Because of Opt-Out Prescreen, I no longer get credit card offers at home. From time-to-time, though, I get them at work. A few weeks ago, I received an offer that puzzles me:

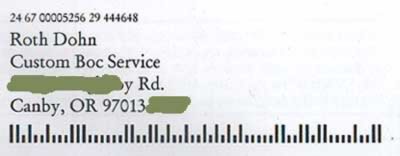

Seems pretty normal, huh? Well, let’s look more closely. Here’s the address:

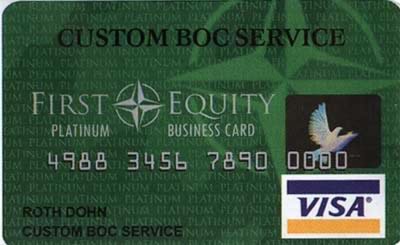

And the fake card:

(Why do they include fake cards, anyhow? Do they really induce more people to apply?)

I have no idea how anyone found a database in which my name was listed as “Roth Dohn” instead of “John Roth”. And “Custom Boc Service”? What exactly does that company do?

All I can come up with is that maybe person A, who had a heavy accent of some sort, read information from an existing database to person B over the phone. But then why didn’t they mess up the street address? The street address is difficult, even when I’m giving it, and I’ve been repeating it for nearly forty years.

If I were more mischievous, I’d fill out the application and send it in. I have no doubt that Roth Dohn would get a credit card.

In related news: Today I submitted an application for my first personal credit in many years. (Under my real name — not as Roth Dohn.) It was a tough decision. My inability to handle credit responsibly got me into debt problems to begin with. But I’m a different person now. I’ll be fine.

After many people recommended a Capital One card for overseas travel — there are no fees on purchases made outside the U.S. — and after realizing this could save me money and provide convenience, I decided to apply on-line. Unfortunately, the web-based application hung. It wouldn’t accept my birthdate.

I called Capital One instead. “I’d like to apply for a Capital One No Hassle Cash Rewards card,” I told the man who handled my call.

He was very eager to help me. “No problem, sir. We can help you out. We’ve got a wide variety of cards with great mileage programs,” he said.

“I don’t want a card with a mileage program,” I said. “I want the Capital One No Hassle Cash Rewards card. I already researched it online.”

“I understand, sir,” the man said. “But you can use miles just like cash. For example, with this card…” He rambled on and on. Eventually I convinced him to let me apply for the card I wanted, though he kept trying to talk me out of it. (Do these folks get commissions for selling certain cards?) Also, the APR he quoted me over the phone was 15.88% instead of 13.88%, but I didn’t fuss about it. I will not carry a balance on this card. This card is simply a convenience. The APR is irrelevant.

I spent twenty minutes on the phone completing the application, increasingly frustrated with the customer service rep trying to steer me toward choices I did not want. And then, when the application was finished, he announced, “Thank you, Mr. Roth. If your application is approved, you will receive your card in two or three weeks.”

Oops. I may have cut the timing too close. I’ve got my fingers crossed — we leave for Europe three weeks from today!

I’d be prepared to call Capital One security and check your voicemail on the phone number you used on the application. You have a very high chance of getting flagged if you use it overseas right after getting it.

I went on a cruise with my wife about a month after I got a card and it got flagged because I used it twice in the Bahamas. I had to call them and confirm the purchases were my own before I could use it again.

I just hate credit cards. I used to have one, and now it’s laying on my desk for almost 6 months.

And I don’t know about US, but here in Brazil they do get comission for certain cards. Usually the most expensive ones =/

They really will – check out The Torn-Up Credit Card Application – my shredder now works overtime!

I hate calling credit card companies. I had experiences where I’ve called to dispute charges and they tried to push identity theft protection, credit reports, even offerings for new cards! It’s ridiculous.

On the topic of anyone being able to get a card. I think I read a story once where this 8 year old boy received a credit card and his mother had to call it in and dispute it and cancel it. The operator told her that she needed to talk to the original card holder (the boy). That’s something seriously wrong there.

@me: And the MSNBC article including an interview with the credit card company: http://redtape.msnbc.com/2006/03/what_if_a_despe.html

big mistake.

Another thanks for the site. I’ve also been receiving multiple offers daily to consolidate my student loans (which I did like a year ago, you would think they could leave me alone!). Maybe this will help that too?

Congrats on the credit card, I think you are ready for it. I just convinced my boyfriend to do the same (he has NO credit history). As much as I do like responsible credit card use, I think credit card companies are a PAIN to deal with–every time I call discover they try to sell me some sort of protection. And when I tried to cancel a card, I practically had to beg them to do it!

I hate to be negative, but… (don’t you love it when people start out that way?) Anyway, we had an account w/Capital One, and had destroyed the actual physical card ages ago. We then decided to go ahead and get a new card (to take on vacation, no less). We waited 2 days past the 14 business days we were quoted, called back, and they hadn’t even sent it out – just flat out lied to us, I guess. This happened twice. It took us from October to mid-January to get our card. Maybe since yours is a brand new account you’ll have better luck, but I would suggest that you call back in a week or so and just make sure that it’s in process. Have fun in Europe!

Consider getting a PayPal debit card. I believe they don’t have surcharges on international transactions either.

I hate dealing with all credit card companies except for Chase. They’re consistently polite, helpful and fast.

I hate to start out negative also, but feel the need to do so it this case. I had an old debt bought by Capital One transferred to a interest free loan plus a credit card. Great! I can pay off this old debt and get credit for it? WRONG!!! A firm know as “Monterey County Bank” bought the loan, and Capital One dropped me like a two-day old used sock.

Just to add insult to injury, I noticed that the new payment history from MCB was not on my credit history for the last 18 months, so I contacted them. The butts told me, “we don’t report credit history until the loan is paid or you default”. Well, geez, thanks for that!!!!

Credit is not bad, as long as good credit is reported. If the card is not reported on at least 2 Credit Reporting Agencies, drop it like a dead fish!!! Get as much credit as you can (unless you are looking for a home loan or refinance), then cut up the card when you get it. Stick to only a few cards with low interest rates and no annual fee, and tell the rest to blow off!!!

I also had a friend that receives his pay for contracted convenient store work via a “PLUS” debit card and had no choice in the matter. I’m not sure this is legal, but I’m not an attorney. In the meantime, each time he uses the card to receive money, he has to pay an ATM fee, sometimes HEAVY ATM fees. No matter how you use a card to get cash, (except for credit cards), try to use the grocery store and get cash back for the rest of your other expenses.

Most grocery stores do not charge a surcharge for using a debit card. If your store does, go elsewhere.

JD,

Your two statements from this post:

“I’ll be fine.” and “This card is simply a convenience.”

Make me sad. You’re letting the credit card companies win by going back to them for the sake of convenience.

You know what they take in Europe? CASH. Visa Debit Cards. You know, like in the USA. Sure, you have to exchange currency and that costs money, but you’re going to spend more with the credit card than you would on the exchange rate.

You should read this:

https://www.getrichslowly.org/i-do-not-use-credit-cards/

JD’s story reminds me of how I had to register my credit card earlier this week, when I received a replacement.

Here’s how it is supposed to work – one calls a 1-800 number from one’s home phone, the card company confirms that this is the number they have on file, and the card is then good to go.

What happened, instead – I had to enter the number of my credit card into the numeric keypad, and then wait briefly for the operator to speak with me. She then launched into a sales pitch of ancillary services offered by the credit card company (‘would you like insurance with your card? imagine if you get injured and you can no longer work, and this insurance will allow you to skip payments… blablabla’) I had to work hard to get a word in edgewise, say that I was not interested, and is my card registered? can I use it now? can I go now?

Amazing – she briefly said “yes, your new card is registered, good to go, but imagine if you lose my job and can’t pay your card payments and…”

okthxbye, [click]

wow, they sure are well-trained to talk over anything, and won’t stop unless you hang up.

I would really not want to have that job.

Joshuat said:

Your two statements from this post make me sad. You’re letting the credit card companies win by going back to them for the sake of convenience.

Believe me: this is not a choice I made lightly. But when I began to look at the fees I was going to pay to use my ATM card for cash in Europe, I began to worry a little. It seems like I’m throwing money away.

I chose this particular card because GRS readers had noted that it carries no annual fee, grants 1.25% cash back, and has no charges for use overseas. Basically, instead of paying 5% for the money I spend, I’m earning 1.25%.

Trust me: I am not going to deficit spend. I will not carry a balance on this card. I have set aside a certain amount of money in the bank as my vacation budget, and it’s ready to go. I know that number by heart, and I will not overspend it. As soon as I return from Europe and receive the bill, I will pay the account balance in full.

I appreciate your concern, and I’m not trying to brush it aside lightly, but I want to make it clear that this is a careful, reasoned decision, and not a whim. If it looks even for a second like this is going to cost me money in any way — through annual fees or poor behavior on my part — I will destory the card and cancel the account.

> (Why do they include fake cards, anyhow?

> Do they really induce more people to apply?)

I’m a marketing consultant. An enclosure like this has many benefits:

– recipient is more likely to open the package to see what it is

– after seeing their name on a card, the recipient is more likely to read the letter to see what it’s about

– people hate to throw away non-paper items, so the recipient will probably hang on to the mailer for a while

– all this makes it more likely that the recipient will respond to the direct mail campaign

J.D.

I just came back from Europe. You are going to get creamed on the exchange rate. Plus everything looks so lovely in Europe you are going to spend, spend, spend. Trust me on that. The quality in Europe is superb!

I only used cash and my Visa Check Card. Unless you are renting a car, a credit card is not needed. If I had a charge card, I would have bought more.

Keep us posted on your charge card use. I hope and pray you don’t get suckered in. Capital One has to be the worse company for a debtor.

Just my 2 cents.

I think it’s sad that you are giving such an unethical, disgusting company your business. You could have easily gotten a debit card from a more reputable company (or even a credit card from a more reputable company). Capital One is among the worst offenders in terms of all the endless credit card tricks and fraudulent practices. Didn’t you want to puke just from talking to them on the phone?? It’s rather gross that they tried to talk you into tons of products you didn’t want and then they committed fraud by giving you a different interest rate than what was advertised. Customers should not have to jump through hoops, repeat themselves endlessly, and fight to get a product as advertised. It’s sad you supported these business practices. And it’s sad that Capital One will be profiting from your trip.

I’m not a huge fan of Capital One, but I do agree that credit cards are extremely convenient. As long as you keep track of things and use your head, things will be fine. It’s when we don’ give it a thought until the bill comes that we have a problem.

-limeade

We’ve been to Europe several times, and it’s been very convenient using a credit card. Not because we’re looking to spend beyond our means (we pay off our credit card bill monthly), but because:

1) we don’t have to carry too much cash, which I consider a safety concern

2) we don’t have an excess of currency at the end of out trip

3) larger tabs (e.g., hotel) are easy to handle

We use an ATM machine at the airport to take cash out and we use it for food, transportation, and incidentals. Generally, we travel very light, so there isn’t much temptation to buy loads of unnecessary trinkets. We like to travel for the experience more than the loot.

Hope you have a great time. And remember not to overpack because you’ll find everything you need there…and then some.

PS…Every credit card company goes on and on trying to sell you stuff. Just be glad that you get good customer service on what you actually called for. We were burned by an American Airlines Mastercard when they didn’t report strange activity (my husband noticed the out of state charges), but were delighted with American Express Blue when they canceled and sent us a new card overnight for suspicious activity. Remember to be a cautious consumer, which is the best anyone can do for themselves.

Another thought…the first comment by Ryan Duff is right on. I’ve heard of credit card companies declining transactions despite being warned beforehand of overseas travel. Be sure to have their phone number on hand. The 800 number won’t work overseas, so get the actual area code and number.

About 10 years ago, I started getting weird credit card solicitations for my business. At the time, I was a professor and did not have a business. It was all very confusing. Then one day, someone from Dunn and Bradstreet called to “update their database.” She asked me how many employees I had. I told her I didn’t have any, that I was a professor. She said, “So, it is just you, then?” I again told her that I did not have a business. She told me that according to their records, I’d had an insurance company for about 10 years. I had a heck of a time getting her to understand that their records were incorrect and that I had been a professor all that time.

I never could figure out how they could have entered me on a database as being an insurance agent since everything in my life revolves around higher education. The only financial transaction I have with insurance is when I pay my premium or file a claim!

Julie

Read the credit card terms with a magnifying glass. Most times these great deals and offers have strings attached. If you can manage your card and stay within the terms, ie; avoiding interest, then use them to get your free stuff.

Watch how many you have though, because too many even with zero balances can lower your credit score.

I use the exact same card you are waiting for, and so far it has been just fine.

The simplicity of the cash rewards site is a breath of fresh air. It really is hassle free, especially next to the insanely frustrating miles and points programs out there. The only mild improvement I can think of is if they allowed me to setup an automatic reward instead of compelling me to login to the site each time.

The overseas travel benefit you mentioned is excellent too. Every comparable card I checked out charges a 2-5% commission.

Based on what I’ve read here lately, it sounds like you’ll be just fine… Enjoy your vacation!

I will not use or have credit cards or have debt of any kind. I’ve been there, done that. Never again. So if my life is inconvenient living by pay as I go, so be it.

They certainly will give credit cards to anyone. That is why I follow these 4 simple steps to give the solicitors a taste of their own medicine.

http://www.russellheimlich.com/blog/how-i-deal-with-junk-mail/

golden rules: atm/debit card for cash; credit card for purchases. if you use credit card for cash you are going to start getting charged interest immediately.

checkout the various surcharges

http://www.smartertravel.com/travel-advice/foreign-exchange-101-update-plastic-charges.html?id=2365145

for various surcharges and atm fees.

Bank of America was a bit confusing with the “no fee” among global alliance. you do in fact get charged the 1% exchange surcharge within the global ATM alliance.

notify cc company of your travel locations. Definitely get the collect call number or local country number for the cc company and your bank if using your debit card.

italy has the worst dollar to euro rates and banks don’t do exchanges.

if you are getting Duty Free tax reimbursement, i’d recommend credit card or debit card credit reimbursement, b/c they will rape you silly on euro to dollar conversion if taking cash. the credit takes longer, but you will get a better rate.

joshuat, not true. you will get hammered on exchange rates with cash, depending on the country. second, carrying around lots of cash, isn’t a good idea at all. moreover, you can only transit with $10k until you have to declare it. cc you get the wholesale commercial rate which is much better and will make up for the 1% visa/mastercard imposed fee.

moreover, depending on the country, i wouldn’t trust using my debit card. with cc your liability is more than likely limited to $0 on fraudulent charges. with debit cards, your whole account can be emptied without anything you can do about it. to mitigate, you can call and reduce your daily cash withdrawal and cash advance limit on your debit card. most are defaulted at $400/day. you can always call the bank to request a temporary 24hr daily limit increase.

remember your debit card has three limits: daily atm withdrawal limit, daily cash advance limit (i.e. you go inside the bank to have them do a cash advance on your debit card), and your daily purchase limit. call your bank to verify these limits so you know what they are and be able to adjust them if desired. also note that the weekend may be considered one day, so a $200 limit when you took out on friday will have to last you the entire weekend. this is problematic if there is a holiday in the u.s. or your bank does not have hours during the weekend. also note, that your daily limit is probably based on your bank’s time zone.

hope you get your credit card on time. i was in the same situation, wanting to use the 0% credit card for a recent trip. luckily i got it before i left. remember, don’t let money be the center of your vacation. budget what you want to spend and then don’t worry about how much things cost; otherwise, you will be pissed off the whole time focusing on money rather than enjoying yourself. have fun!

Just to give a positive spin to your comments, props on getting the Capital One No Hassle Rewards card. Capital One does indeed suck big-time if you have any sort of problem with your card, but the 1% cash back on everything is fantastic. It’s nice to GET money from the cc companies for once. 🙂

And I know the whole “don’t fall victim to the credit card companies” is a bit of a concern for most people reading this, but I’m fairly certain that you’ll be able to handle it. Hey, if I can keep my Crapital One card balance free for 3 months, you can certainly do it for one vacation! 🙂

JD, if you can, work out and write down what your vacation money is in euros and sterling as well as US$. Its harder to do currency conversion on the fly than it is to remember your limits in the currency that you’re purchasing in.

Sounds like you made a good choice with you credit card and I’m sure that you’ve got more financial discipline now – especially if you’ll only be using this on vacation.

One word…SUCKER!!!

I ordered the Capitol One on a tight schedule just before leaving for South Africa. I was approved and it arrived within a week. I think you’ll get it in time.

When I used my debit card for the ATM, I had fees of sometimes as much as $5; the Cap One was the smart way to make most of my transactions.

Hey JD–I didn’t read all the posts, so I assume this has been covered, but what’s with the Capital One card? Among many other things, why did you except the bait-and-switch APR? The APR always matters–even if you “don’t intend” to carry a balance, the point is to be responsible, not impenetrable. You’re financial life should have fallbacks, and the fact that you’re so sure of yourself that you feel you don’t need them tells me that you’re TOO sure of yourself. It’s not just the principle of things–it really matters. And, then, it IS the principle. You’re here, in large part, to be a good example to others. Telling people to ignore the fine print and let the credit cards take a few more points is a BAAAD example.

Also, why not get a Discover or Amex? The deals are 10x better.

They certainly will extend offers to anyone these days: last year when my sister-in-law was still 16, a credit card offer arrived at that household addressed TO HER AIM SCREENNAME! She used that name for various online accounts so it didn’t specifically come from AIM, but still…

I chose the Capitol One card because several GRS readers had recommended it for traveling overseas.

I concede that I was wrong not to make a fuss about the bait-and-switch APR. My rationalization (such as it is) is that I’m going to call the Capitol One as soon as I get the card to let them know that I’m taking it overseas, and while I do that, I’ll complain about the rate. This doesn’t excuse me for consciously allowing the bait-and-switch, but it’s what I told myself during the process.

I appreciate the concern regarding “fallbacks”, but I’ve made sure that I have some already. I’ve saved a $1,000 emergency fund, which will increase when I’ve paid off my debt next spring. My wife and I have a second joint $5,000 emergency fund.

Hah. “No Hassle” card my ass. You should have told their phone representative that their card was sadly misnamed.

Again, some of these responses are hilarious. Congrats on making a step FORWARD — to safe use of credit cards.

I don’t think I would have taken Capital One — I’ve heard canceling their cards is like pulling teeth without numbing! But a good first step.

Hi!

I do hope you get your CC bbefore you go away! I do read your blog often and am de-lurking to ask a quick question: If you only need the card to conduct transactions overseas, could your bank not provide you with a visa-linked transaction card? I live in Australia and my bank gave me with a card that allowed me to use my own money overseas. The card worked exactly like a visa card and gave me $500 credit limit (if I spent all my own money). and I did not have to pay transaction charges or interest (as long as I used my savings).I hope I’m making some sense here. I would have assumed that such facilities exist in the US.

Regards,

Sankari