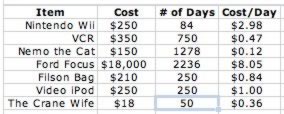

The cost-per-day expense chart

Elizabeth has a lifehack that allows her to manage both money and space. She writes: “This helped me curb my lifestyle choices when I was in high school and first on my own.” Here is her guest entry.

Possessions scare me. My parents are pack-rats, and their house is full of things that have no right to be there. Desk space is taken up by dirty coffee cups, stacks of notebooks, and priceless, irreplaceable piles of loose paper. My Mom's office, the biggest room in the house, has three narrow pathways: one to her computer, one to her bathroom, and one to her closet (which will not open because there is too much stuff inside and outside of it). Scary!

When I became a college student with a (very small) room of my own, I learned how rewarding it is to be in control of your living space, and how important thriftiness is on a student-sized budget. This is how I came up with the following method of worth assessment: the cost-per-day expense chart. How much does something you own cost per day you use it? And how long until your assets break even?

I use this technique to get rid of excess stuff, and to figure out how to be economical in possession and in purchase. This is also a good way to figure out what you're spending money on, and to find alternatives — say, if you buy a lot of books, getting a library card, or if you buy a lot of music, start working at a radio station.

Preparation

You will need:

- a few pieces of paper

- a pencil

- a calculator

- two highlighters

You may also want:

- a pen — I like to use two colored pens, red and black: black for numbers, red for comments or uncertain variables

- a ruler to mark off columns

- a computer with a spreadsheet program

I should preface this by saying that I am not a math genius. The purpose of this is to look at how much your lifestyle costs, not to make you feel insecure about forgetting sixth-grade algebra. All of the math herein is multiplication and division; you don't have to solve for x, and you can use a calculator.

List Everything You Own and How Much it Cost

List everything. Don't worry about order for now. You might want to look up every receipt, but that's not necessary — I'd only recommend doing that for large purchases, such as a big-screen TV, a computer, or a boat. Exclude gifts you've received, since they cost nothing. If this seems daunting, start by writing the cost for each category of possession: clothes, books, furniture, etc. For example, if you have three pairs of shoes you wear in rotation that cost $45, $60 and $50, then group them, writing $150 under shoes.

List Everything You Pay for Monthly

List your mortgage, rent, student loans, insurance, cable, phone, internet, repairs, everything you pay that has an intangible attached to it.

Organize this Data

Make a table, either on the computer or on paper. You need four columns. The first three are the name of the item(s), cost and number of days used since it was bought. The fourth is “cost per day,” which we'll get to in a second.

Part of J.D.'s cost-per-day table

After you've put in both the name and how much everything costs, estimate how many days out of the year you use it. If it's something like clothes or shoes, chances are you use both every day of the year. If it's a television sitting in your basement, chances are you use it zero days out of the year. If you're really not sure, think of how many days you use the object per month and then multiply that by twelve.

Here's a quick reference:

- 73 days = 5 days/month

- 84 days = 7 days/month

- 170 days = 2 weeks/month

- 252 days = 3 weeks/month

Calculate How Much Each Possession Costs Per Day of Use

This means you divide the cost by the number of days it's been used in the last year. For example, I paid $150 for three pairs of shoes which I bought a year ago today. I wear one pair every day, so I punch in the following on my calculator:

$150 / 365 = $0.41095, or $0.41 for every day I wear shoes.

You can also calculate how much it'll cost if you own or have owned something for over a year. For an $150 purchase which I use every day, the cost after a year and a half is $0.27; after 730 days of usage (two years) the cost is $0.21. If I own these very industrious shoes (or something of equal value) for a grandfantacular ten years and use them every day, then it only costs me $0.04 per day used. Do this first for all the straightforward purchases, such as shoes, clothes, furniture, dish sets, etc. Then proceed to the next step, which is to calculate harder sets.

Calculate Monthly Expenses

Tabulate regular expenses, such as rent, mortgage, utilities, DSL. This is the simplest part, because you multiply the monthly amount by 12 and divide it by 365. My utilities are $35/month for DSL, heating and electricity. $35 x 12 = $420. Since I use DSL, heating and electricity 365 days per year, I'm paying $1.15 per day for all three.

Group Open-Ended Items

Some possessions, such as media, are trickier to calculate. A book you buy might sit on your shelf for two years, only to be devoured in a week and cast aside for another two. The simplest way to calculate media expenses is to collate everything you've spent for that year, and how much time you spend on the activity. If you buy $200 worth of books/records/DVDs but spend 200 days out of the year (about two weeks out of every month) using that media, then you're only spending $1 a day. This gives you a general idea of how cost-effective your consumption is, and gives you an idea if you can save money.

Take a Break

Seriously. Take an hour to do something that doesn't involve math or thinking about finances. Go hiking, running, etc. But come back. If you're like me and tend to take more breaks than needed, set a timer for yourself and stick to it.

Decide What to Get Rid of

This is the hard part. First, print a few copies of your chart. Now you're ready to use your highlighters. One color indicates things that you need or must pay: insurance, rent, shoes, etc. The other color indicates things that have sentimental value: a first-edition book signed by the author, a stuffed animal, a wedding dress, et cetera. There's always some grey area, and it raises some interesting questions. Do you really need cable? What about a television in the first place? The wedding dress is nice, but is it just taking up closet space? Are you really going to watch all those movies again and again?

This is why you have multiple copies of your chart. After you highlight everything you need/want, do it again and check the differences. You'll have a better idea of what you can get rid of, and also how much less you can spend.

Conclusion

If you like this method, or if have math errors to point out, let me know. Feel free to ask me any questions (or to vituperate about how starting this was the worst experience of your life).

Elizabeth is a student and freelancer in Berkeley, California. She edits a zine, Zotapine, and does programming for KALX radio, including news features and anchoring.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)