Book review: The Simple Path to Wealth

Yesterday, my pal Jim Collins dropped me a line. “The audio version of my book just came out,” he told me. “Audible is letting me give away some free copies. Do you think your readers would be interested?” I do think so! Plus, this is a perfect opportunity to migrate my review of The Simple Path to Wealth from Money Boss to Get Rich Slowly. At the end of this article, I’ll explain how you can get a copy of Jim’s audiobook, if you’re interested (and lucky).

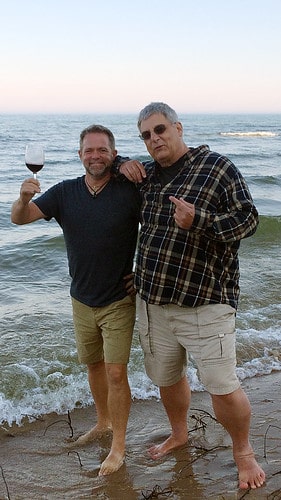

During late July 2015, we stopped for a few days on the Wisconsin side of Lake Michigan. My friend Jim Collins had invited us to spend some time at Shamba, the waterfront vacation home that belongs to his sister-in-law. For several days, we sipped wine and walked in the surf with Collins and his wife. We also talked about work. (I had just begun formulating plans for Money Boss; Jim was writing a book.)

“What do you do?” Kim asked Collins on our first afternoon at Shamba.

“I retired early,” he explained. “I saved up and got out of the rat race. Now I write a blog about money. It started as notes I wanted to share with my daughter, but it’s become something bigger. I guess most people know me because of my series of articles on stock-market investing. Now I’m turning the blog into a book.”

“Ugh,” Kim said. “Investing frustrates me. J.D. has tried to explain his investment philosophy a couple of times since we started dating. He says it’s simple, but it still seems overwhelming.”

“It doesn’t have to be,” Collins said. “You should read my articles. Maybe they’ll help.” Kim read his articles. They helped.

By the time we’d driven around the Upper Peninsula of Michigan and made our way to Indiana’s Amish country, Collins’ blog had spurred Kim to action. As I sat in the RV outlining my early vision for Money Boss, Kim was opening Vanguard accounts and moving her retirement savings into index funds.

During four years together, I couldn’t persuade Kim to manage her own retirement savings. Collins convinced her in two weeks. His advice is that good.

Since that weekend in Wisconsin, Collins published the book he was working on. The Simple Path to Wealth presents the advice from his blog in a coherent, unified package. It’s an easy-to-understand primer on stock-market investing — and financial independence.

The Simple Path to Wealth

- Avoid debt.

- Save half of your income.

- Invest your savings in low-cost index funds.

- Ignore the news — and your friends.

Like me, Collins believes the investment industry has a vested interest in making the process seem complex. Investment pros want you to believe that saving for retirement is complicated, and that you need help to be successful in the stock market. Plus, there’s the problem that many advisers profit from encouraging you to move your money around.

“Too many [investment advisers] have only their own interests at heart,” Collins writes. “By the time you know enough to pick a good one, you know enough to handle your finances yourself. It’s your money and no one will care for it better than you.” (Sound familiar?)

Over the years, I’ve come to appreciate Collins as a story-teller. The Simple Path to Wealth contains fun anecdotes from his own life, but it also incudes some colorful metaphors and parables.

Here, for instance, is how Collins illustrates the importance of frugality and thrift:

Two close boyhood friends grow up and go their separate ways. One becomes a humble monk, the other a rich and powerful minister to the king. Years later they meet. As they catch up, the portly minister (in his fine robes) takes pity on the thin and shabby monk. Seeking to help, he says: “You know, if you could learn to cater to the king you wouldn’t have to live on rice and beans.” To which the monk replies: “If you could learn to live on rice and beans you wouldn’t have to cater to the king.”

There are those that view frugality as sacrifice. They feel like they’re giving more than they get. Collins would argue that the opposite is true: A high saving rate grants you freedom. As counter-intuitive as it seems, learning to live on less allows you to get more out of life.

How the Stock Market is Like Beer

I also like how Collins compares the stock market to a mug of beer:

Imagine [somebody] has poured [a beer] for you, out of sight, and into a dark mug you can’t see through. You have no way of knowing how much is beer and how much is foam. That’s the stock market.

See, the stock market is really two related but very dfferent things:

- It is the beer: The actual operating businesses of which we can own a part.

- It is the foam: The traded pieces of paper that furiously rise and fall in price from moment-to-moment. This is the market of CNBC. This is the market of the daily stock market report. This is the market people are talking about when they liken Wall Street to Las Vegas. This is the market of the daily, weekly, monthly and yearly volatility that drives the average investor out the window and onto the ledge. This is the market that, if you are smart and want to build wealth over time, you will absolutely ignore.

When you look at the daily price of a given stock, it is very hard to know how much is foam. This is why a company can plummet in value one day, and soar the next. This is why CNBC routinely features experts, each impressively credentialed, confidently predicting where the market is going next — while consistently contradicting each other. It is all those traders competing to guess how much beer and how much foam is actually in the glass at any particular moment.

While this makes for great drama and television, for our purposes it is only the beer that matters. It is the beer that is the real operating money making underlying businesses, beneath all that foam and froth, that over time drives the market ever higher.

The more attention you pay to the stock market, the worse your investment performance is likely to be. (This isn’t opinion. It’s a well-documented phenomenon!)

Collins offers specific recommendations for self-directed investing, and carefully explains the rationale behind his conclusions. He also translates studies and stats into easy-to-understand English, which is no mean feat!

Although The Simple Path to Wealth is intended to offer wide-ranging advice about the journey to financial freedom, I think it’s best when Collins covers retirement investing. (He already knows that I disagree with his stance on debt reduction, for instance. He’s against Dave Ramsey’s version of the debt snowball; I’m for it.)

Do It Yourself

I think most Get Rich Slowly readers are comfortable with the idea that they’re responsible for their career, for their budget, for their home. But I receive a surprising amount of email from folks who are apprehensive about investing. People are willing to act as the family CFO when it comes to generating a personal profit — but they don’t know what to do with the money they begin to accumulate. Like Kim, they turn to “professionals”.

That’s too bad.

The truth is, you can (and should) learn to manage your own investments. I like this investment advice from Jim at Wallet Hacks:

A lot of new investors are timid. They don’t want to make mistakes. They believe they need to pay somebody to help them, that the stock market is complicated, or that they can pick winning stocks.

None of this is true.

Go to the library. Borrow some books on smart investing. Learn what stocks and bonds are and how the markets work. Teach yourself to invest in low-cost index funds. Ask questions. Be willing to make a few early mistakes. Take charge of your financial future!

I heartily recommend The Simple Path to Wealth. Whether you purchase the info in book form or consume it for free via his website, Collins can help you make the move from adviser-dependent to confident DIY investor.

Are you an Audible subscriber? Are you interested in a free copy of the audiobook version of The Simple Path to Wealth? Jim Collins has provided me with two (and only two) promo codes for Get Rich Slowly readers. If you’re interested (and use Audible), let me know in the comments. On Sunday, I’ll randomly select two of the interested commenters to get the book on audio!

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)