Note: This article is from J.D. Roth, who founded Get Rich Slowly in 2006. After a year off, J.D. is once again writing here at GRS. His non-financial writing can still be found at More Than Money.

¡Saludos de Ecuador!

For the past two weeks, I’ve been enjoying my third trip to that seldom-remembered continent, South America. I love this place, and love it more each time I visit. My past trips have been personal excursions for pleasure and introspection. But this trip was primarily business-related. (I am in the Galápagos at the moment, and that’s just for personal edification — unless we count the tortoise photos, which could be used for GRS promotion.)

You see, earlier this year, my colleague Mr. Money Mustache contacted me to ask if I’d like to take part in a chautauqua produced by Cheryl Reed of Above the Clouds Retreats. Of course I would! It’s my policy to say “yes” to requests like this. And so for one week in early September, MMM and I joined Cheryl and jlcollinsnh to present our philosophies to an enthusiastic group of 22 participants, most of whom were women and most of whom had reached (or were well on their way to) Financial Independence.

MMM has already shared his lessons from Ecuador. Today, I’ll share mine.

Improving Lives

Cheryl came to Ecuador on a volunteer vacation sixteen years ago. She did physical therapy for poor and disabled children. She loved the country, and was struck by the poverty. Five years later, she bought a 24-acre farm in the tiny community of Santa Elena, a couple of hours north of Quito. She’s tried (and failed) to farm various crops. At the moment, she’s farming coffee. She spends six months out of every year here; the rest of the time, she lives in the States.

Cheryl is passionate about improving the quality of life for the Ecuadorian people, especially those in Santa Elena. She sponsored one local boy through college, and she intends to sponsor more. She donated a laptop computer to another girl who wants to pursue a degree. And a portion of the “profits” from our week-long retreat will all go to Project One Corner, Cheryl’s charitable organization that works to improve her tiny corner of this planet.

Moved by Cheryl’s dedication to her community, MMM, jlcollinsnh, and I all donated our speaking fees to her cause. She used $1,500 of this money to help the above family rebuild their tiny home, which was severely damaged in an earthquake last year. This family of fourteen has been living in a chicken coop since then; with the money we contributed, they’ve been able to make their home livable once more.

During the prep for the chautauqua, we talked a lot about financial equivalencies. “The $1,500 we gave to that family is an espresso machine for some people at home,” MMM observed. “When I see that somebody needs help, and I see that I could help them with just half a day’s work, well I can’t say no.”

“I know,” Cheryl said. “At the end of our retreat, we’ll have a nice dinner at a restaurant in Quito. The first place I contacted wanted $42 per person. I couldn’t do that. That’s $1,200. That’s almost as much as it took to fix up that family’s house. I chose a cheaper place instead.”

Converting to Mustachianism

Prior to this week in Ecuador, my exposure to Mr. Money Mustache’s philosophy was limited. I admired his presentation on how to blog last year at the Financial Blogger Conference, and spent an hour talking with him after he’d finished. But I’ve had more contact with Mrs. Money Mustache since then. (“She likes your writing,” MMM told me on the plane form Houston to Quito. “You’re all warm and fuzzy and not a bossypants like me.”)

But after spending ten days with MMM, I’m a convert. I’m in the process of reading his blog from start to finish. (You can too!)

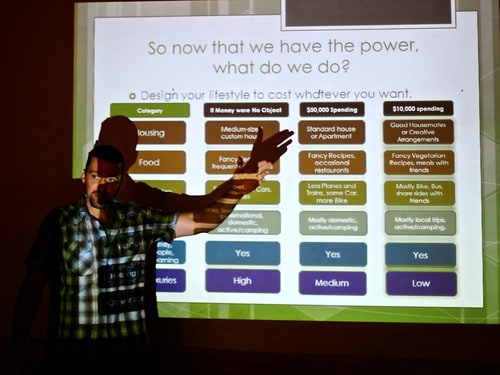

A short summary of the Mustachian Way: MMM believes that this whole “get rich slowly” business is BS. He advocates getting rich quickly — but not through any magical means. The core of his philosophy is adhering to an extreme savings rate. If you can save 50% of your income, you can achieve Financial Independence in seventeen years. Bump that savings rate to 75%, and you can do it in seven years.

“I call this the shockingly simple math behind early retirement,” MMM said.

In general, Mustachianism emphasizes cutting costs. MMM believes that households with incomes greater than $50,000 per wage-earner have no excuse for not building substantial savings. He says it’s still possible to enjoy a luxurious life on much, much less. (He and Mrs. Money Mustache raise a young lad on $30,000 in household expenses.) The problem is that most people have a million excuses as to why they can’t reduce their luxuries. They drive SUVs instead of biking. They have cable television. They buy books and clothes and kitchen gadgets instead of finding low-cost (or no-cost) alternatives. As a result, they choose to postpone retirement until age 65 (or later) instead of retiring at 35.

“The principles on my blog are that you can be happy with less consumption and more hard work,” MMM told me.

He’s absolutely right.

The attendees at our chautauqua were all living proof of what’s possible through extreme saving. Not all of them had achieved Financial Independence, but every single one owned responsibility for their current financial situation. Those that weren’t yet at FI see the path and know what to do. (And, in general, are very young.) Those that had achieved FI did so through extreme saving, careful investing, and optimizing income.

As part of the retreat, I met with thirteen of the 22 attendees. Nearly all of them showed me their financial situation. Most had achieved FI. The average person to have done so was a woman in her mid-forties who still continues to work because she likes what she does. But she could quit at any time and live comfortably for the rest of her life.

What about increasing income? MMM recognizes the value of doing so, but it’s not his focus. “I like to make fun of the ‘earn more’ crowd, even though I think earning more is a good thing,” he told me. “I just think it should be a by-product of being an ethical businessperson. Plus, my secret mission is to reduce the world’s consumption of Stuff, so I focus on that.”

Other Insights

During my ten days with these fine folks, I didn’t just learn about Mustachianism.

Jim (who is known by jlcollinsnh online) gave a short, sharp presentation on how to invest. In short: Stick as much as you can in index funds, then ignore the account. Let the money grow. Resist the temptation to think you’re smarter than the market.

Jim also talked about the importance of “FU money,” having enough cash in the bank that you’re not tied to your job. Most people have so little saved that they’re tied to their jobs. They have no flexibility. But FU money is the little brother of FI. It gives you freedom to choose better opportunities.

Jim told a story about when he was younger (many, many years ago!), he was working at a job he liked. He wanted to take a few months off to travel to Europe, but his boss wouldn’t have it. “Fine,” Jim said. “I’m quitting.” He had saved $5,000 on a $10,000 salary, and that was FU money for him. Surprisingly, this shifted the balance of power. Suddenly his boss was more receptive to the suggested sabbatical. Jim got to take the trip and then return to a job he loved †all because he’d saved enough to walk away, if needed.

“If you don’t have FU money, you’re not free yet,” Jim said. “And if you have debt, your’e a slave.”

“A lot of people equate saving with deprivation,” Jim noted. “It’s not deprivation. It’s just a choice to spend on the future instead of spend on today.” And debt is a choice to spend on the past. “Saving is money spent on buying freedom.”

Anita from Chicago — a corporate lawyer — is in her early thirties and just couple of years from being able to retire. How did she do it? Through very Mustachian extreme saving. She keeps her expectations low. “I have everything I want,” she told me. “I just don’t want very much.”

Val — who has been something of a nomad these past few years — has so much saved that she never has to work again. But this week, she just took a job that pays her more than she’s ever made in her life. Why? Because it sounds like fun. Val praised the power of Financial Independence: “FI takes away the wall of worry,” she told me. “You can just do what you want.”

I also enjoyed talking with the folks who aren’t very far along on their financial journey. Lise is a librarian from London, Ontario. She’s scared to invest, so her money is just sitting in a savings account. She’s overwhelmed by the options, and afraid to make the wrong choice. I hope my conversation with her — and Jim’s presentation — helped to remove some of that fear.

I particularly enjoyed the time I spent with Jesse Meacham. Many of you probably know Jesse as the founder of You Need a Budget, the popular software that’s been helping folks for almost ten years. I’ve interacted with Jesse for years, but never met him until now. He’s awesome: a cheerful, open-minded, Crossfitting nerd who tells fantastic stories. He kept us all entertained for hours during cold nights at the hacienda.

Jesse shared lots of great insights into financial management — and life. Gems like this:

- Don’t forecast. Live on what you have. If you try to guess how much money you’ll have a month from now or a year from now, you’ll almost always be wrong, and your forecast will inevitably be too high. Forget the future when budgeting. Focus on the past.

- Keep it simple When budgeting — or doing anything else with money — use the “mother-in-law test”. If you were to teach your mother-in-law to budget (or invest or buy a house — whatever), how would you do it? That’s where you should start with your own finances. Don’t make things more complicated than they need to be.

- Seek new challenges. Doing new things keeps life interesting, especially once you’ve reached Financial Independence. “I got a puppy a few weeks ago,” Jesse told me. “I wanted a new challenge.” But your challenges might be learning a new language or taking on a new sport. Challenges make life meaningful and keep us from spending money on happiness drugs such as television.

At the end of a week of “crazy rich-person talk” (as MMM called it), everybody felt inspired to continue working to financial and personal freedom. But we also felt inspired to spread the wealth to others. For instance, MMM “hatched a slightly crazy plan to look into buying the 24 acres adjacent to Cheryl’s existing farm to turn it into a permanent gathering point which also generates money for charity.”

As for myself, this experience showed me the power of small-group gatherings. I’ve done a lot of organizing of and speaking at large conferences (such as World Domination Summit), but never participated in something like this chautauqua. It won’t be the last time. I have a slightly crazy plan of my own. I’m going to organize something similar much closer to home. Look for some sort of retreat here in Oregon in late 2014 or mid-2015. I look forward to more “crazy rich-person talk” — this time with you.

I don’t know about that whole FU money thing….

There are so many hungry people for jobs these days and so many people out there with equal degrees that

1. There’s someone else who will easily do the work out there

2. There’s so many other people to do the work out there it’s keeping the wages lower

The balance of power is not in your hand.

I think you may be missing the point. Collins wasn’t bluffing with his FU money – he was ready and able to walk away. The balance of power was definitely in his hands.

Also, I’ve been reading MMM for years and I retired early over a year ago. MMM is awesome! If you haven’t read him, then stop reading my drivel and go there NOW!

Agreed – MMM is really great and will alter your thinking on just about everything!

I dunno…with only $5k, he wouldn’t be able to walk far, not without having to get back into the job market.

He may have been serious about leaving, but if the supervisor had said “Well..good luck!”, he would have been screwed. I think his boss saved his butt from making a juvenile mistake of thinking his little money would take him anywhere.

5k is not f/u money…it’s you better not f/u money until you have some serious f/u money.

But this was “many, many years ago” when $5000 was real money–half a year’s salary in this case.

Folks, MMM is NOT retired. He runs a blog. As many of you here know, running a blog is hard work. JD – you quit your job at the job factory to blog full time. Flexo at Consumerism Commentary same. Jim Wang at Bargaineering same. To say that he’s retired is insulting / condescending to all the people who are also working hard on their own small businesses, and earning a good buck but not claiming they are “retired”. It’s hard work to write, manage comments, etc.!

Then it’s all about developing your personal moat – having skills and abilities that put you above the competition. Even just years of experience that new grads lack might qualify.

Love this post. Just this past year I read MMM from beginning to end, and I frequent him forum more than a couple of times each week. It is very addicting!

We are working on FI. I am in the process of switching to self-employment and doing what I want. For years we were spending pretty much everything we made. However, that didn’t make us any happier. I’m glad that we have realized that.

Great post! Sounds like an amazing trip. I have never read MMM, but will check his site out. It’s interesting to hear about his get rich quickly idea. I have never thought of it that way, but retiring early would be a wonderful thing to pursue other interests.

MMM’s ideas were first laid out (to my knowledge) by Jakob Fiskar of Early Retirement Extreme. He’s the original source.

MMM added his own brand of marketing and perhaps a less “extreme” approach than Jakob, but it was Jakob’s formula all along. Regardless, Jakob “anointed” MMM as his ideological successor some time ago.

Jakob moved on to other pursuits but his old blog is still up and he has a book for sale here:

http://earlyretirementextreme.com

Mr PoP loves Jacob’s book, and it passes the “value product” test:

New book $11.70, free shipping through prime

Used book $10.99 + $3.99 shipping

http://www.amazon.com/gp/product/145360121X/ref=olp_product_details?ie=UTF8&me=&seller=

When a used product costs about as much or more than the new one, this can be read as – people who have bought the book tend to see tons of value in it and aren’t willing to give it up for a song. So it’s a highly valued product, which tends to correlate with very useful!

Longtime reader of both GRS and MMM. Love both! And really looking forward to the Portland gathering as I am just over the river in Vancouver!

I don’t know if I’m the only person who feels this way, but I have the need to put this out there. I tried reading MMM but was seriously put off by the bad language.

I mean the man is addressing the public, not his buddies over a beer. Does he honestly use the same words to his wife…son….mother?

I stopped reading. Just my humble opinion.

The great thing about the internet is that everything is public and voluntary. If you don’t like something, you don’t have to go there. I like MMM’s language – it isn’t used egregiously, and always to either punch something up or add a bit of humor. I kind of like being talked to like a buddy.

I was starting to wonder if I was the only one here who doesn’t care much at all for MMM, almost feels like being Stan in the “Passion of the Jew” episode of South Park.

My main dislike of MMM is that the advice that I read there wasn’t new, a lot of it was of the “no duh” variety, and he’s also one of the preachiest and most judgmental personal finance bloggers I’ve seen. There’s a very strong “my way or the highway” vibe to his writing that I didn’t care for.

I agree that you’re entitled to feel that way, but I disagree with your assertion that he should amend his style because he’s “addressing the public”. I don’t really consider a personal blog as the same thing as addressing the public. Yeah, it may have evolved into that as readership increased but at the end of the day it’s a guy, with a pesonal blog, speaking in the way he prefers to speak.

It’s absolutely refreshing that there are still some folks left who do not allow their personalities to be watered down just because they are now considered a “public” figure. Maybe the public needs to grow a few million pairs.

Clearly everyone has their own opinion here. But for me there is a difference between “watering down your personality” and speaking respectfully to get your message across.

I’m a huge fan of financial freedom. My goal is to be free by 30. I started by graduating from college debt-free. My next goal is to sell my rental property for a handsome profit.

However, I do believe that making more money is a huge part of that equation of financial freedom.

Maybe if MMM wants to make fun of making more money, he can consider taking down his MMM recommends page.

I agree. I don’t understand the point of making fun of people who want to make more money.

If you make more money AND cut your expenses then you can get where you want to be that much faster. Isn’t that the point?

Problem is, when most people make more money, they spend it on more stuff, flashier stuff, etc. Those who have the discipline to save more when they make more are a dying breed in this consumerist culture.

I don’t think that “most people” who make more money go out and spend it on more “stuff,” especially people who read this blog.

And, saying that you usually make fun of the “earn more” crowd is incredibly condescending to a group of people who are obviously trying to improve their lives by earning more.

Why not encourage people to make the right choices with the additional income that they work hard to earn? That strategy would probably be a lot more helpful than “making fun” of them. Because, really, what does that accomplish?

What coincidental timing! I had a conversation with a coworker not ten minutes ago, and he was telling me how we are “All Wage Slaves” because no one can choose not to work, and we are all forced to give away part of our money in taxes. This post gives so many examples of people who have chosen to work harder and work smarter now so that they can choose not to work later; it is very inspiring and just goes to show that no one Has to be a wage slave. As for the taxes bit, I choose to live in a country that upholds standards and values I believe in (like good roads and helping those in need), and if I didn’t want to support those things, I could choose to move to a country that doesn’t.

JD,

I enjoyed the post and looking forward to the retreat. I will definitely check out MMM. Thie is the first time i hear of him.

Matt I totally understand your point, however we, (most of us) give our employer the balance of power and believe that it’s not under under our control.

Retiring early sounds good to me.

If people want to change their lives and are attracted to MMM’s philosophy, then I think that is fine.

If people are happy with their lives and are not attracted to MMM’s philosophy, I think that is also fine.

If people want to change their lives and are not attracted to MMM’s philosophy but would prefer to Find Something That Works for Them (which was always the philosophy behind this blog, and probably the thing that I enjoy most about it) then I think that is also fine.

I enjoy MMM’s writing style in a way. He’s not an apologist, which is refreshing in the PF sphere. I find the strong language awesome (I am also a fan of Gordon Ramsay, I think MMM is along the same lines).

However, MMM thinks it is fine to make fun of people who don’t agree with him or prefer another way of doing things. And he does it in a way that, to me, makes him seem like a bully. And people who are really into MMM often express their genuine enthusiasm in ways that, to me, also make them seem like bullies (though I don’t think they mean to be). So I am really conflicted by MMM, because I think he has been the direct cause of a lot of some really terrible behavior on These Interwebs.

Telling your story of how you realized The Error Of Your Ways and Changed Your Life Forever because of what you learned at his blog? Awesome. Rock on.

Trolling and passing judgment on other people who, after all, are only just learning also? Telling other people they are Living Their Lives Wrong and are Stupid or Lazy for having different values than you? Not cool.

If people ASK for advice, by all means give it. Kindly, if possible. If people are happy, I don’t see the point in being mean.

I find MMM’s writing style to also be very similar to Ramit Sethi’s. FWIW, I find Ramit to be much more clear about his aims in adopting the tone that he does. I also find the “earn more” approach to be much more compelling than the “ultimate frugality” approach, but I understand that’s just me. Other people can Do What Works For Them.

See I don’t consider when MMM berates people, or has harsh comments towards a sector of folks, bullying. He doesn’t do it out of malice (at the worst, it’s ridicule) or intent to harm. And typically, after a verbal punch in the face, he keeps it moving. Nobody is his victim. The people who write into him know what they’re going to get, and that’s why they wrote in.

I agree that the readership can get aggressive, and try to copy MMM’s style in a less charming, more bullish way…but you will have the mindless sheep followers, wherever you go.

He’s passionate about his message and his faux anger is hilarious. There are tons of people who are judgemental in an underbelly skeevy kind of way and are truly just disgusted by those who live their lives differently. Despite the loudness of his insults, I feel like the caring still comes through…I think he truly cares about combatting the consumerist mindset that is ruining the modern world. I never got the feeling that he hated people…only what people do.

” I never got the feeling that he hated people…only what people do.”

That sounds remarkably like the Christian doublespeak – “love the sinner, hate the sin,” as if what people do and who people are are so easy to separate.

And your idea about MMM fits in quite well with my perception of him and his followers as engaging in a quasi-religion.

The conformity even goes down to the ridiculous mustache pose J.D. posted above. Seriously – for a bunch of supposedly free-thinking people, you fall in line with each other pretty easily. I know I’m perhaps reading too much into a pose (possibly made while inebriated), but there is a strong streak of conformity masking itself as non-conformity.

MMM is a good message that was originally written by Your Money or Your Life – then taken a step further by Early Retirement Extreme. The big difference is he has paired it with exceptional marketing. Much of his success is due to developing a cult of personality and the flowery language, for better or worse.

I suppose there are a lot worse cult leaders that could be followed. But does seem like his material over the past 6 mos. has become repetitive and the ideas are drying up. 10 ways to say the same thing. His audience will get fatigued and ultimately let down. Witness the rise and fall of every cult.

Interesting analogy. However, I question how many groups of people have been tortured and killed at the hands of “christians” and how many groups of people have *actually* been punched in the face by MMM because they drive cars.

I guess I can see the ridiculousness in the language that puts it above reality. When MMM says he wants to punch people in the face, it’s funny…because you know he doesn’t really believe people should be punched in the face. When I’m told that I will burn in the eternal fires of hell because I am an atheist…well it’s still funny, but I know that this person actually believes that I should burn in an eternal fire in hell.

I also read MMM on occasion and find him dogmatic and rigid in tone but I take it with a grain of salt.

He can come across like a convert, or a born-again vibe that I don’t like but I let it roll off.

The one thing I don’t read anymore are his articles which constantly drone on about how “everyone can use bicycles instead of evil cars”.

I personally know of half a dozen people riding bicycles killed by cars in my neck of the woods. One just yesterday, so it’s a sore point for me. Risk vs reward is different for everyone.

That is why I’ve shied away from many PF blogs over the years. I know the bloggers are giving advice based on their own experiences but I don’t like the ‘my way or the highway, because its the only right way’ attitudes many have.

I guess the bottom line for me is that:

1) I tend to find evangelism distasteful, regardless of the topic;

2) I think his tone squashes discussion rather than encouraging it;

3) It’s all a little There’s Only One Right Way to me.

Thank you for expressing so well what I’ve long felt about MMM. I find his website comments sections creepy – and you’re so right, that photo in JD’s post can also be seen as creepy! I understand the fun behind it, but there’s more than one way to look at at it.

MMM is wrong in many ways, but god forbid you say that to him or his rabid fans. Ugh.

Honey, I think you should read this: http://www.timelessfinance.com/2012/09/12/personal-finance/

Sometimes there actually is a right and a wrong way to do it. MMM may take it to the extreme at times, but his formula – pay off debt like it’s an emergency, save up as much as you can – is in fact the only way available to most of us to actually become rich.

I’m pretty sure there are at least 387 million people who remember South America more frequently than seldom. You were just there, perhaps you should have listened to a few.

(And when did my mother-in-law become a grade A idiot, exactly?)

I thought that was weird too. Since when was S.A. seldom remembered? I feel like he was posturing an entire continent as a poor, forlorn lost-world in order to set up the theme of poverty in the piece.

Being originally from a 3rd world country, I feel more aware of the theme and verbiage of traveling 1st worlders who over-emphasize the reach of the poverty, and of the assistance provided.

“Cheryl is passionate about improving the quality of life for the Ecuadorian people”

Surely not all Ecuadorian people? Probably just the needy. One doesn’t volunteer in NOLA after Katrina for the good of the American people, do they. That would just be silly.

While we’re on the topic of annoying language, I could’ve done without the comment by Jesse Meacham on keeping it simple, so simple that even your mother-in-law can understand it. As I mother-in-law in good standing, I can assure you that a. I’m not stupid and b. I know more about personal finance than about 98% of the people I encounter, most of them wayyy younger than I am.

I didn’t find it amusing either. I thought it was sexist and ageist.

ditto

I thought, “where the hell didn’t that come from?”

Maybe his MIL is an idiot or maybe he really has sexist attitudes. I know a lot of people who do, unfortunately.

ditto

I thought, “where the hell did that come from?”

Maybe his MIL is an idiot or maybe he really has sexist attitudes. I know a lot of people who do, unfortunately.

Interestingly, in my family, it’s always been the women who do the finances and investments. Including me.

Not to mention also that a lot (possibly the majority) of personal finance blogs are written by women.

My first (and unkind) thought was that Jesse was stupid for marrying a woman with such a stupid mother. Intelligence has a strong hereditary component.

Earning more money is very important for FI. You can have enough FU money but if it’s suppose to last 40+ years you better make sure its large enough to last. MMM built his but the money he makes now probably surpasses what he made when he had a corporate job. Most people won’t have that luxury if their money runs out. You need a big enough income to develop that cushion. Look in the PF world there are hundreds of thousands of bloggers hoping for FI, but only a handful like MMM that achieved it at an early age with an audience to match.

True, there is a lot of luck involved in his story. Had he not gotten big with his blog would that money he saved for early retirement have really lasted?

The link for the PowerPoint slides gives me a

500 Internal Server Error

I appreciate the comment about South America. Sometimes JD’s language is a bit inane and over-worked.

As for MMM, I enjoy his irreverence, but don’t like he way he puts down the majority of the population. He could use some humility.

Maybe it’s my generation (of that apparently not too bright mother-in-law age), but too much success too fast can lead to cockiness, and I see it in boh of them, even though they have good things to offer.

Personally, I can’t wait for a future when we can finally say “that seldom-remembered city, Portlandia” 😉 😀

Wow. $1995 (excluding airfare) for a week stay in a Third World country. This is not to denigrate the destination but rather to point out the discrepancy between this cost and what it actually costs to stay in Ecuador for a week.

I like J.D., but I wouldn’t pay anything close to that to attend an event that is essentially a chance to soak up the “guru vibes” of your favorite PF blogger. If you just wanted to experience Ecuador or volunteer, you could have done it for much less.

While I appreciate that a significant portion of the proceeds are donated to local charitable efforts, it is slightly disingenuous to present the owner as the one donating the money. In essence, the attenders were donating it in the inflated cost of the week. They might be happy to do so, but let’s call a spade a spade. Having said that, it was generous of the presenters to donate their fee back.

Wow, agreed with Jane. I’ve been to ecquador and 2k plus airfare is simply a rip-off unless you are staying very lavishly. It’s even worse in my mind considering this was a “personal finance summit.”

It’s great money was donated, but the donators were clearly the guests, not the organizer.

Wa Wa Wa!!! Its funny to me all the negativity against the PF bloggers who attended this trip. Jealous much? Maybe one day when we reach FI like most of them have and get ourselves some FU money we can hang out with other like minded fun individuals in another country just because we feel like it. Now lets get back to work, save more, spend less, make more and come back with some positivity. I think GRS and MMM are great and have helped many people. If you don’t like it, bounce. You are just one click away to finding out the latest features of the new iphone or what the latest shenanigans a particular celebrity is up to.

“If you don’t like it, bounce. You are just one click away to finding out the latest features of the new iphone or what the latest shenanigans a particular celebrity is up to.”

This is classic. I just had to laugh at how well this poster illustrated Honey’s point above about the underlying meanness and quasi-bullying. If you have to resort to ad-hominem insults to make your point, it must not have been very strong to begin with.

I appreciate hearing about your experiences. Though something about having a retreat about being rich and financially free in a third world country just doesn’t sit right with me. I couldn’t do it. However, I am heartened that Cheryl seems to be a part-time resident of Ecuador and seems generous with her time and money.

I have some issues with retreats like this and certain blogs, because it all makes it so simple, like “you can do it too”. I do believe with education, hard work, hustling and cutting expenses people can become financially independent, but something that is often missing in this conversation is a global perspective. Saying all of those things is very American. Would we say to people in Ecuador, “Just work harder, cut your expenses” to get out of poverty? No. There are real barriers to financial success, and real privileges for many of us as well.

As someone interested in working with communities, traveling, and being debt-free, I am trying to consolidate my own thoughts around these issues.

“Would we say to people in Ecuador, “Just work harder, cut your expenses” to get out of poverty? No. There are real barriers to financial success, and real privileges for many of us as well.”

OMG, yes, yes, yes, YES. The flip side of that is the assumption that if you’re American, you must automatically be wasting your funds on designer handbags and plasma t.v.’s and just need to work harder and cut your expenses to GRS or become Mustachian. I don’t deny that the *average* American overconsumes compared to the *average* 3rd world country resident, but I hate the attitude some people have that if you’re struggling financially, it’s because of your wasteful lifestyle and not due to any outliers, regardless of the country you live in.

The math may be simple, but the ability to use it isn’t there for everyone.

Count me in the camp that likes MMM’s message but not the judgmental tone and disregard of real outliers from the blog and its followers. One thing I really like about GRS is that I feel free to post a (politely) dissenting view. I’ve never posted at MMM and don’t feel I could unless it was to nod my head in agreement as I fall into conforming step with the Mustachians.

Haha, MMM is a bossypants. I just love how the guy conjures up cool new words. I have to agree that I do very much enjoy different writing styles when it comes to my favourite PF blogs. I certainly enjoy MMM’s swearing and what he likes to call bossypants approach. However, I also enjoy this blog’s approach which is more mainstream indeed. Anyway, GRS MMM and jlcollinsnh are still my favourite blogs so the combination of the get together is awesome from my perspective!

You sound like you had a great time at the chautauqua, J.D! I’m definitely tempted to give mustichianism a try now.

Oh I’m late to the comment party…I have to ask this question though – why did you choose to travel to South America for this meeting?

Take two steps back and consider that you traveled many many miles to meet in a private group to discuss the ins and out of money and your ‘wealthy’ lifestyle, possibly convert to the beat-you-with-a-stick style proselatizing of MMM (ugh) and take lots of pictures of your elite little group while living off the generousity of the poorer people hosting you in their country? If any of that is true…then…that’s strange. Elitist? Exhorbitantly expensive considering you could have accomplished the meeting at a common location in the US. I’m not sure what the right word is, but the whole idea of setting up the meeting/conference you describe, where you describe is a strange thing to me.

I know you’re big on the thought of traveling as a means to boost the local economy of the place you visit, so maybe it made perfect sense in your mind. Thanks for donating all the profits you made to charity that directly impacts people in the host country. That’s very generous.

I’m in the camp that MMM has made the cardinal error of going from “I want to tell what’s worked for me” to “YOU MUST DO THINGS MY WAY”. Due to that I won’t read or otherwise support his blog. And I wonder, for those who have ‘converted’ over to the MMM cult – did you do it because of a true desire to live as extremely frugally as possible, or were you just pressured into it by his abusive writing?

The thing about MMM is that it’s more than just “you must do it my way.” He’s not bossy so much as insanely judgmental. It’s more, “you must do it my way or there’s something wrong with you,” or alternately, “you must do it my way or you don’t really want it.”

Good to read about your experience–thanks for sharing this, J.D.! And, good idea to open a chataqua retreat place in Oregon. A retreat to encourage those of us on the road to FI, and to open up a new world of FI, sustainable “less stuff” living for others who are interested.

There is a lot wisdom in the follow statements from the article:

““A lot of people equate saving with deprivation,” Jim noted. “It’s not deprivation. It’s just a choice to spend on the future instead of spend on today.” And debt is a choice to spend on the past. “Saving is money spent on buying freedom.”

These statements hit the nail on the head for me. One would do well to adopt these tenets to the extent that you are comfortable with…everything else is just noise.

Great post J.D. (as was your post on your personal blog). As a Chatauqua attendee, I can’t believe the comments on your post. Yes, it was expensive but priceless for those of us who attended (most of whom are financially independent). As a proud member of the MMM “cult”, I encourage you to join in the fun rather than indulging in the bitching and moaning. MMM is a sincere, generous person who shares valuable insights with wit and disregard for mainstream conventions. I learn a lot reading his posts and laughed harder than I have in years sharing stories and building friendships with a fabulous group of people. And as for some troll-like judgments of my new good friend Jesse, I assure you his mother-in-law analogy is all about offering those we care most about the simplest and most valuable advice possible, NOT an implication that a mother-in-law might be dim-witted or out-of-touch. We would all do well to assume the best of people rather than resorting to cynicism. Off soapbox. J.D. I hope the Galapagos was awesome!

Hey, all.

Just back from the Galápagos, where there was NO INTERNET (Horrors!). Anyhow, I’m just now reading comments

First, not sure why jdroth.com is down. Working on it.

Second, if the “so simple your mother-in-law could understand it” comment bugs you, chill. I make fun of men and women equally here, as does Jesse. Give it time, and I’ll make fun of your father-in-law too. (But odds are that won’t piss you off…)

Third, if you don’t understand why I referred to South America as “the forgotten continent”, you’re not paying attention. How many people in the U.S. know ANYTHING about what happens in the countries down here? Answer: Not many. They’re ignorant. And so are the Australians I just spent a week with. South America doesn’t get a lot of airtime ANYWHERE that I’ve ever seen. Why do I call it “the forgotten continent”? Because nobody seems to know anything about it, and I think that’s a shame. If you DO know something about Perú or Brazil or Argentina, you’re an exception — not the rule.

Finally, I would love love love to see less whineypants commenting around here and more constructive conversation. What do you say?

“Finally, I would love love love to see less whineypants commenting around here and more constructive conversation.”

This is just patently untrue. Large portions of the comments above were very much constructive – criticism but nonetheless constructive. Is honest and civil discussion now not welcome by this blog’s founder? Just because someone doesn’t agree with a phrase a presenter used or the premise of the conference doesn’t make them a troll. Apparently J.D. has now got caught up in the idea that we must all agree with everything he says or we’re “whineypants.” What a ridiculous and juvenile phrase. This type of language (along with MMM’s favorite “complainypants”) is far from constructive and only serves to squash dissenters and criticism in a most holier-than-thou way.

Jane, I’m well aware that much of the conversation here was civil. But much was way off-topic. If you’re on-topic and civil, there’s nothing to worry about. But even this comment you’ve just made crosses the line. You write:

“Apparently J.D. has now got caught up in the idea that we must all agree with everything he says.” You’ve never seen or heard me say anything but the opposite. I welcome constructive criticism and intelligent debate. But comments like that — comments that assume motives on my part or on the part of other people — are not constructive. Nor are nitpicky comments that zero in on tiny bits of story-based information that are irrelevant to the overall message of the post. These are distracting.

It’s not just me who thinks so. I came home from the Galápagos to a dozen “what’s the deal with your commenters?” emails. At one time the Wall Street Journal praised the commenters on this site as some of the best around. I’d like to see that happen again.

Yes, I know it’s the internet. Yes, I know people are going to do this stuff. The thing is, that’s not how things used to work around here. Commenters focused on the meat of the message and we talked about that.

If I had one wish for the current GRS community it would be that people would assume the BEST in each other (and in the writers) rather than intentionally assuming the worst.

From my perspective (and I’ve been commenting on here a long time), what made the GRS comment section so good was the presence of intelligent, dissenting voices. This only happened and was cultivated because you as the writer and moderator seemed comfortable with those voices co-existing with your own. That’s why I was so taken aback above by your rather transparent attempt to shut down dissenters. It didn’t strike me as your usual mode of communicating.

Perhaps the comments haven’t necessary changed but rather your perspective on them has. Many of the above comments that bother you also come from long-term contributors. Either we all have changed our modus operandi of commenting or your perspective has changed. I think the latter is more probable.

I’m sorry if you think my comment crossed a line, but I stand by it, albeit in perhaps a moderated form. At this stage in your professional life, you seem less comfortable with people disagreeing with you. That’s fine to evolve, but I don’t agree that there’s some bygone constructive vibrancy to the comments that needs to be recovered. I think it still exists and this article was proof positive of that vibrancy.

I can certainly see how the negativity would have been jarring so quickly after experiencing the high of your event, but just because the comments went in a direction neither you nor the other attenders anticipated, does not mean they were off topic. Your piece was primarily about the retreat and the philosophy of other bloggers, both of which are the content of the bulk of the comments.

“It’s not just me who thinks so. I came home from the Galápagos to a dozen “what’s the deal with your commenters?” emails.”

JD, don’t you think that explains your reaction? As far as I can see, the comments to this post are very much in line with comments to every other post. Your readers have always varied in the strength of their responses to different articles. This post, like many many others, generated some strong responses. NONE of them was out of line. Not even close.

This thread that I’m commenting on has really shocked me. I’ve never seen you respond so defensively and intolerantly to criticism before. Never, not even when the criticism was about your divorce and way out of line. What’s the deal?

Finally…. lots of Americans are aware of South America, including the massive numbers of Americans who come from there. It’s possible that – again – your own social circle is skewing your view of this. Please also keep in mind that calling a place “forgotten” is really, really insulting to those who care about that place.

JD – a thought from a reader who has been with this blog since you were the blog….

You say this “At one time the Wall Street Journal praised the commenters on this site as some of the best around.” and you are correct! This blog was the best around – and you were pretty much the sole author of it at the time.

The scene of this blog has changed considerably since then – you sold it and took a hiatus (well done and deserved, no doubt there) and the blog become a multi-author content blog. It’s audience changed as well. I don’t know if you noticed the change in tone of the comments, but I have noticed that there has been a shift. I think it’s still constructive, lively criticism and discussion, but the readership has changed perhaps, and/or perhaps this blog has changed as it’s authors have, and the end product and following is not the same today is not as you left it. This is still a solidly good financial blog that I check daily, but its glory days (the time it won high praise from the Journal) seem to be in the past imho.

I do think that it’s OK that some members of the GRS community don’t like MMM. Think about it – One of the tenants of GRS is “do what works for you”. The driving theme of MMM is “you’re an idiot if you’re not doing it this way”. So it appears some in the GRS community vastly prefer to do what works for them versus having someone tell them what to do and aren’t afraid to discuss that fact in the comments. Is that so surprising to you?

Also, if people are spending more time in teh comments discussing MMM vs GRS instead of excitedly discussing your summit…perhaps your GRS audience isn’t entirely into the summit as you were. Perhaps the audience you returned to isn’t at the point where it can entirely appreciate all the amazing opportunities you have and the position you are in due to your choices, work and luck in life. It doesn’t mean we aren’t enthused or excited for you, or want the best for you. We may just be in a different place than you and not able to fully appreciate or understand where you are in life. Getting frustrated that we missed the main point of the article is fruitless if your audience isn’t at the place where it can ‘get’ your point. And yes, I’m biased here. Intercontinental travel for a small group financial summit of peers doesn’t click with me AT. ALL.

I have noticed that the response to your other articles has been overwhelmingly more focused on you and your message, so don’t think nobody loves JD.

Imelda,

The Korean war is often referred to as the “fogotten war” because it was overshadowed by Vietnam. Referring to the war this was isn’t an insult to veterans of the Korean conflict but rather a way to point out that it needs to be given more attention.

JD writes “…I’ve been enjoying my third trip to that seldom-remembered continent, South America. I love this place, and love it more each time I visit.”

“Seldom-remembered” could also be expressed with “over-looked” as in “South America a hidden gem, often over-looked by travelers”.

The last thing I’d call JD’s words about South America is “insulting”. Did we read the same post?

That’s fine. But that’s a reference to Korea, not the entire continent of Asia. I’m not trying to discredit J.D.’s whole article because of a statement, but I am reading into that statement as a bit sensationalist, considering that the gravity of poverty in Ecuador should be sufficient enough to stand on its own without dragging the whole of S.America into it.

My first reaction (and apparently the reaction of many other people who read that statement) was “Hunh?” South America probably has just as many if not more international destinations than North America. You got Brazil, Argentina, Peru, The Amazon, Chile, Bolivia. The epicenter of international biodiversity research, the Galapagos. I think a little more mindfulness and facts, and less emo-documenting, would have made this piece more interesting to the GRS crowd (who is quick to hook the fishy stuff!), and is possibly a more appropriate narrative style for the personal blog.

Every single thing 63/Amy said. I can’t like her comment enough.

This entire thread shows the very best of GRS – polite dissenting discussion. It is one of the major strengths of this site. MMM would be greatly improved by adopting it.

Imelda,

Still I think we’re reading a different post. Are you now saying that JD’s use of the phrase “seldom-remembered” somehow understates or infers that there is not a lot to see in South America?

JD’s point is that the continent deserves more attention and tourism. This is clear no? Where does he say otherwise? To me the clear answer is no, he’s not denigrating the wealth of attractions in South America.

Now you can argue that South America isn’t overlooked. That’s okay. I’d disagree because like JD I think South America (and Central for that matter) ARE overlooked and deserve more consideration by international tourists. The volume of visitors to SA by Americans is MUCH MUCH less than to Europe. This trend is despite the fact that SA is more economical and in some cases closer than Europe.

There is a lot to see in South and Central America. I’ve visited many of the countries but still have only scratched the surface.

Now if he had said Ecuador or South America is “forgettable” than I’d be in total agreement with you.

As to whether the cost of the trip and the location of Ecuador are contradictory to an FI crowd – discuss all you want. That’s a question open to interpretation in my opinion.

I hope you don’t feel like I’m badgering you. I just feel that your interpretation of JD’s words are the OPPOSITE of what he’s saying.

I have to concur with the others. I don’t read any of the prior comments as “over the line.” They are simply challenging some of the content of the post, something that has been done here for years.

Debate is healthy and I hope GRS continues to encourage it. I love much of what MMM has to say, but agree that his tone comes across as my way or the highway and is really only applicable for a small portion of the worlds population.

Again, I have no problem with polite dissent and constructive criticism, and I never will. It’s part of what helps me grow as a person and as a writer.

I think Amy has a point — I’m pretty out of touch with GRS and the community, and I’ll admit that. I’ll work to regain the feel for what’s going on around here, and I’ll try not to get defensive. Sound fair? But I’m asking all y’all to chill a bit too. If we all relax, we’ll have better conversations.

At the Quito airport now catching a flight to Houston, and then to Portland. In twelve hours (or so), I’ll be mounting my motorcycle to make the ride home. About time!

See you all this coming Thursday with the thrilling tale of HOW I SOLD MY COMIC BOOKS! 🙂

Hi JD, I really enjoy your posts, just two things.

South America is not a continent, the continent is called America, South America, central America and North America are just a name of the divisions.

Also US people are not Americans, all of us who live in the continent America are Americans

I respectfully disagree. North America and South America are two different continents.

Yeah, agree to disagree, guys; it’s taught differently in different countries….

ETA: @Jorge: What name do you give people from the United States, then? (in English, I mean)

This is Cheryl from Above the Clouds Retreats who hosted the event in Ecuador. First I will admit that I have not been a follower of any of the bloggers who presented at my event, but I believe in their philosophies of Financial Freedom or any type of freedom for that matter. I am living that freedom by choosing to only work half a year so I can spend the other half in Ecuador. I have had to make what some would say compromises to do so, but I call them choices. Money has to come into the equation because we all like a roof over our heads and food on our table but beyond the necessities, whatever else you want in your life is your choice.

Reading some of the responses, I understand where JD is coming from in his answers to your posts. We just spent an amazing week with people who understand each other, which we don’t often get to do. It was in a magical Hacienda, surrounded by amazing scenery with wonderful food, in a culture that is full of heart and we got to help improve the lives of some less fortunate than us. JD made many cry with his very thoughtful presentation about Freedom. Now he wanted to share his experience, but the posts seemed to go off on a tangent of Mr. Money Mustache and his approach. Prior to the week in Ecuador, Pete (Mr. Money Mustache) was just an acquaintance and a fellow blogger to JD, but now he is a friend. And as any of us will do, we will defend our friends.

As I said I haven’t read Pete, but I met him in person and he is a very positive person and he has unique ideas about the world. They aren’t for everyone, but they wok for him and yes, he is able to live off the money he saved. The money he receives from his blog is a bonus that came from pursuing something he loves and is passionate about. He still lives a very frugal lifestyle and practices what he preaches. He debated about attending, because he does preach frugality, but he offered his presentation on-line and we made sure to tell people to attend only if they are at the right financial point in their lives. Pete’s mind is always coming up with new ideas and he may come off a little strong in his writing because that’s what happens when you are passionate about something, but in person he is a pussy cat. As a blogger, he puts his ideas out there for you to take or leave. He told me that when people respond, it is though they are in his living room saying these things, so he has the right to respond as though you are in his very own home. I think commenting on-line often makes us say things we wouldn’t normally say in person. I agree with JD’s last post when he says polite dissent and constructive criticism works best.

The actual price of the retreat was lowered to $1895 per single and $1720 double because we changed hotels. It was a five star hotel at an American two or three star price. The cost of the same type of hotel in the U.S. would have been double so that was another advantage of doing it in Ecuador. It was combination vacation, conference, charity and meeting of the minds. It was held in a poor country which allowed people to see that money doesn’t necessarily equal happiness. We put a lot of money into the economy. In fact, the salaries of the employees, is determined by a service charge placed on our bill. If we hadn’t been there that week, they would not have been paid. We could consider a more economical retreat staying at a cheaper hostel, but I truly enjoyed being spoiled but not at an outrageous price. The bonding would probably still occur if the retreat were in the U.S., but there is something special about Ecuador and I wanted to share it with people.

The amount we donated to charity equaled $100 per person. I, as the organizer, have not taken any credit for the money donated. It is all given in the name of the group. Pete, JD, and Jim donated their speaking fee and they got the credit for helping my neighbors move back into a real house and met the family in person. Living in this country, I see the inequality and the poverty every day. I want to help make it a little more equal and have for the past ten years. I exchanged having a newer car, or new furniture or other “things” for the joy of helping make the world a little more equal. Living next to the poverty makes me want to punch myself (as Pete says I gather) for being a whiner when I have so much abundance in my life. And my presentation at the Chautauqua was about happiness and one way to have a lasting boost in your happiness levels is by giving to others. The attendees got to experience that in person with their interactions with the kids at the orphanage.

Many attendees said it was a life-changing event so my goals were achieved. I hope to see some of you all next year!

Thanks, Cheryl, for your input. Although I had no opinion on the location or cost of the event, I appreciate that you wrote a thoughtful reply addressing the issues for those with concerns.

I think honestly that the reason much of the discussion took the turn it did about MMM is that a subset of those readers/potential readers cannot voice their concerns and be listened to but only ridiculed instead (which is IMHO a form of bullying). When raising valid concerns more-or-less politely is dismissed as bitching and whining, people are turned off.

67/Chris commented that MMM is only intended for a small portion of the general population. I believe MMM says this himself, that his blog is intended for people already well on the road to FI. GRS, otoh, has a wider spectrum of folks, including many around the point that J.D. was when he started GRS – working because we have to, paying down debt, grappling with our Stuff. We embrace GRS’s theme of “Do what works for you,” and bristle at the idea that we’re morons for not conforming to the One True Right Way of FI.

The two takeaways I got from this thread are (1) GRS is for people seeking FI regardless of the stage they’re at (inclusive), whereas MMM is only for those who have achieved it (exclusive), and (2) I would much rather have understanding and acceptance for all people (something I’m still working on along with FI) but have to work for the Man all my life, than to have FI and demonize those different from me as losers. I believe that money only takes me to the grave, whereas compassion takes me beyond it, not to mention that dividing people into Us and Others is the start of all conflict.

Great comment, Laura. Thank you.

You are most welcome, and thanks very much to you for starting and contributing to Get Rich Slowly. This blog and its community have helped and encouraged me more than I could express. My financial life is turning around for the better thanks in no small part to GRS.

Wow JD, what an incredibly condescending and sweeping generalization you just made about Americans’ knowledge about South America. Maybe you’re just hanging out with an unenlightened crowd. No need to paint us all with the same brush.

Ellie, I spend most of my time with very well-educated people. I spend some of my time with those who are less informed, as well. Universally, people know very little (almost nothing) about South America (or Africa). Americans, in general, are insular and unaware of the world at large. I’m not the only one who perceives this; in fact, it’s a common characterization of Americans at large.

YOU are not uninformed about South America. *I* am not uninformed about South America. But we are but drops in the pond. I challenge you: This week, talk to you friends about South America. See what they know. My guess: Very little.

Can I piggy-back on J.D.’s challenge and suggest that you also ask those same people about Europe and the Middle East? If you’re going to have someone ask folks about what they know about S.A. and use that as a basis for the argument that S.A. is forgotten, then it’s best to compare their knowledge or lack of knowledge of SA, to their knowledge or lack of knowledge of what you consider to be less forgotten continents. My experience has been that some people just don’t care what’s going on anywhere but “here” wherever here is, and they are non-biased in their ignorance.

JD – all is good, excited to see you posting again! If you’re interested in a tad bit of advice from a long time reader, don’t jump on the MMM bandwagon too much. While I am sure MMM is a great guy and all, your style and approach speak to a much broader audience than his does. While his lifestyle facts are practical for many, I believe he lacks the general empathy and understanding you have brought to the table over the years.

While some people do need a “kick in the face” from time to time, that must the exception rather than the rule. Compassion and understanding should be our meat and potatoes and let’s save the head kicks for when we get complacent.

All that said to simply say stay true to yourself and don’t “convert” too much away from who you are.

In fact, MMM’s strategy is not practical for most people. To follow the principle of his advice, you have to earn enough money to be able to not only survive on 50% (or 75%) of your income, but to be content living at that level for life.

So, I could move in with my parents and save 75%+ of my income for 7 years, and by the end I’d have enough money…to keep living with my parents.

The flip side is to earn enough to do that without living with my parents – again, requiring an income that’s unrealistic for most people. OTOH, maybe I’m skewed by living in NYC, where the amount needed for basic subsistence is ridiculously high.

Oh, and I totally agree that JD displayed lots of compassion over the years, to his readers and others, which is very different from MMM’s more lighthearted approach.

Well what a lively discussion! After i read the post and then the comments i almost forgot what i had to say but i wanted to know Where are the women of PF blogsphere in this group? Where are the people of color ?? I see a lot of white people while poor i feel like a big piece of the puzzle is missing. Even a South American PF blogger might have evened out this inbalance. While i know most of this bloggers are self made and did not inherit their money, I don’t see how a single mother such as myself would be able to replicate the same extreme retirement without a lot of roadblocks or barriers that many people experince.

Wow man, haters gonna hate!

The FU money is a key concept. I pulled mine together and suddenly doing crazy things at work like being honest, thinking of the best interests of the constituents, and doing things the right way were ok. Sometimes you get punished for that, but that’s ok if you can withstand the worst case outcome (being fired!).

Being financially independent is so much better than the alternative – being broke. Why not save money hard core and make your future better, even if you don’t know what the future holds. Sure, many can’t save 50% or 75%. But there’s no reason you can’t try to save something and build your own wealth!

Good job JD, MMM, and others. That Chatauqua looked awesome, and while I’m such a cheap ass bastard that I probably wouldn’t spend the couple thousand on it, it would be very tempting in order to hang out with some truly and inspirational thinkers who can’t quietly sit back and ignore the status quo.

I’m ready for a chance to meet you all. I’ll go to Ecuador, or here in Oregon. Sign me up. I could even help out if you wanted…

I had serious plans to attend the next Chatauqua. I heard about it on MMM’s site a few months back, and really was impressed. I did something similar in Guatemala and Honduras a few years ago…great inspiration to this day!

CF

Interesting. People in the US seem to grow up only to develop concepts to quit work as soon as possible.

My co-worker recently said to me “Paula, you really love to work”.

Don’t you love to work, too?

Why not?