Why investing can be better than repaying debt

It’s a difficult choice: On the one hand, you understand the need to begin investing early to make the miracle of compounding work for you; on the other hand, you know that, when you have debt, making those payments hampers the ability to harness the miracle of compounding.

So, what should you do with that $500 you have — invest it or pay down the debt? The answer is not as simple as some make it out to be.

Reasons to repay debt first

1. Risk of disaster

As I mentioned in the article about starting to save for retirement, life is not always fair or kind. Most of us depend on a paycheck for everything: rent or mortgage, food, gas, utilities and so forth. When something happens, like losing your job, divorce or severe illness, those checks get smaller, or may even disappear temporarily. We can cut back some of our expenses like gas, clothing, etc. But some things are impossible to cut back. That list is usually headed by rent or mortgage payments and those monthly payments all other forms of debt require. You can’t cut those back in times of trial.

It gets worse: The banks or credit card companies who lent you the money become adamant about repayment. If you have a car loan, they can come and take away your wheels.

Therefore, the first reason to put debt payment first on the list of things to pay is to remove the risk of bad things happening to you in the event of some unforeseen disaster.

2. Interest

You pay interest on the money you borrow — usually a much higher rate of interest than you can count on for your investing. Let’s say your car loan carries 8 percent interest. In effect, any payments you make on that loan will earn you 8 percent … usually much more than the 2 percent or so you can earn on a CD or savings account.

3. Lifestyle enhancement

The discipline to repay debt and then stay out of it spills over into a mindset. That debt-is-bad mindset inevitably makes you question impulse purchases, which is often the number one reason people incur consumer debt. Instead of getting that new Lexus with a $399 monthly lease payment, you find a used Honda Accord you can buy for cash, or a much smaller (and shorter) loan. After two or three months, you discover you’re actually not losing out all that much by eschewing the Lexus. You pat yourself on the back; and next time the temptation to get into debt arrives, it becomes easier to escape.

Another example: Instead of putting a well-deserved Caribbean cruise on your credit card, you set up a savings account to do it next year. By the time next year rolls around, you have thought of a few other vacation options, some nicer and some cheaper. You end up feeling better after a nicer vacation … and no debt.

4. Freedom

Making payments is a prison. Sure, they let you go home, but your movements become very restricted. There are many unforeseen opportunities which cross our radar every day such as the imminent Ferrari IPO. Wouldn’t it be nice to get on board with one of the most sought-after brands in human history, and possibly triple your money like those who could jump on the Facebook IPO did? Or let’s say a coworker has a situation come up where they can’t take the lovely vacation for which they have already paid. You can pick it up for a third of the price, but you have 24 hours to jump.

If you are making payments, you can only press your nose against the window pane and longingly stare at those opportunities like a poor boy at Christmas. With no payments, though, you would have the freedom to at least consider them seriously.

Those are four powerful reasons for making repayment of all debt your top priority, and relegating investing to second place on your financial priority list.

Not so fast. Nothing in life is ever simple (other than buying chocolates for your loved one). There is another side to this coin.

Reasons to invest first

1. Compounding

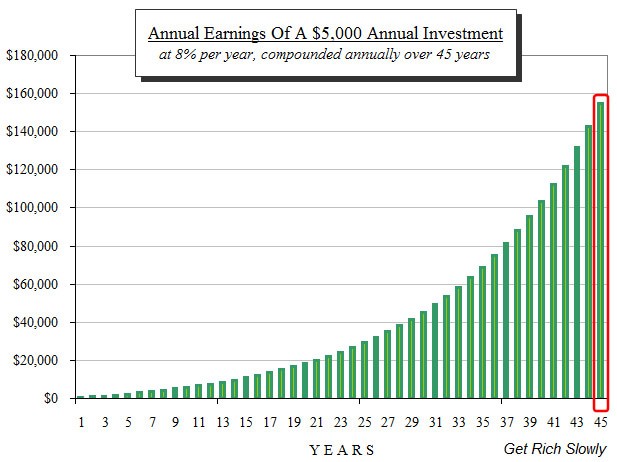

In an earlier post, you saw how dramatic the miracle of compounding is. By way of reminder, here is the chart:

You might be tempted to consider the interest you earn in your first year when you compare your investment earnings with the interest you pay on your debt.

That is a huge mistake!

No matter which year you start investing, you will always get that first year’s interest (or earnings). The only thing that changed is when you get it. There is, however, no guarantee you will ever get that last year’s earnings. That is determined by how early you start.

What you lose by starting a year later is the last year’s earnings. If you start investing a year later, you will never ever get that last year’s bumper earnings. If you wait two years to get started with your investing, you will lose the last two years’ earnings.

And, it almost doesn’t matter what you invest in. Chances are that last year’s earnings will be way higher than any interest you pay on debt in the first year.

This is something most people overlook when they make the debt vs. investing interest comparison.

2. The calendar

The two most common retirement investing mechanisms most people use today are employer direct contribution retirement plans, like the ubiquitous 401(k), 403(b) plans, and IRA’s. What many people overlook is those plans are tied to the calendar: Once you get past a certain date (usually the 15th of April every year), you cannot go back and catch up. If you made your contribution, it gets on the compounding train. However, if you miss a year’s train, it’s gone forever.

Once you understand the miracle of compounding as shown in the chart above, you understand how important it becomes to make each year’s investment contribution in order to get the full benefit of the final year’s returns.

There is also a limit on how much you can contribute each year. In the normal course of events, the calendar and contribution limits do not have all that much impact; but in the event you get a windfall, such as an inheritance, bonus or severance payment, you can’t go back and make catch-up contributions to those retirement plans. You can max out this year’s contribution and that’s it.

However, there is usually no limit to how much debt you can repay, so you can pay back 30 or 40 years’ worth of debt with a single windfall (limited only by how big it is).

Of course, none of us is guaranteed any windfalls, but they do happen. Therefore, you could end up much better off if you kept your investment contributions ongoing and used any unforeseen income (big or small) to get ahead on debt repayment.

What should you do?

The smart thing, of course, is not to have any debt, and then invest everything you can. However, if you’re unlucky (or late to the financial wisdom party, like I was) you don’t have that luxury.

Many people are fervently adamant that one strategy (theirs) is the only way to go. Some say debt has to come first, others insist it pays better to invest first. The truth is that no two people are in the same position and, therefore, there can be no one-size-fits-all solution.

If you put investing first, you stand to have the higher eventual gain; but in order to do that, you have to assume the risk that your income stream will never become compromised. Not everyone is in a position where they can afford to take that risk. Others simply prefer safety today over some nebulous benefit so far in the future that it may never materialize. Your risk tolerance will determine on which side of the fence you fall. You may also find that circumstances may dictate a change in strategy.

For years, my wife and I lived frugally and avoided all debt except our mortgage. However, when the stock market tanked in the Great Recession, I borrowed every penny I could against my 401(k) plan (usually the ultimate taboo) to buy a preferred stock paying 30 percent per year because of the abnormally depressed stock price. I begged and borrowed (drawing the line at stealing) and bought all I could. That was the single investment that turned our fortunes around. As the market recovered, I sold enough to repay all our debt, and still had many times more left over. I’ve never done that again because some opportunities only come along once in a lifetime. At those times, it’s better to be pragmatic than dogmatic.

In the end, each person has to decide which direction their risk tolerance steers them. The best we all can hope for is enough insight to make an informed decision.

Have you been faced with the dilemma of whether to reduce your debt or invest? How did you approach this quandary, and what was the end result? If you had to do it again, would you make the same decision or change it?

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)