How to open multiple accounts at ING (now Capital One 360)

One of my favorite saving techniques is the use of targeted accounts. If I want to save for something big — like a Mini Cooper, for example — I’ll open a new savings account specifically for this purpose. I first learned about this method from Robert Pagliarini’s The Six-Day Financial Makeover:

Traditionally, most people invested for various vague goals and lumped all of their savings together in a single investment account. That’s pretty boring. It’s not very inspiring or effective. Purpose-Driven Investing satisfies our need for a purpose and our need for instant gratification by thinking of each of our goals as a separate “basket”. Each of our baskets represents a single goal with a clear purpose that we can see and grow.

What does this mean in the real world? It means that we have a single investment account for every goal. For example, if one of your goals is to take the family on a European vacation, create a separate savings account called “Family European Vacation Fund”. This account or basket contains all of your savings toward that one goal. Every penny in the account is for the European vacation — not for retirement, a new car, your emergency fund, your kids’ college tuition, or any other goal.

I like this idea, and have been using it ever since I saved for my Nintendo Wii.

Until recently, I kept my targeted savings accounts at the local credit union where they earned me a paltry 0.35%. For the past few months, Get Rich Slowly readers have been urging me to move all of my savings to ING Direct (note: ING Direct is now Capital One 360, which is where I keep my emergency fund. “It’s easy,” my readers tell me. “You can open multiple accounts, give them any name you want, and track them all from the same screen. You can even open a checking account!”

Last month, I finally overcame inertia to try this myself. My readers were right: opening multiple accounts at ING Direct is easy.

Step One: Choose an Account

First, I logged into my ING Direct account summary page. From there, I clicked the big “Open an Account” button.

I was directed to a page listing a variety of available accounts, including business and retirement accounts. Because I wanted to open another savings account, that’s the option I selected.

On the next screen, I was asked to further refine the account type:

Step Two: Fund the Account

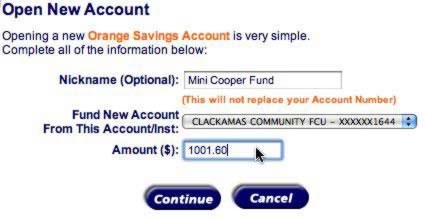

Next came the good part: I selected how much I wanted to put into the account and where those funds would come from. I was also able to give the new account a nickname. Since I was opening these extra accounts specifically for targeted saving, it makes sense to name each one based on my goal.

Finally, I had to agree to the terms and conditions of the account.

Step Three: Wait

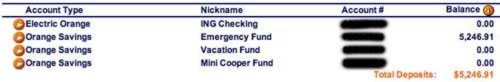

Then the waiting began. Because ING Direct had to “pull” the money from my credit union, it took several days for the cash to transfer to my accounts. At first they appeared empty:

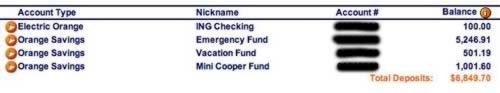

After the money had transferred, it was easy for me to track all of my savings goals in one place.

Next on my list? Exploring ING Direct’s certificates of deposit and business accounts.

A Useful Tool

Thank you to all of the readers who suggested this. I don’t know why I took so long to try it. I’m sure this technique isn’t limited to ING Direct. I was doing something similar at my local credit union (though without the pretty interface, account nicknames, or high interest rates), so I suspect that other online banks offer similar functionality.

Not everyone needs multiple accounts to save for goals. My wife, for example, is perfectly content with a single gigantic savings account for everything. But for me, being able to separate funds like this is awesome. It keeps me motivated to save. And because it doesn’t cost me a penny, I’m happy to do it.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)