Phil Town’s rule #1 investing

Rule #1 by Phil Town is not a general personal finance book, and it's not a book for beginning investors — it turns a lot of conventional investment wisdom on its ear. The book explores a philosophy ascribed to Columbia University's Benjamin Graham (author of The Intelligent Investor), and popularized by Graham's student, Warren Buffet (perhaps the most successful investor of all time).

Rule #1 by Phil Town is not a general personal finance book, and it's not a book for beginning investors — it turns a lot of conventional investment wisdom on its ear. The book explores a philosophy ascribed to Columbia University's Benjamin Graham (author of The Intelligent Investor), and popularized by Graham's student, Warren Buffet (perhaps the most successful investor of all time).

What is The Rule? "There are only two rules of investing: Rule #1: Don't lose money [...] and Rule #2: Don't forget Rule #1." Town writes: "Most Americans are trapped in mutual funds that, at best, ride the waves of the market." He believes that his method can help investors break free from these cycles.

At its heart, Town's philosophy is simply "buy low, sell high". He's not pushing a get-rich-quick scheme (though at times, especially early in the book, that's exactly how it comes across). But he's certainly encouraging his readers to abandon traditional "get rich slowly (and surely)" techniques. Continue reading...

How to Walk for Fun and Profit

In the United States, we value our cars. We've become a nation of drivers. It rarely occurs to us that walking might be an option, even for short journeys. One-quarter of all automobile trips in the U.S. are less than a mile in length; forty percent are less than two miles (one source of many). Looked at another way: of all trips less than a mile in length, eighty percent are made by car (source).

I know a man who drives to work, even though he lives half a mile from his office. Why does he drive? Because he may need the car for some errand during the day. How many errands did he run during the workday last week? None. The week before? None.

I have a family member who will spend time circling a parking lot, looking for the perfect space. In the time it takes her to find these utopic spots, she could usually have parked farther from the entrance and burned some calories by walking a few hundred feet to the store.

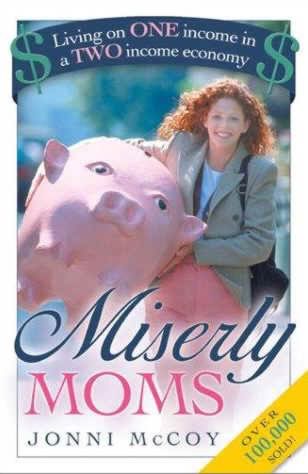

Miserly Moms: Living on One Income in a Two-Income Economy

Don't judge a book by its cover. Most especially, don't judge a personal finance book by its cover. Books promising quick riches and sure-fire investment schemes are generally filled with impractical gimmicks, or lead the reader into the land of financial risk, where fortunes are lost more often than they're made.

Don't judge a book by its cover. Most especially, don't judge a personal finance book by its cover. Books promising quick riches and sure-fire investment schemes are generally filled with impractical gimmicks, or lead the reader into the land of financial risk, where fortunes are lost more often than they're made.

Sometimes it's the most unassuming of books that offers the best advice, that can actively help you on your quest to get rich slowly. Miserly Moms: Living on One Income in a Two-Income Economy by Jonni McCoy is one of these books.

Miserly Moms doesn't offer advice for the Big Picture. Its focus is helping people save money on the little things. The book is ostensibly a guide for stay-at-home mothers, but is actually filled with useful tips for anyone who is concerned with frugality, especially for parents with young children.

Free comics from the federal reserve

Many frugal folks are geeks at heart. Now you can indulge both sides of your personality with comic books from the Federal Reserve Bank!

The Federal Reserve Bank of New York has been publishing educational cartoon-style booklets since the 1950s. "The Story of the Federal Reserve System" is one of ten titles currently available. The comic book is intended for the general public, especially students in high school and introductory-level college economic courses.

Up to 35 copies of each comic book are available free. Additional copies are 25 cents each, with exceptions for classroom use. To order, write to the Public Information Department, Federal Reserve Bank of New York, 33 Liberty Street, New York, New York 10045. These publications can also be ordered online.

26 cheap camping tips

Backpacking and camping are awesome frugal activities. It costs nothing to take a hike. It costs a bit more to camp overnight, but even that can be done inexpensively. While browsing the web for camping stuff, I stumbled upon a great list of frugal suggestions that were originally posted to the Usenet group rec.scouting on 03 December 1994!

According to the original poster:

These low-cost equipment/ideas/fixes for Scouting and camping in general [were] originally found on a F-Net Scouting board and [were] reposted on Fidonet on Nov 11/92 by Steve Simmons. The file evidently originated with BSA Troop 886 in the USA.

Once-a-Month Cooking: Cooking for the Rushed

Get Rich Slowly-reader Kevin comments:

Eating well on a budget requires some thought. But planning out a whole month of meals, and shopping for that month (you only get two paychecks a month) is the real challenge. Is there a website with a month long meal plan of healthy meals, in a spreadsheet shopping list, that can be used at most grocery stores? I cannot find any.

While you can try the 14-day trial of $5 Meal Plan, my brother suggests books might be more useful than websites for long-term meal planning. His family has been using a couple of volumes that do just what Kevin wants:<

Saving electricity: How to reduce your energy costs

How much electricity does your computer use? Your refrigerator? Your washer and dryer? Do you know how to save money on water heating costs? Michael Bluejay's guide to saving electricity answers these questions and more. Bluejay calls himself "Mr. Electricity" — the title is apt!

My guide on Saving Electricity gives you a bit more than you might get elsewhere. I explain exactly what a kilowatt hour is and how much you pay for one. And I show you how to calculate exactly how much electricity your household appliances use, so you know which items are guzzling the most juice (and which ones are the best targets for savings). You'll learn exactly how to read your electric meter. (Find that on any other website!) Finally, I not only give you meaningful tips for slashing your electricity consumption, I give you the tools to figure out exactly how much you're saving as well.

Bluejay recommends you attack the biggest energy users first: "You'll save more electricity by dealing with the biggest electricity-guzzlers rather than worrying about items that don't use much electricity." Because appliances that heat and cool use the most energy, these provide the greatest opportunities for saving. For example: Continue reading...

The Secret History of the Credit Card

How did the United States become a nation of debtors? When did credit cards become popular? Did you know that many modern credit card policies are the creation of one man?

The Secret History of the Credit Card was a 2004 "Frontline" presentation from the Public Broadcasting System. The program examines the nation's use of credit and, more specifically, the methods used by credit card companies to obtain enormous profits. The Secret History of the Credit Card won the 2004-2005 Emmy Award for Outstanding Investigative Journalism.

PBS has made the entire program freely available online in RealMedia and Windows Media formats. The broadcast is divided into five segments of roughly twelve-minutes each for easier download.

The Wealthy Barber

When I picked up The Wealthy Barber from the public library, I figured it must be good: the book was well-worn, the cover bent, pages dog-eared, passages highlighted, whole sections annotated in pencil and pen. Only the best personal finance books receive this sort of treatment. I'm pleased to report that The Wealthy Barber is a good read — author David Chilton offers an excellent introduction to personal finance.

When I picked up The Wealthy Barber from the public library, I figured it must be good: the book was well-worn, the cover bent, pages dog-eared, passages highlighted, whole sections annotated in pencil and pen. Only the best personal finance books receive this sort of treatment. I'm pleased to report that The Wealthy Barber is a good read — author David Chilton offers an excellent introduction to personal finance.

The Wealthy Barber's gimmick is that instead of presenting information in a dry subject-by-subject manner, Chilton has written the story of Roy, a small-town barber who is also a millionaire. (Roy got rich slowly.) The reader learns about IRAs and whole life insurance and compound interest as Roy dispenses advice to a trio of customers, each of whom has different financial circumstances. (This allows Chilton to highlight different approaches to certain problems.)

The Wealthy Barber's financial planning guidelines include: Continue reading...

The true cost of car ownership

The American Automobile Association (AAA) says that, on average, it costs 52.2 cents to drive one mile. To drive a Ford Focus like mine 20,000 miles per year, the average cost is 37.6 cents per mile.

How close are the AAA estimates? I ran some numbers.

Based on the purchase price of my vehicle ($16,500), the interest paid ($1,300), and the number of miles on the odometer (81,762 in 66 months), I calculated that for the past year my average cost per mile is $0.2170 over 20,274 miles. But that's only for the car itself. I've also accumulated the following operating expenses: