How I Won $10,200 on Game Shows

Can you spin a wheel, answer in the form of a question, or guess the price of a showcase without going over? If so, appearing on games shows can be a fun way to earn some extra cash.

Way back in the 1900s, when I moved to Hollywood, I won $7200 on Wheel of Fortune and $3000 on the now-defunct DEBT. Being a contestant on game shows was fun and profitable. I’ll tell you how you can do it too!

DEBT was a trivia show hosted by Wink Martindale in 1996. This was a perfect fit because I have a flair for minutia and know everything that is not on the SAT. At the time, I was a touring stand-up comic, so I jotted that line in my notebook. I read it out loud later: “I know everything that’s not on Saturday.” What the—? That never got big laughs on stage. Some jokes do better in articles.

In late 1997, I reprised my role of “Chip – The Game Show Contestant” on the grand-daddy of them all: Wheel of Fortune. Here’s a photo of me and Pat Sajak. Who’s cool now? Take that, Ed Grimley. I was the big winner on my day, and made enough to be on that week’s Friday Show of Champions.

How to Get on Game Shows

Individual results may vary, but here’s how I got on those game shows. First, I called the “If you want to be a contest” number that ran at the end of the closing credits of every show. But these days, the internet is also your friend. At the end of this article, I have links to a slew of shows.

Individual results may vary, but here’s how I got on those game shows. First, I called the “If you want to be a contest” number that ran at the end of the closing credits of every show. But these days, the internet is also your friend. At the end of this article, I have links to a slew of shows.

Once you get a chance to “audition” to be a contestant, you should treat it like you are actually on a broadcast of the game show. The producers are imagining how you would do on the show, based upon your “audition”. Look your best, speak clearly, and have something interesting to say when the producers ask you about yourself. It’s like going on a first date with America. I told Pat Sajak that I was a haberdasher, then explained I sold T-shirts bearing a phrase I created “Bichette Happens”. This was for (then) All-Star Colorado Rockies outfielder Dante Bichette.

Bottom line: Would you wanna watch you on TV? This is no time to be a mumbling, meandering stiff.

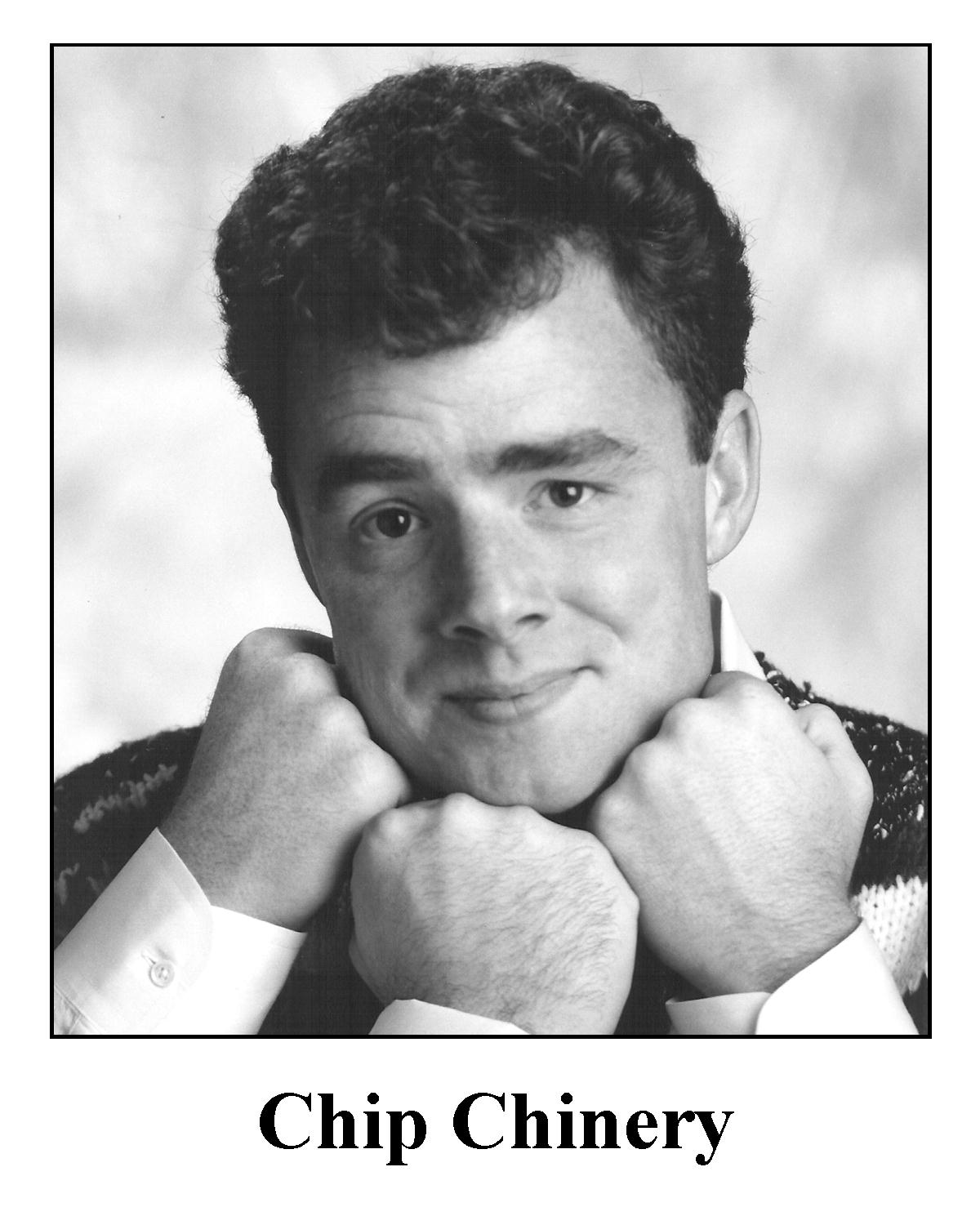

Thousands of people audition for some of these shows. You can do what you want. But after I auditioned for Wheel, I sent my headshot/postcard once a month expressing my hope to do the show. A few months later, they called me to see if I’d be the stand-by contestant in case anyone freaked out. If I did that, they would move me to the front of the line for being an actual contestant. Done. I put in my day. Everyone kept their cool. I went home.

Thousands of people audition for some of these shows. You can do what you want. But after I auditioned for Wheel, I sent my headshot/postcard once a month expressing my hope to do the show. A few months later, they called me to see if I’d be the stand-by contestant in case anyone freaked out. If I did that, they would move me to the front of the line for being an actual contestant. Done. I put in my day. Everyone kept their cool. I went home.

After I was scheduled to appear on Wheel, they called a few days later to say I couldn’t do it since their research showed I had been on another game show in the past 18 months. I had just appeared on Comedy Central’s Make Me Laugh. I’d come too far to give up now. I reasoned with them that I was a comedian on that show, not a contestant like I would be on Wheel.

I told them that no one would recognize me, because I am a man of many disguises — like The Jackal. They agreed to have me on Wheel. Whew. I still have some of that Turtle Wax. They weren’t kidding about a lifetime supply.

I told them that no one would recognize me, because I am a man of many disguises — like The Jackal. They agreed to have me on Wheel. Whew. I still have some of that Turtle Wax. They weren’t kidding about a lifetime supply.

The Reality of Reality Shows

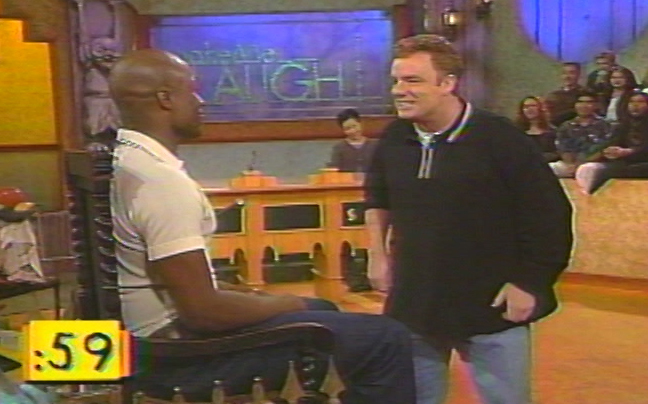

Nowadays there are reality/game shows that require contestants have a certain talent like singing, modeling, or cooking. These are TV shows first and are cast with personalities. In 2006, I participated in one such show: NBC’s Last Comic Standing where I was a semi-finalist. That was a reality show disguised as a stand-up comedy competition.

There isn’t anything wrong with that kind of “contest” as long as the producers are upfront about it. When I read my contract, there was something about NBC and producers having input. If I didn’t like it, I didn’t have to sign it or participate in their reindeer games. They even ran that disclaimer at the end of every broadcast:

For me, it was just a fun venue in which I told my jokes! I even laughed when I saw the show and the editors made it look like I assumed I was going to be named a finalist. They used a clip of me getting off my stool, then they cut to Roz when her name was announced, then to me in a different shot being dejected. All three of these shots were cobbled together from different unrelated situations. Well played, Editor! Well played.

The takeaway on being a contestant on a reality show: Don’t agree to do it if you are uncomfortable with how you might be portrayed. Are you prepared for that? That is the $64,000 question. If the answer is “No”, stick with the old school game shows.

To get more information about how to be a game show contestant, check out these pages:

- Jeopardy

- Wheel of Fortune

- Price Is Right

- Who Wants To Be A Millionaire

- Let’s Make a Deal

You can also peruse these links to see how to get “cast” in reality & game shows on various networks:

- ABC

- CBS

- FOX

- NBC

- Game Show Network

Finally, for full immersion, there are blogs like Game Show Follies. A few more resources that might help you in your search are TVtix.com and TVtickets.com and AudiencesUnlimited.com

Good luck! Have you been on a game show? What was your haul?

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)