What is the average rate of return on stocks?

One of the fundamental ideas I try to promote here at Get Rich Slowly is your savings ought to be invested for long-term growth. You ought to use the magic of compounding to create a wealth snowball.

Naturally, you want put your money into an investment that offers a reasonable return and acceptable risk. But which investment is best? I believe — as do most financial experts — that you’re most likely to achieve high returns by investing in the stock market.

But why do so many people favor the stock market? How much does the stock market actually return? Is it really better than investing in real estate? Or Bitcoin? Let’s take a look.

How Much Does the Stock Market Grow Each Year?

In Stocks for the Long Run, Jeremy Siegel analyzed the historical performance of several types of investments. Siegel’s research showed that for the period between 1926 and 2006 (when he wrote the book):

- Stocks produced an average real return of 6.8%. “Real return” means return after inflation. Before factoring inflation, stocks returned about 10% annually.

- Long-term government bonds yielded an average real return of 2.4%. Before adjusting for inflation, they had a return of about 5%.

- Gold had a real return of 1.2%. “In the long run, gold offers investors protection against inflation,” writes Siegel, “but little else.”

My own calculations — and those of Consumer Reports magazine — show that real estate does worse than gold over the long term. (I come up with a real return of just under one percent.) Yes, you can make money with real estate investing, but it’s far more complicated than just buying a home and expecting its value to soar. (It’s important to note that returns on real estate are a contentious subject. This recent academic paper analyzing the rate of return on “almost everything” found that housing actually outperforms the stock market by a slight margin.)

Siegel found that stocks have been returning a long-term average of about seven percent for 200 years. If

you’d purchased one dollar of stocks in 1802, it would have grown to more than $750,000 in 2006. If you’d instead put a dollar into bonds, you’d have just $1,083. And if you’d put that money in gold? Well, it’d be worth almost two bucks — after inflation.

Siegel’s findings aren’t unique. In fact, every book on investing shows the same thing. Over the long term, the stock market produces an average annual return of about 10%.

Note: As much as I love Dave Ramsey’s advice on getting out of debt, he’s notorious for providing misinformation on investment returns. He argues that you can expect to earn 12% in the stock market. This makes a lot of people — including me — tense. You can’t count on earning a 12% return from stocks. You’re going to earn more like 7% after inflation, and I’d argue that in order to give yourself a margin of safety it’s better to assume 5% instead.

Average Is Not Normal

Over the past 200 years, stocks have outperformed every other kind of investment. But before you rush out and sink your savings into the stock market, you need to understand a couple of things.

First up, it’s important to grasp that average market performance is not normal.

In the short term, investment returns fluctuate. The price of a stock might be $90 per share one day and $85 per share the next. A week later, the price could vault to $120 per share. Bond prices fluctuate too, albeit more slowly. And yes, even the returns you earn on your savings account change with time.

Just a few years ago, high-interest savings accounts yielded five percent annually in the U.S.; today, the best accounts yield about one percent.

While it’s true that stocks average a 10% annual return, it’s rare that the stock market produces a return close to that average in any given year. Recent history is typical. The following table shows the annual return for the S&P 500 over the past twenty years (not including dividends):

![Note that my source for this data is Wikipedia, which may or may not be a good thing. [S&P 500 Annual Returns]](https://www.getrichslowly.org/wp-content/uploads/sp-500-annual-returns.jpg)

The S&P 500 earned an average annualized return of 7.19% for the twenty-year period ending in 2017. But in only one of those twenty years (2004) were stock market returns anywhere near the average for the entire time span. (Note: This twenty-year period has the lowest rate of return on record for the S&P 500.)

Short-term market movements aren’t an accurate indicator of long-term performance. (And make no mistake: One year is “short term” when it comes to investing.) What a stock or fund did last year doesn’t tell you much about what it’ll do during the next decade.

Because of their volatility, stocks outperform bonds during only 60% of one-year periods. But over ten-year periods, that number jumps to 80%. And over thirty years, stocks almost always win.

Stocks for the Long Run

The best way to build your wealth snowball is to invest in the stock market. Doing so is likely to offer you the highest rate of return on your money. And the best way to approach stock-market investing is to take the long view. Forget about what the market does today or tomorrow. Focus on the future.

When I began to turn my financial life around, I made a habit of reading books about money. The more I read, the clearer certain patterns became. I wrote about these patterns in my very first post about getting rich slowly.

I’ve continued to read personal finance books, including books about investing. And I’ve continued to detect recurring themes. One of the most prominent themes — present in most investing books and present in most conversations with real-life financial planners — is that, in the long term, stocks produce attractive returns. They may fluctuate in the short term, and may even decline by 50% in a single year, but historically, they yield an investment return of about 10%.

But I’m no financial expert. I’m just an average guy who is trying to build his wealth. Let’s see what the actual experts have to say. In this post, I’ve included excerpts from four of my favorite books about investing.

From Yes, You Can…Achieve Financial Independence (2004)

This book by James Stowers contains some of the most complete information on investment returns that I’ve found. And Stowers presents it in interesting ways. Here’s what he says about comparing the short term to the long term:

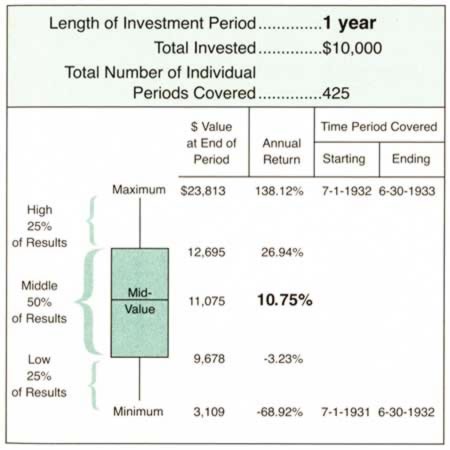

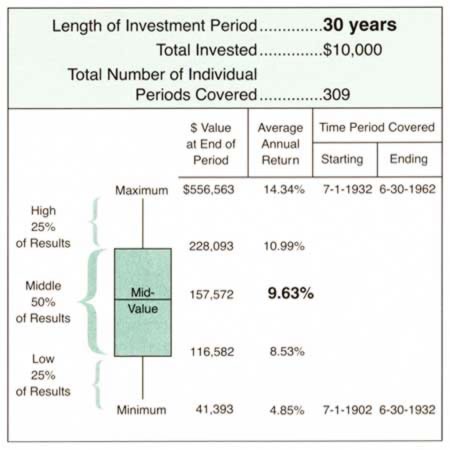

[A $10,000] investment made on 01 July 1932 would have realized, one year later, the worst one-year result out of 425 [periods tested]: minus 69%. Most people, if they had experienced those poor results, would have assumed that this was an indication of future performance and would have become discouraged. Many would have traded their investment back for dollars and tried to find another place to invest their money.Had they had confidence in the long-term opportunities of the Dow and left their investment undisturbed for another 29 years (30 years total), it would have been worth $556,563. The original investment, which began with the worst one-year result, grew at an average annual compound rate of 14.34% (the best 30-year result). As you can see, it is unwise to assume that short-term investment results are an accurate indication of long-term performance.

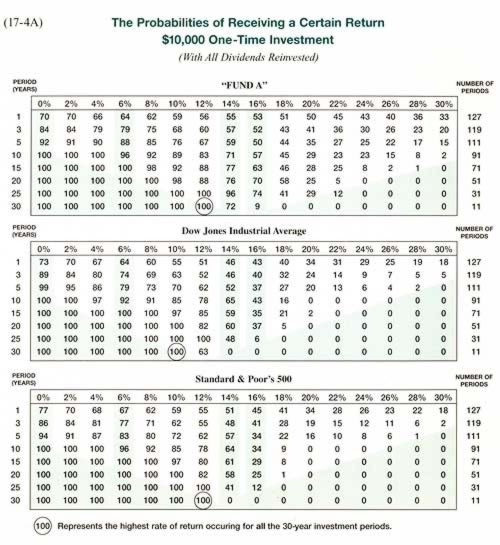

The following charts indicate the probability of obtaining a certain return from a $10,000 one-time investment. The top line of each chart indicates the one-year probabilities. So, for example, there’s an 55% chance that the S&P 500 Index will produce a 10% return over a one-year period. There’s an 85% chance of obtaining that return over a decade. But, historically, there is a 100% chance of earning that return over a 30-year investment career. (Ignore “Fund A” — it’s irrelevant to this discussion.)

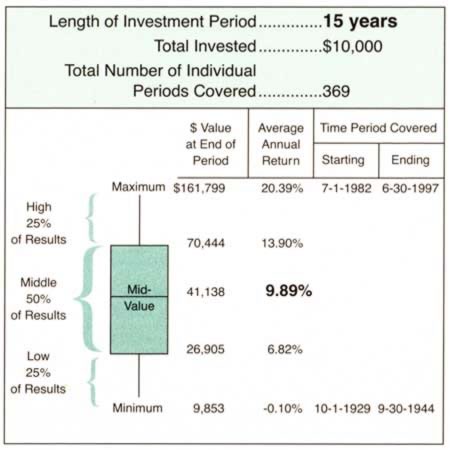

These next three charts provide snapshots of 1-year, 15-year, and 30-year investments from January 1897 to December 2003. The “individual periods” have quarterly start dates. Each chart breaks returns into quartiles. Watch how the numbers move to the middle — at about 10%.

From Saving and Investing (2005)

Michael Fischer’s slim volume remains one of the best and most under-rated finance books of the last few years. It’s a shame it doesn’t have a wider audience. Fortunately, Fischer’s Saving and Investing channel on YouTube continues to grow. (1350+ subscribers now!) Here’s his take on the impact of time on investment returns:

From his book:

In order to capture positive long-term returns from a volatile asset like equities [stocks], it has been easier to predict the result when the asset is held for a long time. Over short time periods the returns are very difficult to predict, and jump around a lot. A longer time horizon significantly increases the likelihood of having a good result.

One implication of this is that when we invest in volatile assets like equities, our investment horizon should be longer to increase our chances of achieving a positive result.

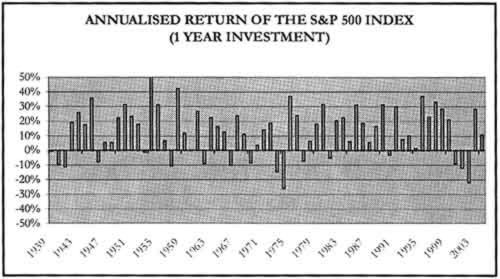

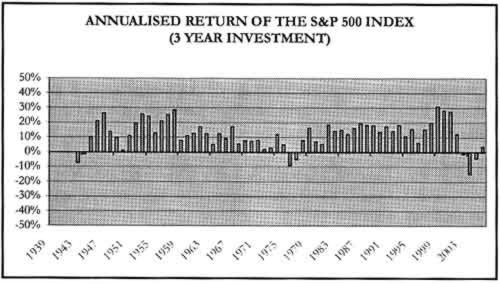

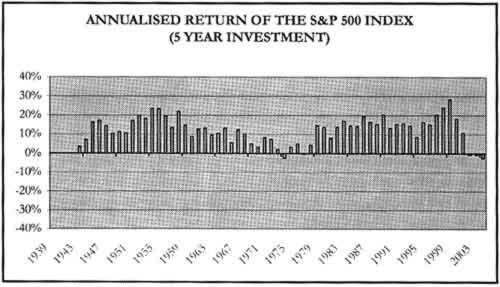

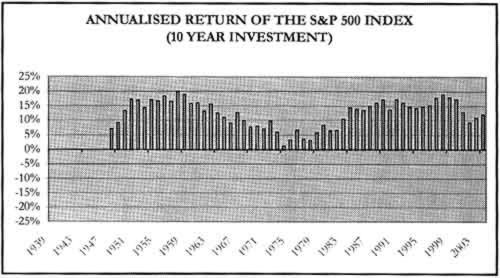

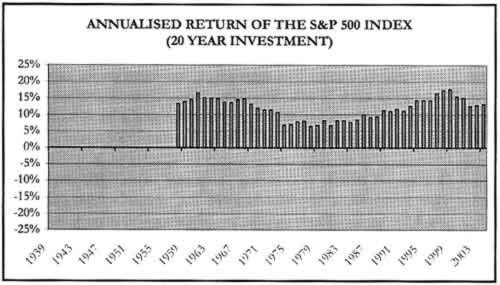

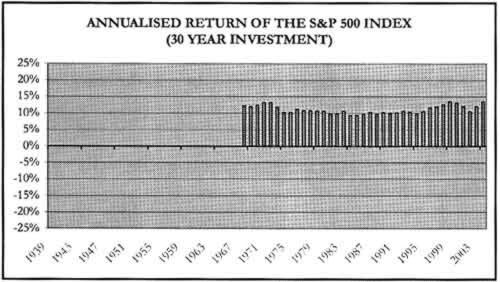

Here are series of charts tracing the annualized return of the S&P 500 Index for a variety of time periods ending from 1939 to 2003. Notice how the one-year returns are all over the map. As the investment horizon increases, the returns become smoother.

From The Four Pillars of Investing (2002)

If I could recommend one book to those who want to learn about the stock market, I think it would be The Four Pillars of Investing. The author doesn’t sugar-coat anything. As he describes the history of speculation, he explains that there’s every possibility that the U.S. stock market’s past performance could simply collapse in the future. All the same, he cannot offer a better long-term investment:

Short-term risk, occurring over periods of less than several years, is what we feel in our gut as we follow the market from day to day and month to month. It is what give investors sleepless nights. More importantly, it is what causes investors to bail out of stocks after a bad run, usually at the bottom. And yet, in the long-term, it is of trivial importance. After all, if you can obtain high long-term returns, what does it matter if you have lost and regained 50% or 80% of your principal along the way?

This, of course, is easier said than done. Even the most disciplined investors exited the markets in the 1930s, never to return…If you want to earn high returns, be prepared to suffer grievous losses from time to time. And if you want perfect safety, resign yourself to low returns…High investment returns cannot be earned without taking substantial risk. Safe investments produce low returns.

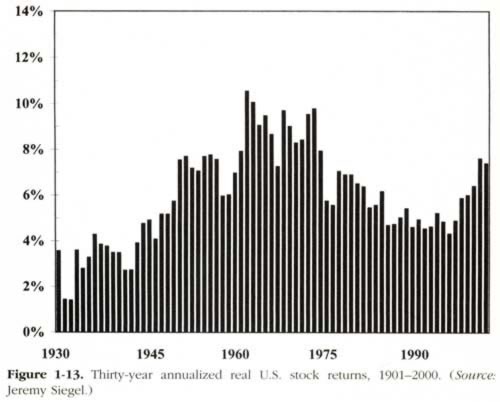

In this chart, Bernstein shows the 30-year annualized inflation-adjusted return on U.S. stocks.

From The Random Walk Guide to Investing (2003)

Finally, financial guru Burton Malkiel also makes the case for stock-market investment. Like the others, he notes that the stock market can (and does) enter prolonged periods of declining value:

Common stocks have been the big winner, providing an average annual return of about 10 percent. This 10 percent return includes both the dividends and capital gains resulting from growth over time in corporate earnings and dividends. But these generous returns have been achieved at the expense of considerable annual volatility, which is a good indicator of risk.

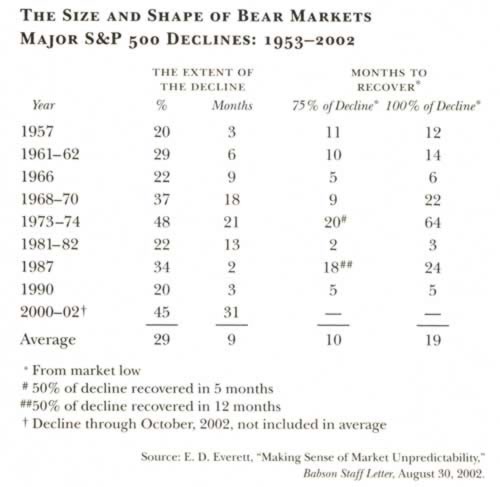

In some years, stocks have lost more than a quarter of their value. And sometimes there have been three years in a row of negative returns, as was the case from 2000 to 2002. In fact, equity investors have suffered through several severe bear markets over the past fifty years. The chart below shows the magnitude of the declines as well as the number of months it took the stock market to recover.

Later in the book, Malkiel writes:

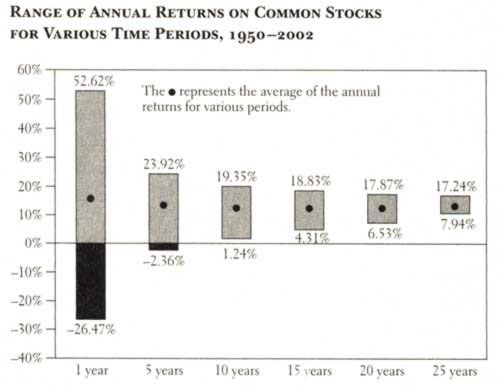

It turns out that the longer you hold your stocks, the more you can reduce the risk you assume from investing in common stocks. The chart below makes the point convincingly. From 1950 through 2002, common stocks provided investors with an average annual return of a bit more than 10 percent…

Even during the worst 25-year period you would have earned a rate of return of almost 8 percent — a quite generous return and one that was larger than the long-run average return from relatively safe bonds. This is why stocks are a wholly appropriate medium for investing in long-term retirement funds.

The Bottom Line

All of the books say the same thing: over the long term, stocks have returned an average of about 10% per year. Obviously, there’s no guarantee that they’ll continue to offer these sorts of returns, but there’s no reason to believe that they won’t, either.

Even after market crashes, I have confidence (some might call it “faith”) that we’ll always see a regression toward the mean. That is, the returns will tend toward the historical norms to which we are accustomed. If you do not share this confidence (or “faith”), then I’d argue that your risk tolerance is too low, and you should consider other investments.

It’s a stock-market crash at the back end of your investment life that will hurt you — if your asset allocation isn’t appropriate for your age — not a crash at the front end. A crash at the front end has, historically, been a good thing. What does this mean? If you’re in your twenties or thirties, the statistics would seem to indicate that your best bet right now is to buy into the stock market. That’s what I intend to continue doing.

Don’t let wild market movements make you nervous. And don’t let them make you irrationally exuberant either. What your investments did this year is far less important than what they’ll do over the next decade (or two, or three). Don’t let one year panic you, and don’t chase after the latest hot investments. Stick to your long-term plan.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)