The spend safely in retirement strategy

On the surface, this report's advice seems stupid simple: To optimize retirement income, delay Social Security and make the most of required minimum distributions from tax-advantaged accounts. Isn't this pretty much what most of us plan to do? Maybe so, but I doubt that anyone else has crunched the numbers like this.

Plus, this strategy provides a specific plan for folks who haven't considered how to approach retirement income. As the authors note, most retirees fall into two camps.

Death by a thousand cuts

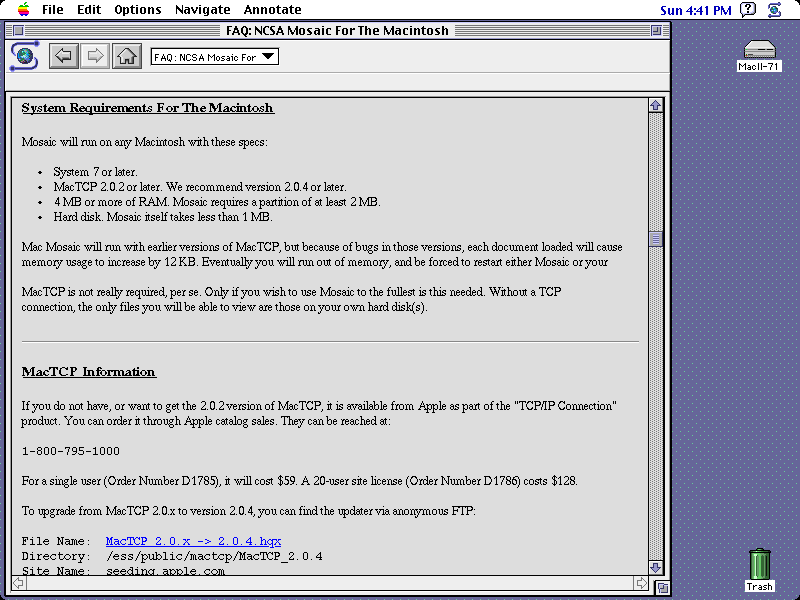

I've been on the internet for a long, long time.

Via local Bulletin Board Systems, I started reading USENET newsgroups -- mostly Star Trek and comic book and computer game stuff -- during college in the late 1980s. I got sucked into the world of MUDs. Soon after graduating, I heard about this new thing called the World Wide Web, so I installed Mosaic on my Macintosh SE.

The power of focus: Why you should tackle one goal at a time

I used to be the sort of guy who loved to have a list of goals. At least once a year -- usually around New Year -- I'd sit down and make a list of all the things that were wrong with me, all of the things I wanted to change.

In 2007, for instance, I made a list of 101 things I wanted to accomplish in 1001 days. (It took me longer than three years to finish that list, by the way. In fact, I still haven't done everything on it because my priorities have changed. But now, ten years later, I see that I have completed nearly all of the ones that still matter.)

Eventually I realized that making a long lists of resolutions is a sure path to disappointment -- at least for me. There's a reason you see newspaper and TV stories every spring about how most people aren't able to maintain the resolutions they set at the first of the year. It's because most of us try to do too much. (And, I think, because we try to set goals that aren't truly aligned with our primary purpose in life.)

My plan for purchasing a new car

Today, things are much easier. Sure, there are challenges. Sometimes I make poor choices. But mostly, what I spend aligns with what I want out of life. (With the caveat, of course, that who I am and what I want shifts over time.)

I'm glad I've developed good habits. Right now, it's keeping me from making a rash decision. For most of 2019, Kim and I have both been fighting the new-car itch. The old J.D. would have succumbed by now. This year's model still does dumb things like spending hours building custom cars on the Mini website, but so far I'm not scratching that new-car itch.

Identity economics: Who are you? And how does it affect your spending?

"What?" I said. I wasn't expecting a philosophical question over supper.

"I don't think you know who you are," Duane said.

Mindful shopping: Learning to be deliberate about the things we buy and own

The older I get, the less I want or need. The older I get, the less I like to spend money. And when I have to buy something, I try to practice mindful shopping.

When I was younger, I wanted (and/or needed) all sorts of things. I wanted new clothes. I wanted tech gadgets. I wanted books. I was convinced that I needed a fast computer to be happy, not to mention a big house and lots of furniture. None of my shopping was mindful. It was mindless.

Now, at age fifty, buying things seems more like a hassle than a reward.

The seven deadly sins of personal finance

I've been reading and writing about personal finance for more than thirteen years. In that time, I've consumed a lot of books about money. Lately, I've found that it's fun to revisit old favorites.

Recently, for instance, I've been re-reading Brett Wilder's The Quiet Millionaire [my review]. It's different than most personal finance books. It's targeted at those who are farther along their financial journeys rather than at those just starting out. Still, there are bits and pieces in The Quiet Millionaire that are applicable to everyone.

Ten years ago, I wrote that I particularly like Wilder's list of the seven enemies to financial success (which is my phrase, not his). I still like them. He writes:

How much I spent during two weeks of travel

I like to travel. Over the past decade, I've probably made an average of two international trips per year. But you know what? Never once in that time have I tried to track how much I spend while exploring the world. Sure, I log my numbers in Quicken (as I do for everything), but I've never analyzed the cost of an individual trip.

This month, I flew to Europe to hang out with my cousin Duane again. He and I enjoy traveling together. Because I was curious, I decided to be diligent about tracking my expenses for this trip.

Note, however, that I didn't try to do anything different. I didn't adjust my normal behavior simply because I knew I'd be reporting to GRS readers. I did what I always do. I spent in ways that felt normal to me.

Beyond wealth: What happens AFTER you achieve financial independence?

In their classic Your Money or Your Life, Joe Dominguez and Vicki Robin argue that the relationship between spending and happiness is non-linear.

More spending brings more fulfillment — up to a point. But spending too much can actually have a negative impact on your quality of life. The authors suggest that personal fulfillment — that is, contentment — can be graphed on a curve that looks like this:

![Increased spending brings increased happiness -- but only up to a point. [The Fulfillment Curve]](https://www.getrichslowly.org/wp-content/uploads/the-fulfillment-curve.jpg)

Book review: I Will Teach You to Be Rich (2019 Edition)

When I started Get Rich Slowly in 2006, I had no idea other money blogs existed. I'd been blogging about cats, computers, and comic books since 1997 -- before blog was even a word! -- and I thought my new venture might be the first blog about personal finance.

I was wrong.

I learned quickly that there were already dozens (dozens!) of people blogging about money on the interwebs. For instance: