How I invest my money

After my recent article about coping with haters, a reader named Sandy left the following comment.

How about…you make a detailed post on how you invest. Let's see some real life detail. I'm sure you won't want to post exactly how much you have invested and that's fine. I'm talking more along the lines of:

a: what stocks/funds you hold

b. what criteria you use to shift funds to maintain balance (good/bad/sky is falling markets)

c. your rate of return each quarter

d. how much you invest each month (ballpark)…Let’s see whatcha got.

Although I'm skeptical that looking at my personal portfolio will be useful to anyone, and although I've already shared most of the following information, let's take a look at how my money is invested.

First, though, let's talk about how I used to invest.

A Brief History of a Bad Investor

Before I decided to become boss of my own life, I did some dumb things with money. I was especially bad at investing. Like many Americans, I didn't understand the difference between investing and speculating. I looked at the stock market as a place to get rich quick. I didn't have the knowledge or patience for long-term planning.

As a result, my first forays into investing were great examples of what not to do:

- During the early 1990s, I followed my cousin's advice and began investing in mutual funds. Over the course of a very long year, I plowed a little more than $2000 into a variety of Invesco mutual funds. But I cashed out all of my money when I decided I needed to buy a Macintosh Classic II computer.

- During the late 1990s, in the midst of the tech boom, some friends and I formed and investment club. Every month, the six (or eight?) of us would meet to choose which stock we wanted to purchase, then we'd each contribute $50 to buy as many shares as possbile. Our stock picks sucked. We continually bought whatever was riding high. We had no concept of sensible investing. We were gambling — and we lost. The tech bubble burst. After two years, we cashed out and folded our investment club. (For years, I've wanted to write this full story for fun. I have all the records from the club, and I'm still friends with all the members.)

- In March of 2000, as the tech bubble reached maximum size, I jumped on the bandwagon for the Palm Pilot IPO. On the day the stock went public, I bought as many shares as possible. Within weeks, I'd lost half my money.

- My final bout of investing stupidity? In the autumn of 2007, I had dinner with a friend who worked at the corporate offices of The Sharper Image. He told me that the company's stock price had dropped but management was certain they could turn things around. It was just a passing remark in a much larger conversation, but I took it as a sign. The next day, I bought $3500 worth of Sharper Image stock at $3.14 per share. (That was the bulk of my Roth IRA money for 2007.) Within a few months, The Sharper Image declared bankruptcy and the value of my stock dropped to $200. Then to zero.

Gambling and speculating are fundamentally non-money boss activities: outcomes are at the whim of fate. Investing, on the other hand, is a conscious, directed activity that relies on discipline, knowledge, and patience.

How to Invest Like a Money Boss

Back when I was doing stupid stock-market tricks, I didn't have a coherent investment philosophy. Today, I do. After a decade of reading and writing about money, I've come to believe that a smart investor should:

Start early

“The amount of capital you start with is not nearly as important as getting started early,” writes Burton Malkiel in The Random Walk Guide to Investing. “Every year you put off investing makes your [goals] more difficult to achieve.” The secret to getting rich slowly, he says, is the extraordinary power of compounding. Given enough time, even modest investment returns can generate real wealth.

Think long-term

It takes time — decades, not years — for compounding to work its magic. Plus, there's another reason to take the long view. In the short term, stocks are volatile. The market might jump 30% one year, then fall 20% the next. But in the long run, stocks return an average of around 10% per year (or about 7% when you factor inflation).

Spread the risk

Another way to smooth the market's wild ups and downs is through diversification, which simply means not putting all of your eggs into one basket. Own more than one stock, and own other types of investments (such as bonds or real estate). When you spread your money around, you decrease risk while (counter-intuitively) earning a similar return.

Keep costs low

In Your Money and Your Brain, Jason Zweig notes, “Decades of rigorous research have proven that the single most critical factor in the future performance of a mutual fund is that small, relatively static number: its fees and expenses. Hot performance comes and goes, but expenses never go away.” Warren Buffett has bet a million bucks that, because of high fees, an actively managed hedge fund cannot beat an average market index fund. He's winning the bet, and by a wide margin.

Keep it simple

Most people make investing far too complicated. There's no need to guess which stocks are going to outperform the market. In fact, you probably can't. For the average person, it's much easier and profitable to simply buy mutual funds.

Make it automatic

It's important to automate good behavior so that you don't sabotage yourself. You want to remove the human element from the equation. I recommend creating a monthly transfer from your checking account to your investment account. And if you have a retirement plan at work, ask HR to max out your contribution via payroll deduction.

Ignore everyone

You might think that a smart investor pays attention to daily financial news, keeping his finger on the pulse of the market. But you'd be wrong. Smart investors ignore the market. If you’re investing for twenty or thirty years down the road, today’s financial news is mostly irrelevant. Make decisions based on your personal financial goals, not on whether the market jumped or dropped today.

Conduct an annual review

While it does zero good to monitor your investments day to day, it's smart to look things over occasionally. Some folks do this quarterly. I recommend once per year. An annual review lets you shift money around, if needed. And it's a great time to be sure your investment strategy still matches your goals and values.

How would you put the Money Boss investment philosophy into action? The answer is shockingly simple: Set up automatic investments into a portfolio of index funds, mutual funds designed to match the movement of the market (or a portion of the market).

Note: Unlike some financial bloggers, I don't believe that index funds are the only answer. They're a smart answer and the best bet for the average person, no question, but there are other investment strategies that match my philosophy. And here's a secret that maybe I shouldn't tell: Even outspoken index fund advocates usually have some portion of their portfolio dedicated to experimenting with other investment strategies.

With the background out of the way, let's answer Sandy's questions.

What Stocks and Funds Do I Hold?

At the moment, 6.37% of my portfolio is devoted to corporate bonds. This is the legacy of a pre-divorce investment decision that Kris and I made together. She was nervous about stock-market volatility in 2009, so we put a large portion of our money directly into municipal and corporate bonds. During the divorce, she got most of those bonds. I was left with a few, which have gradually been reaching maturity, at which time they become available cash. (Actually, I've been using the money from these bonds to fund my living expenses for the past few years.)

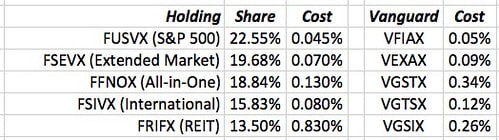

The bulk of my investment portfolio — 90.41%, in fact — is invested in five Fidelity funds. The following table shows the name (and type) of each fund, its share of my overall portfolio, its expense ratio, and the closest Vanguard equivalent (with Vanguard's costs):

Why Fidelity and not Vanguard? In 2008, I wanted to open a self-employed 401(k) with Vanguard, but the company didn't offer one. I went with Fidelity instead. As a result, I chose to invest in Fidelity funds — which turned out to be cheaper than Vanguard funds. (This isn't true across the board, but it's true for the funds I hold…except the REIT.) I believe both Fidelity and Vanguard can be fine choices for individual investors looking to keep costs low. When we set up Kim's individual investment account, we used Vanguard for both the funds and the brokerage.

Of the remaining 3.22% of my portfolio, 2.64% is currently in cash (or cash equivalents) and 0.58% is in “legacy” investments, by which I mean stocks and funds I bought long, long ago. (I still own 1115 of Sharper Image stock, for instance, which is worth zero dollars. I keep it to remind me of my stupidity.)

Note that I haven't included the value of my home in these calculations. I've only included my active investment portfolio. If we add in the condo, then it makes up 29.81% of my net worth, the Fidelity funds are 63.46%, and the bonds are 4.47%.

What Criteria Do I Use to Shift Funds?

This one's quick and easy: I don't shift funds. In the past seven years, I haven't made a single transaction to move funds around. I think market timing is impossible on a micro level. Nobody knows what's going to happen from one day to the next. And while it might be possible to guess at broad trends — both the stock market and the Portland housing market feel frothy right now, for instance — there's no way that I, personally, have the knowledge necessary to guess when the next crash is coming. So I don't even try.

Many people practice rebalancing, of course, which means they adjust their portfolio at regular intervals so that it doesn't become too heavily weighted in one area. Say your target is to have 60% in stocks and 40% in bonds. At the end of each year, you might evaluate your current portfolio to be sure your allocation is close to that. If stocks have had a good year, you might find they make up 72% of your portfolio! In that case, you'd sell some shares and buy more bonds.

I don't rebalance.

I have a high risk tolerance. And the more I read, the more I'm convinced that the ideal allocation is 100% stocks. That's my target. (Your target, obviously, will likely be something different.) I move closer to that target every time a bond matures and leaves my portfolio. No need to rebalance.

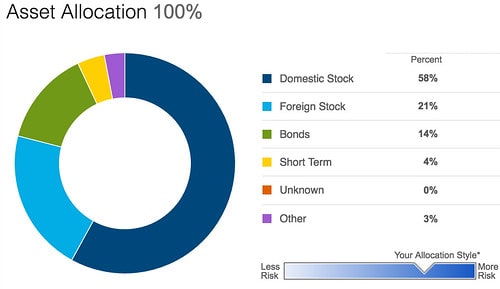

Here's my current allocation:

My portfolio is 79% stock right now. I'm happy with that. I'd be happy if it were 89% stock, but that's not going to happen. Because the funds I own also happen to contain some small percentage of bonds, I'm likely to always have about 15% of my money in bonds. I'm fine with that too.

Really, I think trying to find some sort of perfect allocation is impossible. It's a fool's errand, a red herring. It's part of the optimization trap. I think you should pick a good target and get close to it, but not worry about total precision. The less you trade, the more money you save.

Warning: Again, I want to stress that I have high risk tolerance. My own research leads me to believe that the best long-term asset allocation is 100% stocks. Your own risk tolerance and research will likely lead you to a different conclusion.

What's My Rate of Return?

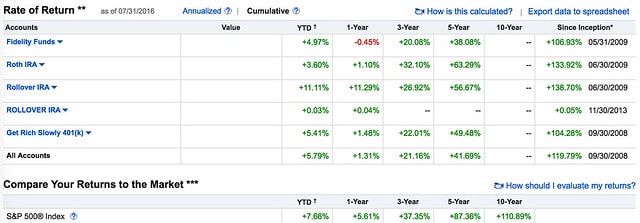

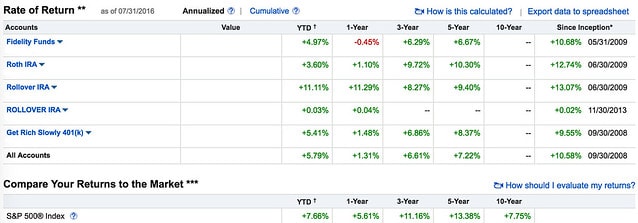

Sandy asked me to share my quarterly rate of return. I don't have that info, and I don't think it's useful. However, Fidelity does provide a couple of reports that show returns over time. Let's look at them.

First up, here are my cumulative returns:

And here are the equivalent annualized returns:

You can click either of those to get a larger, easier-to-read image.

As you can see, my personal rate of return lags behind the S&P 500. Why is that? Because my portfolio isn't 100% stocks! Still, I have nothing to complain about with a 10.58% annualized return since 2008. That number makes me very happy.

Here's how my five largest holdings have fared against the S&P 500:

I'll admit: That international fund looks problematic. Its poor performance puts a drag on my portfolio's overall returns. Still, I have no desire to sell it. It's a piece of diversification that gives me peace of mind.

How Much Do I Invest Each Month?

Lastly, Sandy wants to know how much I invest each month. This is another easy one. I don't. I do not have a regular income, so I don't make regular investments. I'm no longer in wealth accumulation mode; I'm in wealth preservation mode.

I have achieved Financial Independence, which means my net worth should be sufficient to support my current lifestyle for the rest of my life. Having said that, I do hope to make more money in the future. I have Enough, but it'd ease my mind to have a little more, to create a buffer between me and bad times.

As my income increases, I'll first funnel money into my Roth IRA. If I'm able to build my business in the way I hope, I'll eventually resume contributions to my self-employed 401(k) plan (which is 100% invested in FFNOX). Truthfully, I'm eager to make more money soon. I really do think the stock market has been riding high for a very long time and we're due for a drop. When it falls, I'd like to have some money to put into it.

That's it. That's how my money is invested. But now I'm curious. How is your money invested? What stocks and funds do you hold? What criteria do you use to shift funds around? How much do you invest each year? And what have your rates of return been like? Are you happy with your portfolio? What would you like to change? And why?

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)