What is money for? An evening with Vicki Robin

As an adult, my heroes are more mundane. They're the people who make personal finance accessible to average people. Long-time readers know that billionaire investor Warren Buffett is one of my heroes. So too is Dave Ramsey, who has helped countless people -- including me -- get out of debt.

But perhaps my biggest hero is an unassuming 73-year-old woman in cat-eye glasses who lives on Whidbey Island in Washington's Puget Sound.

Two months with HelloFresh: A quick look at the cost and quality of HelloFresh recipes

When I published my first HelloFresh review last June, I liked the popular meal-delivery service. Kim's employer had given us a one-week free trial. The three recipes we received were fun and tasty. In the end, we chose not to sign up with HelloFresh but resolved to remember it for the future.

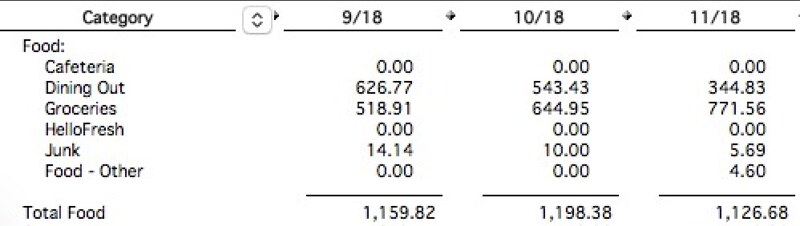

At the end of 2018, as I was evaluating my spending patterns, I was shocked by how much I was spending on food. It's embarrassing to show the following numbers, but facts are facts and truth is truth. I was spending over $1100 per month on food.

Saving regret — and how to avoid it

In November 2018, the National Bureau of Economic Research published a paper called "Saving Regret" [here's the full PDF version]. Once you wade through the study's academic language, there's some interesting stuff here about why people do and don't save for retirement.

Saving regret, the authors say, is "the wish in hindsight to have saved more earlier in life".

Obviously, you can suffer from saving regret at any age. When I met 31-year-old Debbie for dinner last week, her issues boiled down to saving regret. She wishes she'd saved more when she was younger. But for the purposes of this paper, the authors turned their attention to folks aged 60 to 79, people of traditional retirement age.

Twenty years of U.S. government inflation data

Inflation is the silent killer of wealth. Year after year, the purchasing power of your dollar (or pound or euro or yen) gradually erodes. My father was one of those "hide money under your mattress" type folks because he believed that was the best way to keep his cash safe. He was wrong.

If you sit on your money, it doesn't maintain its value. It loses value.

At his Carpe Diem blog, economics professor Mark Perry recently published a new version of the following chart, which visualizes the effects of inflation on certain consumer goods and services.

Case study: Deep in debt but scared to take action

Last night, as I do from time to time, I met with a GRS reader. Actually, Debbie doesn't read this site but her sister does. And Debbie means to. Although I met Debbie's sister last year at a Camp FI event, I'd never met Debbie before.

"So, what's your situation?" I asked after our waiter had brought us each a glass of wine. "What do you want to know about money?"

"Everything," Debbie said, laughing. "I feel like I don't know much at all right now. I guess deep down, I know what I need to do. I just don't do it."

The end of the road: Preparing to buy a new car

Yesterday, Kim and I joined my cousins for an afternoon trip to the Oregon Coast. Our aim was to harvest a bounty of clams. We came home with zero. We managed, however, to harvest a bounty of mussels. Plus, the dog had fun.

My cousin Duane carpooled with us to and from the beach. We rode in Kim's car: a 1997 Honda Accord that's showing signs of its age.

Book review: Work Optional by Tanja Hester

Last week, I published an extended excerpt from Grant Sabatier's new book, Financial Freedom. Sabatier's core message is that time is more valuable than money — and that freedom is more valuable than time.

Several GRS readers took issue with the book's seemingly anti-work tone.

- "There is a lot of talk about the drudgery of work; [I'm] pretty lucky [that] I love my job and have a lot of autonomy," wrote Angelica.

- S.G. said, "The 'wage slave' rhetoric gets old."

- And our pal El Nerdo didn't like this sentence: "I retired early because I didn’t want to spend the best years of my life working in a poorly lit cubicle at a stressful job I didn’t particularly enjoy." El Nerdo's response? "Could you maybe just find a better job? One that you enjoyed? With no cubicles, and better light?"

These comments are telling. They're representative of a common complaint leveled against the FIRE movement. (As you probably know, FIRE is a clumsy acronym for "financial independence/retire early". The FIRE movement is all about saving enough to retire as soon as you can.)

<Why frugality is an important part of personal finance

In a recent article in The Atlantic, Joe Pinsker shared some thoughts on why many ultrarich people aren't satisfied with their wealth.

There seem to be two reasons.

- First, people tend to ask themselves: Am I doing better than I was before? Do I have more today than I did yesterday? "All the way up the income-wealth spectrum," one researcher told Pinsker, "basically everyone says [they'd need] two or three times as much" to be perfectly happy. It's the hedonic treadmill in action.

- Second, people can't help but compare themselves to others. They ask themselves: Do I have as much (or more) than the people I'm comparing myself with? Do I have more than other folks in my family? Do I have more than my friends? Do I have more than my co-workers? We measure our personal success by comparing what we have to what other people have. This is the proverbial "keeping up with the Joneses".

While Pinsker's article is about the ultrarich, I think these tendencies apply to nearly everyone. Even me.

Why NewRetirement is my favorite retirement planning tool

Over the past week, I've shared two terrific retirement planning tools. First, I explored the pros and cons of Personal Capital. Next, I looked at OnTrajectory, which is the best traditional retirement calculator I've found.

I like NewRetirement because it offers amazing levels of customization. Plus, it explains its assumptions and offers ample information about every subject it tackles. And it does all of this without ever becoming overwhelming. It's comprehensive and customizable, yet clear. Most importantly, NewRetirement is more than just a retirement calculator. When I say it's a retirement planning tool, I mean that.

Is OnTrajectory the best retirement calculator?

"You really need to try OnTrajectory," Jillian from Montana Money Adventures told me last summer. "It's great." She's been telling me that over and over ever since. (Meanwhile, Gwen from Fiery Millennials has also been pressuring me to try OnTrajectory.)

Last week, at long last, I had a chance to chat with Tyson Koska, the founder of OnTrajectory. During a 30-minute call, he walked me through setting up an account and playing with the tool's features. I'm impressed. NewRetirement is still my favorite tool, but OnTrajectory is damn close. And I can see how for some people, the latter may actually be a better choice.