What are mutual funds and how do they work?

[This is the first installment in a series examining index funds. We’ll discuss the managed mutual fund market first to form a basis of comparison with index funds. In Part II, we will look at how an index is calculated and what an index fund is. In Part III, we’ll consider how to evaluate index funds and where to buy them.]

We can’t predict the future — so when it comes to investing, minimizing risk is the name of the game. One highly effective strategy to help limit investment risk is through diversification, and most of us achieve it by investing in mutual funds.

Mutual funds, and their close cousins, Exchange Traded Funds (ETFs), achieve diversification by buying a wide variety of different bonds, stocks, or whatever investments they focus on. You and I typically don’t have enough money to achieve that kind of diversification on our own, but we can get it on our limited budget by investing in a mutual fund.

In fact, by law, Roth IRAs and IRAs of any description can invest in many other things, but 401(k)s and 403(b)s and similar employer-sponsored plans are only allowed to invest in mutual funds, because their diversification and professional management keep risk to prospective retirees like us to a minimum.

The Dominance of Mutual Funds

Mutual funds have been around since the mid ’70s. At this point, almost one in two adult Americans have all or part of their financial assets managed by mutual funds, clearly dominating investment options for individuals.

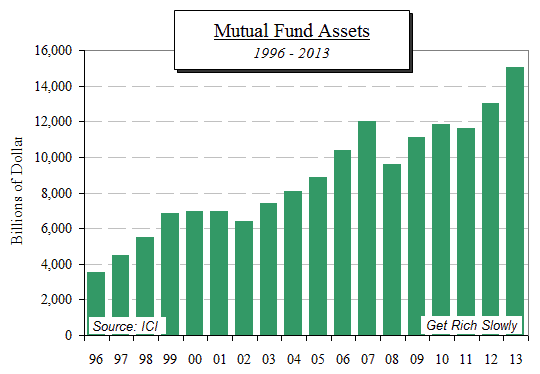

In its latest report, the mutual fund trade association (Investment Company Institute) said America has around 9,000 mutual funds managing about $15 trillion for just under 100 million people. Mutual funds hold 29 percent of all U.S. stocks, 25 percent of all municipal bonds, and 11 percent of U.S. government bonds.

But it’s not just the growth in the stock market we should consider. The mutual fund industry also added $152 billion in new net cash inflows in 2013.

Here is a chart showing the growth of the mutual fund industry’s assets since 1996:

Mutual Fund Types

Initially, mutual funds only invested in equities (stocks). Because the bond market is roughly twice the size of the stock market, it didn’t take long for mutual funds to start investing in bonds too. As time passed, the number of funds increased as they began to specialize in certain types of investments: foreign-country bonds, high-tech stocks, high-yield (junk) bonds, and so forth.

There are tens of thousands of securities (stocks, bonds, etc.) to choose from, but not all of them are equally successful. The staff of every mutual fund scours their universe for the best 30 or 40 investments which amateurs like you and I easily miss. The best fund managers become highly paid celebrities: Peter Lynch achieved international fame by building his Fidelity Magellan Fund into the largest mutual fund in America.

The Reason for Market Dominance

- Most mutual funds are bought for retirement

Defined contribution plans (like the ubiquitous 401(k) plans) owned $5.9 trillion of assets at the end of 2013, according to the ICI. An even bigger amount is invested through IRAs. If you consider that total mutual fund assets are around $15 trillion, you can see how dominant mutual funds are in retirement planning. According to the ICI, over 60 percent of all first-time mutual fund purchases are made within an employer-sponsored retirement plan, like 401(k), 403(b), SEP-IRA and similar plans. - Brand awareness

If your employer offers a 401(k) plan, odds are they don’t administer the plan because they’re not experts in all the legal requirements. Instead, they outsource the plan administration to a financial services firm which offers a menu of choices. Human nature being what it is, plan administrators usually pick firms they know, i.e., those which have brand identities only big money can buy. - Inadequate regulation allows menu manipulation

There are no rules determining which funds your plan has to offer, so plan administrators load up the menu of funds with high-cost, fee-laden mutual funds that benefit the company, the plan administrators, and the mutual fund companies.Among a long list containing, say, 98 of their own managed mutual funds with exotic names, one or two index funds may be buried at the bottom of the list. That’s because they make more money from managed funds.Your employer may benefit too: Kickbacks from administrators to employers are legal and not uncommon. Your employer, therefore, has no incentive to offer anything but managed mutual funds that benefit themselves. Unfortunately, the fees charged by most managed funds are well hidden so that plan participants are not aware of them.

In summary, the best-selling mutual funds are usually from large companies like Fidelity and T. Rowe Price that have large marketing budgets with which to build brand awareness. Not only are they well known, their marketing campaigns make consumers likely to trust those institutions, assuming that a higher price will net them more safety and higher returns.

The evidence, however, clearly has shown that index funds usually have larger returns and lower fees than managed funds and, if anything, have even less risk, because they typically are diversified over more securities. However, their low cost structures don’t leave much room for splashy advertising campaigns and that, in turn, has left the vast majority of retirement plan investors unaware of their benefits, or even of their existence.

Does your retirement depend on managed mutual funds, and are you satisfied with the performance? What is your experience with your employer’s plan administrator? Are they tied to a major mutual fund company or are they willing to offer better investment choices?

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)