How to use credit cards wisely

Fire can be one of the most destructive forces on earth, and yet some say civilization began when we figured out how to harness its power. Credit cards are the same. Ask any long-time reader of Get Rich Slowly if credit cards are good for anything, and you might get a response like: “They’re to be ripped up and burned in an atmosphere-polluting bonfire of relief!”

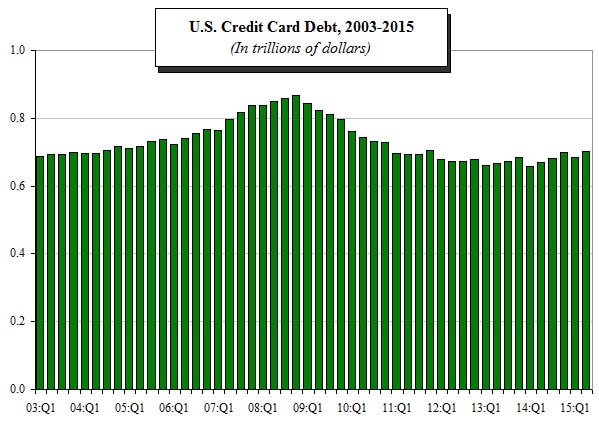

There was good reason to hold that opinion back then. In the days leading up to the Great Recession, a lot of consumers were getting burned by the trap of easy credit and conspicuous consumption. Frankly, the weight of his own credit card debt is what spurred J.D. Roth to start Get Rich Slowly in 2006.

It’s easy to visualize the situation from the chart below. Credit card debt was becoming the largest category of non-mortgage debt in America at that time.

Changing the Credit Card Dialogue

But there’s also good reason to change that opinion about credit cards. Even J.D. Roth’s perspective about credit cards evolved over time — because he decided to stop what he was doing and learn to take control of his finances. Instead of playing with fire, he learned to harness it.

It’s actually an important milestone to reach, being able to use all the tools available to you responsibly and not get burned. In fact, I’d go so far as to say that being able to handle credit properly is evidence of the kind of fiscal restraint and financial maturity that’s necessary to reach financial independence.

Money vs. Credit

Accepting that a credit card is a tool and not a trap is a good step. But it’s just one step among many. To really understand how to handle credit responsibly, we first need to step back and remember the lessons discussed in Money matters: How money works.

As I mentioned in that post, money is a means to facilitate exchanges and store wealth. Banking as we know it developed as a way to put that stored money to use for its owners, and credit (or debt) was born. As you saw with the history of banking, credit and money are closely related but they are not the same … and neither are the financial tools we use.

Debit vs. Credit

The key, then, to handling credit responsibly is to understand what it is. A credit card is primarily a debt instrument, not a payment instrument (even though many use it only for payments). Credit cards come with a revolving line of credit for you to use or not to use. In other words, credit cards combine money exchange and credit.

A debit card, on the other hand, is purely a payment instrument. Debit cards are all about money exchange; and for many, they’re popular financial tools because they provide money exchange in a way that eliminates the temptation of getting into debt.

Both financial tools can be used as payment instruments, but they are not the same. Recognizing that one is a debt instrument that can be used as a payment instrument and the other is purely a payment instrument is one way to help you use them properly.

Is it Good to Have Debt?

We can line up two crowds of people right now, one for each side of the argument. In both crowds, you will find people successful in their money matters and people who are not successful. It is not just people with debt who mess up their money.

But messed up debt is a lot more painful than other forms of financial mismanagement. And the ease with which you can get into debt trouble with credit cards is what alarms most critics.

It is a valid criticism based on the facts. Most GRS readers are aware of the dangers of debt and have arranged their lives in a way which minimizes those dangers. Many, it would seem, have taken the tack that not having a credit card at all is the best way to stay out of debt.

Such a strategy, though, overlooks the payment and security benefits credit cards have — not to mention that learning to handle credit wisely can teach valuable lessons on your way to financial independence.

The simple fact is that you don’t have to get into debt if you own a credit card, but to handle credit appropriately you need to exercise fiscal restraint. It’s a natural part of financial growth, which comes with certain benefits if you learn how to manage your finances well.

Benefits of Using Credit Cards

It’s good to know that, if you’re ready to take a different perspective about credit, there are some benefits to credit cards that debit cards do not offer.

- Credit history: Again, because a credit card is regarded as a credit instrument, you build a credit history even if you pay off the entire bill every month. Using a debit card offers no credit-rating advantage. Chances are you will buy a house and car on credit, which makes a good credit rating imperative in this day and age.

- Cash freeze: When you make a booking with a debit card, they place a hold on your account, which effectively freezes that amount. Other online vendors might do the same thing. Because credit is so interwoven in a credit card, however, that amount is considered a free loan to you, because the actual amount is not applied to your account until you check out of your hotel or the stuff you buy online is shipped.

- Protection: When you buy something with a debit card, that money is taken out of your account immediately. If you get home and discover a defect, you are dependent on the vendor’s goodwill to get your money back. With a credit card, you have a fallback position. If you are unable to resolve the dispute, you can get the credit card company to refuse payment to the vendor and you are never charged.

- Fraud protection: Likewise, when your card is stolen and used for fraudulent charges, you lose your money at first with a debit card. Although you usually get it back, you are out that money until you do. With a credit card, it is a lot simpler — they simply mail you a new card and you are back in business, and never liable for those charges. The end result may be the same, but the path isn’t as painful for credit card users.

- Car Rental: A friend of mine wanted to rent a car for a trip to Canada. He didn’t have a credit card, and he was turned down by several car rental agencies if he wanted to use a debit card. The only way they would waive that exception was if he had a round-trip airline ticket and he was from another place.

- Rewards: Affinity credit cards (such as those for airlines, your alma mater and hotel chains) offer rewards not available to debit card holders. Although a few debit card issuers offer points or rewards, they are not nearly as common as for credit cards, even those that aren’t part of an affinity program. For example, Holly Johnson has a number of articles here on GRS about vacations they funded with credit card reward points.

Downsides of Using Credit Cards

When comparing the two plastic options as an alternative means of payment, credit cards for the most part work better than debit cards too. But there are a couple instances where that is not the case:

1. Vendor limitations: Some retailers, notably Costco, do not accept credit cards, only debit cards. In general, there are more establishments taking debit and not credit than the opposite. Therefore, a debit card opens more doors for you than would a credit card.

2. Payment problems: Because a credit card is always a debt instrument, there is a bill, usually once a month. If you are involved in an accident or find yourself in an unplanned absence and you miss a payment, you incur fees and other kinds of hassles (possibly including a taint on that credit record you want to burnish). With a debit card, everything is always paid.

J.D. Roth’s Essential Credit Card Behaviors

- I resolved to make my decision to buy first, and then decide how to pay.

- I vowed never to buy anything unless I had cash in the bank for it.

- I promised to pay my card in full every month.

- I told myself that I’d never use my card for an impulse purchase.

[Read How to use a credit card (without going into debt) for the full story and J.D.’s essential credit card skills.]

Doing What’s Best For You

Sticking with the notion that credit cards are evil might be necessary for you at the moment, but it can be a mistake to hold on to that notion forever. There are distinct advantages to using credit wisely (not to mention that, as your credit history improves, some of your expenses could also go down as a result).

Being able to handle credit responsibly is one way to know you are mastering your finances. It’s like learning to start a fire and not let it burn you or get out of control. For someone that is committed to that growth process, it’s not a trap to be avoided at all cost. It’s an excellent sign that they have the personal control to reach their own financial success and accomplishments.

Do you think mastering credit is a necessary part of your journey to financial independence? Is credit an important tool in your financial arsenal or a deadly way to play with fire? What makes it so?

Become A Money Boss And Join 15,000 Others

Subscribe to the GRS Insider (FREE) and we’ll give you a copy of the Money Boss Manifesto (also FREE)