How to calculate your net worth (and what to do with it)

In the spirit of getting back to basics this month at Get Rich Slowly, I'm planning to publish a series of articles about the most important numbers in personal finance. Let's start by looking at how to calculate your net worth.

To measure the value of a business, companies talk about equity or “book value”. Jargon, right? In personal finance, equity is known as net worth. It's exactly the same thing but on a personal level. Your net worth is an important number because it reveals how much the business of you is worth at the moment.

Still clear as mud? Maybe this definition of net worth from Wait But Why will make more sense:

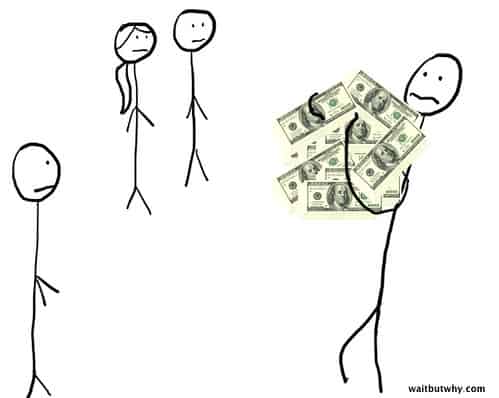

“What would happen if you sold everything you own, liquidated any investments you have, paid off all of your debts, and withdrew whatever cash you have in bank accounts? You'd be standing on the street naked, with nowhere to go, holding a bunch of cash, and people would be looking at you. And whatever cash you were holding would be your net worth.”

At its core, your net worth represents how much wealth you've accumulated until this very moment. In the classic book Your Money or Your Life, Joe Dominguez and Vicki Robin write, “[Your net worth] is what you currently have to show for your lifetime income; the rest is memories and illusions.” Ouch. That's a little harsh, but it's true.

How to Calculate Your Net Worth

Net worth tracks your financial health in the same way that weight measures your fitness. Neither number tells the whole story, but as a measure of change over time each is a handy tool.

Calculating net worth is easy. It's what you own minus what you owe. That's it. Simple, right? Here are more detailed instructions:

- List your assets. Check all of your bank accounts and note their balances. If you have investment and/or retirement accounts, write down how much you have in them. If you own your home, use Zillow to determine its current value. If you own a car, use Kelley Blue Book to figure out how much it's worth. Add all of these together to find the total value of your assets.

- Next, list your liabilities. Write down how much you owe on your car, the current balance of your mortgage, how much you have left on your student loans. Record the balance of each credit card and personal loan. The sum of everything you owe represents your total liabilities.

- Subtract what you owe from what you own. Your net worth is your assets minus your liabilities.?

To make things even easier for you, I've created this net worth spreadsheet in Google Docs for you to copy.

Once you've calculated your net worth, write this number down. Burn it onto your brain. I want you to remember how much you're worth today so that we can see the progress you've made in six months. And a year. And ten years. As you get better with money, your net worth will grow.

Some folks argue that you should not include the value of your home when calculating your net worth. I disagree. Net worth is a thing with a precise definition. I think it's great to run another number that leaves out your home, if you want, but that number is not your net worth.

What Should Your Net Worth be?

People often wonder what their net worth should be. There's no right answer. It depends on where you live, what you spend, and how much you earn. If you're a computer programmer in Toronto, your net worth will probably be greater than if you're a schoolteacher in Mississippi.

Some folks have created benchmarks for comparing net worth. Perhaps the best-known example of this is found in The Millionaire Next Door by Thomas Stanley and William Danko. They argue that your “expected net worth” can be determined with a simple formula:

- Divide your age by ten.

- Multiply this result by your current annual gross (pre-tax) income.

The final number, say Stanley and Danko, reveals how much money you should have.

If your net worth (minus any inheritances) is at this level, you're an “average accumulator of wealth”. If you have less than half the expected amount, you're an “under-accumulator of wealth”. If you have more than twice the expected wealth for your age, you're a “prodigious accumulator of wealth”.

Let's say, for example, that you're thirty years old and have a net worth of $49,872.99. Your income last year was $61,191.38. Based on these figures, the rule-of-thumb from Millionaire Next Door says your net worth should be about $183,500.

Because you have a net worth of less than $91,787, Stanley and Danko would say Landes you're an under-accumulator of wealth. If you had more than $367,000, you'd be considered an overachiever.

More Fun with Net Worth

There are other ways to look at your net worth, of course. Here are two:

- Here's how to figure out your lifetime wealth ratio, which is your net worth divided by every penny you've ever earned. (So, if you have a net worth of $100,000 on $500,000 of career earnings, your lifetime wealth ratio would be 20%.)

- If you want to compare your net worth to others, Zac at Four Pillar Freedom has created a tool that lets you visualize the net worth of Americans by age.

No matter your situation, your goal should be to increase your net worth over time. This might sound glib, but it's true: A high net worth is always better than a low net worth. The more you have, the better your financial health.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)