Your saving rate: The most important number in personal finance

In order to survive and thrive, you need to earn a profit.

You already know profit is the lifeblood of every business. It’s like food and water for the human body. Although proper nutrition isn’t the purpose of life, we couldn’t exist without it. Food and water give us strength to do the stuff that matters most. So too, profit isn’t necessarily the purpose of business — but a company can’t survive without it.

Here’s a secret: People need profit too.

In personal finance, “profit” is typically called “savings”. That’s too bad. When people hear about savings, their eyes glaze over and their brains turn to mush. Bor-ing! But if you talk about profit instead, people get jazzed: “Of course, I want to earn a profit! Who wouldn’t?”

Profit is easy to calculate. It’s net income, the difference between what you earn and what you spend. You can compute your profit with this simple formula:

PROFIT = INCOME – EXPENSES

If you earned $4000 last month and spent $3000, you had a profit of $1000. If you earned $4000 and spent $4500, you had a loss of $500.

There are only two ways a business can boost profits, and there are only two ways you can boost personal profitability:

- Spend less. A business can increase profits by slashing overhead: finding new suppliers, renting cheaper office space, laying off employees. You can increase your personal profit by spending less on groceries, cutting cable television, or refinancing your mortgage.

- Earn more. To generate increased revenue, a business might develop new products or find new ways to market its services. At home, you could make more by working overtime, taking a second job, or selling your motorcycle.

When you earn a profit, you don’t have to worry about how you’ll pay your bills. Profit lets you chip away at the chains of debt. Profit removes the wall of worry and grants you control of your life. Profit frees you to do work that you want instead of being trapped by a job you hate. When you make a profit, you truly become the boss of your own life.

With even a small surplus, the balance of power shifts in your favor.

The Most Important Number in Personal Finance

If you’ve ever calculated your net worth, you know that number is a snapshot of your current wealth. But it’s more than that. Your net worth is the grand total of years (or decades) of profits and losses.

As the authors of Your Money or Your Life put it, “[Your net worth] is what you currently have to show for your lifetime income; the rest is memories and illusions.” Ouch!

The greater the gap between your earning and spending, the faster your net worth grows (or shrinks). This may seem obvious, but it’s important. Everything you do — clipping coupons, asking for a raise, saving for a retirement — should be done to increase your profit and wealth.

But profit doesn’t mean much on its own. Is a $1000 monthly profit good or bad? Well, it depends on your circumstances.

- If your income is $2000 per month (or $24,000 per year), a $1000 monthly profit is great. That’s a saving rate of 50%. Congratulations!

- On the other hand, if your income is $20,000 per month (or $240,000 per year), a $1000 monthly profit gives you a saving rate of 5%. That’s average at best.

You see, it’s not your total income that determines how wealthy you are and will become. Nor is it your monthly surplus. No, the true measure of progress is your saving rate — how much you save as a percentage of your income.

In business, saving rate is called profit margin. I think it’s useful for everyday people — especially folks who have decided to act like the CFO of their own lives — to think of saving rate as profit margin too.

Pull out your personal mission statement. Look at your goals. Your profit margin directly affects how quickly you’ll achieve these aims. A saving rate of 20% will allow you to reach your destination twice as quickly as a saving rate of 10%. And if you can save 40% or 60%, you’ll get there even quicker.

The growth of your wealth snowball is directly dependent on the size of your saving rate.

Profit is Power

Now I’d like you to meet my friend Pete:

Some of you may know Pete as Mr. Money Mustache.

Pete’s personal mission is to enjoy a rich life with his small family in a small house in a small town in Colorado. He wants to pass his days slicing through canyons on his bicycle, building things in his workshop, and sharing quiet moments with his wife and son. And Pete doesn’t want to be tied to a job.

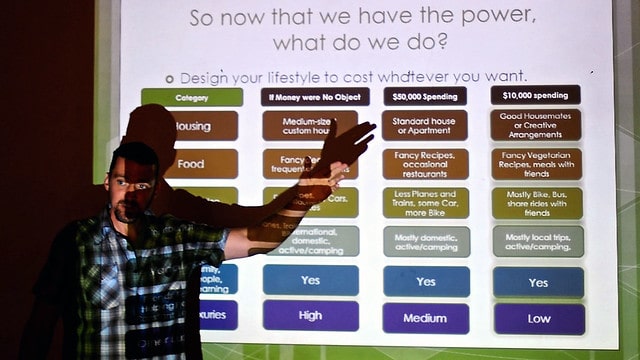

Following the standard advice to save between 10% and 20% of his income, it would have taken decades for Pete to achieve these goals. Pete is an impatient man. He didn’t want to wait that long, so he deliberately pumped up his saving rate.

After college, Pete and his wife worked long hours at jobs that paid well. They moved to a town where the cost of living was low and they could bike anywhere they needed. They bought a modest home. The Mustache family generated a lot of revenue while keeping overhead low.

As a result, Pete and his wife set aside more than half of their combined take-home pay. After ten years with profit margins near 70%, they were able to “retire”. He was thirty years old. Now, a decade later, Pete and his wife continue to pursue their mission, happily ignoring detractors who say what they’ve done is impossible.

The more you save — the higher your profit margin — the sooner you can have the things you really want out of life.

This is the bottom line, the entire thesis of the Money Boss method: Profit is power.

Computing Your Profit Margin

My mission at Get Rich Slowly is to give you the power to choose the lifestyle you want. That means helping you boost your saving rate. If you promise to do the work needed to generate greater “profits”, I promise to share the strategies and mindsets that will help you do so.

To find your current saving rate, you need two other numbers: your monthly income and your monthly expenses. For now, let’s look at only last month. (You’re free to run the numbers on past months or years, but for this exercise last month is enough.)

Here’s how to find your income and expenses:

- If you’re a money geek who already generates a monthly income statement (a.k.a. profit-and-loss statement), just grab your total income and total expenses from the form.

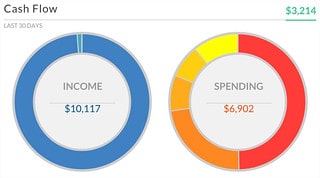

- Many of you track your money in Quicken or through services like Personal Capital. These too make it easy to find your monthly income and expenses. Some will even compute your profit for you. Here, for instance, are my own numbers from Personal Capital. You can see I had a $3214 profit in this example month, which means my saving rate was about 32%. (By the way, these numbers aren’t normal for me. Both income and spending were high!)

- If your finances aren’t yet automated, it’s not too tough to run numbers by hand. Collect your brokerage, bank, and credit-card statements from last month. Use these to total your income and expenses. (You shouldn’t have to do this line by line. Most statements total income and expenses separately in some fashion.)

- What if you don’t track your money? Start! If you owned a business, you’d keep books. Well, a money boss keeps books too. It’s the only way to spot trends and to measure progress. Pick a tracking method — many GRS readers like YNAB — and make tracking part of your weekly financial routine.

Now it’s time for a little math. To find your monthly profit, subtract your income from your expenses. (If your income was $3500 and your expenses were $3000, your profit was $500.) To find your profit margin (or saving rate), divide your profit by your income. (Using the previous example, you’d divide $500 by $3500 to get 0.14286 — a profit margin of 14.3%.)

Burn this number onto your brain. We’re going to spend the months and years ahead making your profit margin grow.

If you want to get fancy, run the numbers again. This time subtract your mortgage and car loan and credit-card payments (and so on) from your expenses before calculating profit and profit margin. See how much profit you’ll have once you’ve paid off your debt? Cool, huh?

Note: During the month of March, I’m migrating old Money Boss material to Get Rich Slowly — including the articles that describe the “Money Boss method”. This is the third of those articles.

- Part one answered the question, “What is financial independence?”

- Part two looked at why you should run your life like a business

- Part three explained how to write a personal mission statement

Look for further installments in the “Money Boss method” series twice a week until they’ve all been transferred from the old site.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)