How to avoid bank overdraft fees

Last fall, I discovered my Quicken data file from the mid-1990s. It contains all my transactions from 01 January 1995 until 06 April 1998. There are many fascinating insights to be gleaned from my crazy spending a decade ago, but as I was looking through my checkbook register, one thing in particular stood out.

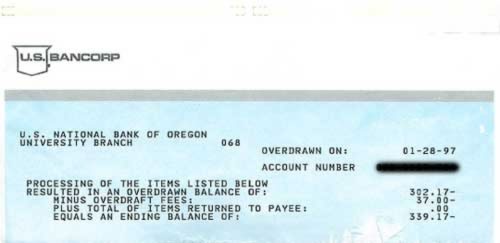

Before nearly every paycheck, my bank balance would dwindle to $12.33 or $7.14 or something similar. When I was paid, the balance would shoot up for a day or two, only to be spent right away. Sometimes, in fact, I overspent. During these 3-1/2 years, I racked up a couple hundred dollars in overdraft fees.

On one particularly bad day, my bank socked me with three overdraft charges at once. When the notice came in the mail, my stomach sank. How could I be so stupid? Speaking as one who’s been there, overdraft fees are an indication that you’re not tracking your finances as closely as you think you are. Tracking finances only through receipts, or only through your bank’s website is inadequate. You need to keep a separate ledger (perhaps a checkbook register) or use a piece of software (such as Quicken) in order to track every expense.

If you live paycheck-to-paycheck and fail to track every expense, you will experience overdraft fees from time-to-time. It may be more convenient to track your expenses only through your bank’s website, but if you do so, you must understand there are always going to be checks and other transactions “in process” that don’t show online, and consider overdraft fees the price you pay for adhering to such a system.

There are other ways to compensate for chronic overdrafts, of course:

- Banks offer overdraft protection, which is usually linked to a secondary account (such as a savings account). This is an excellent option for those who repeatedly suffer overdraft fees but are unwilling to record every transaction as it happens. But be careful. These options sometimes carry fees of their own.

- Many people create an artificial buffer to prevent overdrafts. At one time, I had a $100 in my checking account that I would not allow myself to touch. If my balance fell below $100, I just stopped spending. I wasn’t overdrawn in the bank’s eyes (and thus did not receive a fine), but I was overdrawn in my eyes.

- One of the cool features of Quicken Online is its “real balance”, which displays how much you actually have available, not how much your bank thinks you have available.

- Use an envelope budget system to be sure you do not overspend. The bank will happily let you become overdrawn at the grocery store, but when you’re using a fixed amount of cash (as in the envelope system), it’s impossible to spend more than you have.

- Become familiar with your bank’s overdraft policies. There’s no question that an overdraft is your fault, but as the Center for Responsible Lending notes, prevailing overdraft practices artificially drive up fees. Know how your bank handles overdrawn accounts.

If you suffer from chronic overdrafts, it’s time to re-evaluate your money habits. If you’re a shopaholic, learn to curb compulsive spending. In any case, begin tracking every penny you spend. Good record keeping may not cure your financial woes, but it can help reduce your chances of becoming overdrawn.

And don’t forget the number one tip for avoiding overdraft fees: Don’t buy stuff you cannot afford!

This post was requested by Mary. If you have a topic you’d like to see covered at Get Rich Slowly, drop me a line!

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)