All Value is Perceived Value

A lot of folks hate advertising, and it’s hard to blame them. But in a 2009 TED talk, ad man Rory Sutherland argues that what advertising creates — perceived value — doesn’t deserve its bad reputation.

If you want to live in a world with less Stuff, for example, your two options are:

- Live in a world that’s poorer, which most of us don’t want to do.

- Live in a world where greater value is placed on the intangible — which can conserve resources

Confused? It all comes down to your perception.

Perceived value

Most people think that value is about making things — the labor and the raw materials — and that any intangible value added on top isn’t real. That’s understandable. You can’t touch or feel or see perceived value, yet it affects our actions more than we’d like to admit.

Sutherland uses the example of placebos:

What on earth is wrong with placebos? The seem fantastic to me. They cost very little to develop. They work extraordinarily well. They have no side effects, or if they do, they’re imaginary, so you can safely ignore them.

Another example is Fredrick the Great of Prussia, who wanted Germans to adopt the potato to provide a second carbohydrate staple in addition to wheat. (This would stabilize price volatility in bread and lower the risk of famine.) The problem, says Sutherland, was that Prussians weren’t big on vegetables, and the potato is rather ugly.

So, Fredrick made a law that people had to grow potatoes, and there are records of people being executed for refusing to comply. This didn’t work, so he tried a new approach, which was to declare the potato as a royal vegetable — only royalty could eat it. He had a royal potato patch planted, with guards who were asked not to guard it too well.

“Now 18th century peasants know that there is one pretty safe rule in life, which is if something is worth guarding, it’s worth stealing,” says Sutherland. Pretty soon there was an underground potato-growing operation (ha — underground).

Mustafa Kemal Atatürk, the first president of Turkey, used a similar marketing ploy to create negative perceived value when he wanted to make the country more modern by discouraging the wearing of a veil. Instead of simply banning the veil, which would incite anger among the people, he made a law that prostitutes had to wear the veil. (Sutherland admits he can’t verify this story, but “…it does not matter,” he says. “There is your environmental problem solved, by the way, guys: All convicted child molesters have to drive a Porsche Cayenne.”)

All value is relative — all value is perceived value. This is why all but maybe the top expert wine tasters think a more expensive wine tastes better (and it stimulates in the parts of the brain that experience pleasure), when really it’s a cheap $5 bottle of wine — or the exact same wine to which they’re comparing it.

Impulse saving

Eventually, Sutherland’s talk ventures into the realm of personal finance. He shares his thoughts on impulse buying, which marketing has made extremely easy, and the idea of impulse saving:

If you had a large red button…on the wall of your home, and every time you pressed it it…put $50 into your pension, you would save a lot more. The reason is that the interface fundamentally determines the behavior…We’ve never created the opportunity for impulse saving. If you did this, more people would save more. It’s simply a question of changing the interface by which people make decisions.

To get people to save more, Sutherland says, we need to think about fundamental ways to change human behavior. Obviously, being an ad man, his job is to encourage impulse buying — not saving. But it’s interesting to think about how the methods that get people to purchase a magazine and Coke at the check-out counter might be used to get them to stash an extra $10 per day in a savings account.

For example, automatic monthly billing is a great way to get regular revenue from a customer. Think about how gym memberships operate. Half the time people quit the gym and keep paying, either because they forgot about the dues or they’re too lazy to cancel. Many of us use the same principle to encourage savings by paying ourselves first through automatic deposits, which we know is much more effective than relying on willpower or memory to save every month.

Wanting what we’ve got

“We need to spend more time appreciating what already exists,” Sutherland says, “and less time agonizing over what else we can do.”

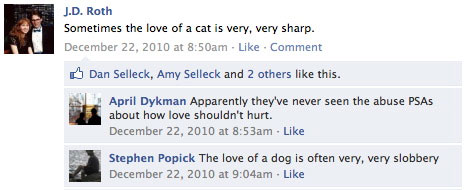

One way to start to place higher value on what already exists is through social networking. (Yes, that threw me for a loop, too; Facebook and I have a love-hate relationship.) But get this: He says there’s some evidence that social networking helps people appreciate what they have because it lets them share news and give “badge value” to everyday, trivial activities.

“So [social networks] actually reduce the need for spending great money on display,” he says, “and increase the kind of third-party enjoyment you can get from the smallest, simplest things in life. Which is magic.”

That’s true — at least in my social network. People post about funny things their kids say, a photo of the cookies they just baked, pictures of loved ones, updates about funny stories or the things that are making them happy. Nobody posts shots of their new Hummer or boasts about spending $500 on new clothes. It’s pretty humdrum, really, but also, as Sutherland says, a little magical.

Appreciating everyday, trivial activities may help you save money.

Another example is the evidence that past a certain modest economic level, we tend to judge our happiness on a relative basis. This is why “keeping up with the Joneses” leads so many to financial ruin. Chances are that if your friends place high value on new cars and fancy clothes, you’ll be less happy without those things. At the very least, it’s going to be uncomfortable to suddenly stop spending money with your friends or to opt out of regular shopping trips. To change the interface and fundamentally change your behavior, you might need to branch out and find a community with the same value perceptions you’re trying to cultivate.

Here’s my favorite part (because I get to pick the brains of GRS readers!): I’d love to hear your ideas for new ways to fundamentally change human behavior. How can we increase the perceived value of saving? What are ways to encourage an appreciation of what we already have?

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)