Life after school: Advice for new graduates

On Tuesday evening I gave my first-ever presentation about personal finance. I spoke to a group of about 70 graduating seniors from Western Oregon University. My talk went okay. It wasn't terrible, but it certainly wasn't good. It's a start. I learned a lot, and I'll do better next time.

I was the fourth and final speaker of the evening, though. Before I talked about personal finance, three WOU alums spoke about life after college. While my talk might have been mediocre, theirs were outstanding.

Brian Reick

The first speaker was Brian Reick, who described his experience moving from job-to-job. He began knocking on doors right out of school and eventually found work. But the job wasn't perfect, and neither was he. He was fired after only two years. This experience taught him a couple things:

I quit my job — What should I do with my 401k?

When you leave your job, you have several choices regarding your 401(k). These options for a 401(k) rollover are pretty much universal, meaning they apply to every 401(k) and to every job change situation. Your options are:

Cash the 401(k) Plan and Receive a Full Pay-Out

I've listed this option first because it has the most serious ramifications.

Some Thoughts on Goals and Adult Education

Last night, Kris and I had dinner with Craig and Lisa. Craig is an architect. Lisa is a technical writer who has spent the past few years as a stay-at-home mother. (Lisa contributed two articles to GRS last year: How to find great deals on eBay and Career advice for the college graduate.)

Now that their children are a little older, Lisa has the itch to return to the workplace, to find some non-motherly pursuit to fulfill her. (She's a great mom, by the way, but she does have other aspirations.) She's now in her second term at a local university, studying to obtain a degree in graphic arts. She's taking just one evening class per term, but she loves it. This is something she's wanted to do for a long time, and she's juggled her life to make it happen.

After Lisa finished telling us about her classes — art history and Photoshop — I mentioned that I'd been thinking about going back to school, too. "One thing about making my living as a writer," I said, "is that it allows me freedom of hours. I can work when I want. I'm not sure I'm ready to take on another responsibility, but if I wanted to, I feel like I could pursue any degree I wanted: finance, computers, history."

6 Tips for Landing Your Dream Job

Do you have a job that's just like everyone else's? Are you looking for a nine-to-five...but wish you weren't? Do you wish there was another option, one that would lead to an exciting, unique, and fulfilling line of work?

I recently interviewed more than 100 people who currently hold their dream jobs as research for my new book. These individuals — who are travel journalists, event planners, fashion designers, forensic scientists, interior decorators, internet business owners and more — have one thing in common: persistence.

As unattainable as a dream job might sound, with the right amount of forethought and preparation, you can make the move as well. Here are six tips to get you started:

Uncommon lifestyles and the truth about the 4-Hour Workweek: An interview with Tim Ferriss

One of the fundamental premises of the Get Rich Slowly philosophy is that by making sacrifices and smart moves now, you can create a better life in the future.  It's a philosophy of deferred gratification.

It's a philosophy of deferred gratification.

But what if you don't want to wait to enjoy life's rewards? What if you want to take advantage of opportunities while you're still young? Is there a way to do this while still maintaining a smart approach to money?

Timothy Ferriss says there is.

How to Earn More from Your Current Job (Without a Raise or Promotion)

The most common ways to increase your salary are to get promoted or to negotiate a raise. But promotions don't come along often, and negotiating a raise may or may not result in a salary increase. So what do you do when you want to make more, but you're between promotions and raises? The good news is that you're not out of options. The bad news is that you'll need to get creative and may have to use a little elbow grease.

Low Effort, High Reward

401(k) match

401(k) match

Perhaps the easiest way to get your employer to give you more money is to contribute to your 401(k), if your employer offers a match. A 2007 Hewitt Associates survey [PDF] reports that 98% of employers put some money into 401(k) plans, and two-thirds provide matching contributions. According to Hewitt, the most common type of match is 50% of employee contributions up to 6% of pay. This means that if you make $60,000, then contribute $3,600 to your 401(k), your employer will kick in $1,800. That's free money that should never be left on the table, if you can help it.

Employee referral rewards

Most companies have employee referral programs, where an employee recommends a candidate and earns a bonus if the referral is subsequently hired. This is an effective way for firms to discover great candidates without paying exorbitant headhunter fees. But referral programs are not always well-publicized. Check with your HR department to see if a program exists and what the rewards are for referrers, then consider submitting a few referrals. Tread carefully, since referring a bunch of people who are not qualified to work at your company will reflect negatively upon you.

The value of a college education

I've been thinking lately about the value of a college education. I earned a B.A. in Psychology from Willamette University in 1991 (with a minor in English Lit, and almost another minor in Speech Com). What have I done with this degree? Almost nothing. Yet I do not regret the money and years I spent working to earn it.

I've been thinking lately about the value of a college education. I earned a B.A. in Psychology from Willamette University in 1991 (with a minor in English Lit, and almost another minor in Speech Com). What have I done with this degree? Almost nothing. Yet I do not regret the money and years I spent working to earn it.

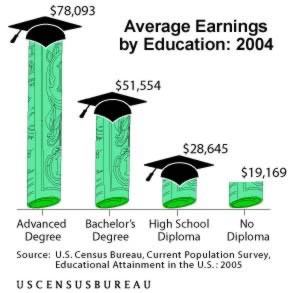

The Financial Value of a College Degree

Does earning a college degree make a difference to your future? Absolutely. The facts are striking. On average, those who have a college degree earn almost twice as much as those who do not. According to the U.S. Census Bureau:

Adults with advanced degrees earn four times more than those with less than a high school diploma. Workers 18 and older with a master's, professional or doctoral degree earned an average of $82,320 in 2006, while those with less than a high school diploma earned $20,873.

How to earn extra income through private tutoring

I've been a private tutor for the better part of seven years now. It kept me in spending money as a part-time job in college, and it has turned into a full-time gig for me over the last few years. The best part about it, though, is that it's an easy concern to keep going whether you have three or thirty hours a week to devote to it.

What to Tutor

I've taught everything from high school writing to college calculus to professional certification exams for public school teachers. That's just the tip of the iceberg: there's a market for tutors for every standardized test in existence, and probably every academic subject at every level, too. Heck, much of this article probably applies to things like music lessons, as well.

Quitting the day job: Finding the guts to pursue your dreams

Something amazing has happened in the past eighteen months. While I've been learning about personal finance — and sharing my knowledge with you — Get Rich Slowly has grown from a small site with a couple hundred readers into a real-life business. GRS currently has 35,000 subscribers and generates $5,000 in monthly revenue. It also takes most of my time. This is a blessing and a curse.

The Blessing

As my income from this site has grown, I've been able to achieve my financial goals more quickly. In two weeks, I'll be debt-free except for the mortgage. I have an emergency fund. I'm maxing out my Roth IRA every year. Get Rich Slowly has also put me in touch with a lot of great people: readers, colleagues, and media contacts. Most of all, I've learned tons about personal finance. I'm still a novice when it comes to investing and retirement planning, but I'm a novice who knows how to find the information he needs, and who is willing to share it with others.

The Curse

As wonderful as this site has been to me, it's not without its drawbacks. Chief among these is that it takes time. Kris and I used to do more things together. I used to have spare time to read books and to play games and to hang out with my friends. Though I still do these things whenever possible, more of my time is devoted to providing quality content. Writing Get Rich Slowly is literally like having a second full-time job.

Breaking the Shackles: How to Escape from Minimum Wage

.jpg) Earlier today I provided a statistical snapshot of minimum wage earners. The numbers indicate that in the United States:

Earlier today I provided a statistical snapshot of minimum wage earners. The numbers indicate that in the United States:

- Most minimum wage earners are young.

- Most minimum wage earners work in food service.

- Most minimum wage earners have never attended college.

Statistics are one thing, but real-life is another. There are still millions of older college-educated Americans who earn minimum wage in jobs outside the food service industry. Many of these people want to escape their situation, but don't know how.

More than pinching pennies

Over the weekend, Trent at The Simple Dollar shared ten steps to financial success for a minimum wage earner. His advice is excellent, but emphasizes frugality and cutting costs. I want to look at another approach to escaping minimum wage — earning more money. Continue reading...