Comparing Quicken to other personal finance apps

Welcome to the final day of my mini series exploring popular personal finance apps. As I prepare to track my spending in 2017, I have to decide which tool to use.

In the olden days, there weren’t many options. Lately, however, there’s been a boom in personal finance tools. Rather than try every available app, I elected to take a look at four that seemed like good fits for me: Quicken, You Need a Budget, Personal Capital, and Mint.

Earlier this week, I reviewed my experience with You Need a Budget. Yesterday I compared Mint and Personal Capital. Today I’ll talk about Quicken.

And at the end of this article, I’ll reveal how I’ve decided to track my money during 2017.

Quicken 2007

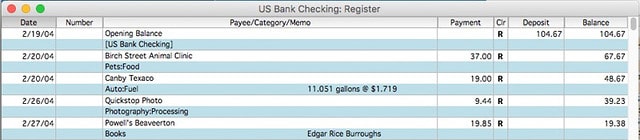

For years, my personal finance tool of choice has been Quicken. I used it to track my descent into debt during the 1990s, although those files are exiled to inaccessible 3-1/2 inch floppy disks. That said, I have transactions in my Quicken datafile going back to 19 February 2004 — almost thirteen years ago!

My records go back to when I was married to Kris and we were living in the small town where I grew up. I was still maxing out my credit cards, still living paycheck to paycheck, and still wondering why I had suck rotten luck. I hadn’t yet had my financial awakening. (That wouldn’t happen until October of 2004.)

I’ve tracked my income and expenses with Quicken intermittently during the past thirteen years. I used the program religiously from October 2004 until April 2009, when I sold Get Rich Slowly. Then I used it again in 2011 and in 2013. So, my records are spotty. But they’re there. If I wanted, it’d be easy to compare my present habits to the past. (In fact, I just for fun I ran a net worth report on each year for which I have data!)

I use the decade-old Quicken 2007 to do the following:

- I have a list of accounts and spending categories. I’ve been using the same accounts and same categories for thirteen years. If an account becomes inactive, I’m able to hide it from view (without deleting data). Account registers work just like check registers. Yes, I’m one of those old men who still uses checks now and then. And because I was raised using checks, I prefer a check-register interface.

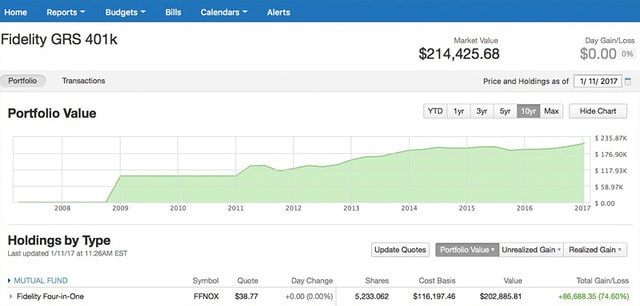

- I enter transactions by hand. Automatic downloads are available but I don’t use them. Manual data entry helps me remain more aware of my habits. That said, I do use automatic updates for my investments. And I like that Quicken downloads stock prices every day.

- I don’t use the budgeting feature, although I might give it a go in 2017. From time to time, I do use other built-in features though, like the retirement calculator and the home inventory.

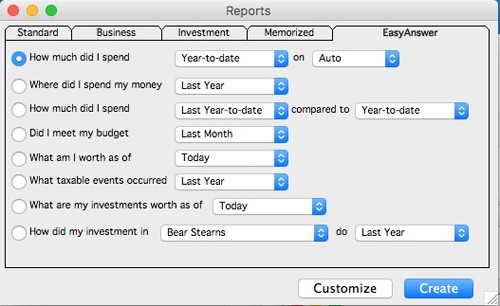

- Finally, I’m a big fan of the reports. Quicken 2007 is capable of producing dozens of different reports, all of which are customizable. As a money nerd, I like this.

Until yesterday, I hadn’t upgraded my copy of Quicken in over a decade. I stuck with Quicken 2007 — warts and all. I was fine with it. The software works. Better still, I know how to use it. I know how to make it do the things I want it to do. This is no small thing; in fact, as you’ll see, it’s probably the biggest determining factor in which tool I use to track my money.

Yesterday, however, I gave myself permission to upgrade to Quicken 2017. I didn’t feel like it was fair to review the current versions of Mint, Personal Capital, and YNAB against something a decade out of date! Let’s see how the new version compares to the old.

Quicken 2017

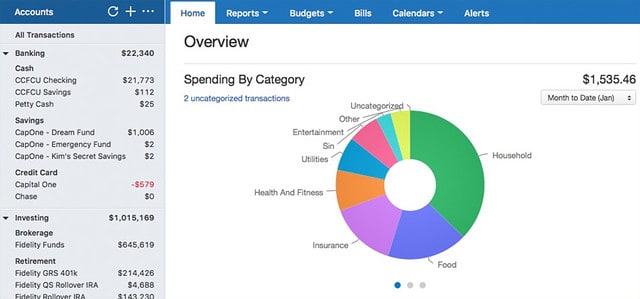

I’m pleased to report that it was quick and easy to copy my data from Quicken 2007 to Quicken 2017. (I’d been worried.) And the new software was easy enough to figure out. Compared to the older edition, the current version of Quicken looks much prettier. (Quicken 2007 is downright ugly.) The interface is spartan and sleek.

Here’s the Quicken 2017 home screen:

And here’s what the investments screen looks like. (Very nice!)

This simplicity comes at a price though. Quicken 2017 has far fewer features than Quicken 2007. It offers similar functionality to Mint (also owned by Intuit) and Personal Capital but lacks the advanced reporting tools, planning calculators, investment tracking, and home finance utilities — emergency records organizer, home inventory, etc. — found in Quicken 2007. The new version is prettier; the old version is more powerful.

Quicken 2017 does offer a few advantages over its elder sibling.

- It’s hard-wired to connect to the Quicken mobile app, for instance, which is probably useful to a lot of folks (but not me).

- Because the interface is streamlined and pretty, everything is incorporated into a single window. This is far nicer than Quicken 2007, where everything has its own window. (It’s not unusual for me to have 5-6 windows open at a time in the old version.)

- You’re able to add attachments to a transaction, which is very cool. You could, for instance, scan in receipts for tax-related purchases and tag them to the appropriate transaction. I like this.

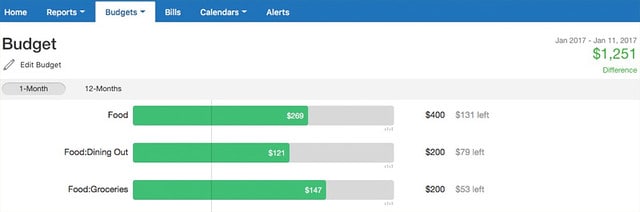

- The budget tool in Quicken 2017 is much improved. It’s nowhere near as good as You Need a Budget, of course, but it’s usable. (And I like the feature that shows you a little bar indicating whether you’re ahead or behind of projected spending for the month.)

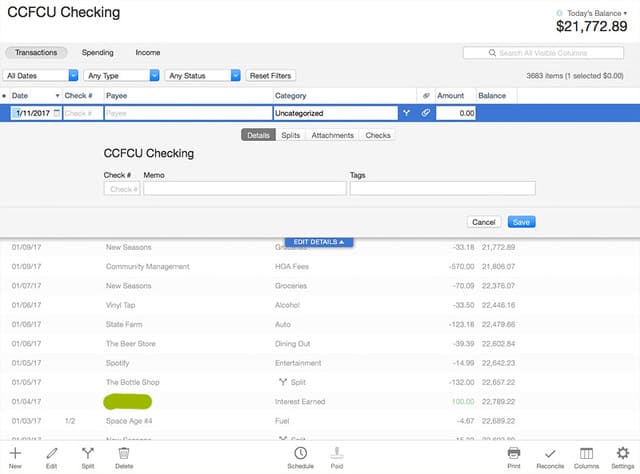

That said, there have been some changes that make things more difficult rather than less. For instance, Quicken 2017 is not designed for manual data entry.

In the older version I’m accustomed to, it’s possible to enter transaction after transaction after transaction without ever taking your hands from the keyboard. That doesn’t work with the new version. Now you have to click the “new” button every time you want to enter a transaction — and if you want to enter a description in the Memo field, you have to click yet another button. Yikes! So fussy. Plus, recent transactions are listed at the top of the screen instead of the bottom of the screen.

I know I’m going to sound like a grumpy old man here but I can’t imagine entering data manually like this for an entire year. And I’m certainly not going to trust Quicken’s automatic categorization! (I’m assuming it’s similar to — if not the same as — Mint.)

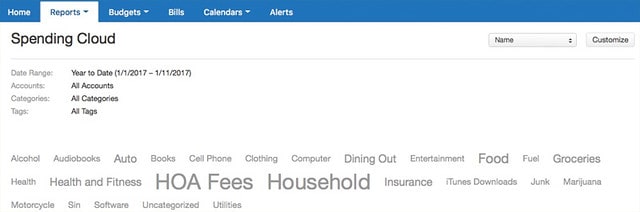

Some of the reports in Quicken 2017 are…strange. Who the hell needs to see a “spending cloud” report? What a pointless feature.

I didn’t like the registration process either. Even though it’s desktop software, you still have to create an Intuit account to use it. I have had nightmare experiences with Intuit accounts — for months, I was charged for a QuickBooks Online account I had cancelled — and I didn’t want to create one. But if I wanted to use the program I’d just purchased, I didn’t have any option.

The thing is, after using Quicken 2017 for a couple of days, I’m not sure I do want to keep it. If I were starting from scratch (and didn’t have a copy of Quicken 2007 already), I’d almost assuredly opt for You Need a Budget instead. Quicken 2017 certainly isn’t terrible, but I see no reason to “upgrade” from my existing copy of Quicken 2007. Just call me Grandpa J.D., I guess.

Decision!

So, after weeks of experimentation with four (well, five) different apps, how will I track my money in 2017? To be honest, I’m probably going to continue using all four money tools I tested. Here’s why.

Mint and Personal Capital are relatively passive. Now that they’re set up, I don’t have to do anything unless I want to. (Well, I guess I have to manually update my credit union balance in Personal Capital since it refuses to connect.) Instead, I can open each app on my iPad now and then to see how things are going. I’ve been doing that with Personal Capital for several years already, so that’s nothing new. And if I don’t like the info I get from Mint, I’ll just stop using it. But again: there’s no overhead involved in continuing to use both of these.

There is overhead if I choose to track transactions in Quicken and/or You Need a Budget. But that’s overhead I want and expect. As I’ve said repeatedly, the process of entering transactions by hand forces me to confront my spending habits. Plus there’s something meditative and satisfying about balancing the books every week.

Right now, I intend to use both You Need a Budget and Quicken 2007. Each offers features the other doesn’t. I’m open to the idea of moving completely to YNAB, but I’m just not there yet. As you can tell, I love having a decade of data in a desktop app, so I’m not yet ready to give up Quicken. I suspect a likely scenario is this: I’ll use Quicken 2007, just as I always have; meanwhile, I’ll pay for a year of YNAB and use it to get my spending habits in check.

So, there you have it. Six weeks of money nerd experimentation has led to an indefinite conclusion. To me, there was no clear winner.

Based on my experience, I’d make the following recommendations:

- If you already use a money tool that you like, stick with it. There’s no compelling reason to switch. (No reason, that is, unless you think you need help budgeting. If that’s the case, make a point to check out You Need a Budget.)

- If you don’t like the tool you’re using — or if you don’t yet have a tool — make a choice based on your needs.

- If you need to budget, You Need a Budget is the clear favorite. (Ha!)

- If you need to track your transactions, YNAB is still a good choice, but I’d also encourage you to try Quicken.

- If you don’t intend to track your spending, then consider an app like Mint or Personal Capital to monitor your progress. Choose Personal Capital if you like tracking your investments; choose Mint if you’re more interested in day-to-day spending.

I know there are other apps out there, and I’m sad I didn’t have enough time to try more of them during this process. That said, the hard work is now done. My accounts are set up in four different apps, and I’m actively tracking my spending. As readers suggest other apps to try, it’ll be easy enough to add them to the mix. And when I do, I’ll be sure to share my impressions with you!

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)