It’s mid-September as I write this, and I’ve been spending the past few days scrambling to prepare for my trip to Peru. I’ve been packing, of course, but I’ve also been editing reader stories and writing blog posts for my absence. While bustling around, I stumbled across an old document. I’ve shared this before, but it’s been a while. Since it’s an important part of my financial history, I’m going to share it again today.

In the beginning

As most of you know, I struggled with debt for more than a decade. When I graduated from college in 1991, I had the start of a credit card problem. By the time my father died in the summer of 1995, I’d managed to accumulate over $20,000 in credit card debt, most of which came from spending on computers and comic books and other frivolous things.

In 1998, I transferred my credit card debt to a home equity loan. I destroyed the cards and closed the accounts. This was a smart move in one respect (because it helped me kick the credit card habit), but it didn’t prevent me from finding other ways to take on debt; I took out personal loans, and I borrowed from family members. By the summer of 2004, I had accumulated over $35,000 in consumer debt. And when we bought a hundred-year-old house, I finally felt stretch past the point of bursting.

It was at this time that I decided to get serious about money. Instead of paying lip service to getting out of debt, I started to read about how to really do it. Friends loaned me books; I read them. Slowly, I put the ideas from these books into practice.

The debt snowball

One of the first books I read was Dave Ramsey’s Total Money Makeover. In this book, Ramsey advocates a different approach to debt repayment. While most experts recommend repaying debt from highest interest rate to lowest interest rate (because, of course, this minimizes the total amount of interest paid), Ramsey ignores interest rates completely.

“Forget math,” Ramsey seems to say. “If you were a math whiz, you wouldn’t be in debt in the first place. Math isn’t the problem. Psychology is the problem.” He recommends starting with the smallest balance first and working up from there. He calls this method the debt snowball.

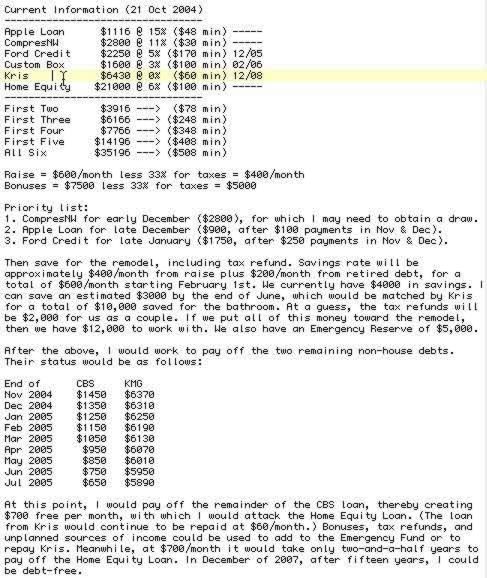

I took this advice to heart. Mostly. Based on the debt snowball, I sat down and drafted a plan for paying off my debt. Here’s what it looked like:

As you can see, I didn’t follow a strict debt snowball. Instead, I tweaked the order of repayment to consider interest rates a little bit. (I put off the 3% loan from the box factory and prioritized business-related debt.) Adam Baker at Man vs. Debt would call this method a debt tsunami. I don’t care what it’s called. All I know is it worked.

Finding financial stability

After drafting this spending plan, I continued to read personal finance books. I subscribed to personal finance magazines. And I started sharing my progress on this blog. There were ups and downs — no doubt! — but from the point I drafted this, I made progress.

In fact, I consider this one text document to be the key to my entire financial turnaround. Its forecast proved surprisingly accurate. “In December of 2007,” I wrote, “after fifteen years of debt, I could be debt-free.” And I was. On 02 December 2007, I said good-bye to nearly 20 years of debt. It felt amazing.

So, today is a sort of personal holiday. It’s a time to remember where I used to be, and to be grateful for how far I’ve come. In a way, it’s fitting that I’m far from home now. (If all has gone well, I’m on Lake Titicaca at the border of Bolivia and Peru. If all has gone very well, there are updates on my trip at Far Away Places.) My travel is physical manifestation of the financial journey I’ve made. And it makes me happy.

It’s my hope that you, too, have made (or will make) a similar journey.

Can you point to a similar turning point in your own financial life? Was there a time you hit rock bottom? Did you create a written plan? What did it take to make you become fiscally responsible? (Or were you born that way?)

My turning point was simply the day I stopped procrastinating and actually started paying more than the minimums on my student loans. I’m not quite debt-free yet, but getting there.

My lowest financial point (and the beginning of my financial transformation) was having to borrow $5 from my bankruptcy attorney so I could pay to park in the parking lot next to his building in order to sign my bankruptcy papers.

That is one of the most significant emotional events (SEE) in my adult life.

My turning point had nothing to do with hitting rock bottom; it was when I left a high paying job to join my husband in his small business. He needed help to take it to the next level and he was having trouble finding a reliable employee. We felt like we were being led in this direction. He had paid off a biz loan and we had also paid off a car loan, so all we had left was a mortgage and his student loan. I was bringing home about 75% of our income at the time, so we spent some time crunching numbers and creating a plan that was doable. We also had some savings to fall back on if needed, but we made a lot of cuts to our spending. It was going to be a completely different way of life for us. It was a leap of faith (and we were childless at the time), but we took it and never regretted it. We spent a lot of time together building the business and it never would have happened if we didn’t have a written plan.

Lady Gaga lyrics aside, i certainly was not born financially responsible. It took a run in with student loan debt and struggling to make those payments that made me take a much closer look at my financial life.

I learned my money skills in college, and still consider the personal finance class i took my senior year, to be one of the most influential classes I ever took.

I always knew you were in debt and came out of it, never knew it was this serious.

I was never in debt, partly because I studied in a country where education is subsidized, and, partly because I had personal finance lessons imparted upon by parents.

When I first got a Real Job, I had additional expenses I hadn’t had before — such as furniture. Apparently I needed a bed.

One Ikea trip later, I had a maxed out BofA CC and wasn’t sure how to pay it off.

I was able to pay that back, and have an EF, upon receiving a tax refund.

Now, I’m putting 10% of my gross income towards student loan debt, and have a large EF, retirement savings, etc.

For me, all it took was being sufficiently scared of a high interest rate.

I remodeled the kitchen in my first house, and THEN realized I had no way to pay for it. Thats when I realized that along with the car loan, the student loan, the mortgage, and my nice shiny new 5 figures of credit card debt, we might have a problem. Well that coupled with the $0 in the savings account.

Congrats JD. I’ve been reading along ever since, and I cant even describe how helpful your journey has been to mine. Safe travels.

This will sound really sappy, but my moment is when I met my future wife my senior year of college. I had credit card debt from financing repairs to two spectacularly crappy cars, plus all sorts of other stuff college related. She had credit cards too – but I found out she didn’t carry a balance. I was amazed because she did not have a full-time job at school; we both got small stipends working as RA’s, but that didn’t pay my bills. Her response: I’ve always saved money from jobs and I know what I can afford. Shocking, right?

I was embarrassed to admit how much debt I had. I don’t think I ever did tell her until after it was gone. But I graduated and got a nice paying entry-level job and got rid of the debt by transferring balances to two 0% interest cards, not charging anything them, and paying over $600 a month to knock it out. I haven’t carried a balance since, probably going on 3 or 4 years.

My turning point was in grad school when I started learning about personal finance in my spare time. My mom bought me a book on personal finance basics. Thanks Mom!

I’d always been fairly frugal and was married and we both had high paying jobs so we didn’t have debt. But we didn’t bother saving much either–we spent it as fast as it came in. After our kids were born we wanted to fix up the house so we borrowed even more for that, and then a few years later my husband left me and we had a contentious divorce with high legal fees.

In 2009 I finally sat down and looked at my situation (which I had been avoiding). I had $13K in credit card debt, a $20K Heloc, another $5K 2nd mortgage, the 1st mortgage, a $12K car loan, college looming <10 years in the future for 2 kids, and only about $40K in the bank. And I was almost 50 years old and had no retirement savings.

I made the mother of all spreadsheets and I laid it all out. It was pretty ugly! But I started to track every penny. Right away I found an error in our health insurance that saved me $5000/year—my health insurance company had ignored the notice I sent them of my divorce, and they were sending my HSA reimbursement checks to my ex instead of to me! I hadn't even noticed that I wasn't getting the reimbursements that I was filing for. I also found out that my ex was supposed to be paying for the kids dental and eyeglasses instead of me (he had the kids on insurance that would repay him), so that saved another me another $1000/year because I had been paying that myself. I started reading financial blogs and I met with a financial planner and did what he recommended, I set up 529 accounts for the kids college, a 401K for myself, and auto-savings from each paycheck that I used to pay down the debts on a schedule that I calculated. I paid off the highest interest rate debts first, because that made the most sense when I did the math. And I tracked our expenses and was able to find savings there too. I set up savings and investment goals and I have kept them for 3 years—yay! Anyway I'm happy to say that I'm now debt-free except for the 1st mortgage and it looks like my college and retirement savings will be adequate for when we need them.

Amazing fiscal turn around, I enjoyed reading about it. I would love to see a post on Post-50 retirement planning. So many in the PF blogosphere act like if you don’t start by 18, you’re screwed. The wonders of compound interest aside, that is not just the reality for a lot of people. I highly doubt that 18-23 is the average demographic served by PF blogs. Some variety in the content is always appreciated and welcomed.

Yes, ‘latecomer’ retirement planning discussions would be helpful!

A Social Security trustee (I think that’s the term) was on the PBS Newshour the other night discussing the COLA adjustment announcement, and if I remember correctly said that 35% of folks receiving SS or SSI rely on those checks for all their income, another chunk (was it 20%?) rely on the check for a substantial portion of their income, and only 11% of folks 65%+ have investment income as part of their revenue stream (!).

You’re the best KM! I’m still learning & you are an inspiration.

I personally was born this way. My husband was not. I had everything paid off and then he went back to school full time. After his graduation we learned that a bachelor’s in engineering did not make him a better money manager. The first half of his enlightenment came when we decided to send our son to a Parochial High school. He let me take back control of all our finances. The second came a few months ago when my job was eliminated. He finally let go of cable TV temporarily and packs his lunch 3 days a week. (Eating out and sports equipment for our kids were his biggest money leaks.)

I was lucky to learn a lot of good financial skills from my mother, and just a few improper habits from my father.

It has been a continuing journey, with the depths 17 years ago while I was in grad school, paying both tuition and a mortgage on $8 an hour. I paid off the school loans & credit cards on a snowball after I graduated, then paid off the car. Now I’m working on paying off my mortgage, after having moved to a much more expensive area for lifestyle reasons. Once that’s done, I’ll rethink my career with less regard to the income generated.

Because of a combination of incredibly good fortune, generous parents, and downright fear of debt, I’ve never held any beyond a mortgage; but of course, I enjoyed the article anyway. It’s good to be reminded how far someone can come, that it can be done, that there’s a light at the end of a sometimes very dark tunnel.

But. Can I just say that I tried more times than I’d like to admit to move that damn cursor off the image of your debt plan? 🙂

I recently found an old checkbook and I once carried a balance as high as $14,000!! At that I carried CC debt of around 7000 but only paid minimum payments. I didn’t do anything productive with my money.

My turning point was the conception of my first daughter in 2007. When my wife was pregnant with her I received an offer in the mail for free magazine subscriptions. I signed up for Parents and Money magazine. One of the first issues of Money I received had a feature of best personal finance blogs with Get Rich Slowly among the list. That’s how I discovered this awesome blog and shifted my focus to accumulating wealth and living debt free (which I know am).

We were in huge amounts of student loans and credit card debt. We just chipped away at it and once debt free, vowed never to go into debt again. We put a year’s worth of expenses in the bank. But even that wasn’t a big turning point for us.

Our financial turning point came about a year ago when I read here about targeted savings accounts. The lightbulb went on. I feel like a dope for not thinking of it sooner myself. When I broke down all the money in our rather large e-fund into replacement cars, tuition, vacation, and actual e-fund, we could see that we needed to save A LOT more. And we’ve been doing just that ever since. So thank you.

My parents’ divorce meant that they ended up telling me ‘just take out loans to pay for college.’ Between that and the mess the family finances ended up in, I felt like someone in our little personal economy needed to know what they were doing. Since that time two years ago, I’ve paid off 25k in student loans. It feels good.

It goes without saying that I don’t know you or your story personally so I’m not attacking you. However, your comment segues into an important topic.

I am not sure if the sense of entitlement is just widely pervasive in America, it’s hard to say because I’ve never lived anywhere else. Is it a reasonable expectation to expect parents to pay for a college education? On the CNN Ticker I saw where the cost of daycare routinely outpaces in-state college tuition. Our healthcare is not subsidized, to add a child to a medical plan may add a few hundred dollars to a household’s monthly expenses. COLA increases to salary are virtually non-existent. Public schools in certain regions of the country are terrible and parents feel compelled to foot the bill for private tuition. If there is a medical emergency, bills can certainly eat away at your nest eggs. Pensions have gone the way of the dinosaur and Social Security is practically insolvent – there is pressure to provide for our own retirement. The sandwich generation often supports their parents fiscally. Private schools can be upwards of $20K-$50K annually. Parents do not always feel comfortable restricting their children’s college choices because it may infringe on their personal autonomy all the while their choice may bankrupt them. Divorces rates are staggering, so a lot of the burden falls on the custodial parent.

Amid all these concurrent pressures, to turn around and say once you’ve provided food, medical care, shelter, and a loving and functional home for almost two decades I still expect to have my parents pay for college? And when they don’t they have somehow failed or wronged me? Is that reasonable? Is this type of attitude healthy or warranted?

Do children have a reciprocal duty to fund parents’ retirement as they have and rear their own families in the context of the a forenamed pressures?

While I wouldn’t make any statements on specific situations, I would say that in general I consider it healthy for parents to support children and children to support parents, depending on who is in a position to do so and the ages involved. I think the view in the United States that each generation should avoid supporting each other in order to avoid co-dependence is something that is a luxury that is not available and has not been available to a lot of people throughout history.

No, parents don’t owe their children an expensive education. But sometimes, parents promise their children that college will be taken care of, then get divorced, and the funds are not there. I’ve known a few people who were in college when their parents divorced and the student either had to drop out or take out massive loans to finish. If you’re a junior or senior in an expensive college that your parents are paying for and the funds dry up, you’re sort of in a bad position.

So in some cases, it’s not that parents “owe” their kids, it’s that the parents are not following through on their promises.

I thought the prevailing belief was that your parents paying for your college is a “nice-to-have”, but not something that one was entitled to. I know plenty of folks who want to pay for part or all of their children’s college, but I bet those same folks would be miffed if their children felt entitled rather than grateful.

I think it is much more important that parents provide a stable, loving home while the kids are still growing and forming than that they set their adult children’s finances up later in life. To that end, if I were Wysteria, I would be more upset that they divorced in the first place (which is one of the most traumatic events for a child to endure) than whatever the financial fallout of that was.

Des, not to put too fine a point on it, but the divorce was the best idea they’d had that decade. What I did not particularly appreciate was the advice I got about how to handle my college finances, a sage example being, “Don’t pay off your loans early, wait for inflation to make the dollar worth less.”

To return to the main point of Dreamchaser’s comment, I consider it part and parcel to how to handle a younger child who wants a banana. If you can afford the banana and they aren’t making bad life choices by wanting the banana, why not? If you can’t afford the banana, then you shouldn’t feel bad for not buying it for them, and a child that feels entitled to the banana is a spoiled child.

Rightly or wrongly, the federal government and private school aid algorithms take into consideration parental finances when determining the amount and type of assistance a student will receive. So it seems that regardless of one’s personal attitude towards parents financing education, in the US there is a societal expectation that parents will contribute to college expenses.

There is no free lunch. I paid for my own college education, debt free, without my parents help.

My parents were broke and died broke.

After we put “those kids” through school, and raise them in a good home, our job is done.

What they do with their lives..well is over.

It makes good, solid people, if they do this.

Spedie

PS: Makes them focused and get a set of balls, does not it?

I know that I wrote out my first written budget in Oct. 2001 because I keep that little note on our current budget. So, whoo-hoo 10 years.

10 years ago was 2 years into my career and 2 years after buying my first home. I had a lot of debt from professional school, student loan debt, car loan debt and debt from buying my house and I was spending a lot. So I was on the road to fiscal responsibility, but I still was using credit cards, although I paid them off, and spending more than I should of.

5 years ago was when I married my husband, and once we merged finances, I got really serious about our finances and dragged my husband along for the ride. He had student loan debt, credit card debt and other debt. Jan. 2007 we had $55,000 in debt, not counting mortgages, most of which was “his” debt. I had read Total Money Makeover in December 2006 and convinced Mr. Sam that we could live a different way.

Jan. 2007, we figured out our debts, Mr. Sam drafted an Excel spread sheet, I opted for a snowball and we got busy. We also stopped using credit cards, went to an allowance system, started tracking our spending and 12 and 1/2 mos. later we had that $55,000 debt paid off.

Oct. 2011 we are still working pretty much the same plan we created in Jan. 2007. No credit cards, we use debit cards, we track our spending, we use a monthly and and an annual spending plan, and we use an allowance system. Each year we create a savings plan and we work hard to accomplish those goals.

I was born fiscally responsible. BUT, there were big turning points in quality of life… When DH’s student debt was paid. When we got an emergency fund. When we got a bigger emergency fund after getting real jobs. So far we’ve been able to have an upward spending trajectory without having to go back to spending less because we haven’t had debt spending (even with income drops we’ve been able to make it up out of savings) and we’ve been fortunate to be able to accumulate a nice emergency fund.

The freedom to be able to enjoy money is wonderful and is worth the sacrifices we made.

J.D.: without the raise, would you have paid down debt slower, reduced other expenses, or some combination? Any idea what you would have cut?

Wow, that was some journey. My dad had a spending problem, so I learned early on what not to do as I was a first hand witnesses to the stress and devastation created from making these types of poor choices. My library is full of financial and self improvement books. I may not have needed a plan like yours, but understanding how to manage my money well was and still is an important part of my life. Thanks for sharing and hope your trip was all you wanted it to be.

my definite turning point was a few years ago, right before the big crash- i was doing my annual tally of what i had in cash, investments, debt, etc- and i saw my debt was 19 thousand and change. i was a couple transactions away from twenty thousand dollars in credit card debt!

at the time i was single and the debt was from messing up my taxes, and living like a kid in the city on their credit cards. twenty grand! it still boggles my mind. today it’s down to 9,000 which is still a lot- but it’s a hell of a lot less that 19k.

I also think financial awakening can come in waves. I’ve been good the last 10 years or so paying off my cc and saving for retirement. I have a mortgage and in 2007, right before properties began to seriously decline in prices, my husband and I bought a vacation home. About a year ago I realized we had a lot of mortgage debt for our ages and were ten years out from having it paid off–too close to retirement. But fortunately weren’t underwater in either of the properties. I put together a very aggressive plan to have all the debt paid off in four years. And nearly into a year of it, we are on track. One property will be paid off at the end of 2012. Then I’ll use the payments from the first property and snowball them into repayment on the second one.

I’ve always been a saver, but got into trouble when I went deeper into in real estate investment. After almost 10 years of having only a couple houses I went into business with a partner and expanded. Suffice it to say it was a business mistake on my part compounded with the economy and the lending meltdown, and my partner then getting cancer. I might have survived it but then I got laid off and was out of work for almost a year.

I went Chapter 7, gave up all real estate but my 2-family that I live in, and since then found other work, have not borrowed anything more and have saved up some. I am paying my mortgage faster than I have to. The rate on it sucks and it doesn’t qualify for HAMP or HARP. And I am pretty sure I can’t refinance because I went bankrupt. At least not for a few more years. Personally I would rather pay it off 4 times as fast and have no debt whatsoever in 10 years, but I’m also trying to build up emergency funds.

I would not be able to pay my bills as a single person unless I had tenants and now also roommates. I simply don’t make enough. My line of work has not had a cost of living increase in 25 years. Likewise I have never been able to afford children, and I refuse to go on welfare to have them.

In the light of the horrible financial and social crash that I think is coming, I have become somewhat of a prepper. So it’s dried beans, solar panels, garden, home defense, and so on. I’ve got almost all I need there now, so it’s back to building up the cash. If nothing epic happens, all these preps will also help against another job loss or tenant vacancy. I figure it’s a no-lose strategy.

When my husband lost his job in August 2009, we had $44,000 in consumer, non-mortgage debt. Not all of it was completely trivial: some of it was a new-to-us car after my 11-year old car refused to start a few times too many for peace of mind, and a basement waterproofing job because our basement kept flooding. But a lot of it was just way too many dinners out and furnishing the new house. He was denied unemployment because he was enrolled in school at the time, even though he’s always been in school and worked full-time. We could have appealed it and probably won, but looking back on it, I’m glad we didn’t have that safety net to rely on. This was our financial rock bottom and it caused us to completely change our ways. I looked at our bills and my paycheck and realized that if our miminum payments went up by even $10, we could’t make the payments. We immediately elimintated ALL discretionary spending: gym, cable, Blockbuster, eating out, etc. We never once had a late or missed minimum payment. In the two years since, I am happy to say that we have established a spending plan that we have faithfully stuck to – which we never managed to do before the Great Scare, saved up a $1500 emergency fund, and paid off over half of the original $44,000 in debt that we had when he lost his job. Also, we haven’t racked up a penny of new debt. We still use credit cards for the rewards, but we track all spending in a little black & white composition book, stick to our spending plan, and pay the credit card off every month. The feeling of being on our way to financial freedom is amazing!! I discovered GRS shortly after the job loss and financial panic, and I’ve been a daily reader ever since.

‘The Great Scare’ is an excellent term. I’m going to remember that expression. Congratulations on your debt reduction too.

Unfortunately I had a few turning points in my life:

1993 – A divorce that left me devastated financially. Not in the 5 digit numbers or even high 4, but it was more than what I could handle at the time given my income and living in an area with high cost of living. Thankfully I had/have no dependents (children). I was able to get out of debit in due time.

2004/2005 – A year and a half of unemployment to the point where I constantly struggled and feared where money for food and rent would come from despite doing any and everything (literally) to make ends meet. Unfortunately this included making a few moral, legal and soul destroying decisions. I was a signature away from joining the Army National Guard to get out of the life I was in, but chickened out at the last minute. Thankfully things got better for me in the next year with a really good job in the financial industry.

2009-Present – Going on disability and having to stay on for much, much longer than anticipated is another huge turning point. Living without a decent income, medical bills piling up = no more fun, at least anything that costs any kind of money. Living on a fixed income is not thing you expect to do in your early 30s. Feeling that your life is over in terms of relationships (dating?), the hope of ever having a family, saving for the future and having *some* fun (travel, etc) is a bitter pill to swallow.

Right now I’m using most of the steps here to get by day-to-day financially and get out of my medical deb t,which thankfully is shrinking with a few setbacks. At a certain point I will be employed again (hopefully!) so that I can have the life I want.

Carla,

Good luck to you in getting your health and employment back. Sounds like you are a strong person and are taking the right steps to do what’s best for you.

Awwww, thank you, Brooklyn+Money!

In 2004 I was the victim of a frivolous lawsuit. I owned property jointly and the other party filed suit attempting to pressure me into signing over my half, though all expenses were split and my name was on the title. Since there was no legal basis for the claim, every month or so there would be a court date and the judge would order us to reach a settlement. Of course the other party refused all offers to liquidate and divide the proceeds, because they were trying to bleed me until I gave up and handed over the property; they actually went through 3-4 attorneys because when they would refuse reasonable settlement offers their lawyers would quit. This went on for a year, during which the other party stopped paying their half. So I was paying mortgage, insurance and taxes alone plus paying my attorney. In the end the judge forced the other party to buy me out, but almost all the proceeds went straight to my legal bill. I walked away with $7000 in the face of $22,000 in credit card debt, having been living off my credit cards, and a few thousand more in a 401k loan. All my savings was long since gone.

Previously I had done fine saving and living within my means without a written budget, but at that point I sat down and made a budget and started reading Fool and other personal finance sites. I really wanted to get the debt paid down so I got a second job and lived very frugally, putting everything I could into debt repayment. When all was paid off, I was surprised that I did not feel an immense sense of relief; it was more of a “there, I fixed it.”

My money habits were a combination of great (always saving at least 12% toward retirement, paying ahead on mortgage) and not so great (no budget, always carrying some CC debt that never quite got out of hand.) I’d always managed to get “bailed out” of the consequences of my bad habits through windfalls, refinancing the house once, etc.

My moment of truth came when our plan to buy land and build a house with the cash on hand from sale of our previous house (sold at the height of the bubble!) ran into the hard reality that my husband *seriously* underestimated what the house would cost (long story). He was entirely focused on trying to finish the house before winter, and for too long I did not shout “Stop!” even though I saw that the costs were going up much faster than the house was. In October 2007 I discovered that we had $60K in debt and the house was less than half done.

Now we are camping in the house as-is and have been chipping steadily away at the debt since 2008. I calculate it will be 2016 before the debt is gone and we can put our earnings into finally finishing the house. The important thing to me is that we have both learned a lot, and will not succumb to blithe magical thinking ever again.

I am looking at J.D.’s and all of the other readers’ stories and finding hope and inspiration here, so thanks!

Becky,

We too seriously underestimated the cost of building our house. We lived in the basement for 6.5 years while we worked to finish the house. Every year we got a little closer until finally, we were able to move in to the main part. We even had our first child while living in the basement. She learned to crawl on concrete. She’s a tough little thing. LOL!

Good luck with your project. It is so easy to underestimate the costs of a project like that. Trust me, you are not alone! You will never again take for granted things like plumbing, finished floors, appliances, etc. 🙂

Thanks Paul, so true! The sad thing is, my husband is a house designer/builder by profession. And on his own project, he made all the falsely optimistic assumptions he’s spent the previous decade sternly warning his clients against!

This would be hilarious if it had happened to somebody else! 🙂 Still, it makes for some good stories, doesn’t it?

I was born into a financially smart family, but was swayed by friends and my fiance at the time that “debt isn’t that bad!” and “you’ll always have some kind of debt; relax!”. Big mistake! My husband and I carried up to 10K in CC debt, and felt entitled for a new car since we both had “good” jobs.

We started chipping away at our debt when our first child was born, but when we realized we could still keep our heads above water, the debt wasn’t a big issue. We planned for our second child, but 17 weeks into the pregnancy, we were surprised to learn we were expecting twins! We were nervous about daycare and infant expenses for the 2nd child -and now a 3rd!?! Yup… debt became something we HAD to wipe out just to break even. We did it, and it just keeps getting better!

The twins are 4 and our oldest is 6. All debts paid off except the mortgage, and we’re saving for retirement, college, and fun! Life is good!

(Best part: deleting my bills from my “Favorites” and bookmarking my saving accounts!! Not to mention checking the mail every day and receiving a statement or two, and only bills to keep the house running)

Like many previous posters, I also racked up nice credit card bills during school (MBA) and I did manage to pay them off. I thought I was doing fine – no credit cards, no car loan, a $12k HELOC, a mortgage. But I had no savings and was barely saving for retirement.

My philosophy had long been “I’ll save when my salary increases and I have more money”. Then the financial crisis hit and HELOCs were being closed on people right and left. That was my emergency fund in my mind. I’ll never forget talking to my (also 40-something) sister one day trying to figure out what we would do if either of us lost our job and our credit lines were taken away. In that moment we both came to the realization that the possibility of incurring further debt is NOT the same thing as savings. At that point, we both cut our budgets mercilessly to save up emergency funds and got serious about retirement savings.

That didn’t even include my student loans! I’ve paid off the HELOC and the student loans, and I’ve saved my EF. I’ve also gone from saving 5% of my salary to 15% for retirement.

This will sound like an ad but it’s absolutely true. My turning point came last year when I started working for a credit counseling agency. Our office also produces financial education books and programs, which I help write. Constantly being inundated with information about making better choices with money has given me a lot of hope. I previously always worked at jobs where I didn’t see any hope, and I never thought I’d be able to do much of anything financially. Now I see how using a budget can be an instrument for meeting goals and creating change (no pun intended!).

I never had debt that I could not pay off immediately (i use debt as leverage), but i just lived my 20s (okay and some of my 30s) in a fog. Earning what I consider to be a lot of $, and then spending it all. I woke up when I decided to go to grad school full time in 2006. I lived like a pauper during school, and then when I moved to another country for six months, I tracked every peso. After returning, I continued living much more modestly than I could afford and paid off about $50K of school debt in a year or so, while saving $ at the same time (some of that was from previous savings). Now I’ve eased up a little, but still try to keep fixed expenses low. For me, it’s all about having a cash cushion. No mortgage, so literally no debt.

$50k in little over a year is freakin’ mind blowing! Kudos to you.

What a turnaround! We don’t have any consumer debt, but we have quit a few mortgages. It will be a long hard road to pay these off.

One of the best influences on me was a roommate my first few years out of college. We were living in Boston in the early 90s and were both making NO money (under $9/hour each which is less than 19k/year..amazing). I had a credit card balance of about 3k, and she didn’t. When it came up she expressed real surprise, and it was the first time it occurred to me that I didn’t have to spend that way. I was lucky that she and some other friends started talking about 401(k)s at the same time, so as soon as I was eligible for one (not until I was 27) I took full advantage of it.

It took a long time for me to get fully out of debt and STAY out (I was queen of the 3k debt… so close and yet NOT paid off), but I never got into really bad shape. I think my worst status was in 2006 with ~5k school loan, ~17k master’s degree debt, ~5k credit card debt. I’ve been out of debt (I rent) since Feb 2010.

The final thing that got me to pay aggressively on my so-called “good” debt was when I calculated that even with a sub-5% rate, it took the equivalent of two payments per year just to pay the interest. Uh, no thanks Sallie!

How do you feel comfortable?

That’s what has been bothering me recently. I’ve been pretty good with the finances: very manageable student loans, small car payment, pay extra on mortgage, save >10% for retirement, have 529 accounts for the kids, 5-6 month emergency fund, small non retirement investment account, positive cash flow most months after expenses and saving for other funds (household repairs, travel, misc)… yet, with all of this I still worry.

I have some significant home expenses coming (garage repair, driveway, windows) and paying for those over the next few years has me concerned.

Even if you do everything mostly right, I still feel uncomfortable… how do you deal with this? Am I too conservative? Should I relax a bit?

Hi Concerned,

Sounds like you are being smart – Robert Brokamp had a great article a month or so ago that addressed this. He suggested that “worriers” play through the worst-case scenarios and actually come up with a plan for them. This can involve things you do now – getting more insurance, saving more, building more employability for yourself, etc – and things that you know you can do later if you need to – cashing out investment funds, etc.

I have been doing this a bit at a time, and it does seem to help.

Turning point was near my 25th birthday.

I decided I wanted to take my first trip for to Europe for my birthday because I “deserve” it and charged the $1000+ trip on my credit card.

Something clicked a few days later. I had a full-time job making $41k a year, no kids, living with my parents (paying low rent/utilities), why couldn’t I pay for this trip to Europe in cash?!

REALITY CHECK: I was spending like a mad woman (clothes, food, trips), I had credit card debt, student loan debt, car loan debt and zero savings!

I’m now at $13k left from when I started in March 2011 at $24k.

Hope to be debt free by May or June 2012.

My story was not about a low point, instead it was more of an opportunity. I worked a really hard job of door to door salesman the summer between high school and college. I earned enough money for spending money in college. I gave myself an allowance each week and it was the beginning of learning to live on a budget. It affected my entire life. I chose a career in accounting and finance. I became very successful and achieved financial freedom at 38 years old.

Looks like you created a good plan to get out of debt and stuck to it. The key to your success was staying focused on the goal and sticking to the plan. Many can learn from your experiences. I personally think I need to do something similar with our debts (car, home equity, student loans, mortgage) so that my wife and I may experience the freedom of being debt free. Unfortunately the big one, mortgage, will take years to pay off although it will provide the most freedom once it is gone so it will be worth it.

My turning point was when I couldn’t sleep at night.

This is sort of a question and a comment. Did Kris have a turning point with YOUR debt? I don’t think I could be in a relationship with a spender.

Oh the 90’s, when a divorce, car accident (I was rear ended but it was 3+ years before it settled) and a long stretch in the hospital for an unplanned illness left me $15,000+ in debt with almost nothing to show for it. When my car accident finally was settled, I was able to pay off my debt, and promptly charged a trip to Vegas. It was only when my second car died and I had to take out money from. 401k rollover (yes, I paid a penalty to do so) to pay for my replacement car that I got serious about debt. Helped by a new job and one on the side, I paid that car off in a little over two years and stopped charging everything. It took a while, but I got a savings account, maxed out what I could stick in my 401k and even invested a few bucks, and oh yeah bought a house last year. So here I am in 2011 with no debt except a house payment. Paid for insulating the garage last fall with cash on hand and am currently saving for a kitchen remodel.

Love reading about how others are working it out too. Which I had access to this info when I was in my 20’s.

I lost my job and it took one full year to find another. I was 48 at the time. Doing all the traveling over the northern half of my state to look for work put us deeper into cc debt. We also helped our daughter some. We ended up almost 32k in debt. But, we did not consider bankruptcy.

The job I ended up with was 90 miles from home. I got a room there and came home when I could, after working at least 2-4 p/t jobs while there. It solved two problems – the debt and the fact I knew no one there and didn’t want to sit around in a single room watching tv.

It took us 15 years to get the cc’s paid off. I had once worked in a financial institution and had learned one absolute fact-pay your bills on time; each time, every time. At one time we had 12 cc’s. If I had to borrow from one to pay the other, I did. As a result, I began to get the best offers from cc companies. When a financial magazine said you were ahead of the game if your cc’s were at 14% interest, mine were down to 3 cards at 9.9% “until paid off.” Later, I got an offer and consolidated my cards at 4% “until paid off.” The last 3 years I got a new card each year at 0% for one year. Those cc offers helped me to get out of cc debt.

When I retired, all we owed was on a vehicle we had bought 6 months before. I took my first withdrawal from my 401k and paid it off. DEBT FREE for the first time in our married life. Still that way. I use 2 cc’s all the time and charge all I can on them and pay them off each month. They pay me, I don’t pay them. It is so freeing.

I have enough in savings that I can buy another car for cash if this one runs out. My 401k goes for home repairs or traveling. It is only about 74k, but it should last me at least 20 years taking only the minimum out each year. I have enough income (SS & 2 small retirements) to live on okay and save some also.

In fact, my 401k is invested only in a straight savings account. But it has paid well enough that I had $78k when I retired and after taking out nearly 15k, I am now only down 4k. Ain’t interest grand?!!

I do not believe people are born fiscally responsible. Hogwash. You might be raised that way, but not BORN that way. I wished I had been raised that way. Unfortunately not. My mother ran the finances in our home. She has more credit cards than one could imagine. She falls for the 0% interest gimmick and will transfer the amount to another card before the period expires. Why not just pay the stupid thing off and be done with it?? This is the finance world I grew up in and was taught.

It wasn’t until I got married that I learned how to manage my finances. And it wasn’t my wife that taught me. It was Dave Ramsey. At some point we had racked up over 30K in credit card debt trying to start a business. Stupid. I have since paid it off. Took me 4 years and LOTS of hard work and sacrifice. But, it’s gone and so are the credit cards. In fact, haven’t used one in 5 years (it’s been a year ago that I paid it off).

Yes, we’ve traveled. Yes, we’ve rented a car. Yes, yada yada yada. You don’t need a credit card to live. You simply don’t. We pay for everything either in cash or debit card. (Hint: look at your debit card. More than likely it has a Visa or a Mastercard logo on it. It acts just like a credit card.)

I’m not saying that Dave’s way is the only way, but that is what worked for us. If you couldn’t tell, I’m a big Dave fan, but I don’t worship him. I do disagree with him from time to time, but on the whole, he’s dead on.

All we have left now is a school loan and a mortgage. Life is so much easier without the debt and we look forward to the day we can scream, “I’M DEBT FREEEEEEE!!!!!!”

Thanks for reading.

I finally got through the mental stuff of the Dave Ramsey plan..I have now been debt free, but the house, for nearly 4 years. Yes, read that right, I am on BS6 for four years.

There is no one who can convince me otherwise this is bad.

I get flack for no credit card, and a house payment on a 10 year, 3.25 percent loan, that is less than 25 percent of my take home pay.

I am truly weird.

But, as you go on, you will realize the strength of your convictions.

I will not do debt, for any kind, ever, unless I am dying.

Oh..I heard it all, about how my FICO would drop and I get bad rates in insurance..yeah, my lowest FICO is now 771…I suffered badly after four years.

Read it and weap.

Spedie, debt free, and loving every minute of it!!!

DR rocks! and I am living proof of it.

PS: and there was a lot of pain in between, but I got over it.

spedie

I’m one of those people who’s always been pretty responsible with money. I’ve always hated debt and enjoyed saving. Even when I was a little kid I liked counting the money I had stashed away in a basket. That’s the way I’ve always been…

Not sure if I had just one point. I’ve just had a few years where I became really focused and took control of my finances. Getting married helped, in that I didn’t want to hold my husband back (he’s been super responsible with his money) from his or our goals.

Your website really helped me too, so thank you for that.

my turning point was the day my boss really started to threaten me that i would loose my job because of some “mis-behaviour” i did not even recognize at that point.

i had earned quite a bit over the years and spent exactly that, so there was no debt. But no savings either.

now, about 1 1/2 years later, i have an emergengy fund which will keep me going/alive for 7 month plus a move to a less expensive part of the country. i have a travel fund, a fun fund, two accounts for retirement (which will allow me cutting down hours to about half when i am 55 and then retire normally) and some money which goes to some fonds each month.

i feel so much better: safer and more self- confident.

my boss does not hate me anymore, and even though i still hate him for shaking my world and terrifying me that much, i am really, really thankful for that shock which made me get my financial things in order! and if he ever talks to me like he did that dreadful day i now am able to just walk away – if i want to.

priceless!

My crisis began when I got my first credit card. I thought I had “arrived” – I had a very small but growing RRSP, mutual funds, and now I could join those others living above the poverty line because I had a credit card. Silly me! Sometimes I carried no balances, sometimes a lot – and most of my credit cards came from the “balance transferring” that seems to be all the rage again! Last summer was a financial disaster and I’m still paying on that! Reading “The Tightwad Gazette”, blogs like this one, and “Total Money Makeover” helped a lot – My debt could have been worse. Now I’m down to three debts and an emergency fund! I like that!

My point was when my wife left and I couldn’t afford the house on my own. Took my two boys to a small apartment that worked for us, buckled down, and now see a bright light at the end of our financial tunnel.

My trigger point was in July 09. ’08 was disastrous: To make a long story short I foolishly cosigned three documents that the family members wound up unwilling and unable to make good on, leaving me holding the bag.

My freak-out moment came when I finally sat down to tally up all the debt and I literally thought I had picked up an extra cell in my Excel spreadsheet: But the formula was right–I was looking at $194,000 in debt, not including my mortgage. While about 65% of that was due to the cosigned debt, I had also bought two new cars and was paying $1000+ a month in car payments. I was also paying back my daughter’s student loans, which I had pledged to her when she picked an expensive liberal arts college.

When I realized that I had absolutely no clue before that sad moment what was happening to me money-wise, I knew I had to figure out how to stay on top of and in control of my finances.

My overall biggest mistake was, not just cosigning the documents, but believing, after struggling financially for years and then experiencing a higher income than I had imagined possible, that I could now buy anything I wanted. Where I had always been used to doors closing in my face; now lenders were calling ME, saying “don’t you want MORE money?” I guess I just was giddy with the opportunities.

Like others here, I adopted Dave Ramsey, too. It’s been two years and I’ve paid off 82,000. I will never never never never go into more debt. Debt truly is slavery, and a mortgage on your future.

When I left my ex.

Tallied up all my debts and started paying them off, final payment date is 12/01/2011.

That’s my freedom day.

JD it’s definitely inspiring seeing that you made it out of so much debt and now you’re basically financially free. My layoff turned some things around for me but my recent 21st birthday is my true turning point to get into gear. I’m on a mission!

My turnaround game after graduating from college in the summer of 2008. I was unemployed and house sitting for a family. They had Dave Ramsey’s Total Money Makeover sitting the coffee table and I sat down and read it in a day. I wasn’t terrible with money before that experience, but that book really opened my eyes. I decided at that point that I wanted to be “weird.” I am now employed, married, and my husband and I paid off 25k in student loans after getting married in 2009. We are now saving for a home.

Congratulations on taking the first steps out of the debt trap.

My turning point was when I lost my job in 1/2009. I was making about $60k/year & I had credit card debt and absolutely no savings. I found Dave Ramsey in April that year & felt that was my Aha! moment. I never looked back after reading his material and was able to secure employment and pay off everything. The only thing DH and I have left to pay is a about $1800 on my student loan & about $6k on his truck. The townhouse, my car and all the boats are paid & no more consumer debt!

My turning point came when my mother went through a divorce and disclosed how bad financially she was. Changed my life immediately for the better. I vowed to never have money issues. I was 23 at the time.

I’m only now becoming more serious about becoming debt-free. I’ve always said “i’ll pay it later,” and now is definitely later. I’m done with school (three degrees later), and thus I have six-figure student loan debt, about $10,000 CC debt, and two car loans. Eeek not making enough has put me into this mess. I’ll be starting new jobs soon and with that will implement my debt-payoff plan! I’ll be following the Dave Ramsay plan as much as I can, but by paying off debts we’ll also have more to live on than we do now. I’m got a big battle to overcome!

My turning point was when my wife threw the checkbook at me and yelled “YOU DO IT”. It had happened many times before, but this time I finally decided to become the leader in my home. I am the one more naturally geared toward dealing with finances and my wife hates dealing with the money on a daily basis.

We did Financial Peace University and eventually became debt free except for our house. I became so passionate about learning about personal finance that I developed my own course (Celebrating Financial Freedom) and now have a blog to go with it.

It has been quite a journey and I love it. I can’t wait to see where it leads, maybe even to lake Titicaca.

Keep up the financial good news J.D.!

“When you help me with money, you help the world prosper.”- J.M. DuMont

My husband and I are 27, with a two-year-old son and another on the way. We have $294,000 in student loan debt (two private undergrad educations, my law degree, his master’s), $16,000 in consumer debt, and we have a $500,000 mortgage. Over the last year, we’ve paid $75,000 to debt service (paid off a lot of consumer debt, minimums on students loans, but the student loan debt keeps going up). Hard to see how we’ll ever get out from under the debt. We pay $3,500 a month to debt ($2,100 minimum, and we’ve managed to put out another $1,400 towards our snowball) but it hardly seems to budge. We’ve cut back on spending in every way possible. Our debt snowball says we’ll pay off all the debt (except the mortgage) by 2020, but it sounds so far away. It’s nice to see that those far-off years eventually do arrive. Thanks for the inspiration – I’m trying to think positively and tell myself we can do it.