The spending plan: Budgeting for non-budgeters

I’ve never been able to keep a budget. They’re a great tool for many people, but for me a budget is a recipe for failure. It’s too fussy. I can’t stick to it. When I don’t stick to it, I feel guilty. When I feel guilty, I want to spend more money. Still, I’ve found it’s helpful to have some sort of written financial plan. Over the past few years I’ve developed what I call a “spending plan”.

To me, a budget is a detailed itinerary. A spending plan, on the other hand, is just a list of places I’d like to go. It doesn’t have the same sort of rigidity that I associate with a budget. When I create a spending plan, I tally upcoming income and expenses, and then use these numbers as a guideline for determining my financial direction.

My Spending Plan

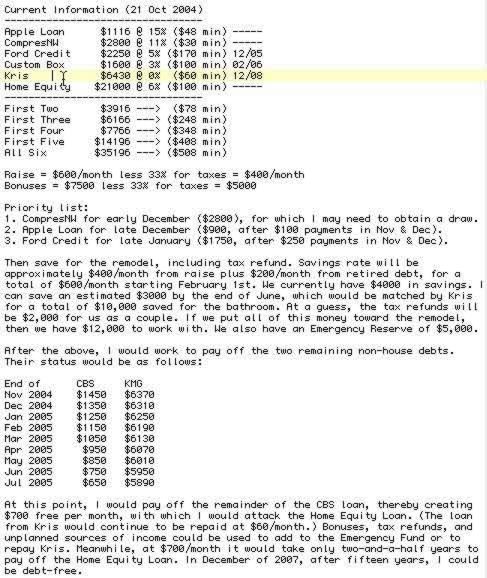

I suppose it would be easiest to just show you an actual spending plan I drew up three years ago. (This document is an important piece of financial archaeology. It’s the first spending plan I ever made, and it’s the first sign that I was ready to start getting rid of my $35,196 in debt.)

As you can see, I began by listing my debts in the order that I wanted to repay them. (This was before I knew about the debt snowball.) Next, I listed my expected sources of income. Finally, I brainstormed a possible plan of attack.

Despite the fact that I will meet the goal I set for myself in this plan, my path to this destination has been different than I had intended. Surprise expenses occurred. I didn’t adhere to the plan as well as I’d hoped. My income projections were too optimistic. The bathroom remodel cost twice as much as I had anticipated. Because of these things, I’ve made it a habit to draft a new spending plan every few months. This allows me to compensate for changing circumstances and changing priorities.

Your Spending Plan

If you, too, are wary of budgets, consider using a simple spending plan to give direction to your finances. The example above is more involved than it needs to be. Most of my spending plans now are about half the size. When drafting your spending plan, be sure to do the following:

- Project income. How much do you bring in every month? Will you receive any windfalls soon? For example, every winter I get a sizable bonus at the box factory. I make sure to factor that into my spending plan.

- List fixed expenses. Jot down those things for which you must pay every month: cable, telephone, gas, electricity, etc. These are the bills that you must pay to maintain your lifestyle. (I didn’t include these in my first spending plan — oops!)

- List your debts. When I put together my spending plan, I keep debt separate from the fixed expenses. My other bills stay relatively constant, but as you can see, I like to play with my debt numbers.

- Plan ahead. Do you have any large expenses on the horizon? When I made my first spending plan in the fall of 2004, I knew that we would be remodeling our bathroom the following summer. I made sure to plan for that.

Good financial habits make it easier to adhere to a spending plan (or to a budget). In order for me to stay on track, I need to track every penny I spend. I use Quicken to do this, but you can use Personal Capital, a spreadsheet, or simply pen-and-paper. When you track your spending, you can tell when you’ve gone off course.

A Man With a (Spending) Plan

A spending plan can help you track your financial goals. In turn, financial goals give your life direction, keep you from making foolish choices with money. Before I had goals for my money, I spent it on whatever struck my fancy. It was easy to fritter away my cash on books, comics, and video games, because I didn’t feel like doing so affected my future. I had no plan for the future. But when I drafted my first spending plan three years ago, the future suddenly became crystal clear.

If you do choose to implement a budget or a spending plan, review it regularly. I try to review mine at least once a month. Periodic review can help you stay on course.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)