Three weeks ago today, I had a major health scare.

Because it was Monday, I was at the family box factory. I had just finished running payroll and had taken paychecks out to the shop. I exited the building and *bam* my chest just sort of seized up.

“Ouch,” I thought. But, being a Roth, my thought process didn’t go much farther than that. (We Roths don’t like doctors and we tend to deal with injuries for weeks or months or years before having them looked at.)

On the way back to the office, I stopped to talk to my cousin Duane. He was digging in the dirt, prepping a spot for his summer garden. We chatted about blueberries, tomatoes, and greenhouses. We admired the warm spring day. After a few minutes, I realized that my chest still hurt.

“I don’t want to alarm you,” I said, “but I’m having chest pains. It’s probably nothing. But just in case it is something, I thought you should know.”

I walked back to the office and sat down at my computer. Instead of going back to work, however, I googled heart attacks. I read the list of symptoms. I wasn’t experiencing anything except chest pain but still…Every site said the same thing: Don’t mess around. If you’re having chest pain, have somebody drive you to a doctor.

Duane came in. “Are you feeling okay?” he asked.

“I’m still having chest pains,” I said.

“Do you want me to drive you to the doctor?” he asked.

I debated things in my mind. “It’s probably nothing,” I thought. “Or maybe it’s a panic attack like twenty years ago.” In 1998, I experienced two similar episodes that turned out to be panic attacks. I was under a lot of stress then. I’m not under a lot of stress now.

“Plus, if I go to the doctor, it could end up costing a fortune. My health insurance sucks,” I thought. “But if it is a heart attack and I don’t go in, I could end up dead.”

“Well?” Duane said.

“Tell you what,” I said. “I know I’m not supposed to but I’m going to drive myself to urgent care. If you don’t hear from me in fifteen minutes, come find me.” (There’s only one logical route from the box factory to the nearest clinic.)

I gathered my stuff, hopped in my pickup, and drove slowly to the clinic.

Hurry Up and Wait

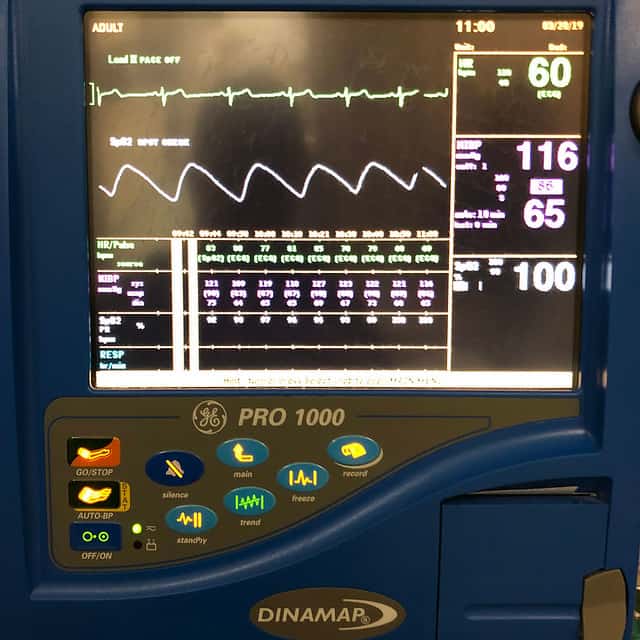

At urgent care, they expedited my case. Within minutes, I’d been hooked up to an EKG machine. While he worked, the doctor asked me lots of questions about my past and current health.

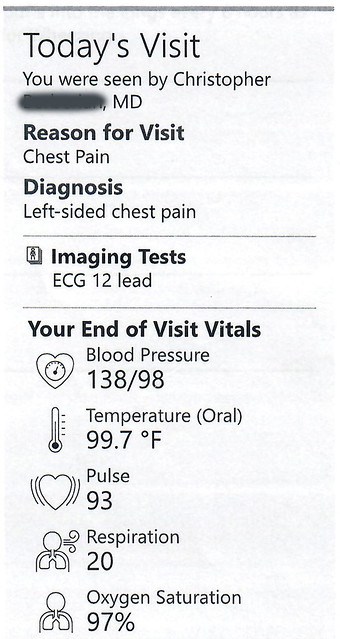

“Everything looks normal to me,” he said. “Your blood pressure is high, but the EKG is good. So is everything else. Are you still having the pains?”

“Yes,” I said. “And they’re now in my back too.”

The doctor frowned. “I don’t think you’re having a heart attack,” he said, “but we should make sure. I want you to drive yourself to the nearest emergency room.” He gave me a printout that explained my situation and wished me luck.

Twenty minutes later, I was in the ER for the first time in my life. (I’ve been there for other people but never for myself.) A nurse ran another EKG. “Everything looks fine,” he said, “but we’re going to do some more tests.”

First, they drew blood. Then they ran chest x-rays. Then they ran another EKG. Then they ran a CT scan. “Oops,” the doctor said when he saw the results of the CT scan. “They didn’t scan the right spot. That’s my fault. I goofed up. I pressed the wrong button. I guess we’ll do an ultrasound to check out your abdomen instead.” So, I got an ultrasound. Then more blood tests and another EKG.

Can you guess what I thought when the doctor admitted he’d run the wrong test? That’s right: “I’d better not be charged for this!” In any other business, if the service provider makes an error, the customer isn’t charged for it. Is that the same with hospitals? We’re going to find out.

After five hours of tests and waiting, they let me go.

“I’m not sure what’s wrong,” the doctor told me. “Your blood pressure is high, but you’re the healthiest person I’ve seen all day. Follow up with a heart specialist. Go enjoy the sun!”

Paying for Pain

Since that heart-attack scare three weeks ago, life has been a whirlwind. We’ve been planting trees and bushes and flowers and seeds. We celebrated my birthday. Kim had knee surgery. Plus, there’s all the rest of Real Life to take care of.

I tried to follow up with the recommended heart specialist but he’s out of my network. “You should find somebody on your own insurance,” his office staff told me. I haven’t done that yet.

Last Friday, two other things happened.

First, I had to go back to urgent care. (When was the last time I sought medical help twice in three weeks? Has it ever happened?) I have miserable allergies this time of year, but my throat seemed even more raw than normal.

Turns out, I have a simple canker sore…on the back of my throat. The doctor prescribed a numbing agent. “Your blood pressure is pretty high,” he said before I left. “You might want to have that checked out.” He suggested that I buy a blood-pressure monitor while I was picking up my prescription. So I did. (Nothing says “I just turned fifty” like browsing blood-pressure monitors at the pharmacy.)

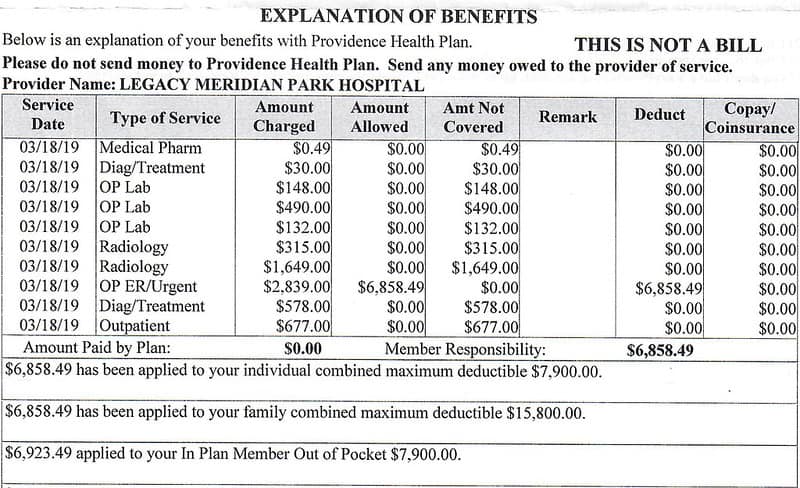

When I got home with the meds and the monitor, there was an Explanation of Benefits waiting in the mailbox. I opened it to learn the initial cost estimate for my ER visit. (For non-Americans, the Explanation of Benefits is a statement we receive after health care but before we receive actual bills. My understanding is that it’s an estimate of what is being billed to whom. But it’s not always 100% accurate.)

According to the Explanation of Benefits, I’m on the hook for $6858.49. That’s enough to give a person a heart attack! (Haha.) I’m under the impression that my insurance plan covers all emergency room visits, so this number could change. Right now, though, I assume I owe nearly $6900 for my four hours in the ER.

A Change of Heart

Over the weekend, I tested my blood pressure several times. It’s high. I haven’t figured out my new blood-pressure monitor well enough to state definitively that I have hypertension, but it seems as if I’m pre-hypertensive at a minimum. In any case, it’s clear that I need to make some changes.

Over the weekend, I tested my blood pressure several times. It’s high. I haven’t figured out my new blood-pressure monitor well enough to state definitively that I have hypertension, but it seems as if I’m pre-hypertensive at a minimum. In any case, it’s clear that I need to make some changes.

Over the next few months, I want to:

- Scrutinize the hospital bill. I want to know what I’m being billed for and why. (I’d better not be charged for the mistaken procedure in the ER!) As much as I hate phones and confrontation, I might have to use both. Good thing I just read this article on how to fight expensive medical bills. I’m curious to see what I’m actually billed for compared to the estimates on the Explanation of Benefits.

- Look into health savings accounts. This is one of my financial blindspots. I’ve never read about HSAs, so I don’t know the pros and cons. I don’t know anything about them. From what little I do know, it sounds like an HSA might be a way for me to cushion unforeseen medical expenses.

- Get serious about my physical (and mental) fitness. For the past few years, I’ve been coasting. I’ve been overweight and out of shape during most of my adult life. In 2010, I lost fifty pounds and gained muscle. I was the fittest I’d ever been. I maintained that for a few years, but have gradually softened. I’ve made occasional half-hearted efforts to change. It’s time to give 100% effort again.

- Find a primary care physician. I had a primary doctor I liked but when Kim and I left to explore the U.S. by RV in 2015, my doctor moved. I haven’t had a regular doctor now for four years. This is enough of a passive barrier to keep me from seeking medical help. Dumb but true. I need to find a new doctor.

- Find a therapist. Like last year, I’m struggling with depression this spring. It sucks. It’s not as bad as it was in 2018, but it’s still enough to sap me of motivation. I need to get some help.

- Be proactive with my heart health. My family doesn’t have a history of heart disease. We have a history of cancer. I’ve been worried about cancer all this time, but what if I should have been caring more for my heart? Fortunately, managing high blood pressure doesn’t seem too onerous.

There’s one other thing I’m going to do — especially if my final bills do amount to $6900 and I can’t get them lowered.

My health insurance carries a $7900 annual deductible and $7900 annual maximum out-of-pocket expense. If I end up owing $6858.49, then there’s only $1050 left until I reach the maximum I can possibly pay this year. That gives me a strong incentive to get as many medical procedures done this year as possible.

Final Thoughts

I’m glad that I didn’t have a heart attack. I’m disappointed with myself for allowing my fitness to erode, but I’m trying not to beat myself up to bad. I can get back in shape. And I can lower my blood pressure. It’ll take time and effort, but it’s doable.

In 2012, I was worried about my lack of energy. I asked my doctor to run some tests. “You have nothing to worry about,” he said when the numbers came back. “You’re one of the healthiest 43-year-old men I’ve ever seen. I’m serious.”

No doctor would say that about me now at age fifty. But if I apply myself, maybe in a few years my doctor will tell me, “You’re one of the healthiest 53-year-old men I’ve ever seen.”

That’s a rough patch but it’s certainly a good motivator to get on top of your health!

Once you have an actual bill in hand, many hospitals / clinics will offer a discount for timely payment. For example, 20% off if you pay within 30 days. Sometimes this is stated clearly on the bill. Other times, you may have to ask… more phones and confrontation 🙂

To JD Roth

Search for “Right Bundle Branch Blockage” a non-fatal common condition.

If it is RBB it may be useful information (due to the Dr’s “under-diagnosis”) to negotiate a reduced bill.

Don, then why wouldn’t they have seen this on multiple EKGs, hmm?

JD — I haven’t ever really seen a difference in what the EOB says and what I end up getting billed. And with Hospital stays, I think you can also get billed by the Drs practices as well, but I suppose it all depends. We recently had a billing snafu for some treatment for my husband’s knee. They billed us for the Rx injections that we’d already paid for. So mistakes do happen obviously.

I have a high deductible plan as well, but only preventative is covered 100% regardless of whether you’ve met your deductible or not. So my annual physical will be covered. Traditional preventive tests for your age (colonoscopy or mammograms for example), covered. But anything that’s not “well visits” is going to go towards the deductible.

Unless I missed it, did your chest pain subside that same day you went to the ER?

(as an aside, alcohol consumption raises your BP and reducing/eliminating can reduce)

Yes, my chest pain was gone by the time I left the hospital. And while I’ve reduced my alcohol intake this year, I’m going to reduce it even more now.

J.D. – Hope you are still feeling well!

HSA – I didn’t think anyone was signing up for an HDHP without also setting up an HSA…that’s the whole point! I’m sure your reading with be studious but the short story is HSAs are governed by the IRS, allow rollovers year to year (unlike FSAs), are investable (depending on who the HSA holder/broker is), are maintained even if you stop having an HDHP (you just can’t contribute to them anymore) and contributions up to a certain point can reduce taxable income.

EOB – As you go through the itemization, have your statement of benefits from your insurance handy, to know what items should/should not be covered, what copay for an ER visit is. Also, as you have several labs listed for the blood work, try to verify if the labwork is in-network. The Houston Chronicle had a story in the past yearish describing the shady billing practices that go on in area ERs: the hospital itself is in-network but the MD on staff was not, the labs the bloodwork was sent to are not, etc. with none of that info provided at the time of care for a patient to object.

Right — I listened to a health reporter recently tell the story of a person who despite being in compromised health (I can’t recall if it was an auto accident or a health issue) asked every single hospital person she encountered to confirm they were in network (and they confirmed yes). IIRC, she needed surgery and found out that the on-call Dr was NOT in network. So then what are you supposed to do? His bill was many many 1000s.

They claimed it’s related to using staffing companies to help cover ER services/hours, but that still doesn’t leave the consumer with any reasonable choices. (And I hate using the word consumer rather than just patient.)

Welcome to my life during 2018 for its entirety. My chest pain was precipitated by a medical emergency in Colombia: a sudden onset pulmonary embolism from which I almost died, and the discovery of an old, quite serious injury to my aorta which had miraculously healed itself. For those who don’t know, an aortic dissection can be fatal within a minute or so. Subsequently, every twinge had me thinking this could be it. Chest pain episodes occurred quite frequently, and as you described, spread to the back. These became quite severe and had me writhing with them dispensing morphine, yet normal heart function. Have your docs check your gall bladder. It’s possible you’re trying to pass gallstones through your bile duct. Mayo Clinic cardio docs couldn’t figure this out with me despite numerous scans and a couple of angiograms. Finally a local ER doc zeroed in. I had the GB removed in November and voila, no more chest pain. Still watching the aorta and may have to have it replaced. Good times. You don’t mess around with this stuff.

Yes!! I was also going to suggest checking the gallbladder. I had severe chest pains, but an EKG and chest X-ray both came back normal. ER docs decided it was indigestion and sent me home.

Two months later, I was back in the ER after vomiting bile for hours and had a crazy high red blood cell count. My gallbladder had gotten so infected, it was too risky to operate right away and I had to wait 3 months, hoping I wouldn’t have another attack.

The bright side is, if it is your gallbladder, you can have it removed with (likely) no major side effects – it’s one of those rare organs that your body is fine without.

Yes to this. I had one gall-bladder attack, and within a couple of weeks was scheduled for an outpatient surgery. Got there at 6 a.m. for the laparascopic procedure and they kicked me out at noon.

By contrast, my ex-husband was in the hospital for four (maybe five? I’ve blocked it!) days and they cut him wide, deep and continuous.

Hope you’re feeling better now.

Maybe pancreatitis. I’ve had a few attacks and it’s chest pain radiating to the back. Was drinking a lot of energy drinks/caffeine at the time, suspect that may have been the culprit.

Yikes dude. First off glad you’re okay. Second – shame on you. At the risk of sounding like your Mother, you NEED to go to he Doctor!! You get one body, no replacements. My Dad died an early death because he didn’t. Just find a good one and go annually for a checkup.

Lastly, that $6800 is exactly why health insurance is the one thing that scares the bejeezus out of me about early retirement. That’s ridiculous. Good luck navigating the mess.

And yet, a 6800 dollar bill to be told nothing is really wrong is exactly what keeps people from going back to the Doctor the next time something doesn’t feel right. It just makes me grouchy about healthcare in the US.

Once you figure out/verify what you actually owe, don’t just go online and pay it either. Call the number on your bill and ask if there’s any discount for paying in full, because if not you want to talk about setting up a payment plan. In my hospital system, it’s always an automatic 10% off the amount I owe- which is no chump change with a big bill!

Getting my exercise in is by far my favorite way to self medicate the winter grumpy’s. I think you have a really good opportunity here to pull a two for one on that part of your to-do list JD.

*And before the internet mental health police come taser me, yes I am very familiar that exercise alone cannot be expected to handle severe conditions.

Yep. Time to start talking about exercise and time to start exercising.

Hi Everybody,

I’d just like to reiterate that high blood pressure can be a silent killer. In too many people the first major sign is sudden death due to a stroke or burst blood vessel.

In other other group, it’s slow death due to congestive heart failure, which often isn’t felt until massive and permanent damage has been done. While it can be managed, it’s a chronic condition and causes a lot of complications.

Both those options suuuuucckkkk. And I’ve seen them take too many of my friends and family.

Get out in front of this early and it might be as simple and cheap as a few diet changes, 2-3 cups of hibiscus tea or punch every day*, and a 20-30 minute walk every day — with regular monitoring to make sure you’re staying at healthy levels. Or, you may need to take prescription meds, but if you catch it early and stay on top of it, it can usually be easily (and cheaply) managed.

Ignore it in the hopes it will go away … well, you’d best get your affairs in order and have an emergency fund.

____

JD — I’m glad you got an early warning, have the $$$ for insurance, and are making a plan to handle this going forward. I hope you find a good PCP. I’m sending the good vibes to you.

____

*FYI, if you have low blood pressure (as I did until very recently), regular consumption of hibiscus drinks (Red Zinger tea, “Jamaica” punch) can push you into dangerous levels of HYPOtension, as I discovered one summer when I was drinking a lot of iced Red Zinger tea (so refeshing on a hot day!) and passed out trying to stand up from the couch.

Yeah, HYPOtension won’t kill you with a sudden stroke, but cracking your head on something hard, falling down the stairs, and/or blacking out behind the wheel while driving, might.

Thanks for all this. I didn’t know how to say that having high BP is a big deal, so your post is perfectly stated. Of anything in this post as “to dos”, seeing Dr seems to be the very first, number 1, most important with everything else a distant 2nd.

OMG. Thank you for the hibiscus tea note; I naturally run low (60-62 bpm) and have been drinking 2-3 cups a day, feeling woozy, and taking my own resting HR it’s been 50-52. Neither my PCP nor my doc friend suggested this could be the culprit! Random internet friend, thank you!!!

Keep monitoring your blood pressure–and if you have chest pain, go straight to the doctor. My husband, who should have known better since he’s a certified first aid instructor, kept trying to “wait out” chest pains. He didn’t tell me about it till it had happened several times and then it was “Well, as long as you’re going in that direction, could you take me to urgent care?” Very lah-di-dah. He’d been having chest pain ALL AFTERNOON.

They tested him ten ways from Sunday (and we have excellent health insurance so we only had the usual co-pay). Could not find anything wrong. And it turned out, since they were so confident that their other tests didn’t reveal any problems, they didn’t order a CT scan, which would have revealed the trouble right away.

Same thing happened the next two times he went in with chest pain. Nothing wrong, don’t know what’s causing it. They did give him some nitroglycerin tablets.

Well, long story short, he finally had chest pains the nitro didn’t deal with, called 911 from work, and ended up having a triple bypass. Was in the hospital for nearly a month.

As I said, we have excellent health insurance (Kaiser Permanent HMO). Cost for all that? $250.

That’s quite a scare. I can share a few tips – learnt it after taking care of parents with high BP.

– Low impact Exercise is the best thing for high blood pressure.

– Eat more fibre – oatmeal, bran, veggies, salads etc

– Drink herbal tea, reduce stimulants, get minimum 8 hr sleep stating at 10 pm

– Most of all reduce stress (Meditate, yoga, relaxation exercises)

I had zero symptoms but my doc sent me for an elaborate stress test with injected dye and rotating xray machines that took a video of my heart beating. They said they’d analyze it in a few days. So I went on with life and was 100 miles from home on business when two heart specialists called my cell. They said come back home now, we have you scheduled for surgery at 630 am tomorrow morning! I said, were they sure? I had gone on a 20 mile training run and then played a grueling three hour singles tennis match Saturday, three days earlier, and felt fine! They said the video showed only 40% of my heart muscle was working, I could easily die before the surgery. So I headed back, told my wife, my boss and others. Before I even finished the drive home the docs called back. Oops! The computer was mixing up the video files. I had the heart of a marathoner, so never mind, no need for surgery or any more tests. I always wondered what they would have done in surgery if they hadn’t found the mistake in time?

YIKES!!

That is crazy! Thank god you weren’t under the knife before they realized their mistake.

Re: high blood pressure: lower the booze intake.

JD – I’m sure I’ll get hate for it, but I suggest reading ‘How Not to Die’, by Dr. Gregor. There is quite a bit of science based info on lowing blood pressure via lifestyle vs. getting started on drugs. Wishing you all the best!

No hate here – I’m with you 100%. An excellent book.

I have 2 siblings who have adopted this lifestyle (not because of their own health issues) so I’m very much aspiring to move towards this (and am, verrrrry slowly).

I follow Forks Over Knives on instragram (motivation never hurt anyone) and found this “success story” today. Many/most of them include people extremely overweight, but this one was specifically for an otherwise healthy person, who found out she had high BP.

https://www.forksoverknives.com/plant-based-diet-hypertension-success-story/#gs.4w8xnb

I agree whole-heartedly with these ladies. I watched Forks Over Knives on Netflix in early 2015. I found it super empowering and decided to eat that way for a month to lose a little weight. I lost more than I’d initially hoped without ever feeling hungry nor counting calories. When that month was over Lent had begun and my dad challenged me to keep it up until Easter (we’re Catholic). By the time Easter came around I had lost all my cravings for meat and most for dairy. I had some ham and creamy (dairy) mashed potatoes on Easter and truly felt those foods were not worth undoing my improved health and/or having to yo-yo diet or count calories again. I am healthier now than I’ve been in years. My BMI is 19 (low normal) and I haven’t counted a calorie since 2015, I didn’t know that was possible! I was raised in a small town and meat and dairy were a huge part of my diet growing up. I was adamant I’d never give them up—but then I did for a month trial and realized food can be super delicious without them!

You should check out the Forks Over Knives movie on Netflix and the How Not To Die book, both are excellent.

I was reading to see if anyone would suggest this. I had high cholesterol in my early 20s and while I’m certainly not perfectly plant based, moving in that direction has made a big difference for my health.

DEFINITELY look into an HSA. I researched them extensively prior to retiring as I expected I would get a high-deductible plan to keep my cost down. Then I ended up moving to Massachusetts which has really good state-subsidized health insurance (this was the plan created under Mitt Romney which became the model for the Affordable Care Act – i.e. Obamacare).

But HSA’s are really great. The amount of money you can contribute annually is limited, but it’s not taxed. Then the earning are tax-free. And, when you withdraw the money for qualified medical expenses, you can withdraw it tax-free.

My research was a few years ago, so this part may have changed: If you still have money in your HSA when you sign up for Medicare, the cost of Medicare is a qualified medical expense. On a side note, once you’re on Medicare, you can no longer contribute to an HSA.

I agree with this. We have had an HSA for almost 10 years now with my husband’s last 2 jobs. We decided to pay most of our expenses OOP, and save the HSA money for something big. It was a blessing when I was diagnosed with breast cancer in ’15. If we don’t need to use it again before my husband retires, we will use for health expenses then. The HSA is the best tax break for high income earners, IMO. I just wish we could put more in. 😉

I am glad to hear everything is ok. Did this change your perspective on life in anyway? I try and stay grounded on the fragility of life, but can get lost in the day to day tasks. I have been lucky enough to not have a big health scare, but that also means I am likely taking my health for granted without realizing it.

Medical billing practices are one of the most backwards processes in out there. Things need to be straight forward. My wife spent hours on the phone trying to figure out how much a visit would cost to run some tests and was handed from department to department without ever getting a straight forward answer. Needless to say, she decided not to go because she was worried about how much we would be stuck paying.

J.D.,

Glad you are ok after your trip to the ER. Check the bill again, they (ER) only billed you $2839 for the 8th item. They (insurance) allowed $6858.49. The sum of the items are: $6858.49. Seems weird that the insurance allowed whatever the hospital charged to stand without a mandatory discount for being an insurance member. You are entitled to a breakdown of the items with the CPT codes. There may be some bogus charges you can negotiate away right off the bat.

Once you have the itemized bill (maybe?), you can look up the Medicare reimbursement for these services by looking up the CPT codes and making an offer based on that.

Everything a healthcare facility and its employees does is coded and given a value except for the smiles – they are free.

Hope it goes well.

Exactly.

Look at every line and see what they add up to. And I would question any charge to you for either that CT they scanned the wrong area on, or the ultrasound they then ordered. One of those was their mistake. You shouldn’t have to pay for that.

I haven’t read all the responses. But building muscle is not enough. You need movement as well, first of all. Weight is not necessarily an indicator of heart risk issues. Get a doctor. NOW. You can always find one later if you hate him.

This is the proverbial wake up call. I had high blood pressure (about 180/90) for years. Fortunately, it got bad enough that my eyes started bleeding once when I was traveling: the hypertension had caused a small hemorrhage in my eyes. There’s nothing like seeing your eyes bleed to get you motivated to change your lifestyle, so I did. I started eating more veggies and less greasy fat, started walking more…and meditating. Like you, I also bought a home BP monitor. My best pal also turned me on to some blogs/websites that she used to turn her BP around (www.webmd.com and http://www.collectivewizdom.com being two of her favorites). My BP is now usually between 120/70 and 122/75. Not bad.

Oh man! Glad you’re OK!

That’s a lot of money to spend. Hope you can get it down.

I had my physical and need to lose 5 lbs – 10 lbs. but I always do haha.

Health is wealth!

Sam

Just something to note about HSAs – there are requirements about the deductible and out of pocket max that have to be met in order for a plan to be HSA qualified. All HSA qualified plans are HDHPs but NOR every HDHP is HSA qualified.

Also – it looks like the insurance company rolled all of the charges into one big lumped item – the invoice from the hospital should show you the breakdown as well as the insurance discount.

Good luck and be well!

Glad you’re doing better. I have a high deductible (shit) plan as well. But since I pay 2k a month for a family of 4 plan I make sure we use every included wellness option including annual physicals for everyone. Some recommendations: Run your health care through the family business or your own LLC if possible, definitely set up an HSA and max out the annual contribution, track all of your medical expenses in quicken and personal capital. If you have a really high expense year you may qualify for an additional deduction.

J.D., Glad to hear all is as well as could be hoped for! Definitely find a cardiologist and figure out the blood pressure issue. Hopefully, all you need is some lifestyle changes to manage your BP.

As for the fitness, I would start slowly and work up from there. Your cardiologist should also have some recommendations. Just work toward sustainability – diet and exercise changes that you can stick with and make part of your lifestyle.

I’m know I’m going to sound like a crazy person, but do not postpone going to see a specialist. Find one as soon as you can and get yourself checked out. Put down the pruning sheers and get to it. High blood pressure can cause a lot of problems quickly, so don’t delay. If nothing is wrong you’ll have peace of mind. If something is wrong you’ll find medical solutions to help you live a long life.

Glad you’re ok. This was your wake up call, so do wake up!

My HSA contributions lower my gross income, I can invest the funds. It isn’t taxed when I ultimately use it to pay a medical expense someday. Its worth checking out.

Thankful you’re okay but holy crap what a bill! I had a similar examination when I had an ulcer (they had to check it was, in fact, and ulcer and not a heart attack) and the total bill was 21 euros (I live in Finland). That amount is just insane.

Finnish healthcare is indeed cheaper, but not by such huge ratios. Your health costs are just hidden/amortized in the form of various taxes you pay every day. Your cost is still there, just comes in different form.

Health care prices in the U.S. are higher due to various factors (higher salaries of practitioners, greater administrative costs,) but on the other hand wait times are shorter than in the rest of the world, which is especially crucial when it comes to heart attacks.

Not to say that our health care system is ideal, there is much we can do to improve it, but it’s not as bad as it appears when comparing deductibles and copays without further context.

Oh yes, the cost is definitely there in form of taxes, but the difference is still mind-blowing. Having grown up in the system you’re used to it, and I’d say the taxes aren’t as high as many people believe they are, because of allocation of those euros collected by the government. In my own mind a taxation of eg. 35% from someone who earns 100.000 EUR/yr is reasonable when you get free education, extremely subsidized healthcare when you need it, your kids get free lunch + books + supplies in school etc. So to us, this seems reasonable and something like what you guys view as reasonable seems very, very strange. But I have to say I don’t quite understand the comment about wait times? Do you have people that have a heart attack and have to WAIT to get to the doctor? If I have a heart attack (or an ulcer that is suspected to possibly be a heart attack) I go right to the top of the line at the ER and receive treatment immediately, I imagined you have that too?

Having said all this, I think what seems reasonable and what doesn’t all comes down to what your reference frame is and what system you are used to.

Yes, the heart attack/wait comment was odd. I think the suggestion is that because “wait times” are a supposed known issue with other health care models, that it would somehow become a risk. I must have missed the coverage of people dying from heart attacks because the ER in some countries wouldn’t see them.

I’m just going to presume that the triage of emergency care does not differ all that much between countries.

As an American, I’m not aware of what routine or diagnostic (non-emergency) care is like in other countries, but I do know that you don’t always get into see a doctor as quickly as you like here. I had a friend whose 3 mo old was in a local hospital due to a viral situation, where it was discovered he had high BP. They referred him to a specialist with a relationship to another hospital, but the wait for an office appointment was going to be so long, they (the medical staff) considered transferring him to that hospital so he’d be seen sooner than being released from the hospital which would have taken a month to see the specialist with an office visit. (In the end, they found another specialist whose wait was only a few weeks and he was released with instruction to see the Pediatrician each day to check his BP in the meantime.) Some GP doctors here do not see new patients.

Oh, I wasn’t arguing about reasonableness of the system or not. I just meant to highlight that there is no free lunch. Things might appear free or very cheap at the point of use, but everyone pays the full cost one way or another.

The US has high costs for suboptimal outcomes (France and Switzerland do it better last I read), but the cost isn’t really 21 euros vs. $7k. I don’t know figures for Finland, but say the UK which is as thrifty as it gets, it’s half the cost of the US and they’re at about half the price we are.

E.g. see: https://www.investopedia.com/articles/personal-finance/072116/us-healthcare-costs-compared-other-countries.asp

Now your system is covered by taxes, but it’s also not just an income tax thing, is it? If I understand (I am no expert, so I claim no claims, please correct me if I’m wrong) you get health care provided at the municipal level yes? Finland has a 24% VAT, which seems eye-popping for Americans who on average pay 8.5% sales tax (with some jurisdictions having none).

Consumption taxes affect the poor the worst of course, and while sales tax is charged at the point of the consumer, the VAT aggregates at every step of the supply chain, which would make everyday items very expensive for everyone every day. If your health system is paid by the VAT, then you’re paying for it in every transaction. But again I don’t know.

As for wait times, it’s not like JD was transported in an ambulance, he went to urgent care first, saw a doctor, etc. Here’s an article from The Guardian talking about long wait times in Finland: https://www.theguardian.com/society/2016/feb/23/finland-health-system-failing-welfare-state-high-taxes — now apparently the council changed the system after that article was published. But I don’t know if or how it has changed.

Again, each society makes their choices, and things appear reasonable to those accustomed to them as you say. Here in the US we’re far from optimal, so I’m not trying to argue that this is the best system (it’s definitely not, in my view.) All I’m asking is that for the sake of accuracy we try to look at actual costs, rather than out of pocket costs at the point of usage, because looks, as the saying goes, can be deceiving.

The Finnish VAT is definitely high, yes. As for what taxes are used towards healthcare I can’t say, since they’re not earmarked.

The article you posted was not wrong, but a bit strange as I’ve heard of no other place where you would get directed to a nurse if you are seeking out a doctor. I don’t know what that situation was about so I can’t comment on a broader scale, but I suspect there is somethin more to it than the article explains.

ER waiting times can be rough yes, if you are coming in with eg an eye-infection on monday Morning you will probably have to sit there for an hour or two. And compared to the Brits our medicine costs seem excessive. I believe they have a flat fee of about 8 GBP, while our system has varying prices for medicines but a yearly max cost of a little less than 700 EUR. After that you pay 1,5 EUR per medication for the rest of the year.

I would argue that the cost in general is much greater in the US, still. Some medicines and their costs pop up in articles about healthcare and sometimes we have the exact same medicine for sale here as well. The costs usually differ from some hundreds to thousands of dollars between the US and the Nordics. The same goes for doctors visits. eg I’ve had knee surgery in one of the top Private hospitals here and the combined costs of doctors visits, Xray (the magnetic tube one, I forget the english word for it), operation and care was a little less than 4.000 EUR. Which was taken care of by my insurance, my deductible was 100 EUR and I pay 350 EUR for the insurance per year.

As for the overall costs of usage I found data from 2004 so it’s a bit oudated but it showed the average cost per patient for the US back then was a little over 5.000 EUR while Finland had 2.100 EUR.

The taxation system also does not prey on the poor exactly in the way you mentioned. First of all we have all kinds of systems in place where you can get subsidized or free housing, help with food and medicine etc, but all in all as a society we work with net payers and net receivers. Which means that at some point during our working lives most of us pay more in taxes than we receive in education/health services/subsidies/etc, and at other points we become net receivers since our taxation is lower or nonexistent. Eg my underage children and retired parents are all currently net receivers, while I am a net payer. When I was a student I was easily a net receiver since the state paid me an allowance to study and my health care cost nothing. Some unfortunate people are net receivers all their life, but for them I am happy they can be.

So it’s very much nuanced as I think your system is too, but it’s just the sheer cost of health care that always astonishes me. It blows my mind that it’s possible for you to have to pay thousands of dollars for simple cholesterol medicine, or that people are not able to pay for the insulin they need to say alive, or that you can be in a car accident and come out of the hospital alive but 1 million in debt.

@Jenni

Right, per capita we pay about double. But I’ve been trying to point out that “cost” per se is not the problem.

I mean, high cost can be seen as a positive in various ways: we pay our doctors and nurses more, we have better and more modern equipment, we produce greater innovation in pharmaceuticals, etc., and so top professionals, and patients seeking top healthcare, often come here, and in Europe they go to Switzerland.

Now, if we had universal insurance and it was well regulated, these high costs could be covered. Switzerland has expensive high-quality healthcare but everyone is insured in a well-regulated environment, for example.

Our problem is that we have a very complex hodge-podge of systems that either overlap or leave gaps that nobody understands, and can create great insecurity in unexpected segments of the population.

Remember that as a country we have the population of about 60 Finlands, and we’re politically divided into 50 states and a number of territories. Each state has its own laws and policies and so forth. So one size does not fit all.

More than half of the population has employer-provided health insurance. Most of those people like it. But if your employer decides to change provider, then you have to find out if that will work for you.

Also, deductible and copays have been rising over the years, and some employer plans look less and less attractive as time goes on.

Employer insurance also ties you to your job. You might get stuck in a job you hate because the health benefits are good.

Having to become a health care provider is of course also a drag on businesses, and the arrangement tends to favor large companies over small ones. So, it’s a kind of “tax” on businesses, especially small ones who might be required by law to provide insurance.

Retired people have Medicare, which is taxpayer funded over the course of working people’s lifetime. It comes in various parts (A,B,C,D… I forget all) and you often need supplemental insurance. Some of this supplemental insurance can be a part of your retirement benefits. I do not understand Medicare, but some day I’ll have to read up on it if I live long enough.

For the poor, we have Medicaid. The ACA expanded Medicaid for people who can’t afford insurance, but because it’s optional, many states did not opt in, so they add to the pool of uninsured. Also recently various states have been trying to add more hurdles to Medicaid. So the poor, because they get government health care, are in the hands of the politicians.

Currently Medicaid covers about 1/4 of the population. So the rich are safe, the poor are more or less safe, and the middle class doesn’t know what will happen tomorrow or what bills may arrive.

The ACA also regulated the individual insurance marketplace, which is where the self-employed and other people may optionally buy insurance. This is great for freelancers, the FIRE crowd, etc. The law provides federal subsidies so that your premiums don’t exceed a percentage of your income.

Unfortunately those subsidies lapse at a certain income level, and with price increases, a middle class family can pay something like 30% of their income on insurance, I read somewhere. (So, this is why people in their productive years tend to like their employer-provided health insurance, and you’ll see here people who are reluctant to pursue FIRE, given the instability of the law.)

The ACA also had penalties to incentivize universal insurance, like the Swiss have. But those penalties were abolished– the law is still there but the “fine” is $0 now. So with all that have about 10% of the population that is still uninsured. That is probably the people you read about owing a million dollars in health bills. The uninsured also drive up the cost of health care for everybody else when they show up at the emergency room. Somebody has to pay, and as usual cost gets passed on to the consumer.

And of course even with insurance there is the whole thing about benefits and deductibles and in-network and out-of-network and you never know what you might get hit with.

Before the current law we had no coverage for pre-existing conditions, and plans had limits for lifetime coverage. I have a friend who back in the day had to sue her insurance company when she got cancer twice. Now the law that protects those people might go away. Who knows?

It’s a complete mess, yes it is, and nobody knows how to fix it really. We have federal laws, but each state is different, and we’ll have to get there gradually over the years.

The thing is, our political duopoly no longer practices compromise. It’s all about the destruction of each other’s plans. There are good ideas to fix health care in various sides of the political spectrum, but we lack a practical center to get things done these days. The game is all about pandering to the extremes, and so nothing happens.

This was just to say– the problem is not really about “cost”, ha ha ha ha. The problem is one of market failures, and the political failure to address those market failures in a very large and complicated system.

But yes, of course we are in hot water (insert bitter laugh).

@Jenni again

I forgot to mention military hospitals and the Veteran’s Administration! Which add to the complexity of the equation. But they are also government funded. Big lapse, sorry about that.

Hi there, I’ve recently started reading your blog.

I’m just gonna jump in and say something which might be important: diet is a huge factor in HBP/heart attacks as you probably know, but specifically, animal products have been pretty strongly linked to heart attack in several studies.

Lowering your meat intake – even if it’s just for a few dinners a week – will probably affect those numbers. I went full meat-and-dairy free a few years ago, as did my partner, and his blood pressure dropped quite a bit. Mine did a little, but I’m young so not a huge change for me. 🙂

JD, sorry to hear about your recent need to interact with the US healthcare system. It’s such a mess for all of us consumers. I hope you update us on the ~$7K bill. We recently had a kid and have started consuming healthcare services, so I’ve been going through the same thing reading Explanation of Benefits (should be called Explanation of Non-Benefits). Finding a primary care physician sounds like a good idea! Those annual exams are probably free, so at least once a year you can check in with the doc and make sure things are on the right path!

I can relate with an unexpected trip to the ER…mine was for a kidney stone. I have had one before but never to the point that it caused vomiting. As a result, I was told I needed to go to the ER just in case it was too large to pass (It ended up being 4mm and I passed it on my own).

I spent about 2.5 hours in the ER. I had an abdominal CT scan done, blood draw, urinalysis, after which the doctor prescribed 1 bag of fluids and two medications (pain and nausea). The hospital has submitted charges to my insurance company for $21,142. To say I was shocked by the amount is an understatement. I know that the insurance company has pre-negotiated rates for services but with a $7,900 individual deductible, like you, I’m definitely concerned. My guess is they will knock down enough of the charges (which I think are crazy high to start with) to just under my deductible and I will be stuck paying the full amount minus whatever discount the hospital will give for full payment.

And those are just the hospital charges…I have yet to see anything from the ER doctor or the radiologist which I have been told will both bill separately. So it is likely that between both doctors and the hospital my insurance will see bills that total $25k for a 2.5 hour ER visit. If that doesn’t demonstrate that the health care system is broken I don’t know what more is needed.

The only bright spot in this whole thing is that this is the 4th year I have had a high deductible plan and I saved more than my deductible ($7900) in monthly premiums over the last 3 years. And, if I do hit my deductible, everything from this point forward in the year will be $0.

Yikes! I agree with everyone else, get to a specialist as quickly as you can. Lots of good advice here. I have a full coverage HMO with the majority of costs covered by my employer, so when I noticed some slight reddening of my knuckles I went in right away and was diagnosed with rheumatoid arthritis. I recognized it as my mom was diagnosed when she was 35. The pain wasn’t bad so I could have put it off but I’m glad we found it way early and I’m in remission. All this to say – stay on top of your health!

About negotiating: I’ve tried this several times (in Georgia) and have been told that the price is part of a contract agreed between the provider and the insurance company, and if the provider lowers the price as part of a negotiation, this would be insurance fraud and illegal. Has anyone else heard this?

I had this happen at a non-profit hospital after the birth of both of my daughters. They would not negotiate and were perfectly happy with a $25/month payment plan.

This is usually true – when people say to negotiate the price of a health care bill, that option generally applies to people without insurance who are paying cash. The hospital or doctor can negotiate in that situation (better to get something from a cash patient then nothing at all). However, if you have insurance and your hospital visit/doctor services are “run through” your insurance, then you’re getting the large discount that applies due to the insurance company and the health care provider having a contract — this can range from 20-50% depending on the service. Granted, these discounts are largely fake (hospital charges a hugely inflated price and insurance company negotiates a specific price they are willing to pay, usually called the “Allowable Cost”), but still, they don’t allow insured patients — even those on high-deductible plans — to “double-dip” by getting the discounted insurance price and then tack on another cash discount on top of that. But yes, many do allow payment plans, so that is worth asking about.

Alcohol really raises blood pressure and lack of exercise. They also both cause depression so maybe those two things might really help you if you reduce the alcohol and exercise, just simply having a good daily walk is great! Good luck.

You’ll have to eat better and exercise more. Don’t put it off.

Yes, also find a good family physician. You need to take care of your health now that you’re getting older.

I hope no more chest pain for a while. It sounds like some kind of warning. Best wishes.

Keep all mailings you get from insurance, the hospital, the doctor’s offices. Ideally, put the date you receive the bill in the mail. Most insurance only gives the hospital or doctor 6 months or a year to bill you, and if they wait too long, you can’t be forced to pay the bill. Also, ask for an itemized bill so you can make sure everything you’re being billed for matches up to the details in your EOB.

Most hospitals and medical practices can’t (or won’t) give an additional discount beyond what the insurance company has negotiated the price to be, but it certainly doesn’t hurt to ask.

Get a doctor, visit them yearly for general checkups, get baselines, etc, so that when something changes they have an idea of how big a change they are looking at.

Oh man… Get. On. That. HSA. Train.

Seriously, it’s amazing. My wife’s employer kicks in a fair bit each year and lately we’ve been maxing it out instead of contributing to an IRA; right now we have over thirty grand in the thing, mostly in an index fund. If we stay in great health then at age 65 it becomes more-or-less a retirement fund and we can withdraw funds at no penalty (only paying taxes). In the meantime if some big medical expense comes up, we won’t get obliterated.

It’s a fantastic savings vehicle.

Your brief comment here makes an HSA sound really appealing, Adam. But sources I’ve read elsewhere seem either confusing or not nearly as rosy about HSAs. I’m just curious if you could recommend a good source for more information on this. (Perhaps/hopefully J.D. will do some research on this and share also!)

Sure! Here’s the source that convinced me:

https://www.madfientist.com/ultimate-retirement-account/

I’ve been on the HSA train since 2012. My employers have contributed to it annually (it saves them on Social Security taxes and their portion of the health insurance premiums) and I’m putting in $5,600 this year. It reduces taxable income – so it’s like getting a 30 % discount or so on your medical expenses. My account is with Optum Bank (part of United Healthcare) and they issue a debit Mastercard that I use most of the time. You could pay any way you want to and then reimburse yourself (if you wanted credit card points, for example). You can also have checks issued directly to providers. It is amazingly simple. I don’t invest the balance (yet, at least). If you do some research you’ll see that some consider it a “backdoor IRA.” The required high-deductible health insurance costs less than the regular health insurance options and I use the savings to fund the HSA. You can’t have an FSA and an HSA per IRS rules. That said, there is none of the “use or lose” downside like the FSA – no last minutes buying eyeglasses or stocking up on contact lenses in the last week of Dec.

Yup, any expenses that we use the HSA for get paid via a rewards card, and we pay ourselves back. My wife has a cosmetic prosthetic that needs replacement every five or six years and that’s generally enough to cover signup bonus required spending for any card we want.

As far as I understand the “Insurance system”, you cannot be billed for an amount more than what your insurance company would be liable to pay. Therefore, if the insurance policy had a contract with the hospital that it will only cover $2,500 for a service/procedure, then your responsibility is $2,500 (not $8,500).

If you have to meet your deductible of $10,000, then the $2,500 gets applied to your deductible and you pay the $2,500.

As someone who works at a hospital, I know too well the frustrations patients experience with ER and in-patient bills. There seems to be a constant disconnect between the billing side of things and patient care, and providers are rarely kept informed of the intricacies of out of pocket costs for patients.

Until we live in a society where transparency of costs is required, figuring out ways to avoid a potential devastating blow to our savings due to an unforeseen health incident is essential. You mention HSAs and I notice at least a few others chiming in. My employer offers its own version of an HSA via a flexible spending account, but we can only max to about $2,650 per year. Anything we don’t spend is automatically forfeited, which I think is absurd. Adam (the commenter above me) seems to have a much more ideal situation, which I’m not sure is necessarily accessible for all of us.

Good luck on your path to finding greater health. If you did it in 2010, you can DEFINITELY do it again!

Elise

I really do not understand that explanation of benefits. Are there people with the insurance company (or the doctor’s office) that will walk you through that?

It looks like you were “charged” an amount for the urgent care visit (and all the other stuff), but the “amount allowed” is what hits your deductible? Plus, the amount “not covered” in total would seem to be logically what you would end up paying, but the sum of that column doesn’t appear anywhere…

Not to mention – the urgent care visit itself is covered, but none of the tests or diagnostics/treatment are covered? Whats the point of going on the visit without getting the tests or treatment? They pay for you to be there, but not to receive care? How can the doctor figure out what’s wrong without running any tests?

I am so confused…

I write medical billing software – and that EOB doesn’t make sense. Maybe there is more on the parts of the paper not shown?

My guess is that the emergency room was out-of-network, but the plan covers ER visits regardless. The labs were somehow considered outpatient and out-of-network and thus show $0.00 allowed, but because they were ordered from the ER, they were swept in with the other charges. Not well presented on the EOB, if that’s the case.

I think you’re correct, Anne. I am a member of the Providence network. I went to a Providence urgent care facility. They sent me (for some reason) to a Legacy hospital. From what I understand of my plan, ER visits are covered regardless of the hospital and network. That’s why I say I’ll have to see how all of the billing settles out because from the EOB, I can’t tell what’s going to happen.

Your experience just proves what everyone says about the costs of ER…..just put your nose in and the bill is already a few thousand dollars copayment even if you have insurance. You made the right choice to go to a clinic first which would have cost way less but then, even after you tested OK, they second guessed themselves and sent you to ER and big expenses. I imagine you could have had the tests done elsewhere at a cheaper rate on another day. Also I doubt that you will get a break on the mistake test…..after all the technician will expect to be paid for doing what was ordered by the doctor…..

Yep…old(er) age stinks….welcome to your fifties. :0)

Please get a primary care physician and follow up with a cardiologist soon. Your money means nothing without your health. I am Canadian so I don’t understand any of the money part of your article. I was with a family member at my local hospital for an entire day of tests and exams a few weeks ago and the only cost was $10 to park.

Do you have first aid and CPR training? You are back at work now so why don’t you bring a trainer in to your work place and get lots of staff trained. Have your wife come in that day too. Everyone benefits if they know what to do in an emergency.

I have to strongly criticize you for driving yourself when you wondered if you were having a heart attack. If things had gotten worse when you were driving you may not have been able to control your car and you could have caused an accident. Who would have paid for the victims medical bills or, worse yet, their funeral?

Here’s some HSA info to add to your research:

https://www.madfientist.com/ultimate-retirement-account/

Try L-Lysine for that canker sore. I started getting them in my throat/back of mouth decades ago and finally a doctor recommended 1000mg of lysine when they first come on and each day until they’re gone. It cuts the duration in half, sometimes even making them go away over night. Cutting out alcohol also helped.

Hi JD: thanks for sharing this story with us. I will tell you the two greatest things I ever did for my physical and mental health were to stop drinking and start exercising. My anxiety was through the roof, and my weight had ballooned, and no matter how hard I tried, I couldn’t stop drinking on my own. You might not need to go as drastic as I did (treatment) but the decision to cut out booze and move my body tackled 98% of what ailed me. You can do this.

JD, get and stay well please! I’m really selfishly wishing you many more years of health because I read the new (old) GRS everyday!

Hey!! I hope I’m not too late with this

https://twitter.com/businessinsider/status/1116488599849947136?s=21

There are two charges from radiology on that EOB. It’s possible one of them is for the oopsie CT scan. It’s also possible one of them is for the ultrasound and the smaller one is for the doctor to review the ultrasound… I would look into that.

I have an HSA and I really like it. I don’t like the insurance company that comes with it, but that’s a separate issue. And not all HSA managers are equal, but another separate issue. I’m hoping to build up a healthy amount in the HSA so going into retirement my husband and I have good medical rainy day fund.

I’m glad it wasn’t a heart attack, but definitely get the high blood pressure looked at! Oh, and you’re at the fun age for your first regular colonoscopy. Woohoo!

Also, as a side note, since we’re talking about middle aged health concerns, heart disease is the #1 killer of women, not breast cancer. The estrogen keeps our cardiac systems healthy until menopause. Once the estrogen drops, our heart health becomes similar to men, but our heart attack symptoms are sneakier.

First, glad you are okay.

I’m with Nirav Patel, how can the total you are responsible for be more than the charge? I don’t get it. Medical costs are totally out of hand.

Last year I went to the doctor for the flu, wanted the shot that is supposed to shorten how long someone suffers. $700 later I was home. Next time I will suffer through it. I updated my insurance this year. And I’m still afraid to go in for the “free annual physical” because of my experience last year. Doctor visit is covered with the free annual physical, but any lab work is still charged.

Hope Kim is recovering nicely from her knee surgery.

Contact Patient Financial Services or some hospitals call it Patient Accounting and ask for a detailed bill which will list all the charge codes billed. You are going to see the CT is probably that larger $1,649 Radiology charge and you should push back.

The $677 Outpatient could be the ER Physician portion of the bill but often you are going to get that on a separate bill. There is a good chance that Outpatient charge is from your visit to Radiology for the CT and you can dispute. The labs are ridiculous and those cost a few dollars each. The $0 allowable on most items indicates your insurance treats an ER visit as a bundled episode and doesn’t pay line items on the diagnostics and labs they think should be included in the ED visit code. Might possibly come to your advantage as the ED visit may be only allowable.

You should also ask for their payment plan policy when all is settled. They will usually offer 12-24 months interest free and you then ask for double that. 36-60 months plans are not uncommon.

I’m glad you didn’t have a heart attack! I have had success losing weight and keeping it off with https://www.naturallyslim.com/home. No – I don’t sell their program or make any money off recommending them in any way. I got it free through my health insurance but you can also pay for it out of pocket. I think Naturally Slim is the approach to weight loss like FI is the approach to wealth. No counting calories, no food restrictions, no crazy exercise. It’s just about learning tricks to eat intentionally and learning to eat just enough. I’m passionate about it in the way that the FI community is about the FI message.

I would recommend avoiding a cardiologist. It seems you do not have a diagnosis of heart disease, and even if you did, a good PCP should be able to manage that. When you have a hammer, everything is a nail. Specialists are much more likely to run unnecessary tests or prescribe extra medications. Locations with a strong system of general practitioners have much better health outcomes at a much lower cost. Based off of this story, the only thing I would even consider ordering for you is a stress test (PCPs can order these). While I haven’t interviewed or examined you, I would possibly do that.

Visit a PCP, get your hemoglobin A1c, lipids, and kidney function checked. Measure your BP at home when relaxed and seated for a few minutes. Ideally keep your BP < 120/80. Most people focus on the top number, but the bottom number is important, as well. Exercise and lose weight. I recommend primal-style diet (check out Marks Daily Apple), and if you want a food reset, do a Whole 30. One of the best dietary interventions (much better than eating "low salt") is to eat a diet high in potassium.

There's my unsolicited advice.

Sorry to hear about your scare. Here a description of what it’s like to have an actual heart attack in your early 50s.

https://www.mindfullyinvesting.com/i-hope-you-have-a-heart-attack/

It’s not necessarily all bad.

JD, go see a REAL doctor, instead of getting internet advice. Good luck!

Glad things are OK with your health, except for that crazy bill!

My advice is to call the phone # on each bill. After I had a baby, I got hit with many hospital and lab bills. I couldn’t understand what they were and they kept coming so consistently, that I would have different bills from the same company with different totals day after day.

Finally, I just started calling. One of the labs cut my bill in half just by paying over the phone on the day I called….what??!! From $850 to $425! It was a crazy experience. I learned that prices are very “negotiable” in the healthcare world.

Best of luck to you!

Thanks for sharing. Sadly, healthcare is the leading cause of bankruptcy, which is very frustrating since 75-90% of the $3.5 trillion spent annually in the US is preventable. But the age of Polygenic Risk Scoring (PRS) is here and that could change things through personalized prevention.

Full disclosure: I hung up my high paycheck paying physician hat to help change this status quo through PRS innovation via my startup.