home equity loan to pay off credit cards

You've spent the past few years being dumb with money. You realize that now. Your credit cards are maxed out, you're living paycheck-to-paycheck, and you cannot see a way out. You plan to sell some stuff and to take a part-time job, but you're looking for other ways to ease the burden. If you're a homeowner, one option to consider is tapping your home equity to consolidate your consumer debts.

You've spent the past few years being dumb with money. You realize that now. Your credit cards are maxed out, you're living paycheck-to-paycheck, and you cannot see a way out. You plan to sell some stuff and to take a part-time job, but you're looking for other ways to ease the burden. If you're a homeowner, one option to consider is tapping your home equity to consolidate your consumer debts.

Definitions

Just what is home equity anyhow? Home equity is the difference between what your property is worth and what you owe on it. If your home is currently worth $200,000, for example, and your mortgage balance is $150,000, then you have $50,000 of equity.

Under normal circumstances, this equity remains untapped, increasing slowly with time. There are, however, a couple of ways to use home equity for other purposes:

The thrill of paying off a mortgage

A few weeks ago, J.D. and I were chatting when he asked me what it felt like to be debt-free. He'd read on my blog that I had no debt and was curious if I'd write about it for Get Rich Slowly. In particular, he asked me to communicate both how I managed to pay off my mortgage (the biggest debt most people have) as well as how it felt when we did so. I was happy to accept his offer.

Just to note, the purpose of this post isn't to debate whether or not paying off all debt is a good idea (versus only making mortgage payments and investing the rest, for example), so I've purposely left it out. My goal is simply to tell you our story — what happened and how we did it. From there, you can decide whether or not this path is for you. Since my wife and I are debt-haters, this option simply seemed natural to us. In addition, I can also tell you that living ten years without any debt has been a great feeling.

In the mid-90's, we moved to the southern part of the U.S. Here's how we paid off our mortgage in 1997 and haven't had one since: Continue reading...