Learning to dance: How couples can have constructive conversations about money

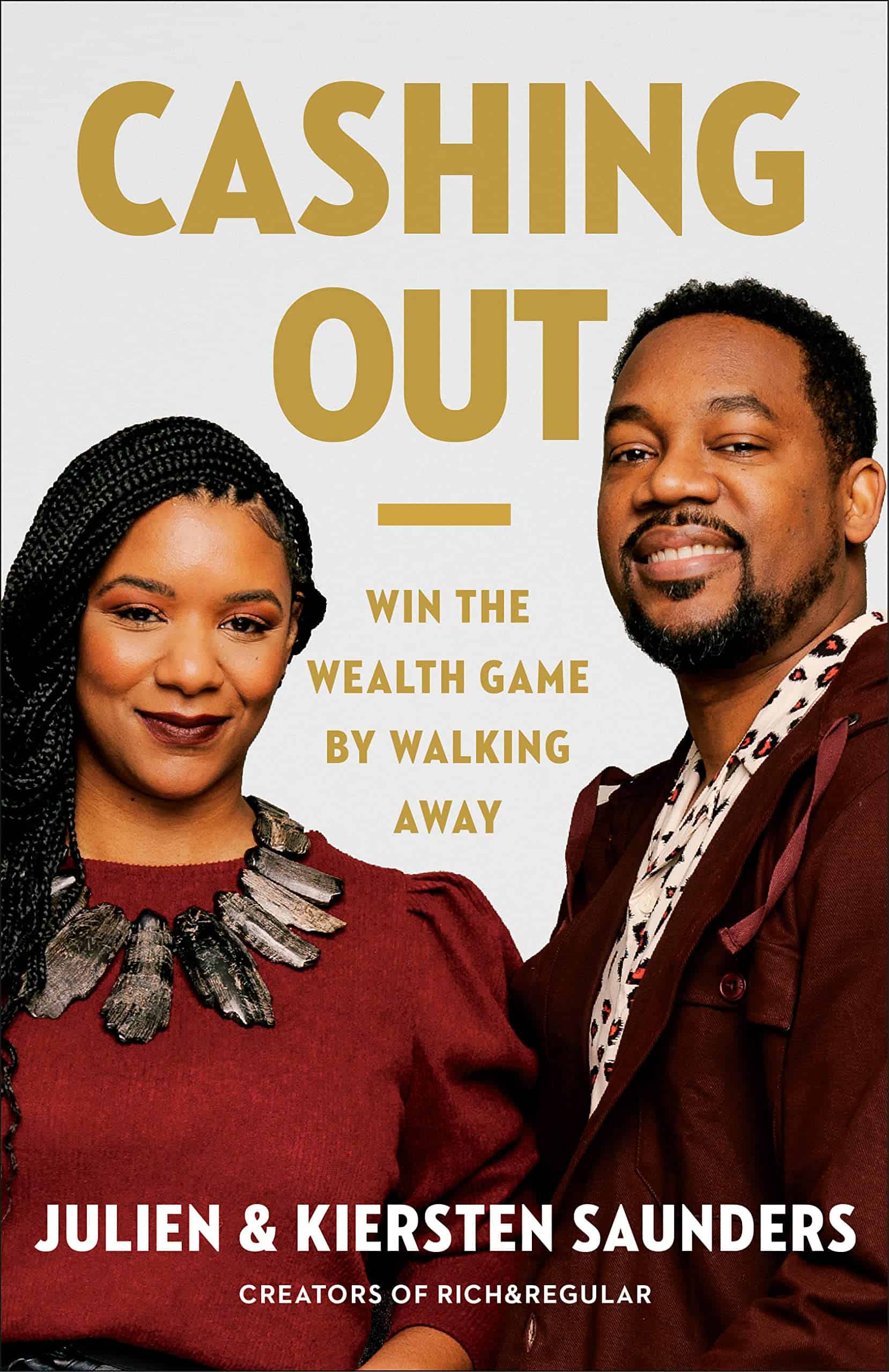

Today, the Get Rich Slowly summer of books concludes with an excerpt from Cashing Out: Win the Wealth Game by Walking Away from Julien and Kiersten Saunders. Julien and Kiersten are the power couple behind the rich & Regular blog and YouTube channel.

The following excerpt from Cashing Out (published by Portfolio/Penguin) is used with permission. Copyright © 2022 by Rich & Regular LLC. This passage has been edited to be more readable on the web.

Growing up poor (and how it messed with my mind)

A couple of weekends ago, Kim and I enjoyed a short vacation on the Oregon Coast. She's been taking foraging classes, and she had an early morning workshop on harvesting sea vegetables one Sunday. Rather than wake in the middle of the night to drive out, we rented a small place in Tillamook and took the dog for an adventure. (The dog loves the coast.)

We let Tally lead us on a walk through town one rainy afternoon. Coming home, we cut through a trailer park. "We're in the poor part of town," Kim said.

"Yep," I said. "But look at that trailer house right there. That is almost exactly like the one I grew up in." Here's the trailer I grew up in:

As good as it gets

It's December 1972. I am three years old. My parents have to be away for the night. They drive me to stay with Dad's brother and his family. It's cold and it's raining. We stand on a covered porch and knock. A big lady with a big smile opens the door to greet us.

"This is your Aunt Janice," Mom tells me. "And this is your cousin Nicky."

You are standing behind your mother. You are eight years old. This is the first time we meet. You're not interested in a little kid like me, and I'm too timid to pay much attention to you.

Drama in real life: Moving Mom to memory care

Today, I did the second-hardest thing I've ever had to do: I took away Mom's cat.

Mom's assisted living facility called last Thursday. "We strongly encourage you to consider moving your mother to memory care," the director told me. "I know we talked about this a year ago, and at that time you and your family decided she wasn't ready. We think she's ready now. She's refusing her meds. She's refusing to eat. She's wandering. She's more confused than ever."

I phoned my brother, Jeff, who has handled the bulk of Mom's care since she moved to Happy Acres a decade ago. "What do you think?" I asked.

Drama in real life: Making planned gifts before death

My mother's health has been declining over the past few months, and it's produced a wee bit of year-end financial drama in our family. (The word "drama" is a bit of an exaggeration. Maybe it's produced some year-end financial consternation?)

As long-time readers will recall, my mother has been in assisted living for more than a decade now. She lives a mellow life filled with television, her pet cat, and a regular routine. Because she has cognitive problems, it's difficult for her to communicate. The doctors call her "non-verbal", and they can't explain the cause. She cannot form complete sentences (sometimes two words is tough!), and it seems as if she cannot formulate complex thoughts. It's a mystery to everyone.

Today — at this very moment — my brother is driving my mom to the emergency room. It's her third visit in six weeks, and it's always the same issue: vomiting, dehydration, confusion. During the previous two episodes, a few days of hospital rest helped her, and she returned to the assisted living facility feeling better (and actually able to carry on a basic conversation, like you might have with a two-year-old).

Finding a millionaire money mentor

You are the average of the five people you spend the most time with.

You've probably heard that saying before. It's from motivational speaker Jim Rohn. He used it as a way to encourage people to learn and grow from others' experiences, habits, attitudes, and so forth. He wanted folks to seek out and spend time with people of high quality.

Unfortunately for most people, this advice can be difficult (if not impossible) to implement.

How to talk with your parents about their finances

Talking to your parents about their finances probably seems like one of the most awkward you conversations you could ever have. I'll bet it ranks right up there with the sex talk your parents gave you when you were a kid — or that you’ve had with your own children.

I grew up in the South, where we don’t talk about money or sex. So when I asked my mom where babies came from, she told me a man and woman "make love". That’s it. That was the extent of the conversation.

I have three kids, so clearly I figured out where babies come from. When my oldest was 10, she asked me where babies came from. I didn’t say something vague like, “A man and woman make love.” I simply told her the basics. She then looked at me – and remember, I have three kids – and said, “Ooh, you did that three times.”

I decided to b

Racism is not a political issue. Racism is a MORAL issue.

Yesterday, as I do most Fridays, I sent the GRS Insider to folks who subscribe to the Get Rich Slowly email list.

The email was unusual. It was more like a blog post than a simple summary of recent articles. I've had several people request a version they can share with other people, so -- this one time only -- I've created a stand-alone web version.

Parts of this have been edited slightly to account for the transition from email to web.

A candid conversation about race in America

Minneapolis, Denver, NYC, Oakland, Atlanta, Washington D.C., Louisville, San Jose, Des Moines, Detroit. The list goes on. These are just some of the cities that have experienced protests in the past week.

George Floyd's murder (and murder-porn video) was one of the catalysts for these protests. But let's be clear: Sooner or later, this was going to happen. Things are not okay in America. America's continuing issue with race, inequality, and the routine acceptance of the mistreatment of black people and other people of color came to a head in the last couple of days.

Then, we had Amy Cooper in New York City calling the police on Christian Cooper unecessarily during a normal incident that plays out all the time - annoying people with their dogs off leash. That one call could have resulted in Christian Cooper's death.

Our first annual family meeting

Yesterday, to celebrate Thanksgiving, Kim and I instituted what we hope will become an annual tradition. Yesterday, we held our first annual family meeting.

Kim approached me with the idea last week. "I think it'd be nice to sit down and talk about our goals," she said.

"I agree," I said. I was thinking of the article Matthias shared here in August. Matt and his wife create five-year plans to co-ordinate their shared future. They spend a day drafting couple goals to build their dream life. I've been thinking that Kim and I should do something similar.