How to build credit the quick and easy way

Most Americans know that it's important to build credit but many don't know how. If you're one of those confused about how to build credit, you're not alone.

In 2019, CNBC reported that around 40% of Americans don’t know how credit scores work. This is a disappointing but not altogether surprising statistic since credit-building is still absent from curriculum at most schools. Good for you for seeking out this valuable information!

Today, let's cover some credit-building basics. In this article, I'll share some tips on how to build credit quickly and easily. Continue reading...

How to cancel a credit card without hurting your credit score

I have a credit card I'd like to cancel, but I don't know if I should. I'm afraid it'll hurt my credit score. Today I'm going to walk you through in real time as I evaluate this decision. Then I'm going to explain how to cancel a credit card, no matter why you want to do so.

I normally don't pay much attention to my credit score. I know that it ranges between 800 and 820, so I don't worry about it. With a score like that, I'm considered to have "exceptional credit", and that's good enough for me. (Kim's very proud that she has a higher credit score than I do, by the way.)

That said, for the past several years I've been carrying a credit card that I don't want or need. It's a Chase British Airways card that I signed up for in 2011. It's a fine card, but I never use it because I have better ones. My primary credit card right now is the Chase Sapphire Reserve, which I use for 99% of my personal credit transactions.

Reader question: Does repaying a loan hurt your credit score?

Last week, on my review of Kristin Wong's new book Get Money!, a reader named Luke left an interesting comment. Luke wondered:

One thing that I've taken to heart is debt reduction. In my case, student loans. I refinanced a while back to get a lower rate and have been paying almost triple the monthly minimum to accelerate payoff. The goal was to finish the loan payments a few months before we buy our first home (which we are currently in the middle of saving for our 20% down).

But I've encountered a sort of catch-22. As the individual loans get rolled off when they get paid, it's been hurting my credit score because my average age of credit is dropping. (I'm 27 years old.) This is exactly what I don't need before applying for a mortgage.

Your credit score — and why it matters

For today's edition of "back to basics" month at Get Rich Slowly, we're going to talk about credit scores. What is a credit score? Why should you care?

As you go about your life, you leave a trail of transactions. You take out a mortgage, you buy a new car, you use your credit card to buy new clothes and your debit car to purchase groceries.

Every month, your creditors -- the companies to which you owe money -- send info about your recent activity to a variety of credit reporting agencies (commonly referred to as credit bureaus). Each agency collects this info into a file called a credit report.

How to use credit cards wisely: A definitive guide

It's back to basics month at Get Rich Slowly! Today, we're going to take a l-o-n-g look at how to use credit cards wisely. Believe it or not, credit cards can be a useful tool -- so long as you don't fall into debt.

Well, credit cards are dangerous -- but they're not evil. Credit cards are a tool. Like any other tool, credit cards can be used to build or to destroy. Just as you'd treat a chainsaw with respect, you need to be careful with credit to avoid hurting yourself. If you use credit cards wisely, they can actually give you a financial edge!

How to prevent identity theft (and: What to do if you’re the victim of identity theft)

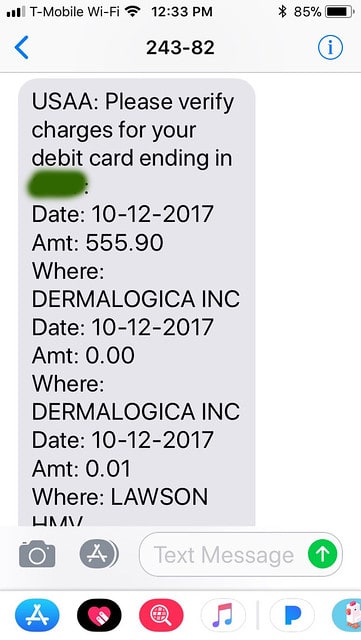

The thief first tried a couple of test transactions for amounts of $0.01 and $0.00. (How is a $0.00 transaction even possible? I have no idea.) When those worked, she went all-in. She charged $555.90 to the account.

Fortunately, Kim has an excellent bank. USAA both phoned and texted to let her know something seemed suspicious. Then, over the next week, they worked with her to keep disruptions as minimal as possible.

How to use credit cards wisely

Fire can be one of the most destructive forces on earth, and yet some say civilization began when we figured out how to harness its power. Credit cards are the same. Ask any long-time reader of Get Rich Slowly if credit cards are good for anything, and you might get a response like: “They're to be ripped up and burned in an atmosphere-polluting bonfire of relief!”

There was good reason to hold that opinion back then. In the days leading up to the Great Recession, a lot of consumers were getting burned by the trap of easy credit and conspicuous consumption. Frankly, the weight of his own credit card debt is what spurred J.D. Roth to start Get Rich Slowly in 2006.

It's easy to visualize the situation from the chart below. Credit card debt was becoming the largest category of non-mortgage debt in America at that time.

How to dispute credit card charges

According to a 2013 Nilson report, credit and debit card fraud were the cause of over $11.2 billion in losses in 2012. And if you think that sounds bad, just wait; it's expected to get much worse.

As USA Today reported last year, hackers and scammers have turned stealing credit card numbers into an art form. By focusing on major retailers such as P.F. Chang's, Target, and Home Depot, they can score thousands of credit card numbers in one fell swoop -- numbers that are then packaged and resold for a profit.

And stolen credit card numbers aren't as cheap as one might think; they often pull in big profits. According to Neal O'Farrell, founder of the non-profit Identity Theft Council, stolen numbers are often sold for $120.

Do credit card rewards count as taxable income?

Over the past 12 months, I have used credit card rewards to finance the bulk of our trips to Jamaica, Las Vegas, Denver, New Orleans, London, Paris, and St. Maarten. And in the process, I've also cashed in a five-figure sum of hotel loyalty points, airline miles and rewards. Of course, I blame part of this on my love of family travel, but it also has to do with how I make a living. Since I'm a points-and-miles blogger for Frugal Travel Guy, it would be pretty weird if I never went anywhere.

Aside from the questions I hear about earning points and miles and booking award travel, I get a lot of questions on the financial aspects of these trips. Are credit card rewards counted as taxable income? How about bank bonuses? If the fine print isn't all that specific, how can I tell?

Are Bank Bonuses Taxable?

We've all gotten at least one of these offers in the mail. They say something like, "Open a new savings account with XY Bank and receive a $300 bonus after setting up direct deposit" or "Earn a $250 bonus after making 10 qualifying transactions with your bank debit card."

Featured Credit Cards from Our Partners

If shopping for credit card deals was a sport, the offers you'll find on this page would be a good start. Keeping an open mind about brands, bonuses and other rewards could lead you to some money-saving opportunities in personal finance.

Our credit card list features deals in each of our most popular categories. Cash back rewards, zero percent APR, air miles, and low fees all rank highly on this chart. Deals change frequently, especially with competition heating up among banks. You may have to act quickly to snag a credit card offer with a low introductory rate, a sign-up bonus offer or a generous rewards program.

Find the Best Credit Cards Across Categories - Top Recommended Cards

Cash back rewards

Recent research shows that American consumers respond very well to cash back rewards and signup bonuses. If you're disciplined about paying your balance at the end of your statement cycle, you could earn a few pennies back from every dollar you spend.