How the things we own vary at different levels of net worth

Do people at different levels of wealth spend their money on different things? Of course they do.

Some of these differences are by necessity, of course. If you have a million dollars in net worth, for example, then even average spending on your weekly meals will make up a much smaller portion of your net worth than the same spending would for somebody who has a net worth of $10,000.

(To put it another way: If you have two families that both spend $100 per week on food, but one family has a net worth of $1,000,000 and the other family has a net worth of $10,000, then the wealthier family spends less than one-tenth of one percent of its wealth each week on food while the poorer family spends one percent of its wealth.)

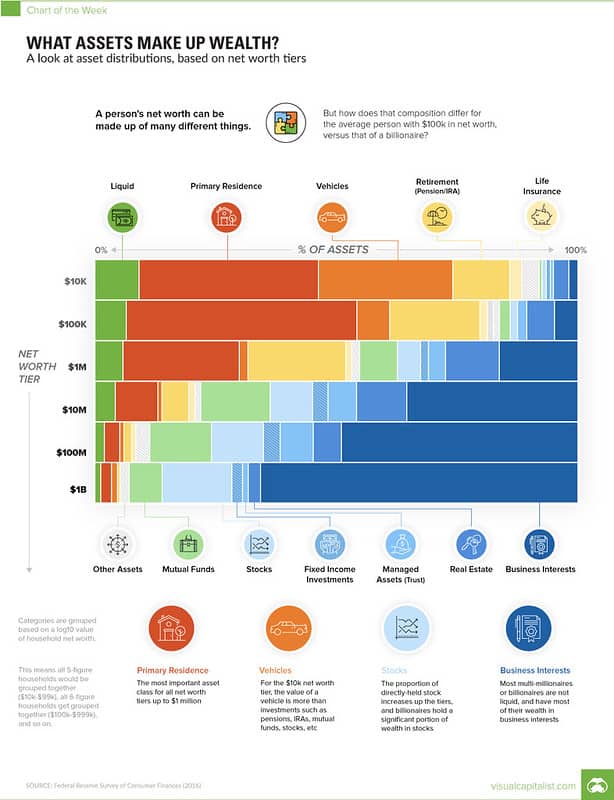

To illustrate how people at different levels of wealth allocate their money differently, the folks at Visual Capitalist have collated data from the Federal Reserve’s 2016 Survey of Consumer Finances to create this chart. (Click image to open full-size version in new window. Or visit Visual Capitalist for more info.)

The chart divides Americans into six groups based on net worth. For each group, it shows how much of this wealth is in various assets, such as cash, housing, and cars.

Most of the info here is unsurprising. At lower levels of wealth, certain assets make up a disproportionate amount of a person’s net worth. Basic housing, for instance, is by far the most important asset for folks with less than $1,000,000 in net worth.

There are, however, a couple of things that stood out.

- First, look at the value of vehicles as a percentage of net worth. For folks under $100,000 in net worth, vehicles make up almost as much wealth as housing. Holy cats! This is insane — and in a bad way. Cars are a depreciating asset. In fact, they depreciate quickly. If you’re piling much of what you own into the value of a vehicle, you’re basically throwing money away. From my experience, the wealthiest people I know drive the least-valuable cars. Coincidence or cause? You make the call.

- As net worth increases, business interests make up a greater percentage of wealth. I guess this makes sense, but it’s nothing I would have ever thought about. Not all of the wealthy people I know own businesses, but a greater percentage do than the folks I know who are poor. Not sure which is the chicken and which the egg in this scenario, though. Do people who own businesses build wealth? Or do people with wealth invest in businesses? Or both?

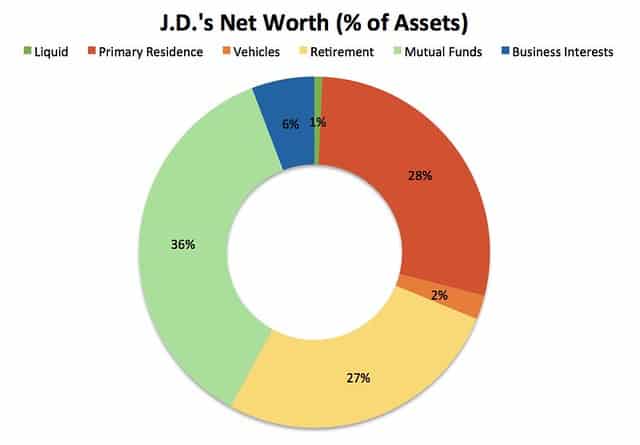

Inspired by this, I tried to create my own bar graph in Microsoft Excel. I failed. I did, however, make a “doughnut chart” using the same color scheme as the Visual Capitalist chart.

I was surprised to see that my asset distribution — representing a net worth of roughly $1.6 million — is very similar to the asset distribution for the millionaires in the chart above.

Where there are differences (the average millionaire has more non-residence real estate than I do), it’s because of the way I’ve classified things. A huge chunk of my retirement mone is in REITs, for instance, which are like mutual funds for real estate. In other words, I do have about the same amount of money in real estate as the average millionaire but I didn’t call it out that way.

Another point of interest: My net worth contains less liquid cash than other folks at a similar level of wealth. And believe me, I feel it. It sucks. The older I get, the more I understand why it’s important to keep at least some cash readily available in bank accounts so you don’t always have to be selling mutual funds to generate working capital.

I’m not sure there’s anything actionable to be gained from this info, but it’s interesting to look at.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)