How to budget: A pain-free guide to building a budget that works

"A budget is telling your money where to go instead of wondering where it went." — John C. Maxwell

I've had more one-on-one money coaching meetings during the past year than my previous twelve years writing about money combined. I used to claim that I'd never do money coaching. Apparently, I was wrong.

As I meet with folks, certain common themes stand out. Continue reading...

Food waste and food consumption in the United States

I've been thinking a lot lately about how much food I consume (and waste). I'm not happy with how I shop and eat, and it's not just because I'm fat right now. I don't like what I'm eating and I don't like how much food I'm throwing out.

Food waste is a huge problem in the United States. Most studies find that Americans waste about one-third of all food that enters the supply chain. This is insane. And when you consider that food spending is the third-largest component of the average American budget, this is a great place for most folks to boost their budget.

According to the 2017 Consumer Expenditure Report, the average household spends $7,729 per year ($644.08 per month) on food. If, as the USDA reports, 31% of the average family's food goes to waste, that's the equivalent of burning $2395.99 per year ($199.67 per month).

An introduction to square-foot gardening

I grew up in the country. My family always had a vegetable garden. For us, gardening meant a large plot, plowed and raked, then planted with long, widely-space rows of vegetables. It also meant weeding and hoeing, weeding and hoeing. Lots and lots of weeding and hoeing.

Gardening was a chore.

When my ex-wife and I bought our first home, we both wanted a vegetable garden, but we didn't want the drudgery that came with it. Besides, we didn't have a big space in the country — we had an average city lot. Fortunately, we discovered Mel Bartholomew's Square-Foot Gardening. Continue reading...

Why financial literacy fails (and what to do about it)

April is Financial Literacy Month in the United States. This is a pure and noble thing. I think it's great that there's one month each year devoted to promoting smart money habits. That said, it has become increasingly apparent over the years that most financial literacy programs fail. They don't work. And this isn't just me speaking anecdotally.

In a 2014 paper from Management Science, three researchers conducted a "meta-analysis" of 201 prior studies regarding the efficacy of financial literacy. Their conclusion?

Interventions to improve financial literacy explain only 0.1% of the variance in financial behaviors studied, with weaker effects in low-income samples. Like other education, financial education decays over time; even large interventions with many hours of instruction have negligible effects on behavior 20 months or more from the time of intervention.

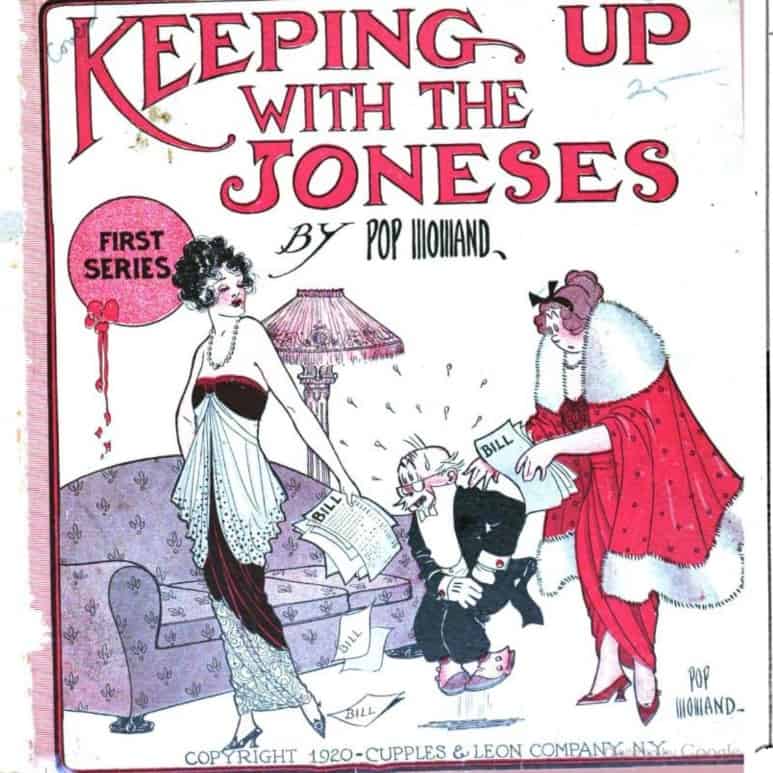

Keeping up with the Joneses

It's always fun when disparate worlds of geekdom collide. Today, for instance, I learned that the term "keeping up with the Joneses" -- a popular phrase in the realm of personal finance -- actually originated in the funny pages.

That's right: "Keeping Up with the Joneses" started out as a newspaper comic strip. As a comics nerd, one who especially loves comic strips, this makes me happy. (Note: For some strips in this post, you can click on the image to open a larger version in a new window.)

The Get Rich Slowly Anniversary

The middle of April is a Big Deal in my world.

The trees have nearly finished blossoming, which means my allergies will soon go away. We're seeing more of the sun, which means the worst of my seasonal depression is behind me. Today, on the 15th, Get Rich Slowly celebrates its anniversary.

In the Beginning

When I started Get Rich Slowly, I had no idea what it was going to become. I had no grand plan or vision. I just wanted to write about money while accomplishing three goals.

Lifestyles of the rich and foolish

It's the first of April. You know what that means. Spring is here! Your friends and family are pulling April Fools' Day pranks. And my tree allergies are kicking my butt. Every year, tree pollen makes my life miserable. This year is no different.

Facebook kindly reminded me this morning that three years ago, Kim and I were in Asheville, North Carolina. After wintering in Savannah, Georgia, we'd resumed our tour of the U.S. by RV.

While in Asheville, we toured the Biltmore Estate, the largest home in the U.S. This 250-room chateau contains 179,000 square feet of floor space -- including 35 bedrooms, 43 bathrooms, and 65 fireplaces -- and originally sat on 195 square miles of land. (Today, the estate "only" contains 8000 acres.)

How to cancel a credit card without hurting your credit score

I have a credit card I'd like to cancel, but I don't know if I should. I'm afraid it'll hurt my credit score. Today I'm going to walk you through in real time as I evaluate this decision. Then I'm going to explain how to cancel a credit card, no matter why you want to do so.

I normally don't pay much attention to my credit score. I know that it ranges between 800 and 820, so I don't worry about it. With a score like that, I'm considered to have "exceptional credit", and that's good enough for me. (Kim's very proud that she has a higher credit score than I do, by the way.)

That said, for the past several years I've been carrying a credit card that I don't want or need. It's a Chase British Airways card that I signed up for in 2011. It's a fine card, but I never use it because I have better ones. My primary credit card right now is the Chase Sapphire Reserve, which I use for 99% of my personal credit transactions.

How I learned to stop worrying and love DIY

"Oh good," Kim said when I rolled out of bed yesterday morning. "I’m glad you’re up." She gets up at 5:30 for work most days, but I tend to sleep in. Especially during allergy season.

"Huh?" I grunted. It was 6:10 and I was very groggy. My evening allergy meds kick my butt. Plus, I hadn't had my coffee yet.

"Something’s wrong with the bathroom sink," she said. "Look. It’s leaking. The floor is soaked." She wasn't kidding. The bathmat was drenched. When I looked under the vanity, I was greeted by a small lake.

Financial advice from my father (when I was nineteen)

"It's odd you should ask that today," I said after I told her the story of my father's six-year battle with cancer.

"Why?" she asked.