The New York Times rent vs. buy calculator

Is it better to buy or rent? It's one of the eternal personal finance questions, and one that each person has to decide for herself. There are lots of non-financial factors that affect this decision, of course, including your hobbies, lifestyle, and personal psychology.

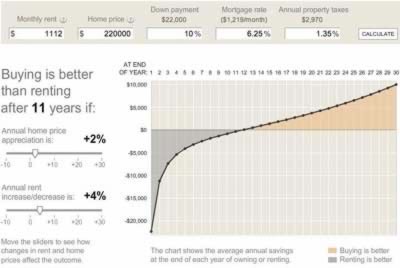

Despite these non-financial considerations, often the choice comes down to money. What makes the most financial sense? In July, guest-author Tim Ellis shared his thoughts on the rent vs. buy debate with us. While re-reading his article recently, I followed a link to this beautiful rent vs. buy calculator from The New York Times.

This interactive tool allows the user to play with the numbers, providing immediate feedback after adjustments to predicted home appreciation or rent increases. Don't overlook the panel of advanced settings — these can help you evaluate tricky scenarios.

This could be a handy tool if you believe you'll have to make a decision whether to rent or to buy in the near future.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)