The power of compounding: How your wealth snowball grows with time

So much of financial success involves good habits practiced over long periods of time.

Yes, you can still have a positive impact on your financial future if you’re starting late in life — but if you’re 59 years old and just beginning to think about financial freedom, you have a lot of work to do.

But if you’re 19, you have an extra forty years to set yourself up for financial success. This extra time makes a ginormous difference!

A lot of this is due to the magic of compounding. Over the short term, your investment returns don’t help a whole bunch. But over the long term? Over decades? Wow! Compounding can help you create a truly impressive wealth snowball.

I once received email from a reader named Anders who testified the power of compounding:

I used to save money in funds without knowing more than it gave a better interest than ordinary savings accounts. Then a few years ago I came across a book that explained compound interest and showed graphs of how it works. I was blown away by the idea!

I think, for me, that was the biggest impact on my way of thinking about savings and it got me more interested in the stock market too. So in my opinion, the things people who don’t know too much about savings/investing need to hear is about how compound interest works and how the stock market works.

We’ll leave “how the stock market works” for another day. (If you want to know more right now, check out my articles on stock market returns and how to invest.) Today I want to look at why some folks consider compounding to be the most powerful force in the universe.

The Power of Compounding

On its surface, compounding is innocuous — even boring. How much does it matter if you start saving now? Will it really affect what you can spend in the future?

To illustrate the power of compounding, I spent far too much time playing with spreadsheets. (Seriously. Kim managed to get like three major projects done in the time it took me to generate the following numbers and graphs. But I had more fun.)

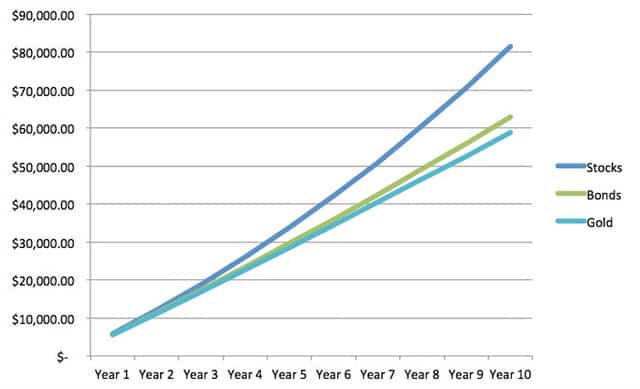

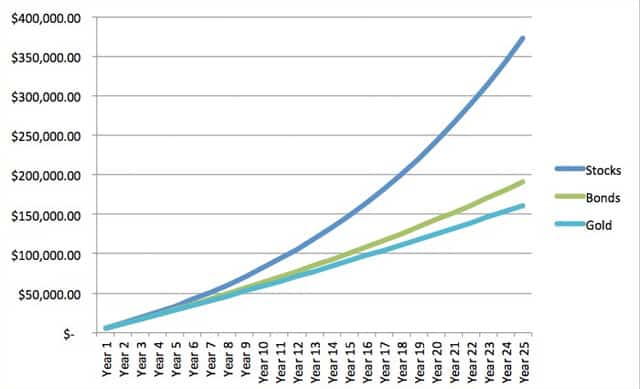

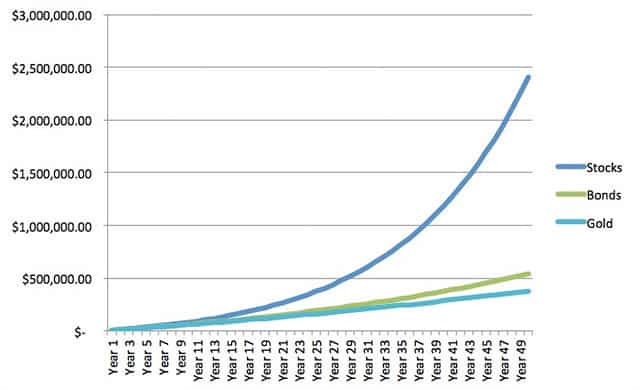

Note: All of the numbers that follow are based on certain assumptions. For each of the three asset classes — stocks, bonds, gold — I’m using the long-term average real return: 6.8% for stocks, 2.4% for bonds, and 1.2% for gold. That’s what these investments return over decades (not year to year) after accounting for inflation. However, it’s very important to undertand that average is not normal. Returns can (and do) vary widely from year to year.

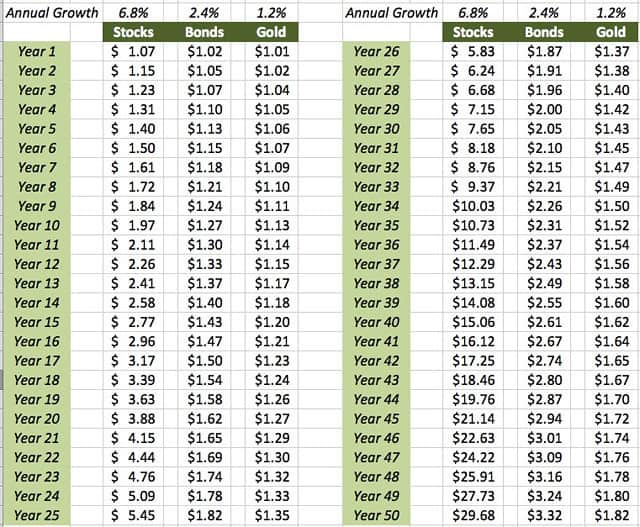

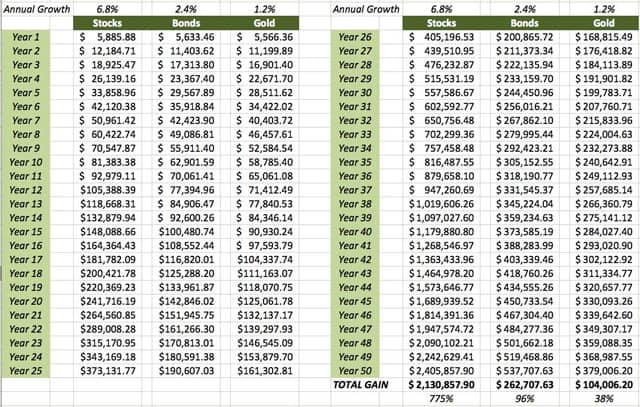

First up, here’s a basic look at compounding in action. This table assumes you invested one dollar into each of stocks, bonds, and gold. Based on historical averages, I’ve calculated how much your dollar would have grown to at the end of each year for fifty years:

As you can see, compounding doesn’t really do much during the first few years. After a decade, your $1.00 would nearly double if invested in stocks. (Remember, this is inflation-adjusted. The nominal number would be greater. But this is what your dollar would be worth.) If invested in bonds, that $1.00 would grow to $1.27. And if you invested in gold? That $1.00 would grow to $1.13. (For the record, my research shows that real estate offers long-term returns similar to gold. Others say real estate returns are worse than gold.)

The longer your money remains invested, however, the more powerful compounding becomes. After ten years, your $1.00 in stocks grew to nearly $2.00. Afters sixteen years, it will grow to nearly $3.00. In 20 years, it’ll grow to nearly $4.00. In 24 years, it’ll be worth more than $5.00. From there, the growth becomes even more rapid. By year 40 — which, yes, is a very long time — you’re earning more than a dollar every year.

Compounding a One-Time Investment

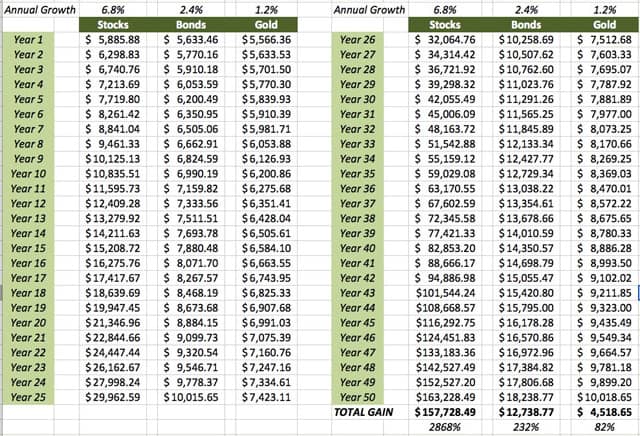

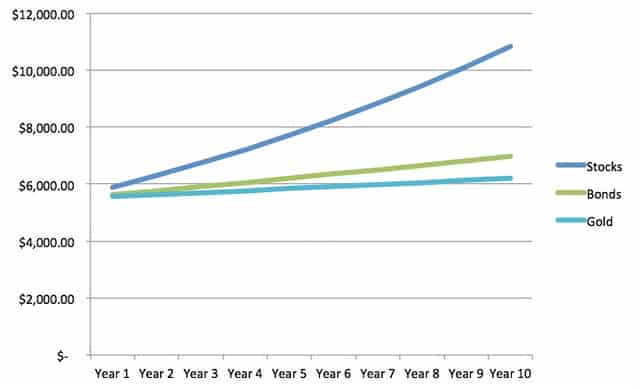

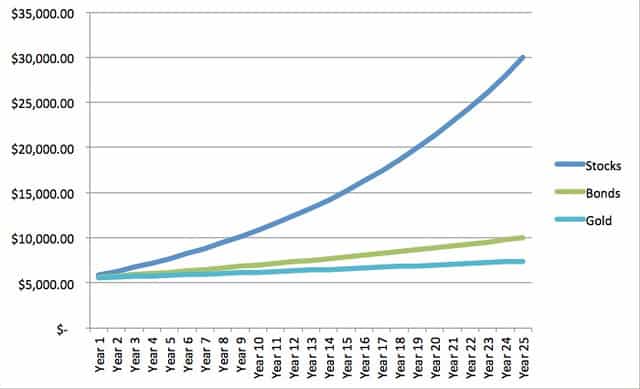

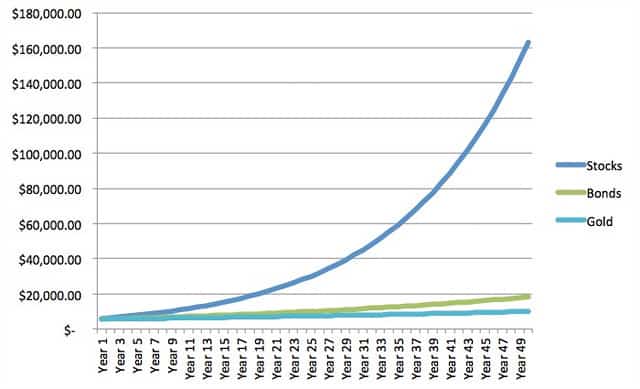

That’s a fine hypothetical example, but nobody invests just a dollar. Let’s assume instead that you made a one-time $5500 investment in your Roth IRA. How would your future returns on that investment vary depending on where you put the money? Here’s a table that demonstrates:

As you can see, compounding can make a huge difference — especially when time is allowed to magnify the difference in annual returns. (This is one reason index funds outshine managed mutual funds. Index funds, as a whole, earn that 6.8% average annual return that the overall stock market earns. Managed funds earn that less fees, which average about 2%. That’s not much in the short-term, but it’s a huge amount in the long-term.)

For the visual thinkers out there, I’ve created a series of charts that dramatically demonstrate the difference that compounding can make over time.

Over fifty years, compounding can make a dramatic difference if you’re able to earn higher returns on your investments! (Who has a fifty-year investment horizon? Well, your typical college student does, for one.)

The Importance of Saving

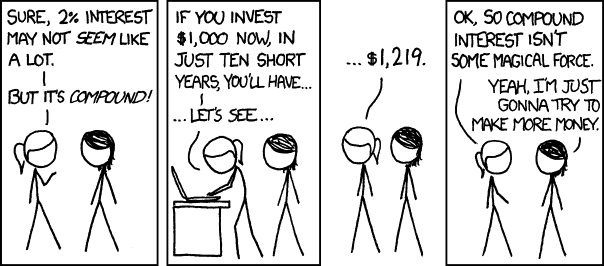

Now, it’s often said — sometimes even by me — that your investment returns are less important than your investment contributions. That is, how much you invest matters more than where you invest it. Here, for instance, is an XKCD comic belittling the power of compounding:

How true is that? Let’s look at another hypothetical example.

In this case, assume you invest $5500 on January 1st for the next fifty years. How would your investments grow in this case? Here’s the table:

And here are the charts:

Look at that! Investing more does make a difference. Shocking! Sarcasm aside, there are a couple of things to note about these numbers:

- First, investing more absolutely produces better results. The more you contribute, the more there is to compound. If you want to build a wealth snowball — and I hope you do — the best thing you can do is invest as much money as possible.

- Second, when you invest more, you erase some (but nowhere near all) of the difference between the rates of return. Take a look at our one-time investment example. In that situation, stocks double gold by year 13 and they double bonds by year 16. But with ongoing investments, it takes stocks 21 years to double gold and 26 years to double bonds.

Yes, the amount of you save is more important than the returns you earn. That said, there’s no denying the extraordinary power of compounding over time. Real-world numbers bear this out.

A Real-Life Example

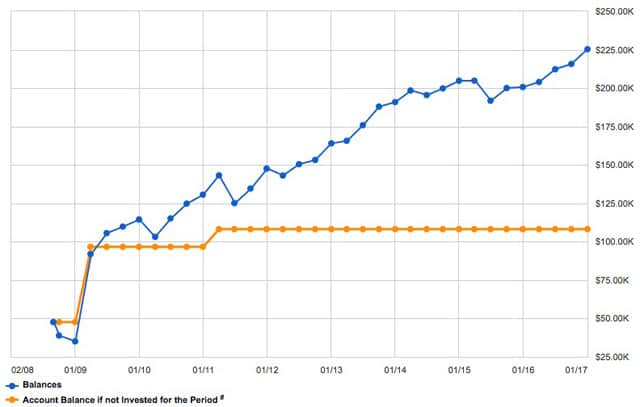

Finally, let’s look at a real-life example or two. These are actual numbers from actual accounts.

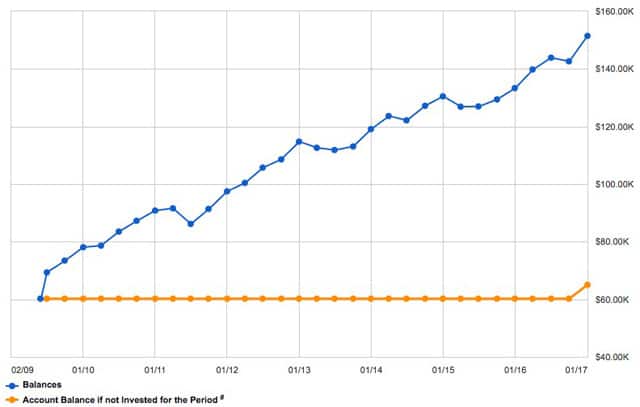

To start, here’s the balance history for the 401(k) I started back when Get Rich Slowly was throwing off huge wads of cash:

The blue line represents my actual balance over time; the orange line represents my balance if I had not been invested. (In other words, if I were earning no return because I stuffed my money under a figurative or literal mattress.)

I’ve contributed a total of $60,518 to this 401(k) since the end of 2008. In that time, it’s grown $117.121.19 so that my balance today is $225,331.75. That’s 193.5% growth in just over eight years (or 12.31% annually).

Here’s a second example, this time with the moved money from my box factory retirement plan to a rollover IRA:

Here, I’ve contributed a total of $65,027.41 to the account — most of it in 2009, but a few thousand just last month. (I closed a smaller IRA and moved the proceeds to this account.) In that time, I’ve gained $86,425.88. That’s 132.9% growth (9.73% annually) in under eight years — all because of compounding.

The Bottom Line

Based on all of this, there are three keys to make compounding work for you:

- Start early. The sooner you start, the more time compounding has to work in your favor, and the wealthier you can become. The next best thing to starting early is starting now. Yes, if you start investing at age 19, you’ll enjoy better results by the time you’re 65. But even if you’re 59, compounding is your friend and you shouldn’t hesitate to invest.

- Stay disciplined. Make regular contributions to your savings and retirement accounts, and do what you can to increase your deposits as time goes on. Your goal should be to generate as large a saving rate as possible, to widen the gap between what you earn and what you spend. Don’t be tempted to cash out a retirement account when you switch jobs. I see so many people make this mistake, and it makes me want to cry. Don’t be tempted to sacrifice your future security for a few bucks today.

- Be patient. Don’t touch your investments. Compounding only works if you let your money grow. Remember: You’re creating a wealth snowball. At first, your returns may seem small, but they’ll become enormous as more money accumulates.

Do these things, and your wealth snowball will grow. Sure, there might be some years where your investment balance decreases rather than increases. Again, that’s normal. The examples I’ve used here assume stocks, bonds, and gold return a stead annual average. They don’t. Their returns fluctuate — sometimes wildly. But, over long periods of time, your investment accounts should steadily swell.

For a brilliant example of compounding in real life, turn to American statesman Benjamin Franklin. When he died in 1790, Franklin left the equivalent of $4400 to each of two cities, Boston and Philadelphia. But his gift came with strings attached. The money had to be loaned out to young married couples at five percent interest. What’s more, the cities couldn’t access the funds until 1890 — and they couldn’t have full access until 1990. Two hundred years later, Franklin’s $8800 bequest had grown to more than $6.5 million between the two cities! True story.

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)