Building a wealth snowball

To conclude “back to basics” month at Get Rich Slowly, today we're going to explore an important concept, one that's new to most people. Today, I want to talk about building a wealth snowball.

After nearly twelve years of writing about money, I've gone from not knowing anything to having some very strong opinions.

I now believe know, for instance, that the single most important thing you can do to improve your financial situation is also the most elementary: Increase the gap between your earning and spending.

Spend less than you earn — that's the basic rule of personal finance.

People don't want to hear this. It sounds too basic, too facile and simplistic. It's reassuring to believe that the answer to your financial woes is somehow more complex. It isn't. The answer to every financial problem is to increase the gap between your earning and spending. (The complicated part, the tough part, is developing the skills and mental fortitude to make this happen.)

If you spend less than you earn, you'll build a wealth snowball that will allow you do do the things you dream of doing and to have the things you dream of having.

What on earth is a wealth snowball? It's the ever-increasing stash of cash you have in your banking and brokerage accounts as you boost your saving rate and earn returns on your investments. Your wealth snowball is your nest egg, your net worth.

To better explain the wealth snowball, it might help to first review the concept of the debt snowball.

The Debt Snowball

Most of you are probably familiar with the debt snowball. This term — popularized (but not invented) by Dave Ramsey — describes a method for rapidly repaying debt. Here's how it works:

- Let's say Jim is in $20,000 debt. The minimum payments on his debts come to $500 per month. Each month, he pays this $500 total toward his debts.

- When Jim repays his first debt, let's say one $100 minimum payment disappears. Now his minimum payments total $400 per month. With the debt snowball, however, Jim doesn't reduce his debt payments to $400. He keeps them at $500 per month, applying that extra $100 beyond the minimum payments to the debt of his choice.

- Now let's assume Jim pays off a second debt, eliminating one $120 minimum payment. Now his minimum payments total $280 per month. Again, Jim keeps his total debt payments at $500 per month, throwing an extra $220 per month at whichever debt he chooses.

- This pattern continues until all of Jim's debts have been repaid. He never drops his debt payments below $500 per month, even when his total minimum payments are far lower.

With the debt snowball, the order in which Jim repays his debts is irrelevant. (With Dave Ramsey's version, you repay debts with low balances first. There are other ways to order the debts, though.) What matters is that as you eliminate each debt, you keep your total debt payments steady. Doing this creates an ever-accelerating snowball of debt reduction.

To make the snowball even more powerful, Jim could add to his total monthly debt payments. Imagine he gets a $200 per month raise at work. Instead of spending that money, he could add it to his $500 debt payment to achieve a total of $700 per month in debt reduction. In this manner, his debt snowball can become an unstoppable force.

Life After Debt

But what happens once Jim is able to get out of debt? What happens when he no longer has debt payments and suddenly finds himself with an extra $500 in cash each month?

For folks who take the view that debt reduction is a goal and not a side effect, there's a real danger that this money will now be used to fund consumerism — and that this consumerism will snowball too, leading them right back into debt. I've seen it happen.

But debt reduction is an outcome and not a habit. As such, I think it makes a sub-optimal goal. Better instead to focus on the habit that leads to debt reduction. That habit is saving. That habit is creating a gap between your earning and spending.

For Jim to be able to pay $500 toward his debt each month, he had to increase his earning and decrease his spending until he had enough cash to make the payments. It's this action — spending less than he earns — that should be Jim's goal, not debt reduction. Debt reduction is merely a side effect, an outcome, a result of implementing a smart action.

If instead of focusing on debt elimination as a goal, Jim instead pursues the gap between his earning and spending, he puts himself in a terrific position to enjoy other positive side effects once his debt is gone. Perhaps the best of these side effects is the reverse of the debt snowball, the wealth snowball.

The Wealth Snowball

Now let's imagine that Jim had never become focused on debt elimination as a goal. Let's imagine that he always viewed it as a side effect, and that he (rightly) kept his attention on his saving rate.

Once Jim has finished his debt snowball, once he's repaid his $20,000 in debt, he now has $500 per month to do with as he pleases. Because Jim is a smart fellow, he decides to build a wealth snowball. Here's how it works:

- Jim opens a retirement account. Because he reads Get Rich Slowly, he knows how to invest. He takes the $500 per month he had been using to repay debt, and now he puts that money into an index fund at Vanguard (or Fidelity).

- Whenever Jim has a chance to work overtime, he works overtime. He doesn't spend that money, but puts it toward his new wealth snowball. Same thing whenever he gets a raise: He invests that money for future growth.

- Jim looks for ways to economize, large and small. He bikes to work during the summer. The money he saves, he invests. He and his wife move to a smaller home, one with a smaller mortgage. He invests the difference between the old payment and the new payment.

Jim does what he can to increase the gap between his earning and saving, because he's come to understand that his saving rate is the key to building an enormous wealth snowball. If he can invest $1000 per month, his wealth snowball grows twice as quickly as if he were to invest $500 per month.

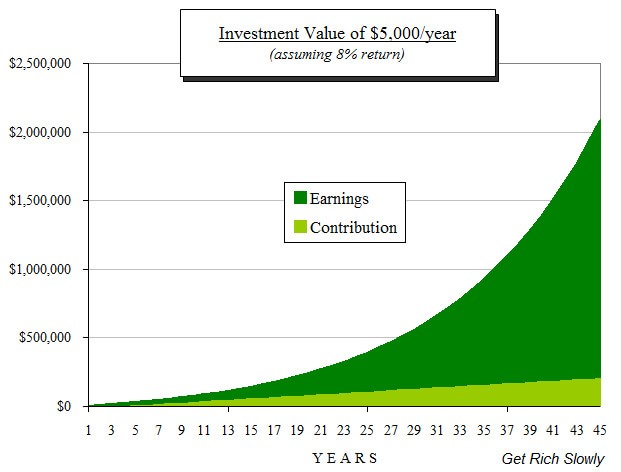

Because I'm lazy and don't want to make a new graph, I'm going to re-use the same graph I used in yesterday's article about how to invest. Although the numbers are different than the ones I've been using for Jim, the idea is the same. Let's assume Jim's wife Jane invests $5000 per year for 45 years and earns an 8% return on her investments. Here's how her wealth snowball would grow with time.

Pretty amazing, huh? Jane contributes $5000 per year for 45 years. That's a total of $225,000. In the end, her investments are worth ten times what she contributed! That's the wealth snowball in action.

The Shockingly Simple Math of the Wealth Snowball

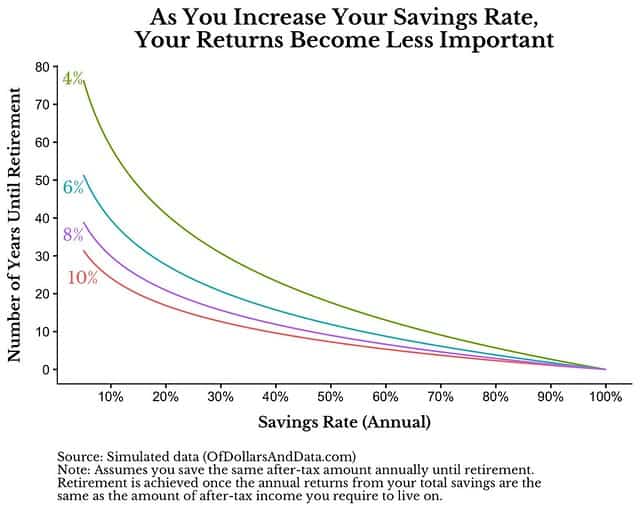

This concept is what Mr. Money Mustache has famously referred to as the shockingly simple math behind early retirement. Look at these numbers.

- With a 10% saving rate, you need to work for 50 years to save enough to afford to retire. Your wealth snowball grows — but not quickly.

- With a 20% saving rate, you need to work for 37 years before you'll have saved enough to retire.

- With a 35% saving rate, you need to work for 25 years to achieve Financial Independence.

- With a 50% saving rate, you only need to work for 17 years before you can retire.

- And if you can manage to save 70% of your income, you could retire in 8-1/2 years!

The “shockingly simple math” is true even if you have zero desire to retire early. Whatever your goals are, the more you're able to save, the quicker you can achieve them.

This isn't magic. It's not a scam. It's math. It's the wealth snowball in action.

The sooner you grow your wealth snowball — and the bigger you grow it — the sooner you can do the things you dream of doing.

Last week at Of Dollars and Data, Nick Maggiulli shared another benefit of a large saving rate: As you increase the amount you save, your investment returns become less important. Here's a graph from Maggiulli's article that demonstrates this phenomenon:

If you only save 10% of your income, then the growth of your wealth snowball is largely at the mercy of market returns. If the stock market has several good years in a row, your wealth snowball embiggens. If it has several bad years in a row, your wealth snowball remains roughly the same size.

But if you save half your income, for instance, market forces have a minimal impact on how quickly your wealth snowball grows, how quickly you can achieve your financial goals. Sure, there's an impact, but because you're saving half your income, that impact is much smaller than it is for your friends who are saving less.

A Call to Action

My not-so-secret wish is that every reader of Get Rich Slowly would make it their personal mission to increase their saving rate, to widen the gap between their earning and spending so that they could build ginormous wealth snowballs that allow them to pursue their purpose.

For readers who already save, my dream is that you would save even more.

For readers who are in debt, start where you are. Rearrange your life to achieve a positive cash flow, then use that positive cash flow to build a debt snowball. When you've used that debt snowball to crush your debt, do not stop. Keep that snowball rolling, but now use it to build wealth.

The journey may seem difficult now. I get it. But I believe in you. You can do it. Wherever you are, whoever you are, you too can build a wealth snowball if you try.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)