Easy ways to give your 401(k) a tune-up

As it stands right now, there is just over $4 trillion in 401(k) plans. That’s trillion with a capital “T.” If you’re working for a company, then you’re probably one of the 67 million Americans who have a 401(k). It was included as one of those perk benefits that got you even more excited about the position.

The only problem is that your job probably didn’t offer you any guidance beyond the lovely welcome packet you received during your orientation. I envision the conversation went a little something like this:

Your employer: “Congratulations, you now have a 401(k).”

You: “Great! Now what?”

Your employer: “You choose your own investments. Good luck!”

You: “Uhh… I don’t know how to do that.”

Your employer: “Sorry, we can’t give recommendations.”

You: “What the…?”

I hear some variation of the above conversation all the time. The reasons employers started offering 401(k) plans is because they didn’t want to have to be on the hook with the old-school pensions that your parents or grandparents had.

The 401(k) allows them to put the responsibility into the employees’ hands — that’s you — to determine their retirement fate. How does that make you feel? If you’re a little uneasy, you should be.

Why exactly? Look at this way: At some point in time your 401(k) will probably be the largest asset you own — even bigger than your house. The BIG fundamental difference between the two is that the 401(k) will be your income source at retirement. You can’t draw an income from your house, the last time I checked.

If your 401(k) will one day be the single largest asset you own, I would then expect that you would want to spend countless hours researching your 401(k) options making sure you know exactly where your paycheck is going each month, right?

Right?

Exactly.

Face it. People would rather spend the night camping out in front of Best Buy in sub-freezing weather on Black Friday to get a $100 discount off of a television than to spend an hour a year researching their 401(k). It’s a sad truth.

Today, I want to share with you some free tools that you can use to quickly have a better understanding of your 401(k) and how you might improve it.

BrightScope

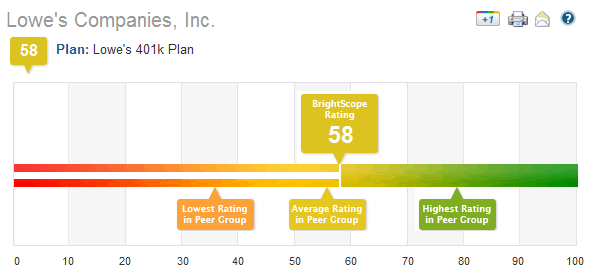

If you are looking for a way to see how your company’s 401(k)K stacks up to the others in the industry, look no further than BrightScope. BrightScope offers a way to search for your companies 401(k) and compare it to other companies in the same industry.

It will grade your 401(k) on a scale in different categories such as total plan costs, company generosity and investment menu quality.

Here is an example of a Lowes’ Companies, Inc. 401(k):

This BrightScope score shows that it is in the top 15 percent of plans for total plan cost. It will also show you how much more you could save with a plan that costs less.

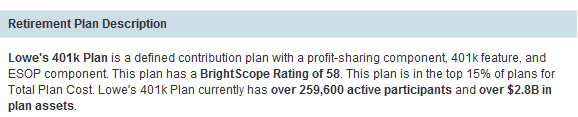

In the Plan Component section, BrightScope shows you how this plan ranks compared with other plans in the same peer group. This will show you how good your company’s 401(k) design and performance are.

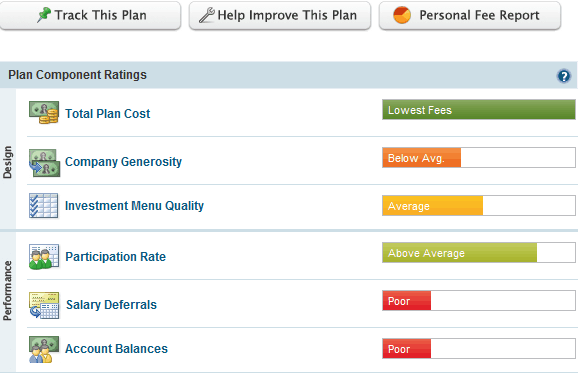

You can also see how much you are paying in fees with your current investment selections. If you hit the Personal Fee Report button, you will be taken to a separate page where you will insert your age, annual salary and your annual contributions to the plan.

From here you can add all of the investment options you have currently selected in your 401(k). This will allow you to see how much your are paying in fees, as well as how much you can expect to save until you reach retirement.

The BrightScope rating calculates how quickly a given plan can get an average participant to their retirement goal line. While the strength of the investment menu is certainly impactful in terms of the calculation of a plan’s BrightScope rating, the rating is a result of many different data points and plan characteristics, such as match structure, company generosity and the fees paid from plan assets.

When participants perform research on their 401(k) plan on BrightScope, many are disappointed to see that their plan pales in comparison to other plans in their employer’s peer group (peer group is determined by comparing plans of similar participant count, asset size, and industry) and immediately assume that a poor investment menu is the only cause. In many cases, the plan’s BrightScope rating is affected just as much by a poor company generosity score or the fees paid out of plan assets as the investment menu quality rating.

In the past, plan participants have felt “stuck” with their current 401(k) fund lineups, and we have seen the BrightScope rating become an important catalyst for change. Participants can use the BrightScope rating for their plan as a conversation starter with their employer and, in many cases, it has led to significant improvements in the plan’s design and cost.

That being said, in some cases, a plan’s limited fund menu and excessive fees may mean that a participant can find improved retirement outcomes by investing outside of their 401(k).

BrightScope has a pretty large database, but if you work for a smaller outfit, then it probably won’t do you much good.

Now that you have some idea on how your 401(k) compares, let’s take a look at how you can make sense of your investment options.

Morningstar

Another tool you can use to help you manage your investments or 401(k) is Morningstar.com. Morningstar has a several helpful tools for managing your investment portfolio. Many of them are free, but some require you to be a member. Premium membership is not cheap at $195 a year. Here is a list of the free tools that Morningstar has to offer.

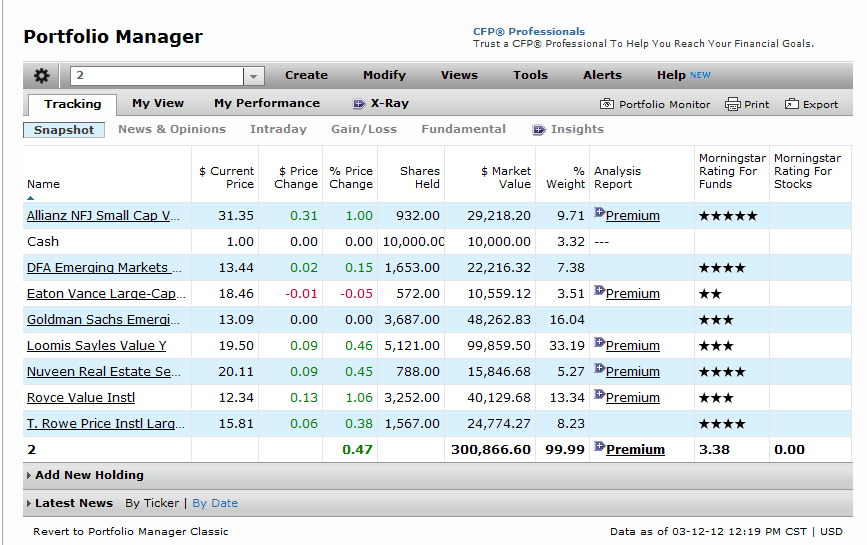

Portfolio Manager

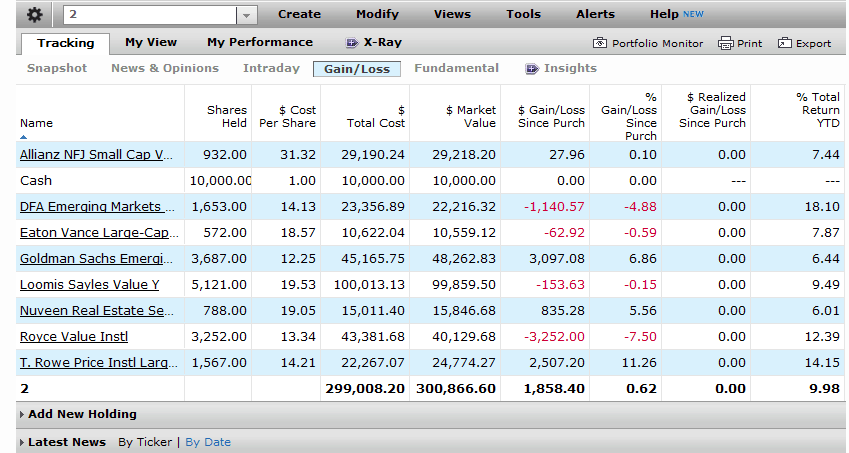

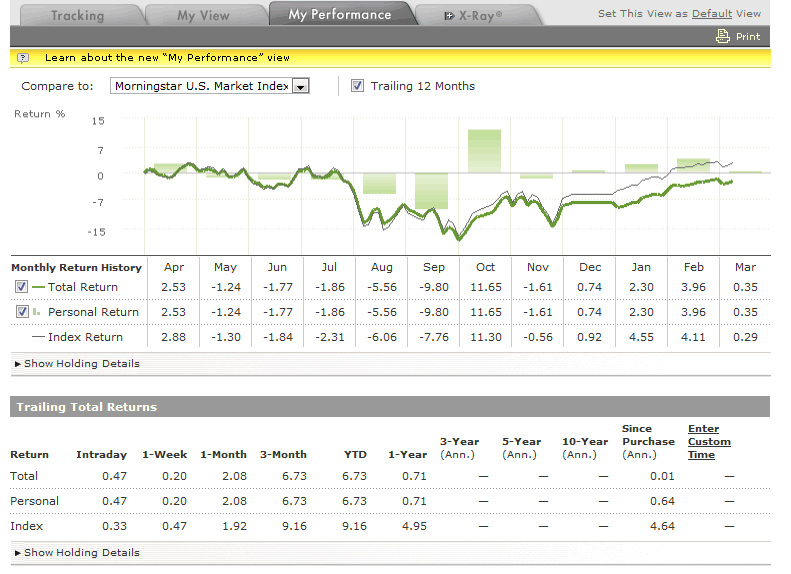

Portfolio Manager allows you to track, rebalance and analyze your portfolio. You can enter your investments and track them throughout the day. The Portfolio Manager has a performance tracker, which will show you your portfolio’s performance on a month-to-month basis.

It also allows you to see your gain or loss on each investment. This is a great tool to see the performance of your portfolio broken down into individual investments. This can help you determine if a certain investment is the right fit for your portfolio.

Morningstar also has a news and opinion section in the Portfolio Manager. This will give you the latest news regarding each investment in your portfolio.

You can also set alerts for investments you are watching to allow you to pick the perfect timing to get in or out of the market.

If you’re extremely analytical, then you’ll absolutely love Morningstar. If you get anxiety with pie charts, bar graphs, and a lot of data, then it will be very overwhelming.

Portfolio Monkey

Bound and determined to find another option that was 1. free and 2. easy to use, I hit the web searching for the Holy Grail. I made have found it with Portfolio Monkey.

According to their site:

“Portfolio Monkey is a social venture whose mission is to educate and provide self-directed investors the most simple-to-use and sophisticated investment portfolio management tools available.”

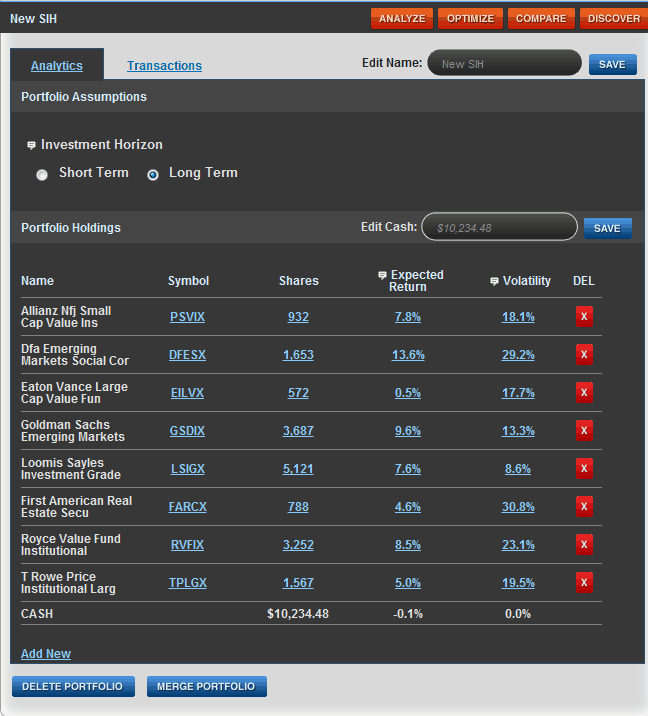

Portfolio Monkey has designed this site to help you analyze and better allocate your portfolio. They allow you to enter in your current or desired portfolio to see how well everything flows together.

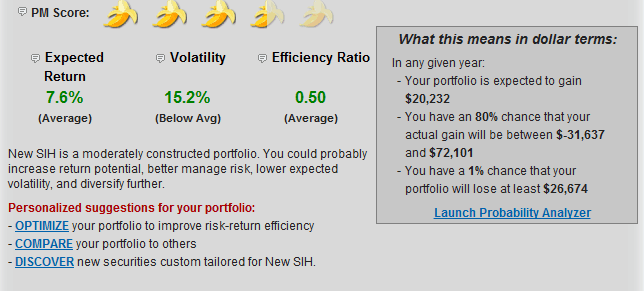

This example portfolio shows you the expected return and volatility of each holding in your portfolio. This will better enable you to find funds that you want to keep or funds that you want to get rid of in your portfolio.

Each portfolio you enter is given a Portfolio Monkey score. They will also show you what your portfolio’s expected return, volatility and efficiency ratio are.

It will give you a dollar figure on what your portfolio stands to gain or lose by taking the standard deviation of your portfolio.

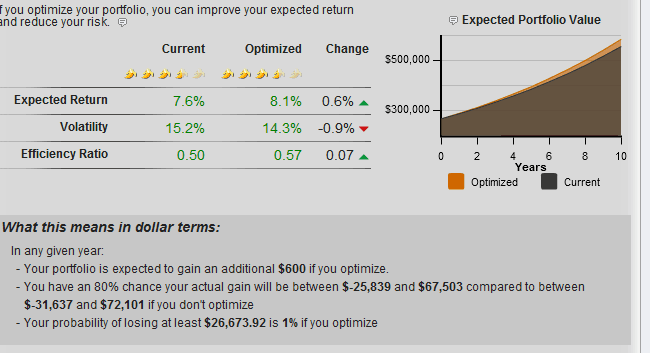

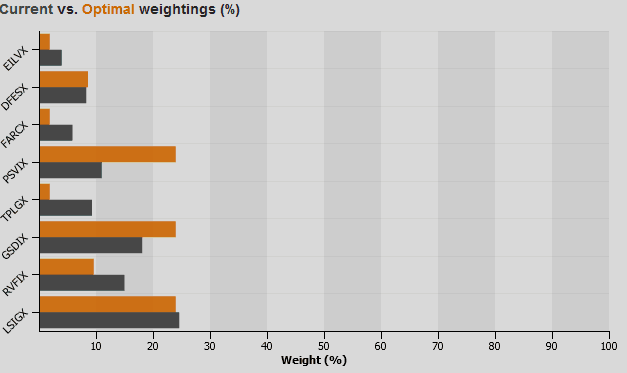

Portfolio Monkey also has an Optimizer tool. This tool will try to optimize your portfolio, compared to the buy-and-hold strategy, by giving you different weights in your holdings.

They try to optimize your portfolio by giving you a higher expected return and a lower volatility. The tool will give you a dollar figure of what it would mean if you optimized your portfolio.

Overall, I was very impressed in with what Portfolio Monkey had to offer. For a novice investor, it is very easy to use and can help with your 401(k) and any other investments, for that matter. For more, you can check out an in depth review of Portfolio Monkey on my blog.

Not a do-it-yourselfer? No problem

While their are plenty of free options out there to help out with your 401(k), I understand that we’re all busy. I can hear it now, “Jeff, I just don’t have the time to review my 401(k) consistently.” Instead of chastising you, I’ll just give you another option. This option, though, has a cost.

The other option you have is to hire a fee-only planner who will either charge you a flat fee or an hourly rate to assist in your 401(k) options. This planner should have a good understanding of your goals, how aggressive/conservative you are, and resources to review your investment options.

Before hiring this adviser, make sure you have a clear understanding of how much you are paying and what you are getting in return. For this kind of relationship, one way to ensure you’re in good hands is to use a NAPFA fee-only financial adviser or at least one who is a Certified Financial Planner.

Get your 401(k) reviewed

With all the tools available to you, self-directed investing has never been easier. You have no excuse not to have a good understanding of what’s going on in your 401(k).

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)